Money is weird. Especially when you’re looking at a country like Afghanistan, where the economy shouldn't, by any traditional logic, be holding its own. But if you look up the rate for 1 dollar in afghani today, you aren't seeing a total collapse. You're seeing a currency that has somehow become one of the best-performing "underdog" stories in the global market over the last couple of years. It's confusing. Honestly, it defies a lot of what we’re taught in Econ 101.

Most people expect a war-torn, sanctioned nation to have a currency that’s basically wallpaper. That’s not what’s happening here. The Afghani (AFN) has been remarkably stable, and at times, it has even gained value against the US dollar while other regional currencies like the Pakistani Rupee or the Iranian Rial were busy diving off a cliff.

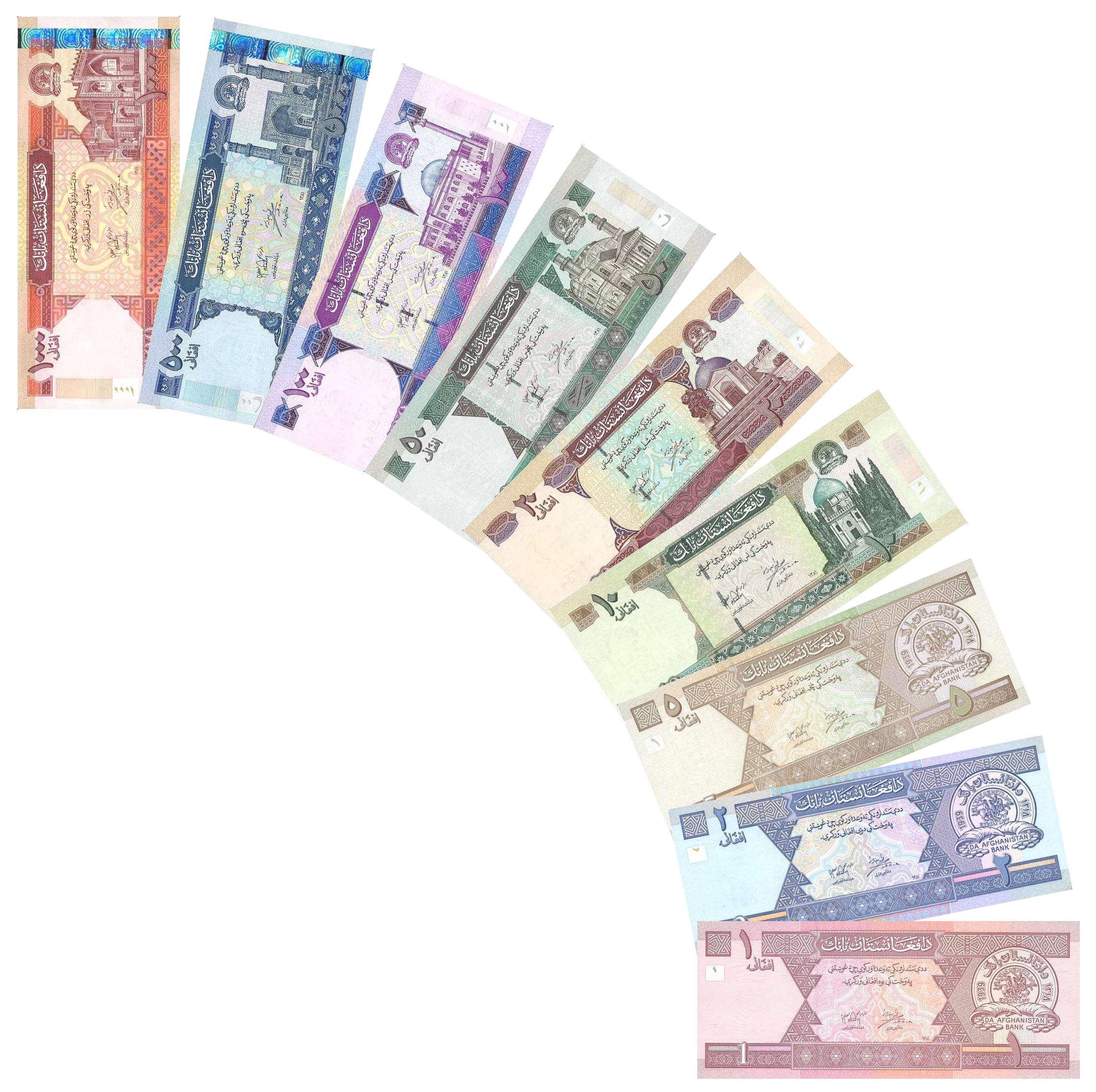

What Actually Determines 1 Dollar in Afghani?

You can’t just look at a ticker symbol and get the whole story. The rate for 1 dollar in afghani isn't just about trade balances or GDP growth; it’s about physical cash. For a long time, the Da Afghanistan Bank (DAB) has been propping things up with regular auctions of US dollars. They literally auction off millions of greenbacks to keep the AFN from drowning.

It’s a supply and demand game played with high stakes. If there aren't enough dollars in the local market, the price of everything—flour, fuel, medicine—skyrockets because Afghanistan imports almost everything. When the central bank injects $15 million or $16 million into the system on a Tuesday morning, the exchange rate reacts instantly.

📖 Related: McCracken-Dean Funeral Home Explained: What to Expect When You Need Them

The Role of International Aid

Since 2021, the UN has been flying in literal plane-loads of cash. We are talking about billions of dollars in humanitarian aid. While this money is meant for "humanitarian assistance" and technically circumvents the central government, it still ends up in the local economy. It provides the liquidity that keeps the AFN from becoming worthless. Without those flights landing in Kabul, the value of the Afghani would likely crater within weeks.

The Sarai Shahzada Factor

Forget fancy digital trading floors. If you want to know the real value of 1 dollar in afghani, you look at Sarai Shahzada. This is Kabul’s open-air currency market. It’s chaotic. It’s loud. It’s full of men carrying massive bricks of cash in plastic bags.

In this market, the rate is determined by real-time sentiment and the physical availability of bills. Interestingly, the Taliban government banned the use of foreign currencies—specifically the Pakistani Rupee and the US Dollar—for local transactions. If you’re caught buying bread with dollars in Kandahar, you’re going to have a bad time. By forcing everyone to use the AFN for daily life, they’ve artificially boosted demand for the local currency. It’s a "forced" stability, but it works.

Why the Rate Moves

- The Winter Effect: During harsh Afghan winters, trade slows down. Border crossings like Torkham or Spin Boldak might close due to weather or political spats. Less trade means less demand for currency, which can cause weird ripples in the exchange rate.

- Smuggling: There is a massive, shadow-economy flow of dollars moving across the border into Pakistan. Because Pakistan has struggled with its own dollar shortages, the "Kabul-to-Peshawar" pipeline is real. When too many dollars leave Afghanistan, the AFN weakens.

- Central Bank Auctions: These are the primary lever. The DAB usually announces these on X (formerly Twitter) or their official website. They’ll say, "We are auctioning $17 million tomorrow." Traders prep. The market holds its breath.

Comparing the AFN to Neighbors

It’s wild to see the contrast. While the 1 dollar in afghani rate might hover around 68 to 75 AFN (depending on the specific month and year), the Pakistani Rupee has gone north of 280. Why? Because Afghanistan doesn't have a massive external debt-servicing problem like Pakistan does. They’re basically cut off from the global banking system (SWIFT). It’s a bit of a paradox: being an international pariah has actually shielded the currency from certain types of speculative attacks and global market volatility.

But don't let the "stability" fool you into thinking the economy is thriving. It’s a "starvation stability." People might have a currency that holds its value, but they don't have jobs, and they don't have money to spend in the first place. A stable exchange rate is cold comfort when 85% of the population is living below the poverty line.

👉 See also: Reese’s Peanut Butter Cups Factory: What Really Goes On Inside

Understanding the "Spread"

When you look up the rate online, you’re seeing the "mid-market" rate. You will never actually get that rate at a kiosk. There is always a spread. In Kabul, the gap between the "buy" and "sell" price can be wide, especially if there’s a rumor of a border closure or a new round of sanctions.

Also, the physical condition of the US dollar bills matters. In Afghanistan, if you have a $100 bill that is old (the "small head" bills) or slightly torn, you will get a significantly worse exchange rate than if you have a crisp, "big head" blue-strip note. It’s a weird quirk of cash-based economies. Your money is worth less just because it looks old.

Future Outlook: Can the AFN Stay Strong?

Most experts, including those at the World Bank and various NGOs, are skeptical about the long-term. The current strength of the Afghani is built on a foundation of sand—specifically, the continuation of UN cash shipments and strict capital controls.

If the international community decides to stop the cash flights, or if the central bank runs out of its foreign reserves (which are currently frozen in the US and Europe, though a portion is in the "Afghan Fund" in Switzerland), the game is over.

What You Should Do If You're Sending Money

If you’re sending remittances back to family via Hawala or services like Western Union, timing is everything.

- Watch the DAB Auctions: Check the Da Afghanistan Bank’s official announcements. If they just did a big auction, the AFN might be slightly stronger, meaning your dollars will buy fewer Afghanis.

- Avoid Small Bills: If you are physically bringing cash, bring new, $100 denominations.

- Use Local Knowledge: The rates you see on Google are often lagging behind the actual street rate at Sarai Shahzada by a few hours.

The story of 1 dollar in afghani is ultimately a story of a controlled environment. It’s a laboratory for what happens when a country is forced to survive on its own while being fed an intravenous drip of humanitarian cash. It’s stable for now, but in the world of currency, "for now" can change in a single afternoon.

Actionable Steps for Monitoring the Rate

Don't just rely on a single source. If you need to track the value of the Afghani for business or personal reasons, you have to look at the three-headed monster of currency data. First, check the official central bank (DAB) site for auction results; this tells you the government's "target" price. Second, look at the "interbank" rate on sites like XE or Bloomberg to see the global perception. Finally, if you can, get a contact in Kabul to check the "Money Exchange" Telegram groups. These groups are where the actual street prices are whispered before they hit the news.

Keep an eye on the "Blue Stripe" premium. If the gap between the value of a new $100 bill and an old one starts widening, it usually means the market is getting nervous and people are hoarding "good" cash. That’s your early warning sign that a devaluation is coming. Stay liquid, stay informed, and never assume a stable rate in a volatile region is permanent.