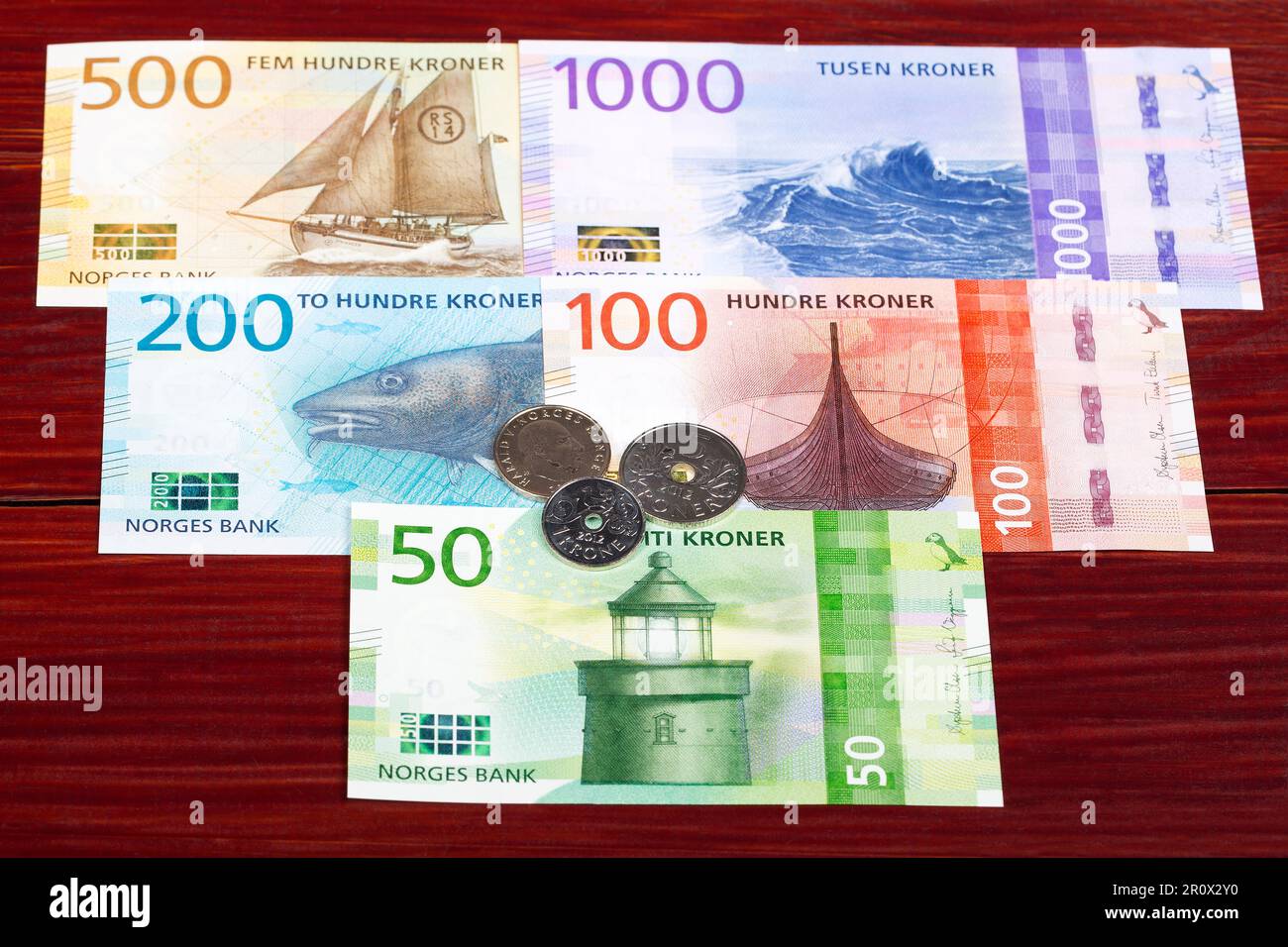

Money moves in weird ways. If you're looking at 1 USD Norwegian krone today, you're probably seeing a number somewhere around 10.11. That's a far cry from the days when you could get a cheap coffee in Oslo. It’s been a wild ride for the "Nokkie," as traders like to call it.

Honestly, the krone has spent the last year being the punching bag of the G10 currencies. You’ve probably noticed that even when the U.S. dollar softens globally, the krone doesn't always jump for joy. It’s stubborn.

What’s Actually Happening with 1 USD Norwegian Krone?

Right now, as of mid-January 2026, the rate is hovering in that 10.05 to 10.15 range. Just a few months ago, analysts were sweating over it hitting 11.00. Why did it stop? Basically, Norges Bank—Norway's central bank—decided to play chicken with the rest of the world.

While the Federal Reserve in the U.S. started trimming interest rates to around 3.75% by the end of 2025, Norway’s Governor Ida Wolden Bache kept her foot on the brake. Norway’s policy rate is sitting at a steady 4.00%. They aren’t in a hurry to cut. They’ve watched inflation (which was still 3.2% in December) like a hawk.

This creates a "carry trade" vibe. When Norway keeps rates high and the U.S. starts lowering them, investors usually flock to the krone to chase those higher yields. But there’s a catch. Norway is an oil and gas economy. You can’t talk about the krone without talking about Brent Crude.

The Oil Problem No One Admits

For years, the link between oil and the krone seemed broken. It was annoying. Oil would go up, and the krone would just sit there. But lately, that relationship has come back with a vengeance.

- Brent Crude is currently holding above $78 per barrel.

- Natural Gas (TTF) prices have been bouncing around €33 per MWh.

When energy prices are stable or rising, the krone breathes. When they dip? The USD/NOK pair shoots up instantly. Bank of America recently pointed out that the krone is also weirdly sensitive to China's economy. If China’s manufacturing sector sneezes, the krone catches a cold. It’s basically a high-beta proxy for global growth.

🔗 Read more: Why Advantages of Home Equity Loan Options Still Make Sense in a High-Rate World

Why 10.00 is the Magic Number

Technically speaking, 10.00 is a huge psychological barrier. If you're a traveler, you love seeing the rate go above 10. It makes your dollars feel like they have superpowers in the high-priced shops of Aker Brygge.

But for the Norwegian government, a weak krone (where 1 USD buys more NOK) is a double-edged sword. Sure, it makes their oil exports worth more in local terms, but it drives the cost of imported food and tech through the roof. That’s why the central bank is being so "hawkish"—they want the krone to stay strong to keep your grocery bill from exploding.

Historical trends for 2026 suggest a bit of a seasonal pattern. Usually, we see the krone strengthen in the spring. There’s a theory that dividend season in Norway drives demand for the currency. If you're planning a trip or a business deal, keeping an eye on the late Q1 window is smart.

The Reality Check

Don't expect the rate to go back to 6.00 or 7.00 anytime soon. Those days are likely gone. The "new normal" for 1 USD Norwegian krone seems to be shifting between 9.50 and 10.50.

Société Générale analysts have noted that the floor for the krone against other currencies, like the Swedish krona, has finally formed. This suggests that the worst of the "weak krone era" might be behind us, but the U.S. dollar is still a titan. As long as there is global uncertainty or a "risk-off" mood in the markets, people will sell their kroners and buy dollars. It’s the ultimate safety blanket.

Actionable Steps for 2026

If you are managing money between these two currencies, here is how to play the current 10.11 landscape:

- Watch the Norges Bank Calendar: The next big rate decision is January 22, 2026. If they even hint at a rate cut before summer, expect the USD/NOK to spike toward 10.30 immediately.

- Monitor Brent Crude Floors: If oil drops below $70, the krone will lose its primary support. This is the biggest risk for anyone holding NOK right now.

- Use Limit Orders: If you're a business or a frequent traveler, don't just buy at the spot rate. Setting a limit order at 9.85 or 9.90 could save you a significant percentage if there’s a random market rally.

- Hedge for Q4: History shows that the dollar usually gains strength against the krone in October and November. If you have payments due at the end of the year, try to lock in your rates during the summer "dip" in July.

The currency market doesn't care about your plans. It only cares about interest rate differentials and energy demand. Stay flexible and keep an eye on those oil charts.