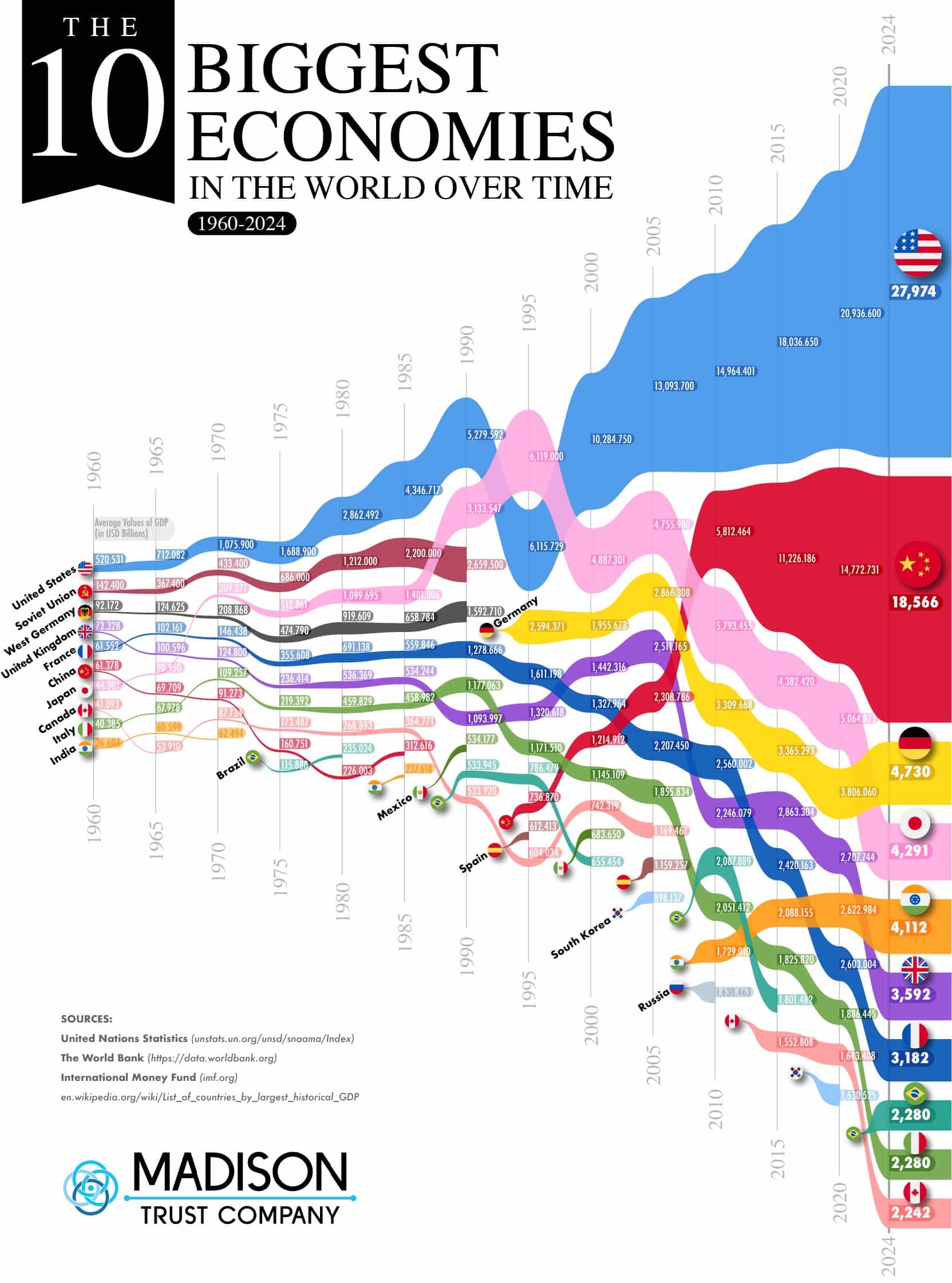

Money makes the world go round, right? Well, sort of. If you look at the 10 biggest economies in the world, you’ll realize it’s not just about who has the most cash under the mattress. It’s about who’s producing the most stuff, selling the most services, and basically keeping the global engine from stalling out.

Honestly, the rankings for 2026 are a bit of a wild ride. We’ve seen some old-school powerhouses barely moving the needle while others are climbing the ladder like they’re on a mission. If you only look at the total "Gross Domestic Product" (GDP), you’re missing half the story.

The Heavyweights: Who’s Actually Winning?

Let’s be real—the United States is still sitting comfortably at the top. With a projected GDP of $31.82 trillion, it’s basically an economic behemoth. But don't let the big numbers fool you into thinking it's all smooth sailing. While the U.S. remains the financial anchor of the world, it’s facing its own set of headaches, from national debt to shifting trade policies under the second Trump administration.

China follows in the second spot at roughly $20.65 trillion. Now, here’s where it gets interesting. For years, everyone said China would overtake the U.S. any second now. But lately? Things have slowed down. A cooling property market and an aging population mean that "convergence" everyone talked about is taking its sweet time.

The 2026 Leaderboard: A Quick Snapshot

If we’re looking at the raw data from the IMF and World Bank for early 2026, the list looks something like this:

- United States: $31.8 trillion (Still the king of tech and finance).

- China: $20.7 trillion (The world’s factory, but catching its breath).

- Germany: $5.3 trillion (Europe’s industrial heart).

- India: $4.5 trillion (The absolute speed demon of growth).

- Japan: $4.4 trillion (Precision engineering meets a shrinking workforce).

- United Kingdom: $4.2 trillion (Service-led and rebounding).

- France: $3.6 trillion (Luxury, aerospace, and a lot of wine).

- Italy: $2.7 trillion (North-south divide but still a manufacturing pro).

- Russia: $2.5 trillion (Commodities and a war-transformed economy).

- Canada: $2.4 trillion (Resource-rich and North American-aligned).

Why India is the One to Watch

If there’s one country that’s basically acting like the "main character" of global economics right now, it’s India. By early 2026, India has firmly secured the 4th spot, officially nudging past Japan.

Why? Because they’re growing at over 6% while most of the G7 is lucky to hit 1% or 2%. India is the only top-five economy still in a major expansion phase. They’ve got a massive, young, English-speaking workforce and a digital infrastructure that’s actually putting some Western nations to shame.

But—and there's always a but—their GDP per capita is still super low, around $3,000. Compare that to the U.S. at over $90,000. It's a reminder that a "big" economy doesn't always mean "wealthy" citizens. It’s a scale vs. prosperity thing.

Europe's Mixed Bag

Germany is holding onto 3rd place ($5.3 trillion), mostly because of its insane export machine. However, the energy transition has been rough. The "Mittelstand"—those medium-sized companies that make everything from specialized screws to high-tech car parts—is the backbone here.

Then you’ve got the UK and France. The UK has managed a bit of a rebound, sitting at $4.2 trillion, largely thanks to the City of London’s financial grip. France, at $3.6 trillion, is doing its thing with luxury giants like LVMH and aerospace (Airbus). But both are struggling with slow productivity. It’s kinda like they’re running a marathon with a backpack full of bricks.

What People Get Wrong About These Rankings

Most people look at these numbers and think, "Okay, the higher the number, the better the country is doing." Not exactly.

Nominal GDP vs. PPP

You’ve probably heard of Purchasing Power Parity (PPP). If we measured by PPP—which accounts for the fact that a dollar buys way more in Beijing or Mumbai than in NYC—China would actually be #1 and India would be #3. Nominal GDP (the list above) is what matters for global trade and power, but PPP is often a better look at actual living standards.

Growth vs. Size

Japan is the perfect example. It's the 5th largest economy, but it's barely growing (forecasted at 0.6% for 2026). It's a massive, wealthy, stable ship, but it's not moving very fast. Meanwhile, a country like Indonesia (sitting just outside the top 10 at $1.5 trillion) is a "strategic climber."

The "Under the Hood" Drivers

What’s actually pushing these numbers up?

🔗 Read more: How Much is Mercedes Company Worth: The Truth Behind the Numbers

- Technology & AI: This is why the U.S. is still #1. Silicon Valley and the massive investment in AI infrastructure give it a "tech premium."

- Demographics: India’s young population is a huge tailwind. Japan and Italy’s aging populations are huge headwinds.

- Commodities: This is why Russia and Canada stay in the top 10. Whether it’s oil, gas, or minerals, if you have the stuff the world needs to build things, you’re going to stay relevant.

The 2026 Reality Check

We’re seeing a world where "economic gravity" is shifting east. Asia builds, North America invests, and Europe engineers. That’s the basic breakdown. By 2028, India will likely pass Germany for 3rd place. Brazil and Mexico are also nipping at the heels of the top 10, often swapping places with Canada or Italy depending on the year's commodity prices.

Actionable Insights for the Global Observer

If you're an investor or just someone trying to make sense of the world, here’s how to use this info:

- Don't ignore the "slow" giants: Just because Japan or Germany are growing slowly doesn't mean they aren't powerful. They hold the "IP" (intellectual property) and deep capital.

- Watch the "Per Capita" gap: A country can have a huge GDP and still have a lot of poverty. Looking at GDP per capita tells you more about the consumer market's actual strength.

- Diversify toward growth: If you’re looking at where the next decade’s consumers are coming from, it’s the India-Indonesia-Brazil axis.

- Keep an eye on 2027-2028: The "flippening" where India hits #3 is going to be a massive psychological shift for global markets.

The global economy isn't a static scoreboard. It's more like a living organism that reacts to wars, tech breakthroughs, and even how many babies are born. Staying on top of the 10 biggest economies in the world is basically a full-time job in watching human progress (and sometimes, human struggle) in real-time.