Money is a weird, moving target. If you’re looking at a K-drama budget or a Seoul real estate listing and wondering what is 1.7 billion won in us dollars, the quick answer—right now, at least—is roughly $1.21 million to $1.25 million.

But don't just bank on that single number.

The exchange rate between the South Korean Won (KRW) and the U.S. Dollar (USD) is notoriously twitchy. One week it’s stable, and the next, a shift in Federal Reserve policy or an export report from Samsung sends the numbers sliding. If you had 1.7 billion won in 2021, you were looking at nearly $1.5 million. Today? You've lost the equivalent of a luxury SUV in purchasing power just by waiting.

🔗 Read more: Berkshire Hathaway Market Capitalization: Why $1 Trillion Was Just the Start

The Breakdown: Doing the Mental Math

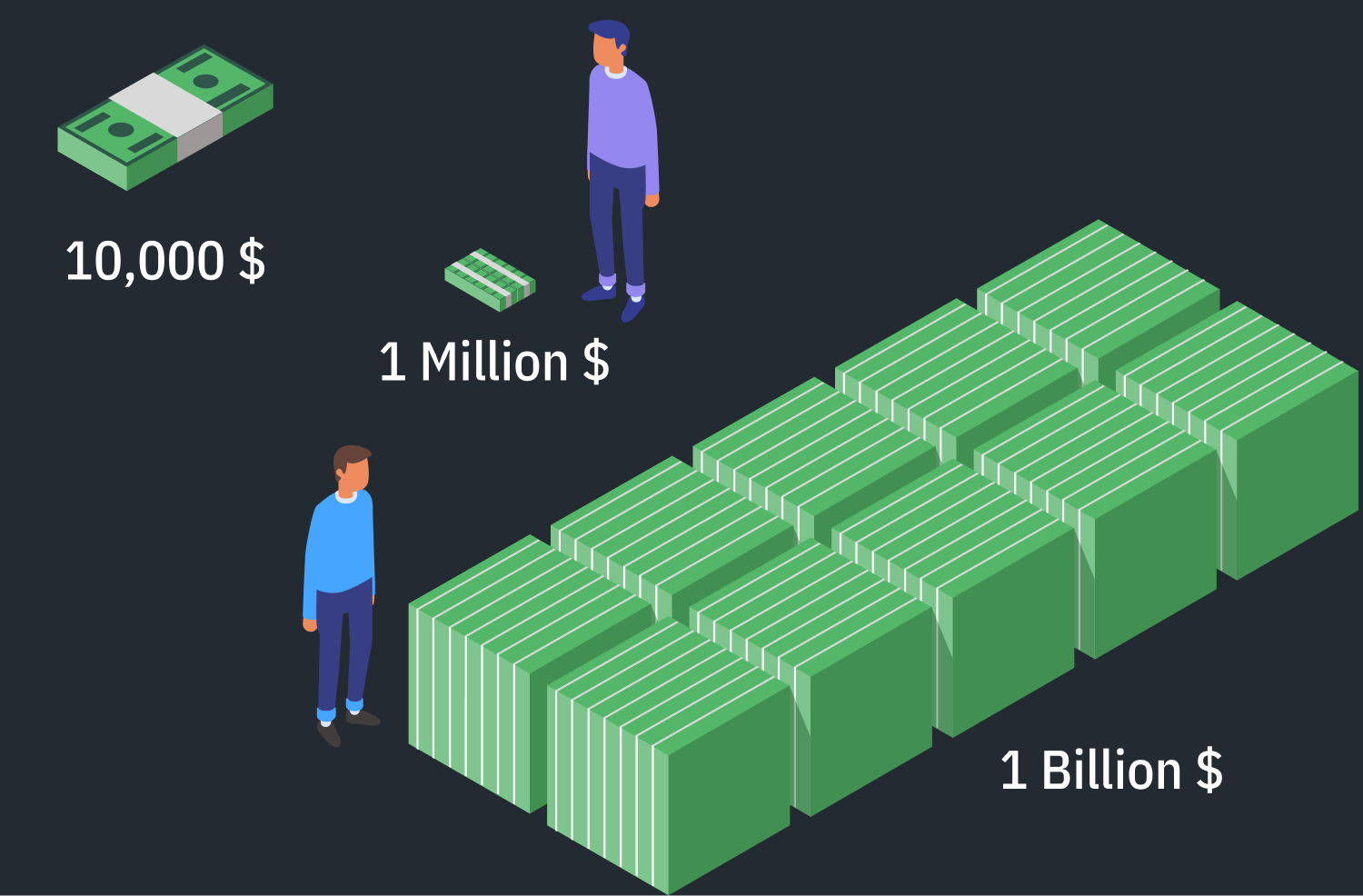

Calculating large sums like 1.7 billion won (₩1,700,000,000) requires getting comfortable with a lot of zeros. Korea uses a "man" (ten thousand) and "eok" (one hundred million) counting system, which confuses most Westerners immediately.

To find out what is 1.7 billion won in us dollars, you basically take 1,700,000,000 and divide it by the current exchange rate. If the rate is 1,380 won to the dollar, you get approximately $1,231,884.

It’s a lot of money. Honestly, in most American mid-sized cities, $1.2 million buys a mini-mansion. In Seoul? 1.7 billion won might only get you a decent three-bedroom apartment in a "good but not flashy" neighborhood like Mapo or parts of Songpa. It certainly isn't buying you a penthouse in Apgujeong anymore.

Inflation hits differently when you’re swapping currencies across the Pacific.

Why the Value of 1.7 Billion Won in US Dollars Fluctuates

Markets don't sleep. The KRW is what traders call a "proxy" currency for global tech health. Because South Korea’s economy is so heavily tied to semiconductors and exports, the won often weakens when people get scared about a global recession.

The Interest Rate Gap

Central banks are the real puppet masters here. When the U.S. Federal Reserve keeps interest rates high, the dollar becomes a magnet for investors. They want those high yields. Consequently, they sell their won to buy dollars. This drives the price of the dollar up and makes your 1.7 billion won worth less in American terms.

Experts like those at Goldman Sachs or KB Securities spend all day tracking "yield spreads." It sounds boring, but it’s the reason your 1.7 billion won might be worth $1.25 million on Tuesday and $1.22 million by Friday.

Geopolitical Jitters

Let's be real: North Korea matters to the markets. Any time there’s a missile test or heightened rhetoric at the DMZ, the won takes a slight bruising. Investors are flighty creatures. They prefer the "safe haven" of the USD when things get tense in East Asia.

What 1.7 Billion Won Actually Buys You

To understand the scale of what is 1.7 billion won in us dollars, we have to look at real-world purchasing power. Context is everything.

In the world of K-Entertainment, 1.7 billion won is a respectable, though not massive, production budget for a variety show season. For a top-tier drama like Squid Game or Moving, 1.7 billion won wouldn't even cover the lead actor's salary for a few episodes. Production costs for high-end series now regularly exceed 30 billion won.

In Corporate Seoul, 1.7 billion won is roughly the "exit' price for a successful small startup's seed round. It’s enough to hire a team of ten developers for a year and rent a modest office in Gangnam.

✨ Don't miss: US Dollar Bill Thickness: Why Your Wallet Isn't as Fat as You Think

In Luxury Lifestyle circles, this amount of cash is the sweet spot. You can buy a Ferrari SF90 Stradale in Korea—which retails for around 600-700 million won—and still have a billion won left over for a very nice condo or a portfolio of stocks.

The Hidden Costs of Moving Money

If you actually have 1.7 billion won and want to turn it into dollars, you won't get the "mid-market" rate you see on Google. Banks take a cut.

- The Spread: Banks buy currency at one price and sell it at another. This "spread" can eat up 1% to 3% of your total if you aren't careful. On 1.7 billion won, a 2% fee is 34 million won (about $25,000). That is a painful "convenience fee."

- Wire Fees: Swift fees are small, but the intermediary bank fees can add up.

- Reporting Requirements: If you're moving this much money from South Korea to the U.S., you're going to trigger the Foreign Exchange Transactions Act. You have to prove where the money came from. Tax offices in both countries (the NTS and the IRS) will want to know if they're getting a slice.

Historical Context: When the Won was Stronger

There was a time, not that long ago, when the won hovered around 1,100 to the dollar. In those days, 1.7 billion won was worth roughly $1.54 million.

The shift to the 1,300+ range has significantly changed the math for expats and international investors. If you're an American working in Seoul getting paid in won, you've effectively taken a massive pay cut in USD terms over the last few years, even if your nominal salary stayed the same.

Why did this happen? It wasn't just one thing. It was a "perfect storm" of high U.S. inflation, a cooling Chinese economy (Korea’s biggest trading partner), and surging energy costs. Korea imports almost all of its oil, and oil is priced in—you guessed it—dollars.

Actionable Steps for Handling Large Currency Conversions

If you are dealing with a sum as large as 1.7 billion won, don't just hit "transfer" on your mobile banking app. You'll get fleeced on the rate.

Use a Foreign Exchange Specialist

Companies like Western Union are fine for $500, but for $1.2 million, you need a specialized FX broker or a private banking relationship. They can offer "limit orders," where the conversion only happens if the rate hits a target you're happy with.

Watch the Calendar

Avoid exchanging money during major holidays like Chuseok or Lunar New Year when liquidity can thin out and spreads widen. Also, pay attention to the U.S. Consumer Price Index (CPI) release dates. These reports usually cause the dollar to jump or dive.

Hedge Your Bets

If you don't need the full amount in USD immediately, consider converting in tranches. Move 400 million won this month, 400 million the next. This "dollar-cost averaging" protects you from a sudden, disastrous dip in the exchange rate.

Consult a Tax Professional

Moving 1.7 billion won is a major financial event. In the U.S., you may need to file an FBAR (Report of Foreign Bank and Financial Accounts) or Form 8938. Failing to do this can result in penalties that make the exchange rate losses look like pocket change.

Ultimately, 1.7 billion won represents significant wealth. Whether it’s an inheritance, a business sale, or a lucky investment, treat the conversion with the same respect you used to earn the money. The difference between a "good" rate and a "bad" rate on a sum this size is enough to buy a brand-new car. Stay sharp, watch the charts, and don't rush the process.