So, you’ve got two thousand bucks. Or maybe you need them. Either way, converting 2000 dollars in rand isn't just a matter of clicking a button on a currency converter and calling it a day. It’s a whole mood. Depending on the day of the week or what some politician just said on Twitter, that number can swing enough to pay for a fancy dinner in Sandton or barely cover a tank of petrol.

Exchange rates are fickle.

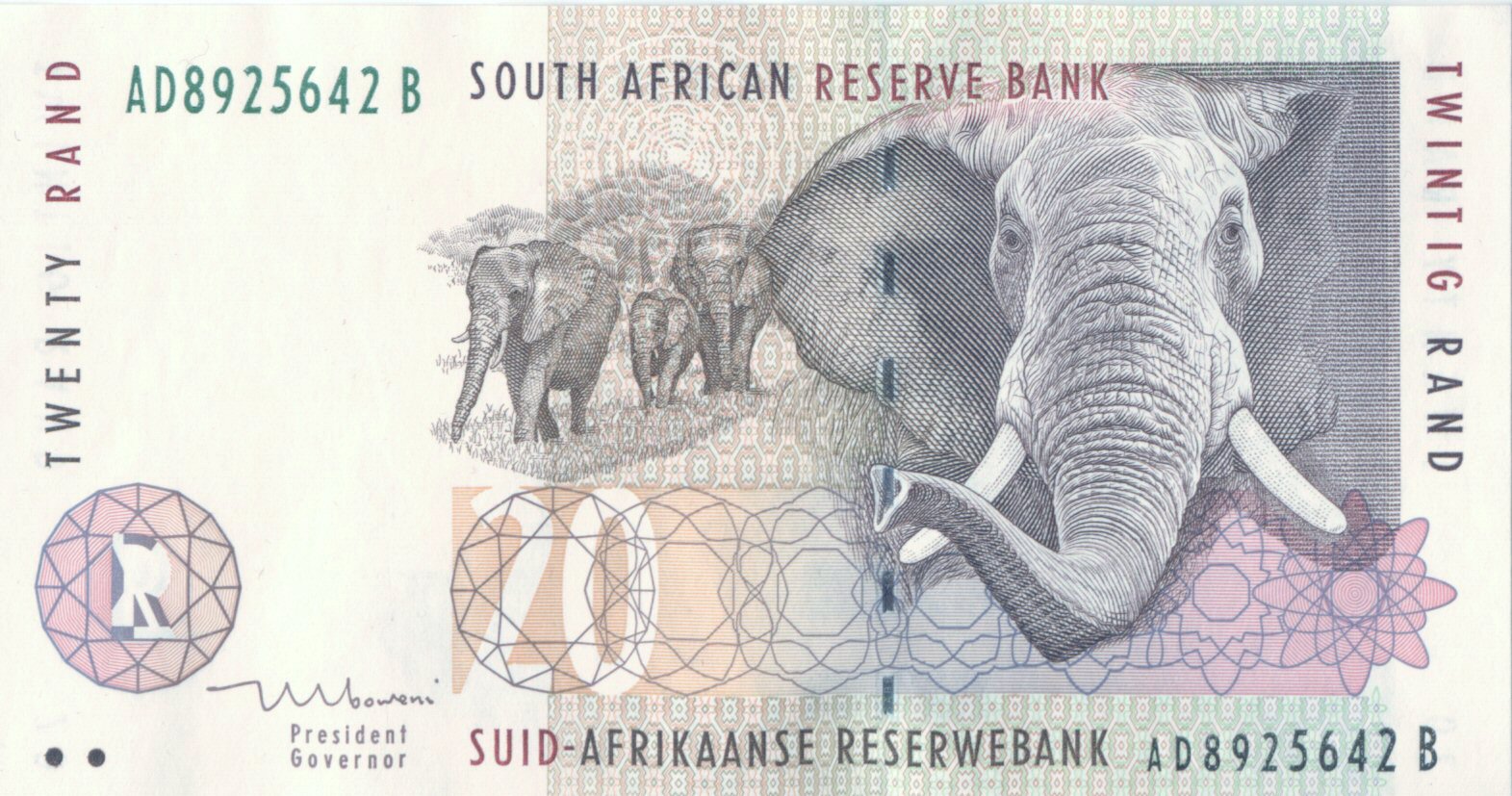

If you look at the historical data from the South African Reserve Bank (SARB), the Rand has been on a wild ride for decades. It's an emerging market currency. That basically means it’s the "risk-on" asset for global investors. When the world gets scared, they sell Rands and buy Dollars. When everyone feels brave, the Rand strengthens. Right now, sitting with $2,000 in your pocket feels like holding a decent bit of leverage, but exactly how much leverage depends on the "ZAR-volatility" factor that keeps traders up at night.

What $2,000 Actually Gets You in South Africa

Let's get real for a second. If the exchange rate is sitting around R18.50, your $2,000 is worth R37,000. If it dips to R19.00, you’re looking at R38,000. That R1,000 difference? That’s a grocery run. Or half a tire. It matters.

In the context of the South African economy, R37,000 to R39,000 is a significant chunk of change. To put it in perspective, the median formal sector wage in South Africa—according to Stats SA’s Quarterly Employment Statistics—often hovers well below that mark. If you’re a digital nomad landing in Cape Town with two grand USD, you’re living quite comfortably. We’re talking a high-end Airbnb in Sea Point, eating out at Kloof Street every night, and still having cash left over for a weekend trip to a game reserve.

But for a local business importing components? $2,000 is nothing. It’s a rounding error. It’s the cost of a few high-end laptops or a small shipment of specialized machinery. This is the duality of the South African economy. Your 2000 dollars in rand goes incredibly far for lifestyle expenses, but it shrinks rapidly when you're trying to compete in a globalized business environment.

The "Hidden" Costs of Conversion

Don't think you're actually getting the rate you see on Google. Honestly, you're not.

Google shows you the mid-market rate. That’s the "fair" price halfway between what banks buy and sell for. But banks like Standard Bank, FNB, or ABSA need to make their cut. They’ll usually shave off 2% to 5% in "spread." Then there are the wire transfer fees. If you use a traditional SWIFT transfer to move $2,000, you might lose another R500 just in administrative noise.

If you're using a service like Wise (formerly TransferWise) or Shyft, you'll get closer to the real deal. They use the interbank rate and charge a transparent fee. It sounds like small potatoes, but on a $2,000 transaction, the difference between a bad bank rate and a good fintech rate can be over R1,500. You've basically paid for a flight from Joburg to Durban just by picking the right app.

Why the Rand is So Dramatic

South Africa is a commodity-driven economy. We dig stuff out of the ground—gold, platinum, coal, iron ore—and sell it to the world. When China’s manufacturing sector slows down, they buy less of our stuff. The Rand drops. When the US Federal Reserve raises interest rates, investors pull money out of "risky" places like South Africa to put it back into US Treasury bonds. The Rand drops again.

It’s a bit of a rollercoaster.

Economists like Dawie Roodt often point out that the ZAR is one of the most liquid currencies in the world relative to the size of the country’s GDP. This is a double-edged sword. It means you can always trade it, but it also means it’s the "whipping boy" for any bad news in emerging markets. If Turkey’s Lira crashes or Brazil’s Real wobbles, the Rand often feels the splash damage.

Then you have the internal factors. Load shedding (or the lack thereof lately), port congestion at Transnet, and political uncertainty around elections all bake into what you get for your 2000 dollars in rand. It’s not just a number; it’s a temperature gauge for the country’s stability.

Timing the Market: A Fool's Errand?

People always ask: "Should I change my dollars now or wait?"

Unless you're a professional currency trader at a hedge fund, you're probably going to get it wrong. The Rand is notoriously difficult to predict. Technical analysts use "support" and "resistance" levels, but a single speech from the Finance Minister can blow those levels out of the water in five minutes.

If you have $2,000 and you need Rands to pay for something specific, like a deposit on a car or a semester of university fees, the safest bet is often "averaging." Change $1,000 today and $1,000 next week. It smooths out the spikes. Sure, you might miss the absolute peak, but you also won't get caught changing your money at the absolute bottom because of a random news cycle.

Real-World Value: The Big Mac Index and Beyond

The Economist’s Big Mac Index is a famous way to see if a currency is "undervalued." Traditionally, the Rand is almost always undervalued against the Dollar. This means that, theoretically, your $2,000 should buy more in South Africa than it does in the US.

And it does.

A $15 burger in New York is roughly R280. In Cape Town, a better burger with grass-fed beef and hand-cut chips might cost you R150 ($8.10). Your 2000 dollars in rand effectively gives you double the purchasing power for services, labor, and food. This is why South Africa remains a massive hub for outsourcing and call centers. Global companies can pay a "modest" dollar salary that translates into a "upper-middle-class" Rand lifestyle.

However, this doesn't apply to everything.

- Electronics: An iPhone 15 Pro costs more in SA than the US because of import duties and "Ad Valorem" taxes.

- Cars: Expect to pay a premium.

- Fuel: It’s priced globally in dollars, so when the Rand weakens, the price at the pump in Randburg goes up immediately.

Small Business Perspective

If you're a freelancer in South Africa earning in USD, $2,000 a month is the "sweet spot." It’s enough to cover a decent bond, a car payment, medical aid, and still have a "fun" budget. But you have to be disciplined. When the Rand is at R19.50, you feel like a king. When it strengthens to R17.20, your "salary" just took an 11% pay cut without your boss even saying a word.

🔗 Read more: AT\&T Stock Price Today: Why This $23 Level is Testing Everyone's Patience

Expert tip: If you’re earning this amount regularly, keep a portion in a USD-denominated account. Apps like Revoult or local options like FNB’s Global Account allow you to hold the dollars. You only convert to Rands when you actually need to spend it or when the rate is particularly juicy.

The Practical Mechanics of the Swap

If you are physically in South Africa with $2,000 in cash—maybe you're a tourist or you had some "under the mattress" savings—getting those into Rands can be a headache.

Forex bureaus at airports (like Travelex) have notoriously bad rates. They know you’re tired, you’ve just landed, and you need cash for a taxi. They will eat a huge chunk of your money. If you can, go to a branch of a major bank in a shopping mall. You’ll need your passport and proof of where the money came from (anti-money laundering laws are strict in SA).

Better yet? Use an ATM. If you have a US-based debit card, many South African ATMs will let you withdraw Rands directly. Just make sure to decline the "conversion" offered by the ATM. Let your home bank do the conversion; it’s almost always cheaper.

How to Handle Your 2000 Dollars in Rand Right Now

If you're looking at a screen right now and $2,000 is waiting to be converted, here is the move.

First, check the 5-day trend. If the Rand is on a steady strengthening streak (the ZAR number is getting smaller), you might want to pull the trigger before it gets even stronger. If the Rand is crashing (the ZAR number is getting bigger), maybe wait a day or two to see if it stabilizes.

Actionable Steps:

- Check the Spread: Compare the Google rate with the rate your bank or app is actually offering. If the difference is more than 3%, you're getting ripped off.

- Use Fintech: If you aren't using Wise, Shyft, or Mama Money, you are leaving Rands on the table. Registering takes ten minutes.

- Watch the SARB: If the South African Reserve Bank is about to meet to discuss interest rates, wait until after the announcement. High interest rates usually strengthen the Rand.

- Factor in Fees: Remember that a "flat fee" of R500 hurts a lot more on a $2,000 transfer than it does on a $20,000 one. Look for percentage-based fees.

- Diversify your holding: Don't convert it all if you don't have to. Keeping some "greenbacks" is a classic South African hedge against local inflation.

The bottom line? 2000 dollars in rand is a powerful amount of money in the local context, but it's a moving target. Treat the exchange rate like the weather—you can't control it, but you can certainly dress for it. Keep your eyes on the mid-market rate, avoid the airport kiosks like the plague, and use technology to bypass the old-school banking fees. That's how you actually make sure your two grand stays worth every cent once it hits South African soil.