Tax season usually feels like a giant, looming cloud, doesn't it? You hear the term 2024 tax brackets tossed around on the news or by your "finance bro" cousin, and suddenly everyone is an expert. Honestly, though, most people have a fundamental misunderstanding of how this stuff actually works. They think if they get a raise and "bump" into a higher bracket, they might actually bring home less money.

Spoiler alert: That is not how it works. At all.

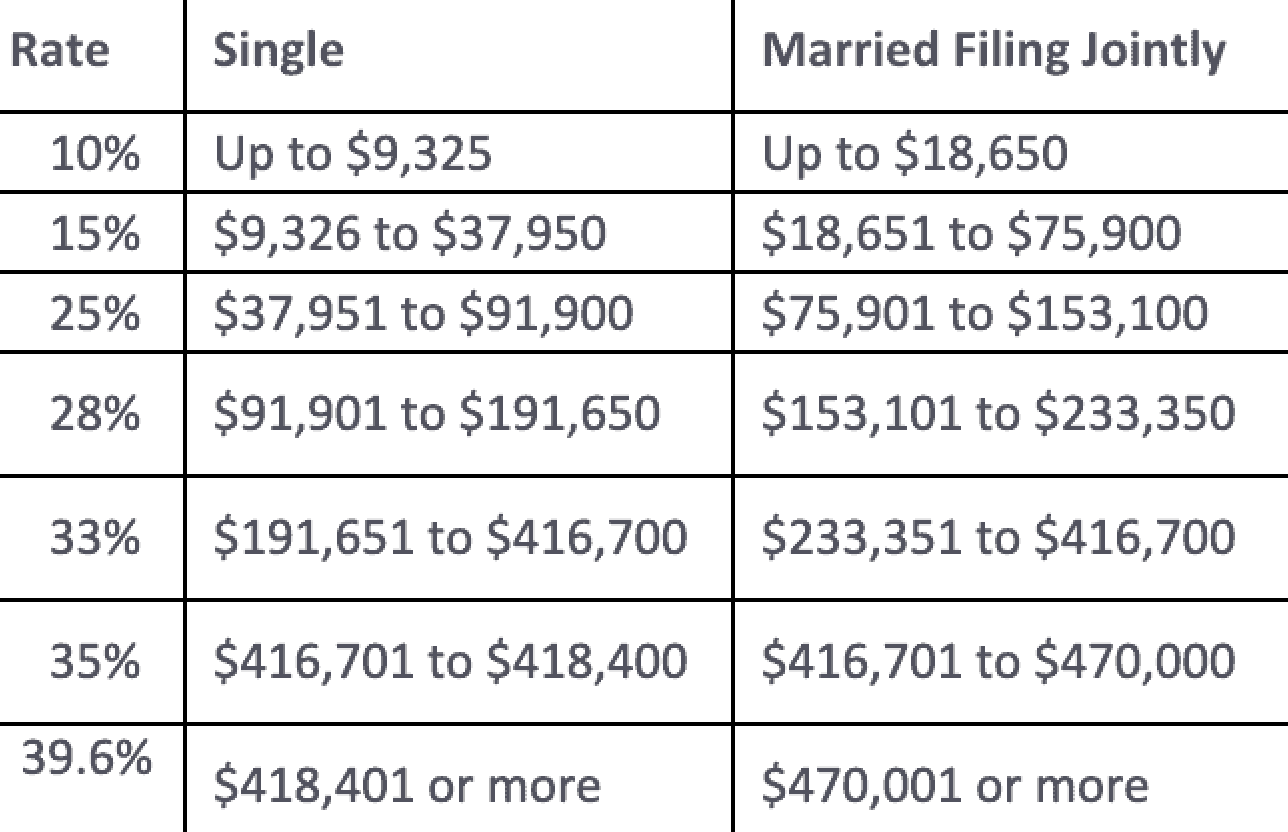

The U.S. has a progressive tax system. Think of it like a series of buckets. Your first chunk of money goes into the 10% bucket. Once that's full, the next chunk spills into the 12% bucket, and so on. You're only paying that higher rate on the "spillover" money, not every single dollar you earned. If you're looking for the specifics for the 2024 tax year—which, just to be clear, is the money you earned in 2024 and are filing for right now in early 2026—there have been some pretty significant adjustments for inflation.

The 2024 Tax Brackets Simplified

The IRS adjusted the thresholds by about 5.4% compared to the previous year. This is basically their way of trying to prevent "bracket creep," where inflation pushes you into a higher tax rate even if your actual purchasing power hasn't changed.

If you're filing as a single person, here is how the 2024 tax brackets shake out:

- 10% on income up to $11,600

- 12% for income between $11,601 and $47,150

- 22% for income between $47,151 and $100,525

- 24% for income between $100,526 and $191,950

- 32% for income between $191,951 and $243,725

- 35% for income between $243,726 and $609,350

- 37% for anything over $609,350

Now, if you're married filing jointly, the numbers are basically doubled. You don't hit that 22% mark until you pass $94,300 in taxable income. And for those of you filing as Head of Household, your 10% bracket goes all the way up to $16,550.

Why your "Taxable Income" is lower than you think

Before you go looking at your total salary and panicking about which bracket you're in, remember the Standard Deduction. This is the amount of money you get to deduct right off the top, no questions asked. For the 2024 tax year, it jumped up to $14,600 for singles and $29,200 for married couples.

Basically, if you're single and made $60,000, you aren't being taxed on $60,000. You subtract that $14,600 first. Now your taxable income is $45,400. Suddenly, you've dropped from the 22% bracket down into the 12% bracket. It's a massive difference.

Marginal vs. Effective: The Math Most People Skip

There is a huge difference between your marginal tax rate and your effective tax rate.

Your marginal rate is just the highest bracket your last dollar touched. If you're a single filer making $50,000 in taxable income, your marginal rate is 22%. But your effective rate—the actual percentage of your total income that goes to Uncle Sam—is much lower, probably closer to 13% or 14%.

"The biggest mistake I see is people turning down overtime or a bonus because they 'don't want to move into a higher bracket.' You always end up with more money in your pocket, period." — A common sentiment among CPAs like those at Deloitte or EY.

Retirement and Other Tweaks

It wasn't just the brackets that shifted. If you're putting money into a 401(k), the limit for 2024 was $23,000. IRAs went up to $7,000. These are "above-the-line" deductions that lower your taxable income before you even look at the brackets.

Also, watch out for the Earned Income Tax Credit (EITC). For 2024, the max credit for those with three or more children is $7,830. That's a huge chunk of change that acts as a dollar-for-dollar reduction of your tax bill, not just a deduction from your income.

🔗 Read more: How Much Are Tariffs on Chinese Goods: The 2026 Price of Doing Business

Don't Forget the "Other" Taxes

While we obsess over federal income tax, don't forget that the Social Security tax cap also moved. In 2024, you paid that 6.2% tax on every dollar up to $168,600. Once you hit that threshold, your take-home pay actually goes up because they stop taking the Social Security portion out.

And then there's the Alternative Minimum Tax (AMT). Most regular folks don't have to worry about this, but if you're a high earner with lots of specific deductions, the exemption for 2024 was $85,700 for individuals. It's basically a "backup" tax system to make sure people with massive deductions still pay something.

Actionable Steps for This Tax Season

Stop guessing and start looking at your actual W-2 and 1099 forms.

- Calculate your Taxable Income first. Take your gross pay, subtract your 401(k) or HSA contributions, and then subtract that standard deduction ($14,600 or $29,200).

- Identify your Marginal Bracket. Use the list above to see where that final number lands.

- Check for Credits. If you have kids or paid for college, credits like the Child Tax Credit ($2,000 per child, with $1,700 being refundable for 2024) are way more valuable than deductions.

- Adjust your 2026 withholdings now. If you're getting a massive refund, you're essentially giving the government an interest-free loan. Adjust your W-4 at work to keep more of your own money in each paycheck.

The 2024 tax brackets are designed to be a little bit fairer in an era of high prices, but they only work in your favor if you actually understand which "buckets" your money is filling.