Taxes are usually about as exciting as watching paint dry, but 2026 is looking a bit weird. Honestly, we’ve spent years hearing about the "fiscal cliff" and the expiration of the 2017 tax cuts. Well, we're here. The 2026 tax year is officially under the rules of the One Big Beautiful Bill Act (OBBBA), which basically swooped in to stop the old rates from reverting to those high pre-2017 levels.

You've probably heard rumors that your taxes were going to skyrocket because the Tax Cuts and Jobs Act (TCJA) was expiring. That didn't happen. Instead, the OBBBA made those 10%, 12%, 22%, 24%, 32%, 35%, and 37% rates permanent.

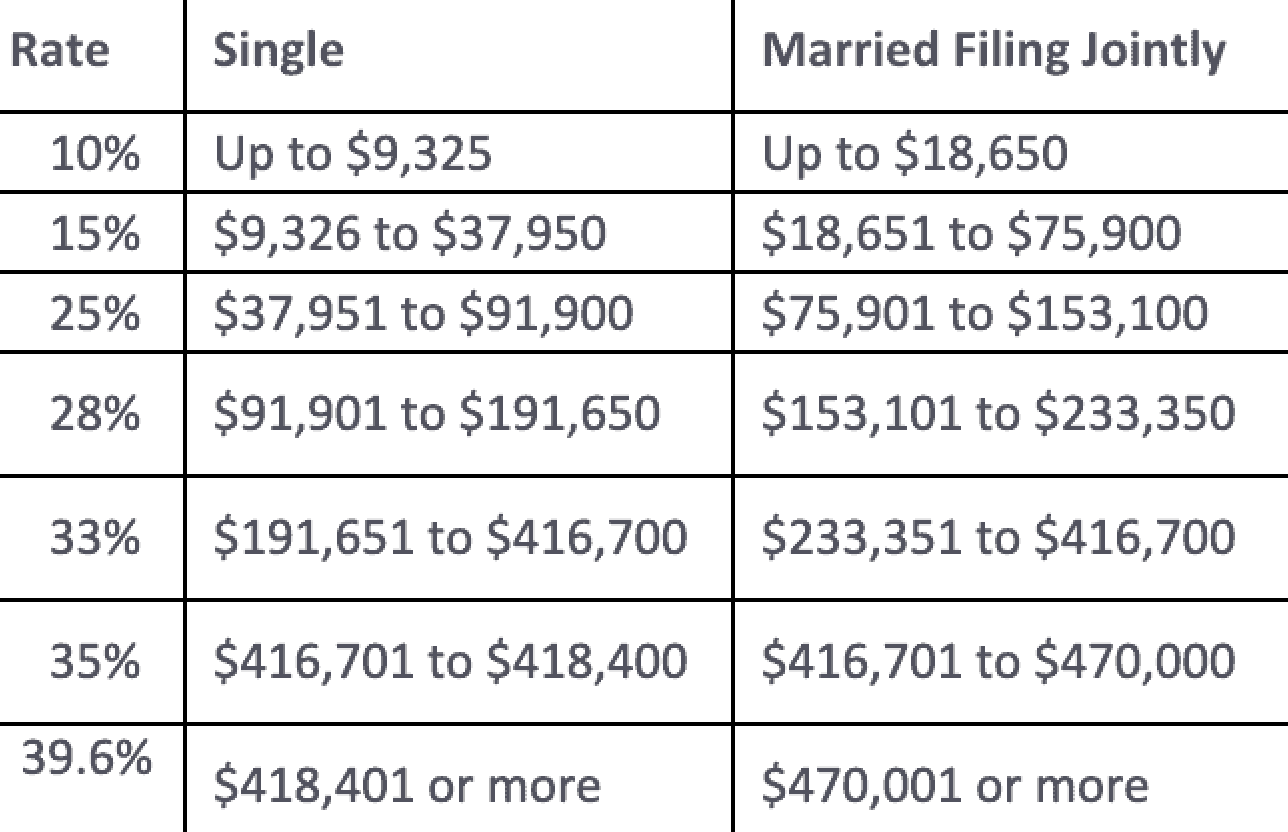

2026 Tax Brackets Explained (Simply)

The IRS released the official numbers in Revenue Procedure 2025-32, and they’ve adjusted everything for inflation. It's a graduated system. That means if you’re a single person making $100,000, you aren't paying 24% on every single dollar. You pay 10% on the first chunk, 12% on the next, and so on.

Here is how the rungs on the ladder look for Single Filers in 2026:

- 10% on income from $0 to $12,400.

- 12% on income from $12,401 to $50,400.

- 22% on income from $50,401 to $105,700.

- 24% on income from $105,701 to $201,775.

- 32% on income from $201,776 to $256,225.

- 35% on income from $256,226 to $640,600.

- 37% on anything over $640,600.

If you’re Married Filing Jointly, the ranges are much wider. Basically, the IRS doubles most of those thresholds so couples don't get hit with a "marriage penalty" as easily. You’ll stay in the 10% bracket up to $24,800 and won't hit the top 37% rate until your combined taxable income clears $768,700.

The Standard Deduction Got a Boost

Most people don't itemize anymore. It’s just too much paperwork for very little gain. For 2026, the Standard Deduction for single filers is $16,100. If you're married and filing together, that number jumps to $32,200.

If you are 65 or older, there is a massive perk you shouldn't ignore. The OBBBA added a special $6,000 deduction for seniors. If you and your spouse are both over 65 and filing jointly, you could potentially knock $44,200 off your taxable income before you even start looking at other credits ($32,200 base + $12,000 senior bonus).

💡 You might also like: Why Plant Vogtle Units 3 and 4 Changed Everything for American Nuclear Power

What about the "Trump Accounts"?

There is a new player in town for 2026 called Trump Accounts (TAs). These are tax-advantaged savings accounts for minors. While the full IRS regulations are still rolling out, the general idea is that parents can stash money away for children under 18, and the growth remains tax-protected. It's sorta like a 529 plan but with more flexibility for non-education expenses.

Why your "Effective Rate" is the only number that matters

People freak out when they "move up a bracket." Don't.

👉 See also: Unemployment in GA Requirements: What Most People Get Wrong

If you earn one dollar over the 22% limit, only that one single dollar is taxed at 24%. Your Effective Tax Rate—the actual percentage of your total income that goes to Uncle Sam—is always lower than your top bracket. For a single person earning $65,000 in 2026, the math works out to an effective rate of about 13.9%.

Other 2026 Tax Changes You’ll Notice

- SALT Deductions: The cap on State and Local Tax deductions used to be a measly $10,000. For 2026, that limit has been raised to **$40,000** for most filers. This is a huge win for people in high-tax states like New Jersey, New York, or California.

- Car Loan Interest: You can now deduct up to $10,000 in interest paid on a loan for a new vehicle, provided it was assembled in the U.S. and weighs under 14,000 pounds.

- Child Tax Credit: This stays at $2,200 per child for 2026.

- Estate Tax: The exclusion amount is now a whopping $15 million. Unless you're inheriting a literal empire, you probably won't owe a dime in federal estate taxes.

Actionable Steps for 2026

- Check your withholding. With the new OBBBA adjustments and higher standard deductions, you might be overpaying every paycheck. Use the IRS Tax Withholding Estimator to see if you can take home more cash now.

- Plan your "Above-the-Line" donations. Even if you don't itemize, you can deduct **$1,000** ($2,000 for couples) for charitable gifts in 2026.

- Max out your HSA or FSA. The contribution limit for Health Flexible Spending Accounts rose to $3,400. This is "pre-tax" money, so it effectively lowers your taxable income.

The 2026 tax year is less about a "tax hike" and more about managing the new deductions available. Between the higher SALT cap and the senior bonus, many middle-class families might actually see a smaller bill this year despite the headlines.