So, you’re looking at 30 000 japanese yen to usd and wondering what that actually gets you right now.

It’s a specific number. Maybe it’s the price of a fancy dinner in Ginza you're eyeing, or perhaps it’s the amount of "pocket money" you want to change before landing at Narita. Honestly, the exchange rate has been a total roller coaster lately. If you haven't checked the charts in the last 48 hours, the number in your head is probably already wrong.

Right now, as we sit in January 2026, 30,000 Japanese Yen converts to approximately $189.47 USD.

But wait. Don't just take that number and run to the airport. Currency exchange isn't a stagnant thing. That $189 figure is the "mid-market" rate—the kind of rate banks use to trade with each other. By the time you hit a retail kiosk or use a credit card with a sneaky 3% foreign transaction fee, that 30,000 yen might actually cost you closer to $195. Or, if you're selling yen back for dollars, you might only see $182 in your hand.

Why 30,000 Yen is the Magic Number for Travelers

Why does everyone seem to search for this specific amount?

Basically, 30,000 yen is the "sweet spot" for a weekend in Japan. It’s roughly three of those crisp, brown 10,000-yen notes. In the Japanese economy, this amount carries a certain weight. It’s enough to feel like you have "real money," but not so much that you're terrified of losing your wallet in a crowded Shibuya crossing.

For a solo traveler, 30,000 yen is about two days of very comfortable living. You've got your 1,500-yen ramen lunches, a few 5,000-yen izakaya dinners, and plenty left over for those ubiquitous vending machine coffees and Shinkansen supplements.

The Real-World Value of 30,000 Yen in 2026

If you're trying to visualize what 30 000 japanese yen to usd actually buys you on the ground in Tokyo or Osaka today, here is the reality:

👉 See also: When Do Tariffs on China Start: What Most People Get Wrong

- Accommodation: You could get one night in a very decent, mid-range business hotel like a Dormy Inn or a Mitsui Garden Hotel. You’ll even get the breakfast buffet with the weirdly delicious eggs.

- Dining: It buys a high-end omakase sushi lunch for one person at a Michelin-rated spot, or about 20-25 bowls of high-quality Ichiran ramen.

- Shopping: This is roughly the price of a high-quality, made-in-Japan denim jacket or a very nice pair of noise-canceling headphones from an electronics giant like Yodobashi Camera.

- Transport: You could take the Shinkansen (bullet train) from Tokyo to Osaka and back, with a little change left over for a bento box on the way.

The "Yen Collapse" Drama of 2026

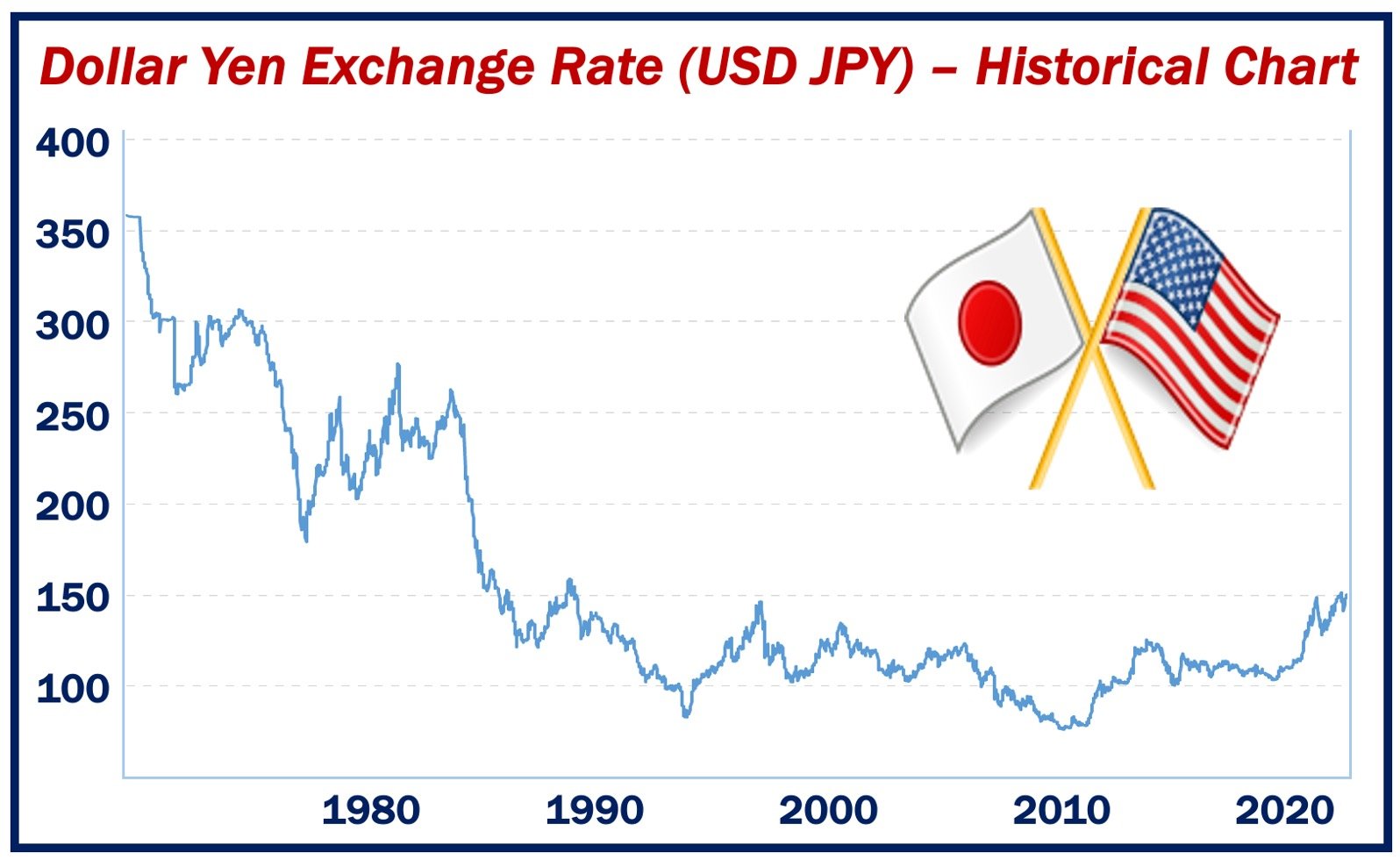

You might have heard the news: the yen has been through the wringer. Just a few days ago, around January 14, 2026, the yen slipped to nearly 160 yen per dollar. People were panicking. Headlines were screaming about a "fiscal crisis."

But then, the Japanese Finance Minister, Satsuki Katayama, stepped to the mic.

She dropped some hints about intervening in the market. Basically, she told the world that Japan wasn't going to let the currency just rot. The market listened, and the yen clawed back some ground. This is why when you look up 30 000 japanese yen to usd, the result changes every single hour.

The Bank of Japan (BoJ) is in a tight spot. They raised interest rates to 0.75% in December—the highest they've been since 1995. For a country that lived with "zero" or negative interest rates for decades, this is huge. They're trying to protect the yen, but they're also worried about the massive national debt.

It's a balancing act that affects every single dollar you trade.

The Hidden Fees Nobody Tells You About

When you type "30 000 japanese yen to usd" into a search bar, Google gives you a clean number.

The reality is messier.

📖 Related: Thomas Siebel Net Worth: What the AI Hype and Stock Slumps Actually Mean

If you go to a physical currency exchange booth at the airport, they’re going to "spread" the rate. They might give you a rate that’s 5 or 10 yen worse than the official one. On a 30,000 yen exchange, that’s like losing $10 or $15 just for the privilege of holding physical cash.

Pro tip: Use an ATM. Specifically, the 7-Eleven (7-Bank) or Lawson ATMs in Japan. They usually give you the best possible rate, though your home bank might still hit you with a $5 "out of network" fee. Even with that fee, you're usually better off than using the airport booths.

What to Expect for the Rest of 2026

Forecasters are split. Some experts at places like ING and Nomura think the yen will actually get stronger as the year goes on. They’re eyeing a target of 150 or even 145 yen per dollar by the second half of 2026.

If that happens, your 30 000 japanese yen to usd conversion is going to look very different.

At a rate of 145, those 30,000 yen would be worth about $206.

That’s a $17 difference just based on timing. For a tourist, that’s a free dinner. For a business traveler or someone paying for an export, those shifts add up to thousands of dollars very quickly.

Is it a Good Time to Buy Yen?

Honestly? Kinda.

Relative to the last 20 years, the yen is still historically weak. Even with the recent hikes, the dollar still has a lot of "buying power" in Japan. If you're planning a trip for later this year, locking in some yen now isn't the worst idea, especially if the Bank of Japan continues to hike rates as expected in June or September.

But don't dump your life savings into it. Currency markets are notoriously fickle, and the "snap election" uncertainty in Japan right now is adding a layer of "who knows?" to the whole situation.

Actionable Steps for Your Money

If you need to move 30,000 yen (or any amount) into USD right now, don't just click the first "convert" button you see.

📖 Related: Funny Workplace Quotes That Actually Keep You From Quitting

First, check if your credit card has a 0% foreign transaction fee. Cards like the Chase Sapphire or various Capital One options are life-savers here. You get the real exchange rate without the middleman taking a cut.

Second, if you need to send money to a bank account, use a service like Wise or Revolut. They show you the fees upfront.

Lastly, keep an eye on the news out of Tokyo next week. There’s another Bank of Japan meeting on the horizon. If they stay "dovish" (meaning they don't plan to raise rates soon), the yen might slide back toward 160. If they sound "hawkish," the yen could jump, making your dollars buy less.

Timing is everything.

Watch the 159.50 level. If the yen stays stronger than that, we might be seeing the start of a recovery. If it breaks above 160, expect the Japanese government to start jumping into the market to prop it up manually. Either way, that 30,000 yen in your pocket is going to be a moving target for a while.