If you’re sitting on 3100 Canadian dollars and need to move them across the border today, you’re looking at a figure that feels a bit like a moving target. Right now, specifically on January 13, 2026, 3100 CAD to USD converts to approximately $2,233.16. That's based on an exchange rate of roughly 0.7204, which has been bobbing up and down like a buoy in a storm all morning.

But here is the thing.

Most people just Google the number, see the mid-market rate, and think that's the cash they'll actually get.

Honestly? You've probably noticed that's rarely the case. Between the "convenience fees" at the airport and the hidden spreads baked into your bank's "zero commission" promises, that $2,233 can quickly shrink into something much less exciting.

✨ Don't miss: MoneyNewsWorld Managing Your Money: What the Gurus Get Wrong About Your Cash

The Reality of Converting 3100 CAD to USD Right Now

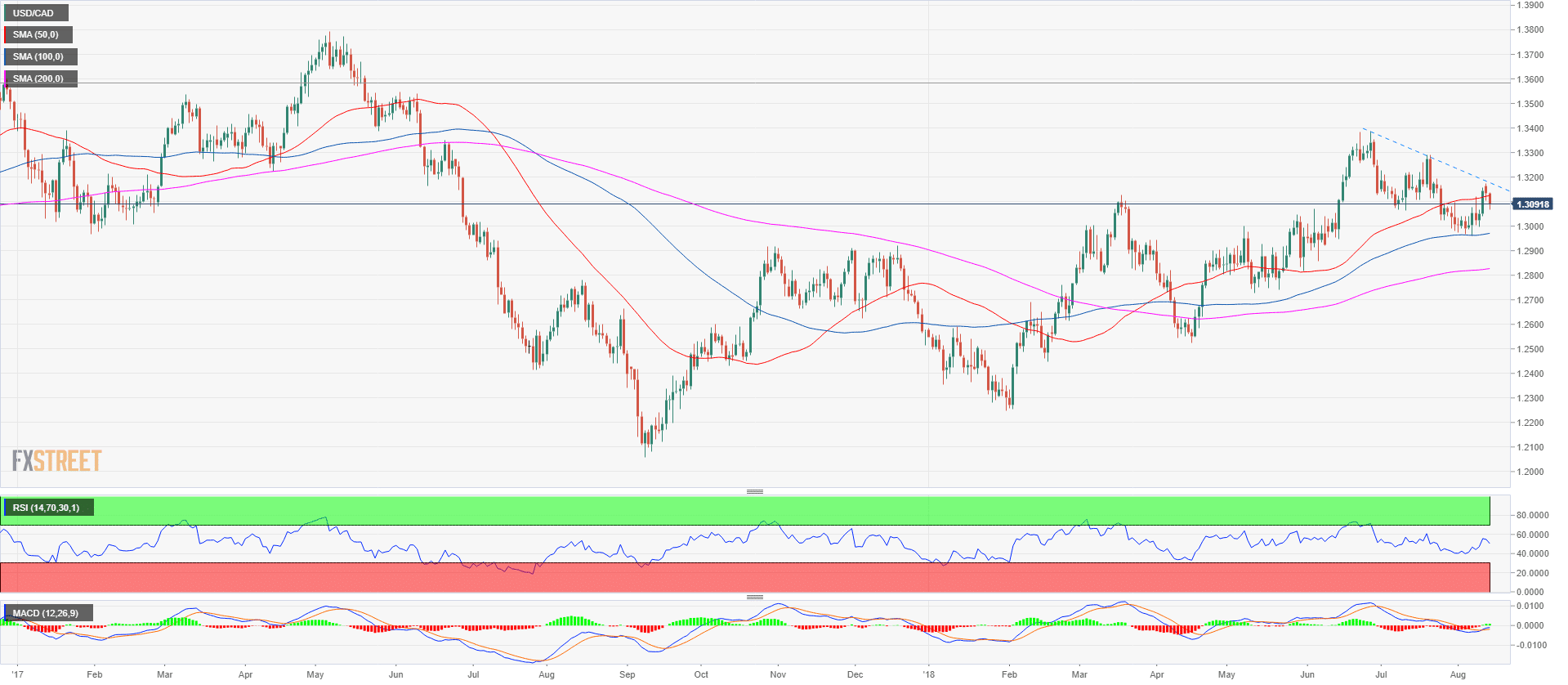

The market is twitchy. This morning, we saw the rate peak at 0.7210 before sliding back down toward 0.7203. If you were doing this trade at 4:30 AM, you’d have netted a few extra dollars compared to doing it during lunch. It doesn't sound like much, but when you're talking about three grand, those fractions of a cent start to matter.

Why is it so volatile?

Well, it's a mix of big-picture drama and boring technical stuff. We’re currently seeing a lot of tension between the Bank of Canada (BoC) and the U.S. Federal Reserve. Tiff Macklem, the BoC Governor, has been holding the line at a 2.25% interest rate. Meanwhile, over in the States, Jerome Powell is dealing with subpoenas and a very vocal administration that wants rates to drop faster than the Fed thinks is safe.

📖 Related: The Dow Jones Index Over Time: Why 30 Stocks Still Rule Wall Street

This tug-of-war is what dictates whether your 3100 CAD is worth $2,200 or $2,300 by next week.

What’s Actually Happening with the Rate

The 0.72 level has become a sort of "home base" for the Loonie lately. We saw a brief, terrifying dip toward 0.61 back in early 2025, but the currency has clawed its way back into this 0.71 to 0.73 range.

- Bank of Canada stance: They are essentially on "pause." They think 2.25% is the "sweet spot" for now.

- The Fed Factor: The U.S. just cut rates in December to a range of 3.5% to 3.75%, but they’ve signaled they might only do one more cut in all of 2026.

- Trade Noise: There's constant chatter about tariffs and CUSMA renegotiations. Every time a politician tweets, the CAD/USD pair flinches.

Stop Giving Your Money to the Banks

If you walk into a major Canadian bank with 3100 CAD, they aren't going to give you 0.72. They'll likely give you something closer to 0.69 or 0.70.

That is a $60 to $90 difference.

Basically, you’re paying for the privilege of standing in line. For a sum like 3100 CAD, it’s often worth looking at peer-to-peer exchange platforms or specialized fintech services. They usually hover much closer to that "real" mid-market rate you see on Google.

The "Norbert’s Gambit" Myth

You might have heard of Norbert's Gambit—the trick where you buy a stock listed on both the TSX and NYSE to dodge exchange fees. While it's a genius move for $50,000, for 3100 CAD to USD, it’s probably overkill. The journaling fees and the three-day wait time might end up costing you more in sanity (and potential rate shifts) than the $40 you'd save.

Is Now a Good Time to Exchange?

Kinda.

📖 Related: When Does The No Overtime Tax Start: What Most People Get Wrong

If you look at the historical data from the last year, 0.72 is a relatively strong position for the Canadian dollar. Just a few months ago, we were hovering closer to 0.71. However, the forecast for the rest of 2026 is murky. Some analysts at Scotiabank think the BoC might actually have to raise rates by the end of the year if inflation doesn't stay in its lane. If that happens, the CAD could jump.

On the flip side, if the U.S. economy remains the "cleanest shirt in the laundry basket," the USD will continue to be the safe haven everyone runs to, keeping the CAD suppressed.

Actionable Steps for Your 3100 CAD

- Check the "Spread": Before you hit 'confirm,' compare the rate you’re being offered to the one on a site like XE or Reuters. If the gap is more than 1%, you're getting fleeced.

- Use a Multi-Currency Account: If you don't need the cash in your hand this second, move it into a digital USD wallet. These platforms often provide rates within 0.5% of the mid-market.

- Watch the Calendar: The next big Bank of Canada announcement is January 28. If you can wait two weeks, you might see a better (or worse) rate depending on their tone.

- Avoid Weekend Trades: Markets are closed, so providers bake in an extra "risk premium" to protect themselves against gaps when the market reopens on Monday.

When you're dealing with 3100 CAD to USD, accuracy is your best friend. The difference between a "okay" rate and a "great" rate is enough to cover a decent dinner in New York or a few tanks of gas in Seattle. Don't leave that money on the table just because it's easier to click a single button in your banking app.