You probably heard the IRS bumped the numbers again. It happens every fall, like clockwork, and most people just shrug and assume their HR department will handle it. But honestly, if you're just coasting on last year’s settings, you're literally leaving money on the table. The 401 k limits 2025 update isn't just a minor "cost of living" tweak; it includes a specific, first-of-its-kind "super catch-up" that could fundamentally change how you plan for the next decade.

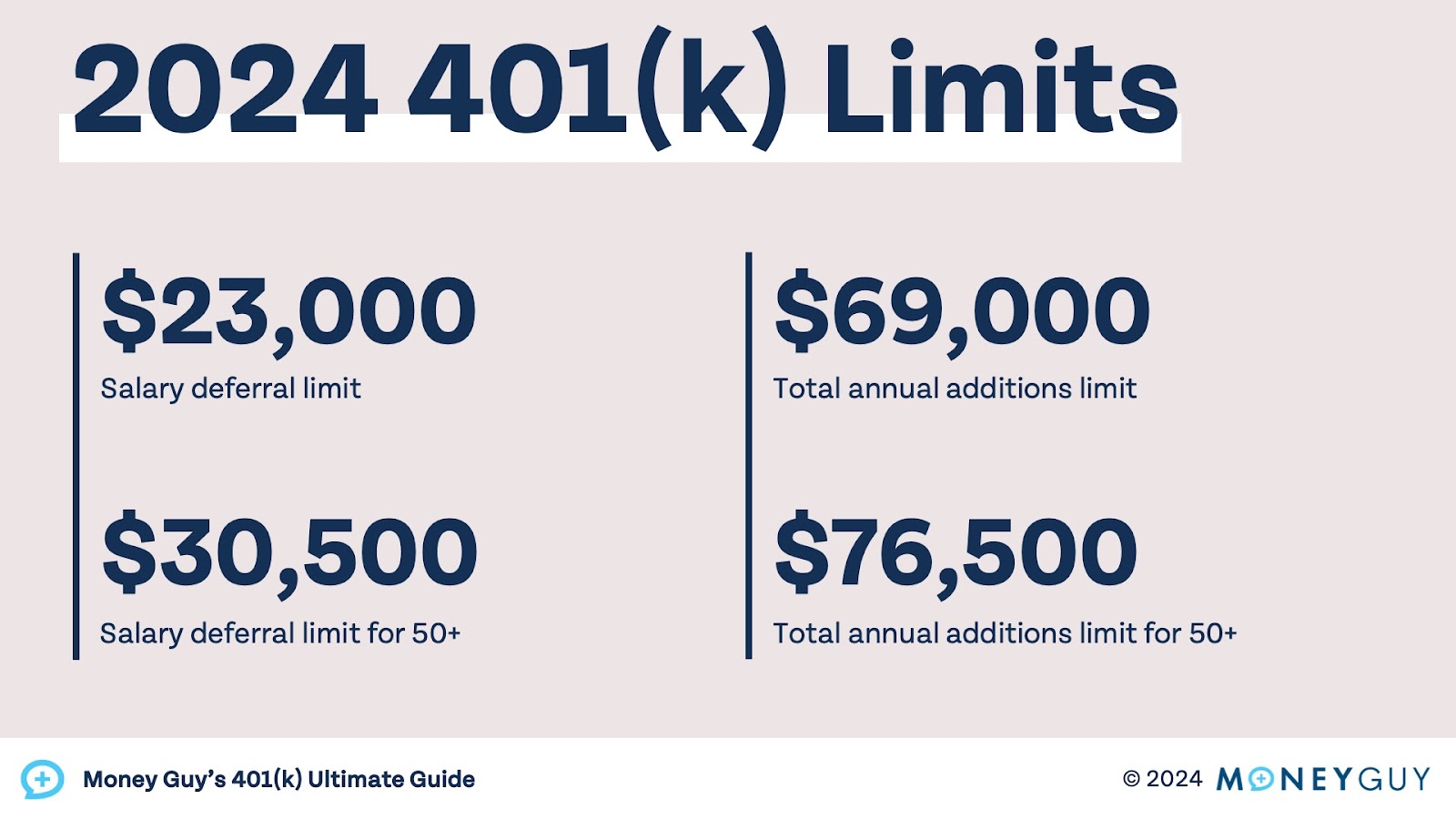

Inflation has been a beast. We all know it. Because of that, the IRS uses a specific formula to adjust retirement caps so your savings don't lose their punch. For 2025, the standard employee contribution limit is jumping to $23,500. That is a $500 increase from 2024. It might seem small, but over twenty years of compounding, that extra five hundred bucks a year starts looking like a brand-new car or a very long vacation in Italy.

If you’re 50 or older, you’ve probably been using the standard catch-up. That stays at $7,500 for most people. But wait. There is a weird, very specific new rule for people aged 60, 61, 62, and 63. This is the SECURE 2.0 Act finally kicking into gear.

The Weird New "Super Catch-Up" for 60-Somethings

This is where it gets interesting. If you happen to be in that narrow window of 60 to 63 years old in 2025, your catch-up limit isn't $7,500. It’s **$11,250**. Or, more accurately, it’s 150% of the regular catch-up limit.

Basically, the government realized that people in their early 60s are often in their peak earning years and freaking out about how close retirement actually is. So, they gave you a bigger bucket. If you’re 62, you can shove $34,750 into your 401(k) this year just from your own salary. That is a massive amount of tax-deferred growth.

But there's a catch. There's always a catch.

If you make more than $145,000 (based on your 2024 wages), the law originally said your catch-up contributions had to go into a Roth account. This was a huge headache for payroll providers. So much of a headache, in fact, that the IRS pushed the "mandatory Roth" rule back to 2026. For 2025, you can still do your catch-ups in a traditional, pre-tax 401(k) regardless of your income level. It’s a temporary reprieve. Enjoy it while it lasts.

Breaking Down the Total Pie

Most people think the 401 k limits 2025 only apply to what they take out of their paycheck. Not true. There is a "total" limit that includes what your employer kicks in. For 2025, the combined limit for employee and employer contributions is $70,000. If you're 60-63 and hitting that super catch-up, the absolute ceiling for the year is actually $81,250.

Think about that.

If you work for a company with a generous profit-sharing plan or a massive match, you could potentially stash away eighty grand in a single year. That’s more than the median household income in many parts of the country.

- Standard Employee Limit: $23,500

- Catch-up (Age 50-59 or 64+): $7,500 (Total $31,000)

- Super Catch-up (Age 60-63): $11,250 (Total $34,750)

- Total Limit (All sources): $70,000 ($81,250 for age 60-63)

Wait, what happens if you have two jobs?

I see this mistake a lot. The $23,500 limit is per person, not per plan. If you have a day job with a 401(k) and a side hustle with a Solo 401(k), you can't put $23,500 into both. You'll get slapped with an excise tax and a whole lot of paperwork to undo the over-contribution. However, the employer side of the limit (the profit-sharing part) is usually per plan. If you’re navigating multiple plans, talk to a CPA. Seriously.

Roth vs. Traditional: The 2025 Dilemma

With tax brackets currently set to "sunset" or increase in 2026 unless Congress acts, a lot of experts are leaning harder into Roth contributions for 2025.

The logic is pretty simple. Taxes are historically low right now. If you pay the tax now on your contributions, you get to pull that money out—and all the growth—tax-free when you're 70. If you take the tax break now (Traditional), you're betting that your tax rate in retirement will be lower than it is today.

Are you willing to make that bet?

Most people just default to Traditional because they want the lower tax bill today. It feels good to see that $2,000 tax refund in April. But if you’ve got a massive Traditional 401(k) and a Traditional IRA, you’re creating a "tax bomb" for your later years when Required Minimum Distributions (RMDs) kick in. Diversifying your "tax buckets" is just as important as diversifying your stocks.

💡 You might also like: Finding a Gantt Chart Excel Format Free Download That Actually Works

Why "Set it and Forget it" is Actually Dangerous

Most HR systems don't automatically adjust your percentage to hit the new 401 k limits 2025. If you have your contribution set at 10% and your salary stayed the same, you’ll likely fall short of the new $23,500 max.

Even worse? Some companies only match per pay period.

Let's say you're a high earner and you decide to "front-load" your 401(k) by putting 50% of your check in during January and February. You hit the $23,500 limit by March. If your company doesn't have a "true-up" provision, you will miss out on the employer match for the rest of the year. They can't match a $0 contribution. You basically throw away free money because you were too aggressive.

Check your Summary Plan Description (SPD). Look for the phrase "True-Up Match." If they don't have it, you need to pace your contributions so you're still contributing something in December.

The After-Tax "Mega Backdoor" Secret

If your company allows "after-tax" contributions—which is different from Roth—you can blow past the $23,500 limit. You contribute up to that $70,000 total cap using post-tax dollars, and then you immediately convert those dollars into a Roth 401(k) or Roth IRA.

Not every plan allows this. Most don't, actually. But if yours does, it’s the single most powerful wealth-building tool in the IRS code. It’s how tech workers in Silicon Valley end up with seven-figure Roth IRAs by their 40s.

Real World Action Steps for January

Don't just read this and move on. Money is emotional, but the math is cold.

First, log into your benefits portal. Right now. Look at your current contribution. If you want to max out at $23,500 and you get paid 26 times a year, you need to contribute roughly **$904 per paycheck**. If you're 62 and want that super catch-up, you're looking at about $1,336 per paycheck.

Second, check your beneficiary designations. I know, it’s morbid. But you’d be surprised how many people still have an ex-spouse or a deceased parent listed as the beneficiary of their 401(k). That document overrides your will. It doesn't matter what your will says; the plan administrator follows the beneficiary form.

Third, look at your fees. If you're in a target-date fund charging 0.75% and there’s an S&P 500 index fund charging 0.05%, you’re paying a massive premium for someone to rebalance your portfolio once a year. That fee eats your compounding.

The 401 k limits 2025 are a gift from the IRS to help you stay ahead of inflation. Use them. Even if you can't hit the max, try to increase your contribution by just 1% today. You won't notice it on your paycheck, but your 80-year-old self definitely will.

Quick Summary of Numbers to Remember

- $23,500 - The new magic number for everyone.

- $11,250 - The "Super Catch-up" if you are aged 60-63.

- $7,500 - The standard catch-up for those 50-59 or 64+.

- $145,000 - The income threshold to watch for future mandatory Roth rules.

- $70,000 - The total "all-in" limit for 2025 (employee + employer).

The window to maximize these tax advantages for the 2025 tax year is officially open. Re-evaluate your 401(k) strategy now to ensure your payroll allocations align with these new thresholds before your first paycheck of the year is processed. If your income has increased, use a portion of that raise to cover the gap between the old limits and the new ones. This keeps your lifestyle stable while accelerating your path to financial independence.