So, if you’re looking at your screen right now and wondering what on earth is happening with the adobe share price today, you aren’t alone. It’s been a rough ride. As of Sunday, January 18, 2026, we’re looking at a stock that just closed the week at $296.12.

That’s a big deal. For the first time in a long time, Adobe has dipped below that psychological $300 floor. On Friday alone, the stock slid about 2.62%. If you’ve been holding ADBE for a while, this probably feels like a punch to the gut. The stock is down nearly 17% just in the last month.

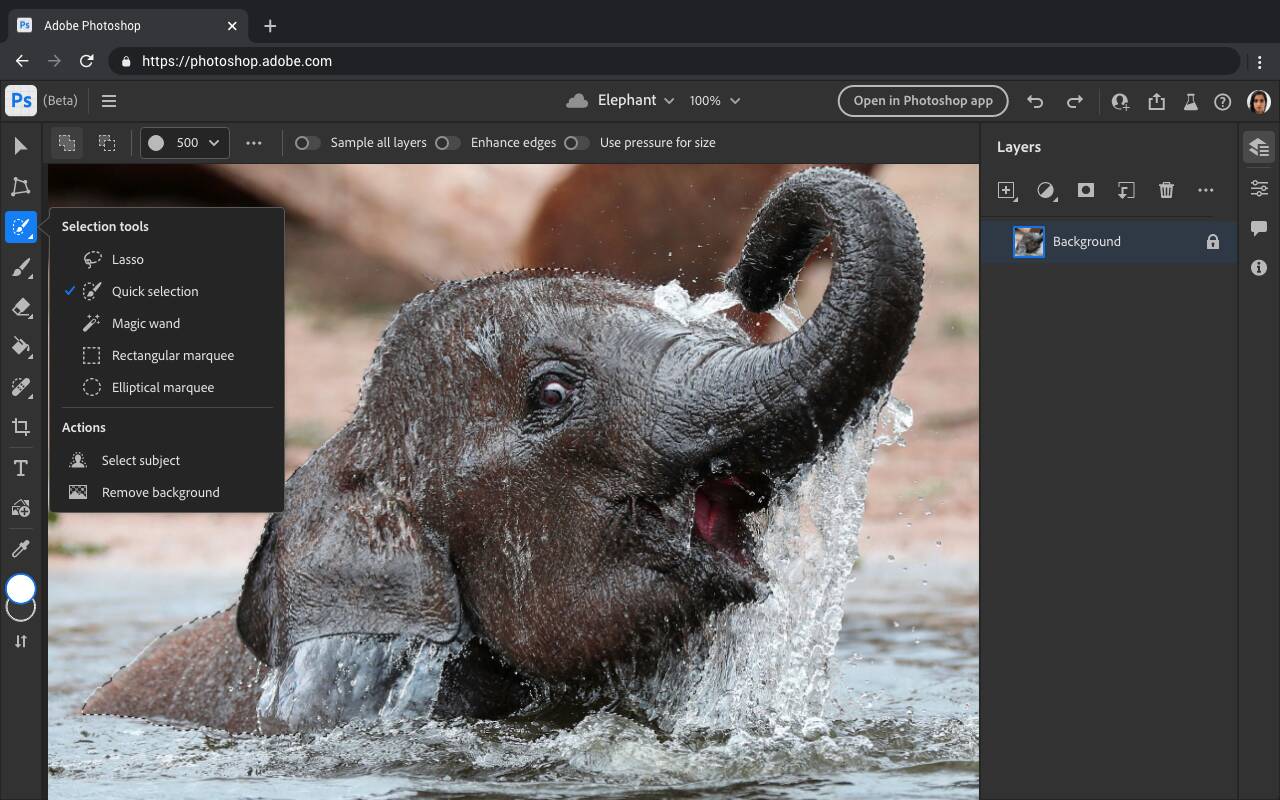

Honestly, it’s a weird vibe in the market. Adobe used to be the untouchable king of software. Now? People are panicking about AI. They’re worried that OpenAI’s Sora or some new Canva update is going to eat Adobe’s lunch. But when you look at the actual numbers, the story gets a lot more interesting.

📖 Related: The Age for Retirement: What Most People Get Wrong About the Finish Line

What’s Actually Driving the Adobe Share Price Today?

The "AI bubble" fear is real. Investors are terrified that generative AI will make professional tools like Photoshop obsolete. It’s a classic "disruption" narrative. But if you dig into the Q4 2025 earnings that dropped back in December, Adobe actually beat expectations on the top line. They pulled in $6.19 billion in a single quarter.

The problem? The outlook.

Wall Street is a "what have you done for me lately" kind of place. Management set the fiscal year 2026 revenue target between $25.9 billion and $26.1 billion. While that’s solid growth, the "agentic AI" transition is taking longer than some of the impatient big-money managers expected. Goldman Sachs recently slapped a $290 price target on it with a "sell" rating. That kind of talk from a major bank usually sends retail investors running for the hills.

The Competition is Louder Than Ever

It’s not just Microsoft or Google anymore. You've got:

- Canva pushing hard into the enterprise space.

- Midjourney and OpenAI changing how people even think about "creating" an image.

- Salesforce and HubSpot nibbling at the edges of the Digital Experience segment.

Adobe’s AI-related revenue is still relatively small compared to its total pie. This is the crux of why the adobe share price today feels so heavy. Investors want to see the "Firefly" hype turn into cold, hard subscription cash immediately.

🔗 Read more: Why Every OTR Expeditor Is Looking For A Box Truck With Sleeper Right Now

Is the Stock Actually "Cheap" Right Now?

Let’s talk valuation because this is where things get kinda spicy. Right now, Adobe is trading at a forward P/E ratio of about 17x to 18x. To put that in perspective, this company used to trade at 40x or 50x without anyone blinking.

Simply Wall St basically says the stock is 43% undervalued based on cash flow projections. They’ve got a "fair value" pegged at over $519. We are miles away from that. Even if you take a more conservative view, the gap between the current price and where analysts think it should be is massive.

There’s a clear divide. On one side, you have the "bears" who think Adobe is the next Kodak—a giant that missed the technological shift. On the other side, you have "bulls" like those at Stifel or RBC Capital who keep reiterating "Buy" ratings with targets north of $400. They see this as a temporary transition period.

The Secret Strength Nobody Mentions

While everyone focuses on Photoshop, Adobe’s "Document Cloud" is quietly a beast. Acrobat Web saw monthly active users jump 30% last year. It’s the unsexy part of the business—PDFs and e-signatures—that provides the floor.

✨ Don't miss: Where Can I Get a Student Loan Without Getting Scammed by High Interest

Plus, they are buying back shares like crazy. In 2025 alone, they repurchased over 30 million shares. When a company eats its own stock at these prices, they’re basically saying, "We think the market is wrong."

Real-World Action Steps for Your Portfolio

If you’re staring at the adobe share price today and trying to decide whether to click "buy" or "sell," here is how to play it:

- Check Your Horizon: If you need this money in six months, stay away. The volatility around AI headlines isn't going anywhere.

- Watch the $290 Support: Many technical analysts see $290 as the ultimate "must-hold" level. If it breaks that, we could see a slide toward $270.

- DCA is Your Friend: Instead of going all-in, consider Dollar Cost Averaging. The current P/E of 17x is historically a bargain for a company with 90% gross margins.

- Monitor the "Agentic" Shift: Keep an eye on the Q1 2026 earnings report coming up. If Adobe can show that their new AI "agents" are actually being paid for by enterprise clients, the stock will likely snap back fast.

Bottom line? Adobe is in the middle of a massive identity shift. It's a high-quality business with a temporary narrative problem. Whether you see it as a falling knife or a golden opportunity depends entirely on if you believe Shantanu Narayen can integrate AI faster than the startups can steal his customers.

Next Steps for Investors: Review your tech sector weighting to ensure you aren't over-leveraged in software-as-a-service (SaaS) before the next earnings cycle. Set price alerts at the $290 and $310 levels to track if the stock manages to reclaim its 50-day moving average, which currently sits way up at $334.