You see the name Altria Group Inc and your mind probably goes straight to Marlboro. It makes sense. Marlboro has been the undisputed king of the American cigarette market for decades, holding a retail share that still sits comfortably around 42%. But if you're looking at Altria today, specifically as we move through 2026, and you’re only thinking about cigarettes, you're basically looking at a photograph from ten years ago.

Things have changed. A lot.

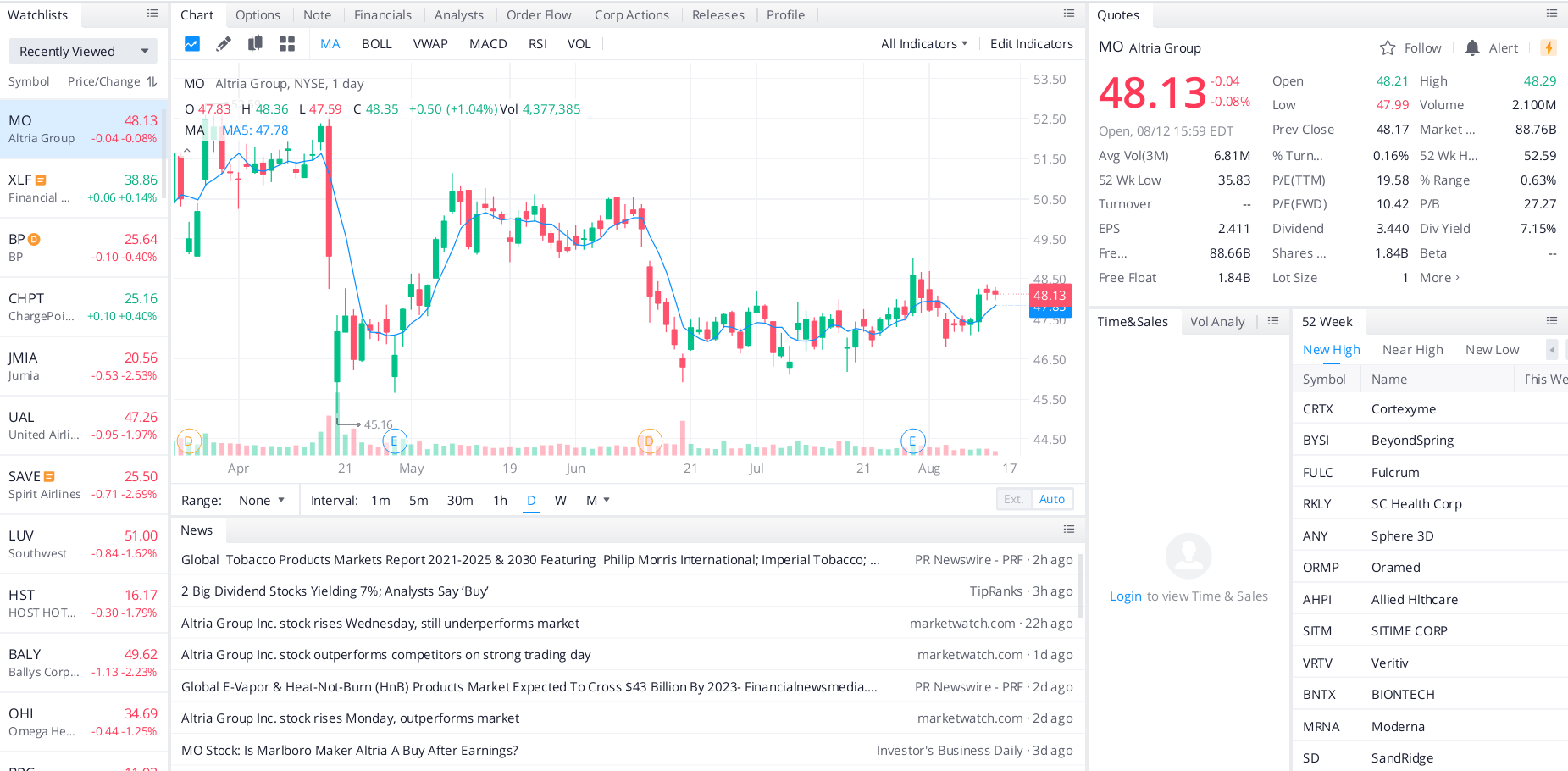

The stock, traded under the ticker MO, is a weird beast. It’s a "Dividend King," meaning it has hiked its payout for over 50 consecutive years. For some, it’s a "sin stock" to be avoided at all costs. For others, it’s a cash-flow machine that pays them to wait while the company tries to figure out its next act. Honestly, the 2026 landscape for Altria is less about tobacco leaves and more about a frantic, high-stakes pivot into "smoke-free" nicotine.

The 7% Yield: Safety or Trap?

Let’s talk about the dividend first because that’s why 90% of people own this stock. Right now, Altria’s dividend yield is hovering around 7% to 7.5%. In a world where the S&P 500 yield is often a fraction of that, a 7% check feels like a gift. But is it sustainable?

The bears will tell you the payout ratio is too high, often sitting north of 75-80% of earnings. They aren't wrong. If cigarette volumes continue to fall off a cliff—we’re talking 8% to 10% declines annually—at some point, you can't just keep raising prices to bridge the gap.

But here’s the thing most people miss: Altria has a "break glass in case of emergency" fund. They still own a massive stake in Anheuser-Busch InBev. Even after selling off some shares to fund buybacks recently, that stake is worth billions. If the dividend ever truly got shaky, they have an ATM sitting in the form of a beer company.

Plus, the cash flow is just... sticky. People keep buying Marlboros despite the price hikes. It’s a grim reality of the business model, but from a purely cold-blooded financial perspective, it provides a floor that few other companies can claim.

The "on!" Pouch and the ZYN War

If you’ve walked into a gas station lately, you’ve seen the cans. Nicotine pouches are the new gold rush. While Philip Morris International (PM) has the global juggernaut ZYN, Altria is betting the house on on! and the newly authorized on! PLUS.

The FDA actually gave Altria a big win recently. In late 2025 and early 2026, they granted marketing orders for several on! PLUS varieties. This is huge. Why? Because the "modern oral" category is growing at nearly 30% a year while cigarettes are shrinking.

- Market Share: Altria's oral tobacco segment retail share is roughly 34.7%, but they are fighting tooth and nail for the pouch segment.

- Growth: Shipment volumes for on! pouches jumped over 20% in recent reports.

- The ZYN Factor: ZYN still owns the room, but Altria is using its massive retail distribution network to force on! into every corner of the country.

It’s a dogfight. Altria is currently the underdog in the pouch world, but they have the advantage of being the "incumbent" with US retailers. They know how to play the shelf-space game better than anyone.

💡 You might also like: Pink Slip Meaning: Why Getting One Isn't Always About Losing Your Job

NJOY and the Vaping Headache

Vaping has been a disaster for Altria in the past. Remember Juul? They lit $12.8 billion on fire with that investment. It’s one of the worst corporate M&A moves in history. Period.

Now, they are trying again with NJOY.

The strategy is different this time. Instead of buying a "cool" startup that the FDA hates, they bought NJOY because it already had FDA authorizations. It’s the "safe" play. But the market is currently flooded with illegal, flavored disposable vapes from overseas. Altria is spending millions on lobbying and legal actions to get those disposables off the shelves.

If the government actually cracks down on illicit vapes in 2026, NJOY’s market share (which is currently small, around 6-7%) could skyrocket. If the government stays hands-off? NJOY might just be another expensive lesson.

Why 2026 is a "Show Me" Year

We have a leadership change happening. Billy Gifford is stepping down as CEO in May 2026, and Sal Mancuso is taking the reins. This is more than just a name change on the door. It signals a shift toward a leaner, more aggressive Altria.

They’ve expanded their share buyback program to $2 billion, expiring at the end of 2026. This is management’s way of saying, "We think the stock is cheap." When a company retires 10% of its shares over a few years, as Altria has done, it makes the remaining shares more valuable even if the company isn't growing like a tech startup.

What most people get wrong: They think Altria is dying.

The reality: Altria is harvesting a dying industry to build a new one. It’s a slow, messy, and controversial transition.

Actionable Insights for 2026

- Watch the Volume: If cigarette volume declines accelerate past 10% year-over-year, that's a red flag that pricing power is finally hitting a wall.

- Monitor the Pouch Split: Check the quarterly reports for the "on!" retail share. If it stays stuck below 10%, they are losing the war to ZYN.

- The Beer Exit: Keep an eye on any further sales of their Anheuser-Busch (BUD) stake. Those sales usually signal a big stock buyback or a debt-clearing move, which is generally good for the share price.

- Regulatory Heat: Watch the FDA’s stance on menthol and flavors. Any nationwide ban on menthol would hit Altria harder than almost anyone else.

Altria Group Inc isn't a "buy and forget" stock anymore. It's a high-yield turnaround story that requires you to pay attention to the fine print of FDA filings and gas station shelf space.

To dig deeper into the actual numbers, you should pull the latest 10-K filing from Altria’s investor relations page and look specifically at the "Smokeable Products" vs "Oral Tobacco" operating margins. Comparing the profit-per-unit between a pack of Marlboros and a can of on! will tell you exactly how much "new" business Altria needs to replace the "old" business.