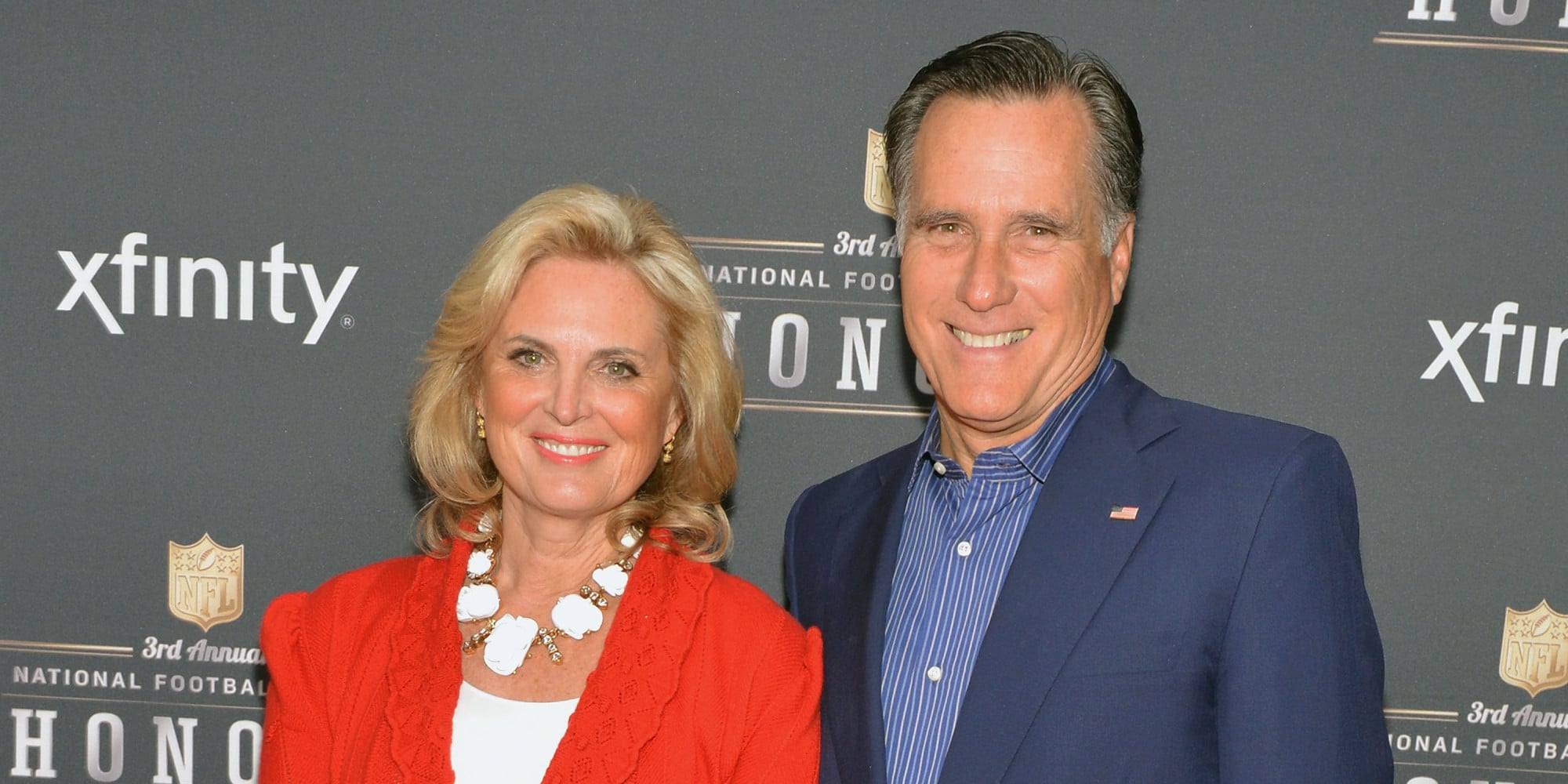

When people talk about the Romney family finances, they usually picture Mitt. They think of private equity, Bain Capital, and the kind of "corporate raider" wealth that defined the 2012 election. But if you actually look at the filings, Ann Romney net worth is a distinct, complex beast that isn't just a byproduct of her husband's success.

Honestly, it’s kinda fascinating.

Most folks assume she’s just along for the ride, but she has her own independent assets, a high-stakes horse breeding operation, and a family trust structure that would make a forensic accountant sweat. We’re talking about a woman who owns a one-third stake in an Olympic dressage horse while simultaneously managing a multi-million dollar charitable foundation. It’s not just "old money." It's a highly strategic, diversified portfolio.

The $270 Million Question: Where Does the Money Actually Live?

Basically, you can't pin down a single number for Ann Romney because the wealth is spread across so many different buckets. Public financial disclosures (the last major ones coming during Mitt’s Senate runs) put the couple’s combined fortune in the $190 million to $270 million range.

But wait. There's a catch.

A huge chunk of that—at least $21 million—is held independently by Ann. In some years, her personal investments alone have pulled in over $3 million in annual income. She isn't just "Mitt's wife" in the eyes of the IRS; she’s a significant individual filer with her own capital gains and dividends.

Breaking Down the Romney Asset Map

- The 1995 Family Trust: This is the big one. Valued at roughly $100 million, this trust was set up for their five sons. While Ann isn’t the primary beneficiary, she and Mitt funded it using sophisticated financial instruments like GRATs (Grantor Retained Annuity Trusts).

- The Blind Trust: Most of their liquid wealth is tucked away in blind trusts managed by trustee Brad Malt. This means they literally don't know which specific stocks they own at any given time to avoid conflicts of interest.

- Real Estate Portfolio: They’ve owned everything from a $12 million beach house in La Jolla, California, to a massive estate in Wolfeboro, New Hampshire. Even their "smaller" condos in places like Utah or Massachusetts are worth more than most people's entire neighborhoods.

Horses, Hobbies, and the "Olympic" Revenue Stream

You’ve probably heard about the horses.

The media went wild over Rafalca, the dressage horse Ann co-owned. While some pundits mocked it as a "rich person's tax write-off," the reality of the horse business is much more cutthroat. Ann Romney’s involvement in the world of high-end dressage isn't just a hobby; it’s a capital-intensive industry.

The Romneys faced some heat for declaring $77,000 in losses on their tax returns related to the horse, but under the "hobby loss" rules, they actually only got a tiny deduction (about $50 in some years). The real wealth here isn't the tax break—it's the asset value. An Olympic-caliber horse like Rafalca is an appreciating asset that can be worth seven figures.

The Business of Being Ann Romney

Beyond the investments, Ann has built her own brand. She’s an author. She’s a speaker.

💡 You might also like: John D. Rockefeller Net Worth: Why He Is Still the Richest Person Ever

Her book In This Together and her cookbook The Romney Family Table weren't just vanity projects. They were commercial successes. While the couple has a history of donating book royalties to charity (like the Ann Romney Center for Neurologic Diseases), the earning potential there is significant.

Speaking of the Center, this is where a lot of the "wealth" isn't personal, but it's certainly part of her legacy. The Romneys gave a $5 million gift to establish the center at Brigham and Women’s Hospital. It’s a massive operation focused on five diseases: MS, Alzheimer’s, ALS, Parkinson’s, and brain tumors. Ann, who was diagnosed with Multiple Sclerosis in 1998, has used her platform to raise hundreds of millions for research.

What Most People Miss About Her Background

It’s easy to look at the Romney name and think "dynasty," but Ann’s father, Edward Roderick Davies, was a self-made man. He co-founded Jered Industries, which built heavy machinery for the Navy.

👉 See also: USD to NGN Exchange Rate: What Most People Get Wrong About the Naira

She grew up in Bloomfield Hills, Michigan, in a world of privilege, sure, but it was the kind of privilege built on 1950s industrial grit. That "self-made" ethos is why she’s often more comfortable talking about the "friends and loved ones" being her true riches, even if she’s sitting on a nine-figure net worth.

The Reality of 2026 Finances

As of early 2026, the Romneys have largely stepped back from the front lines of elective politics. This usually means more freedom in their investment strategy. Without the constant scrutiny of a presidential campaign, they can move assets more fluidly.

However, don't expect the net worth to skyrocket or plummet. When you reach this level of wealth—what financial planners call "ultra-high-net-worth"—the goal isn't necessarily to double the money every year. It’s preservation and philanthropy.

📖 Related: Why Halloween is the Second Most Commercially Successful Holiday After Christmas

Actionable Insights: What You Can Learn from the Romney Portfolio

- Trusts are your friend: You don't need $100 million to benefit from a trust. Using a living trust can save your family a massive headache (and money) in probate court later.

- Diversify beyond the S&P 500: The Romneys don't just hold stocks. They have real estate, private equity (Bain leftovers), and alternative assets (horses). Most people should aim for at least some exposure to real estate or gold.

- Charity as a Legacy: Ann Romney’s net worth is inextricably linked to her philanthropy. If you're building wealth, start thinking early about the "why" behind the money.

Ultimately, Ann Romney’s financial story is about more than just a big number. It’s a masterclass in how the American elite manage, shield, and distribute wealth across generations. Whether you agree with their politics or not, you’ve gotta admit the math is impressive.

To get a clearer picture of how similar high-net-worth individuals structure their estates, look into Family Limited Partnerships (FLPs). This is a common tool the Romneys used to transfer value to their children while maintaining control. Understanding how these work can give you a better grasp of how "dynastic" wealth is actually maintained in the U.S.