You’re looking at your bank account and wondering if everyone else in the country is just as stressed about the price of eggs as you are. It’s a classic Canadian pastime. Honestly, trying to pin down the average income in Canada feels a bit like trying to grab a handful of smoke—every time you think you’ve got it, the wind shifts.

Numbers get thrown around constantly. You’ll hear one person say Canadians make $75,000, while another insists the "real" figure is closer to $50,000. They might both be right, which is the annoying part. It depends on whether they’re talking about "average" (the mean) or "median" (the middle), and whether they're looking at a single person in Brandon, Manitoba, or a dual-income household in downtown Toronto.

The Reality of the Numbers Right Now

Basically, as of early 2026, if you look at the most recent data from Statistics Canada, the average weekly earnings for employees across the country sit around $1,312. If you do the math for a full year, that puts the average annual salary at roughly $68,224.

But wait. That number is a bit of a trap.

📖 Related: Finding 13345 N Central Expy Suite 204 Dallas TX 75243: What You Should Know Before Visiting

Averages are easily skewed by the CEO making $10 million a year. Most economists and folks who actually study this stuff prefer the median income. In late 2025, the median after-tax income for Canadian "economic families" and unattached individuals was hovering around **$74,200**. If you're a single person, that number drops significantly, usually landing in the $40,000 to $50,000 range after the government takes its cut.

Why Where You Live Changes Everything

Canada is huge, and its economy is basically five or six different economies wearing a trench coat. If you’re working in the Northwest Territories, you’re likely seeing much higher numbers. Weekly earnings there can top $1,750 because, frankly, you need that kind of cash to afford a jug of milk that costs as much as a small car.

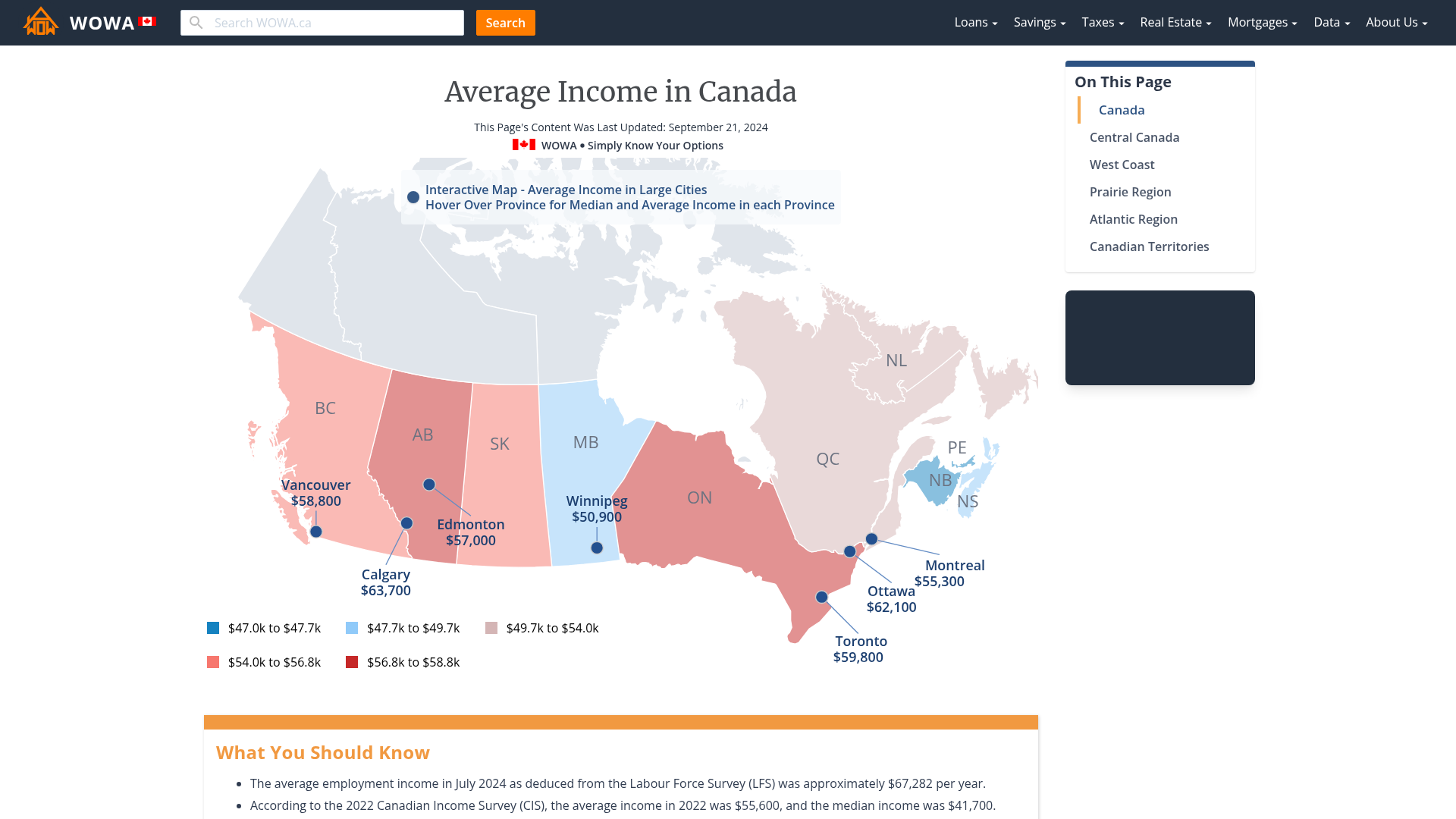

The Provincial Breakdown

In Ontario, the average weekly pay is currently around $1,357. It sounds decent until you realize that a one-bedroom apartment in Toronto is going for $2,500 a month. Alberta remains a heavy hitter with weekly earnings of **$1,353**, largely thanks to the energy sector, though that volatility is always lurking in the background.

Meanwhile, the East Coast tells a different story. In Prince Edward Island, the average is closer to $1,141 per week. You’ve got a lower cost of living there, sure, but the "sticker shock" of modern inflation has started to close that gap. New Brunswick and Nova Scotia are in a similar boat, with earnings often lagging behind the national average by a few hundred bucks a week.

The Industry Gap: Who's Actually Making Bank?

It’s not just about where you are, but what you do.

If you're in the utilities sector—think power plants and water systems—you're looking at some of the highest wages in the country, often exceeding $55 per hour. On the flip side, the accommodation and food services sector is still struggling, with many workers averaging closer to $21 per hour.

- Professional and Technical Services: These folks (lawyers, engineers, accountants) are averaging about $47.14 per hour.

- Public Administration: Government work remains a stable bet, with hourly rates around $46.

- Finance and Insurance: A solid $43.75 per hour, though this is heavily concentrated in the big city hubs.

- Manufacturing: Hovering around $35 per hour, though it's been surprisingly steady lately.

The 2026 Outlook: What's Coming Next?

Predictions for the rest of 2026 suggest a bit of a cooling period. We’ve seen a lot of "catch-up" wage growth over the last couple of years as workers demanded more to deal with the cost of living. But employers are starting to tighten the purse strings.

Projections from groups like Eckler Ltd. suggest that salary increases for 2026 will likely drop to about 3.3%. That’s down from the 4% or 5% jumps some sectors saw previously. It's a "cautious" environment. Companies are worried about a soft labor market, and while the Bank of Canada has been cutting interest rates, the "vibecession"—that feeling that things are tough even if the numbers say they're okay—is real.

📖 Related: Why Your New York Take Home Pay Calculator Might Be Lying to You

The Gender and Age Factor

We can't talk about the average income in Canada without acknowledging the gaps that still exist. For every dollar a man makes in Ontario, recent data shows women are making about **$0.89** based on average hourly rates ($39.41 vs $35.21).

Age plays a massive role too. If you're between 15 and 24, you're likely earning an average of $22.10 per hour. Once you hit that prime working age of 25 to 54, that jumps to nearly $40. It’s the "experience premium," but for many young people entering the workforce in 2026, it feels like they're starting the race ten miles behind everyone else.

Is $70,000 Actually "Good"?

Honestly? It depends on who you ask and where they live.

In Montreal, where rent is still (relatively) more manageable at around $1,500 for a decent spot, $70,000 can provide a pretty comfortable life. You can go out for poutine, hit the jazz fest, and maybe even save a bit.

✨ Don't miss: Income Tax Calculator AY 2024-25: How to Actually Save Money This Year

In Vancouver? $70,000 is basically survival mode. When you factor in the "sunshine tax" (the price of living in a beautiful place), taxes, and the cost of groceries, you're not exactly living the high life. Experts at National Bank have noted that housing affordability is technically "improving" because prices have dipped slightly, but for the average earner, it’s still a mountain to climb.

How to Actually Use This Information

Don't just look at the $68,000 national average and feel bad if you're not there. Or feel great if you're above it.

You've got to look at your "real" income. That’s what’s left after you pay for the basics. A high salary in a high-cost city can often leave you with less "fun money" than a modest salary in a smaller town.

- Audit your location: If your job is remote, look at the "earnings-to-rent" ratio in cities like Sherbrooke or Kingston.

- Skill up in high-growth sectors: Professional services and tech are still forecasting the highest raises for the next 12 months.

- Negotiate based on the 3.3% benchmark: If your annual review is coming up, know that the national projected increase is around 3.3%. If you’re offered less, you’ve got the data to push back.

The Canadian economy is in a weird spot. We're seeing "stabilizing inflation" but "slowing growth." Basically, it means your paycheck might finally stop feeling like it's shrinking every week, but it’s not going to suddenly double overnight either.

Stay informed. Check the StatCan "Daily" releases if you really want to nerd out. But most importantly, compare your income to your specific life goals, not just a spreadsheet of national averages.

Actionable Next Steps:

- Calculate your own "Personal Inflation Rate" by comparing your 2024 spending to your 2025/2026 expenses to see how much of a raise you actually need just to stay level.

- Use the Statistics Canada Salary and Wage Search tool to see exactly what people in your specific postal code and job title are making.

- If you're earning below the $1,312 weekly average for your province, research whether your industry is currently in a "labor shortage" phase, which gives you significantly more leverage for a market adjustment.