Ever looked at your bank statement and wondered why your neighbor pays $80 while you’re stuck shelling out $180? It feels personal. It’s not. But honestly, the average monthly auto insurance rate is a ghost. It’s a number that exists on paper but rarely reflects what landing on a specific premium actually feels like for a real human being with a messy life.

Rates are climbing. In 2025, data from the U.S. Bureau of Labor Statistics and major aggregators like Bankrate showed that motor vehicle insurance costs rose significantly faster than general inflation. We're talking double-digit percentage jumps in some ZIP codes.

Most people think a "good" rate is just about being a safe driver. That’s a half-truth. You could have a pristine record and still get hammered because your credit score dipped or because you live in a city where catalytic converter theft is basically a local pastime. Insurance companies are essentially massive data-crunching machines that bet against your misfortune. To win, you have to understand how they’re calculating that monthly average you see in your inbox.

The Reality of the Average Monthly Auto Insurance Bill

If you want the raw numbers, the national average for full coverage usually hovers around $200 to $215 per month. Minimum coverage? You’re looking at maybe $50 to $70. But these figures are kind of useless without context.

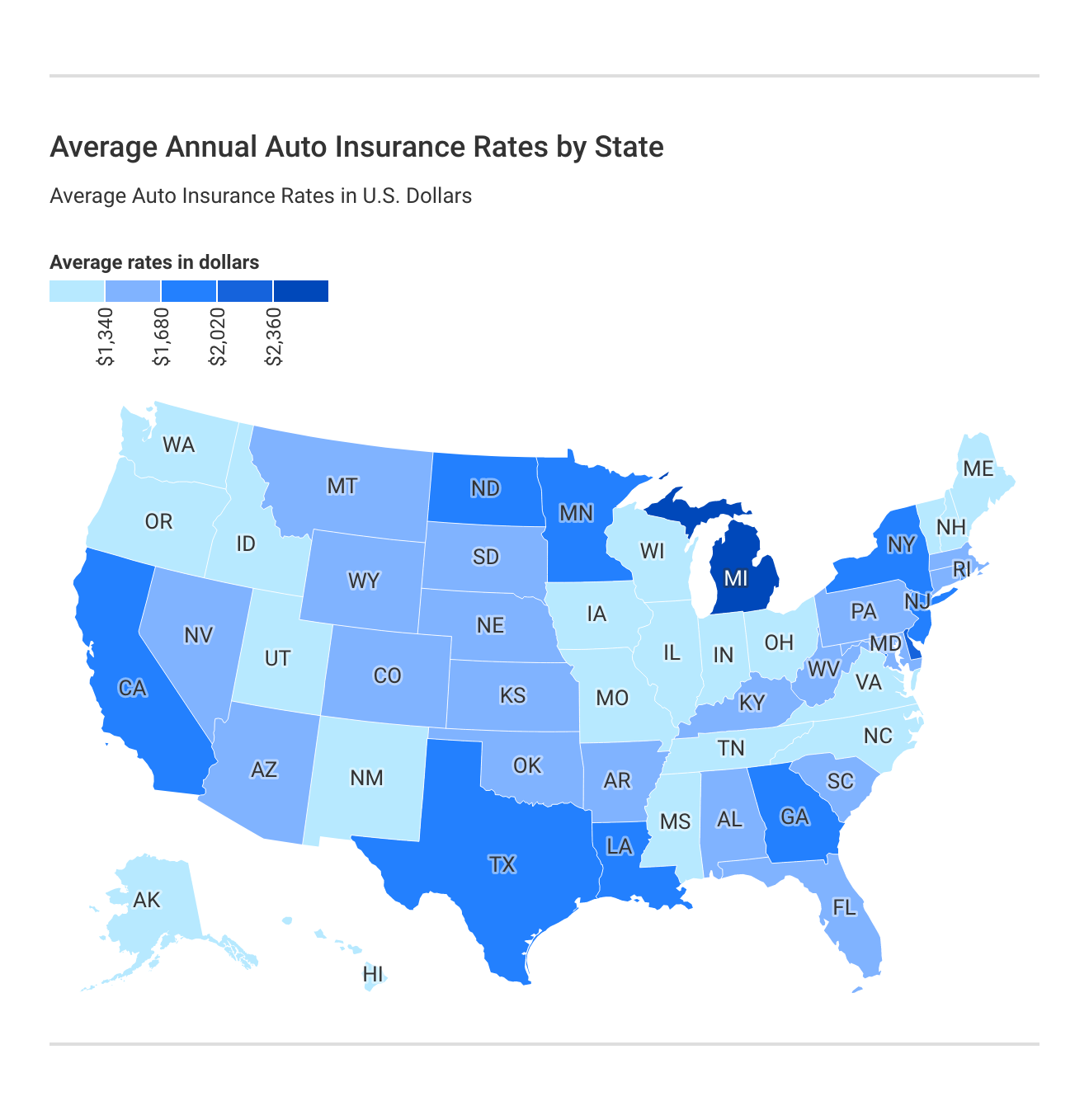

Florida drivers often pay double what people in Maine pay. Why? Hurricanes. High litigation rates. A massive population of uninsured motorists. When a state has "no-fault" laws or high fraud rates, the average monthly auto insurance cost for every single resident spikes, regardless of how many gold stars you got in driver's ed.

It’s about the "Risk Pool"

Think of insurance like a giant pot of money. If you live in a "litigious" state—places like Louisiana or Florida—lawsuits are more common and more expensive. The insurance companies aren't charities; they pass those legal fees directly to you. This is why a 40-year-old accountant in rural Vermont might pay $60 a month, while the same person in Miami pays $250. It’s not fair. It’s just math.

Insurance companies also look at "social inflation." This isn't about TikTok. It’s a term for the rising costs of insurance claims resulting from things like increased jury awards and broader definitions of liability. When a court awards $10 million for a fender bender, your monthly bill feels the aftershock six months later.

Why Your Rate Doesn't Match the National Average

Your credit score is probably the biggest "secret" factor in your average monthly auto insurance quote. In most states (excluding California, Hawaii, and Massachusetts), insurers use a credit-based insurance score.

👉 See also: Sunstone Hotel Investors Inc: Why This REIT Is Betting Everything on Luxury Right Now

Statistically, people with lower credit scores file more claims. Is that a perfect correlation? Probably not. Does it feel discriminatory? Many consumer advocates say yes. But it is the industry standard. If your score is under 600, you might be paying 50% to 100% more than someone with an 800 score, even if you both have identical driving records.

Then there’s the car itself.

- A Tesla Model 3 is expensive to insure because the sensors in the bumper cost a fortune to replace.

- A 2015 Honda Civic is cheap to insure because parts are everywhere.

- A Hyundai or Kia might be uninsurable in some cities due to the "Kia Boyz" theft trend that exploited ignition vulnerabilities.

The Age Factor: Why 25 is the Magic Number

We’ve all heard it. "Wait until you're 25."

There is actually a drop-off in premiums at that age, but it’s not a sudden cliff. It's a gradual slope. Data from the Insurance Information Institute consistently shows that drivers under 25, especially males, are the highest risk. They go fast. They get distracted. They lack the "muscle memory" of defensive driving.

If you’re a 19-year-old male, your average monthly auto insurance could easily top $400. It’s brutal. The only real way to dodge this is by staying on a parent's policy as long as possible or qualifying for "Good Student" discounts, which usually require a 3.0 GPA or higher.

👉 See also: Dow Sabine River Operations: What’s Actually Happening at the Texas-Louisiana Border

How Coverage Limits Change the Math

Most people just click "buy" on whatever the website recommends. That's a mistake.

Standard "split limits" look like 25/50/25. That means $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage.

If you hit a $80,000 Mercedes-Benz and you only have $25,000 in property damage coverage, you are personally on the hook for the other $55,000.

Upping your coverage to 100/300/100 often costs only an extra $10 or $15 a month. It’s the best "insurance for your insurance" you can buy. When calculating your average monthly auto insurance budget, don't skimp on the liability limits just to save the price of a burrito.

Comprehensive vs. Collision

- Collision covers you if you hit a pole or another car.

- Comprehensive covers "acts of God"—hail, fire, theft, or hitting a deer.

If your car is worth less than $3,000, you might want to drop these entirely. Why pay $600 a year to protect a $2,000 asset? At that point, you’re better off "self-insuring" by putting that money in a savings account.

The 2026 Outlook: Why Rates Won't Drop Soon

We are seeing a permanent shift in how car insurance is priced. Telematics—those little "spy" apps or plug-in devices that track your braking and speeding—are becoming mandatory for the best rates.

If you’re a "hard braker" or you drive at 2:00 AM, your average monthly auto insurance will stay high. Insurers like Progressive and State Farm are leaning heavily into this. They want to know exactly how you drive, not just who you are.

Furthermore, repair costs are out of control. A simple side-mirror replacement on a modern car now involves recalibrating cameras and blind-spot sensors. That’s a $1,500 job today for something that used to cost $150 twenty years ago. As long as cars get smarter, insurance gets pricier.

📖 Related: Bath and Body Works Distribution Center: How Your Candles Actually Get to Your Door

Actionable Steps to Lower Your Monthly Bill

Stop accepting the "loyalty" increase. Most companies use "price optimization," a fancy way of saying they raise rates on customers they think are too lazy to switch.

- Shop every 12 months. Use a broker or an online comparison tool. New customer discounts are real.

- Bundle your renters or homeowners insurance. This is usually a 10% to 25% discount across the board.

- Check your mileage. If you work from home now but your policy still says you commute 20 miles a day, you’re overpaying. Call them. Change your status to "pleasure use" or "commuter (low mileage)."

- Audit your deductible. Moving from a $500 deductible to $1,000 can shave 15% off your premium instantly. Just make sure you actually have that $1,000 in the bank.

Don't assume the big-name brand is the cheapest. Sometimes regional players like Erie Insurance or Auto-Owners Insurance crush the rates of the "Big Four" because they have lower overhead or better localized data.

To truly master your average monthly auto insurance costs, you need to view your policy as a living document. Check it when you move, when you get married, or even when your credit score improves by 50 points. The "average" is just a benchmark—your goal is to stay as far below it as possible through constant adjustment and specific coverage choices.