Ever wonder what the person living three doors down actually clears every month in their Golden Years? It's a weirdly specific curiosity. We all look at the national averages—those big, shiny numbers that say the "average" retiree household is doing just fine—but honestly, those figures are kind of a lie. Or at least, they don't tell the whole story. If you’re looking at average retirement income by zip code, you quickly realize that retirement in 90210 looks nothing like retirement in 44101.

Geography is destiny.

In the United States, the median retirement income for those 65 and older sits around $56,680. That sounds decent until you realize it’s being dragged up by the ultra-wealthy in places like Fisher Island or Atherton. Most folks are living on much less, often cobbling together a lifestyle from Social Security, maybe a small pension, and whatever they managed to squirrel away in a 401(k).

Why Your Zip Code Changes Everything

You've probably noticed that some neighborhoods just feel "wealthier." It isn't just the cars. It's the tax data. The IRS and the Social Security Administration (SSA) track this stuff meticulously, even if they don't make it super easy to find.

🔗 Read more: Why the S\&P 500 200 Day Moving Average Chart Is the Only Indicator That Actually Matters Right Now

Take a place like Scarsdale, New York (10583). The average household income there—much of it coming from investment dividends and high-tier pensions for retirees—frequently tops $600,000. Contrast that with a rural zip code in Arkansas or Indiana, where the average might hover closer to $22,000.

It’s a staggering gap.

But here is the kicker: a high income doesn't always mean a better life. Retirees in high-income zip codes are often chased by high property taxes. If you're in a New Jersey zip code like 07046 (Mountain Lakes), you might have a "high" retirement income on paper, but after you pay the $20,000+ annual property tax bill, you might have less "fun money" than someone living in a tax-friendly pocket of Wyoming or Florida.

The Social Security Divide

For many, the average retirement income by zip code is essentially just a reflection of their career-long Social Security contributions. The SSA actually publishes "OASDI" (Old-Age, Survivors, and Disability Insurance) data by zip code.

- In Manhattan (10021), the average monthly Social Security check might be significantly higher because those residents had higher taxable earnings over their 35-year work history.

- In Detroit (48201), the checks are often smaller, reflecting lower lifetime earnings or more frequent periods of unemployment.

Basically, the system is designed to reward those who earned more, but it also creates these geographic islands of wealth and struggle. In 2026, the maximum Social Security benefit for someone retiring at full retirement age is roughly $4,018 a month. But very few people actually hit that. Most are closer to the $1,900 mark.

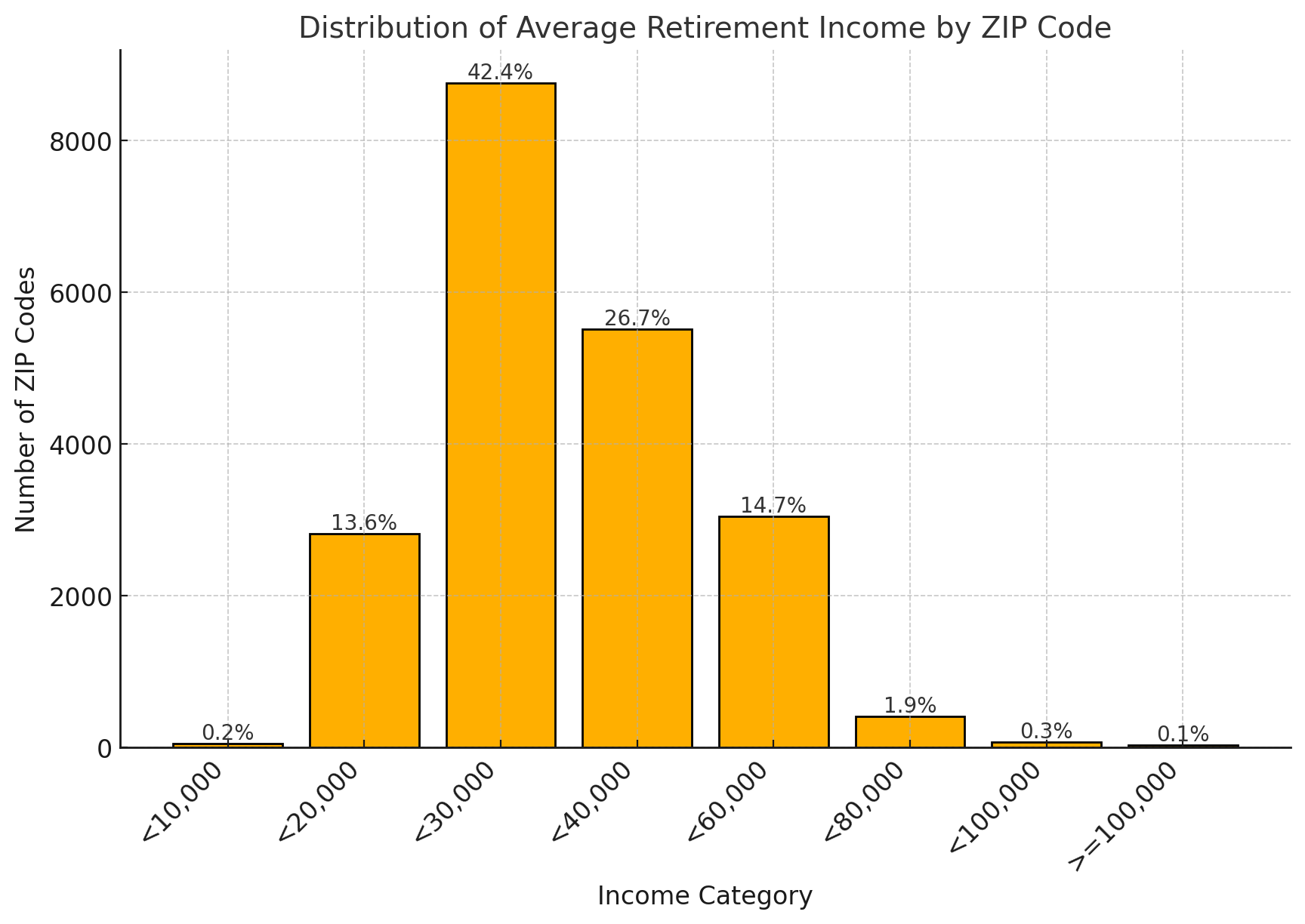

When you look at a zip code where the "average" income is $30,000, you are looking at a community almost entirely dependent on that monthly government check.

The 2026 Reality of "Comfortable" Income

How much do you actually need?

Financial planners used to say you need 80% of your pre-retirement income. That’s a bit of a blanket statement. Honestly, it depends on whether you still have a mortgage. In expensive zip codes like San Jose (95120) or Seattle (98101), a retirement income of $80,000 might feel like poverty if you’re still paying off a million-dollar home.

Meanwhile, in McAllen, Texas (78501), $50,000 a year makes you the king of the neighborhood.

Recent Data Benchmarks

According to the latest 2025-2026 cost-of-living adjustments, the "average" isn't what it used to be. Inflation has been a beast.

💡 You might also like: Corporate Culture: What Most People Get Wrong About How Teams Actually Work

- Low-income retirees: Often under $30,000 annually. Primarily Social Security.

- Middle-income: $30,000 to $75,000. Usually includes a mix of IRA withdrawals and maybe a small pension.

- High-income: $100,000+. These are the folks in the "wealthy" zip codes, often drawing from significant taxable brokerage accounts.

Tax Havens vs. Tax Hells

If you’re looking at average retirement income by zip code because you’re planning a move, you have to look at the "hidden" deductions.

States like Florida (33109 - Fisher Island) and Nevada (89101 - Las Vegas) have no state income tax. This is why you see the average income numbers spike there; wealthy people move their "residency" to these zip codes to protect their RMDs (Required Minimum Distributions) from the taxman.

On the flip side, look at Vermont or Oregon. These states have high income tax rates that apply even to retirement distributions. A $70,000 income in a Portland zip code (97201) is worth significantly less than $70,000 in a Sioux Falls zip code (57101).

Surprising Pockets of Wealth

You might expect the highest retirement incomes to be in California or New York. And yeah, they are up there. But have you looked at Southlake, Texas (76092)?

👉 See also: Fidelity Retirement Income Calculator: What Most People Get Wrong About Their Readiness

Southlake has seen its average household income skyrocket, and its retiree population is following suit. The same goes for Alamo, California (94507). These aren't just "rich people" towns; they are hubs where the "average" retirement income is buoyed by massive corporate pensions and executive deferred compensation plans that are now paying out.

Actionable Steps for Evaluating Your Area

Don't just look at the raw number and panic. Comparison is the thief of joy, especially when it comes to bank accounts. If you want to see how you stack up or if you should move, do this:

- Check the SSA Zip Code Data: The Social Security Administration provides "OASDI Beneficiaries by State and ZIP Code." It’s an Excel file, but it’s the most accurate way to see what your neighbors are actually getting from the government.

- Calculate the "Real" Value: Use a cost-of-living calculator that includes taxes. If you’re moving from a $60,000-average zip code to a $40,000-average zip code, your quality of life might actually go up if the local costs are lower.

- Audit Your Property Tax: Zip codes in Illinois and New Jersey can have "effective" tax rates that eat 20-30% of a modest retirement income.

- Look for the "Pension Peaks": Some zip codes are high because they are near former major manufacturing hubs or government centers where retirees have "defined benefit" pensions—a rarity today.

The average retirement income by zip code is a useful metric, but it’s just one piece of the puzzle. It’s a snapshot of the past (what people earned) and the present (what they can spend). Whether you're in a "wealthy" zip or a "modest" one, the goal remains the same: making sure your outgo doesn't exceed your income.

The data doesn't lie, but it also doesn't account for how well you can live on what you have.