You've probably heard the advice a thousand times. "Wait until 70 to claim Social Security." It sounds like one of those things financial planners say because they like big numbers on spreadsheets. But when you actually look at the average social security check at age 70 in 2026, you start to see why people obsess over that magic number.

Honestly, the difference between claiming at 62 and waiting until 70 isn't just a few bucks for a coffee. It's a massive, life-altering shift in your monthly budget.

The Real Numbers for 2026

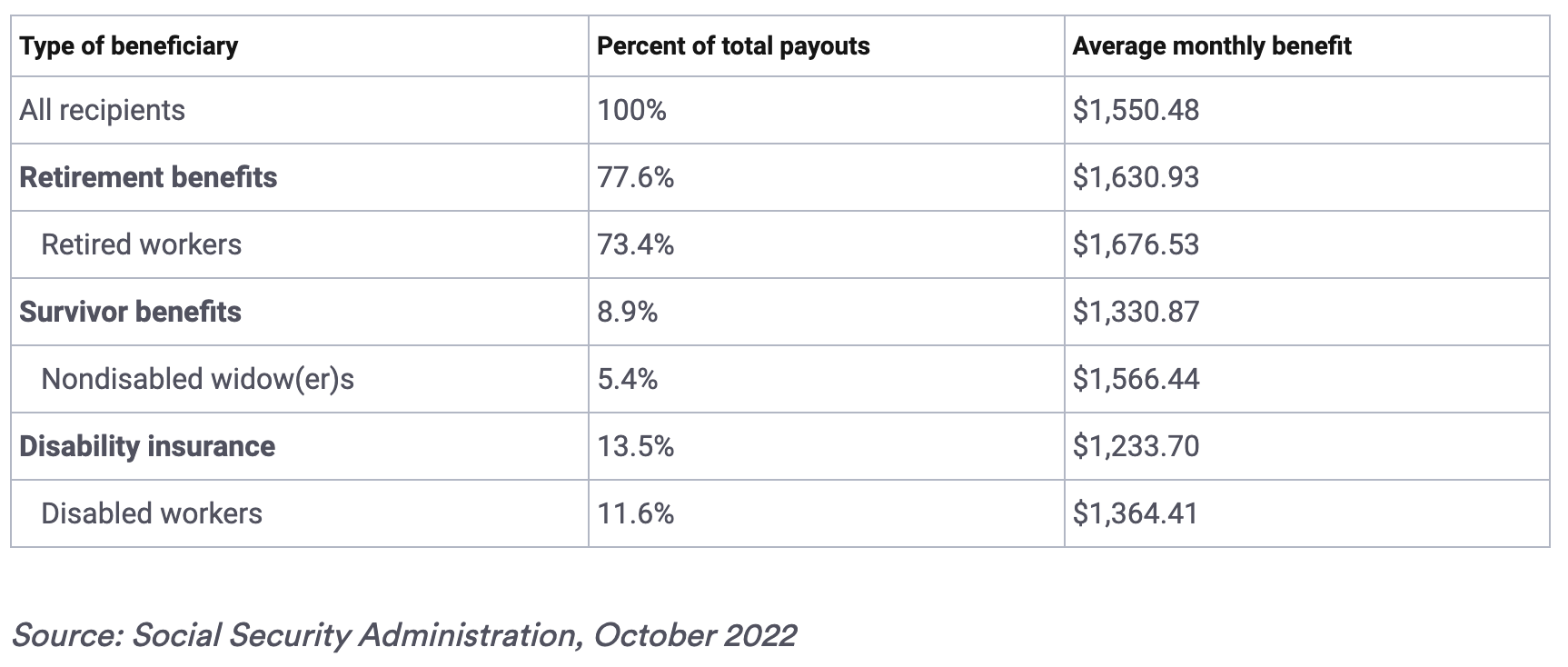

Let’s get the hard data out of the way. As of January 2026, the average Social Security check for a retired worker is sitting right around $2,071. That's after the 2.8% Cost-of-Living Adjustment (COLA) kicked in. But here is the thing: that’s the average for everyone.

When you isolate those who waited until 70, the landscape changes.

📖 Related: 1 Euro in Won: Why Your Currency Exchange Math Is Probably Wrong

Recent data from the Social Security Administration (SSA) and analysis from groups like Kiplinger show that retirees at age 70 often pull in significantly more than the "all-retiree" average. While the broad average is roughly $2,100, men at age 70 are averaging closer to **$3,333**, while women—who often have different earnings histories or were more likely to claim earlier—average around $2,689.

Why the gap? It’s the credits. Basically, for every year you wait past your Full Retirement Age (FRA), your benefit grows by 8%. If your FRA is 67 and you wait until 70, you've baked in a 24% permanent raise.

Why $5,000+ is the New Ceiling

For the high earners out there, the 2026 numbers are kind of eye-popping. If you earned the maximum taxable income for at least 35 years and waited until 70 to pull the trigger, your monthly check could be as high as $5,251.

Think about that.

If you had claimed that same maximum benefit at age 62, you’d only be looking at $2,969. You are essentially choosing between a decent check and a "mortgage-paying, luxury-travel-funding" check just by being patient.

The Medicare "Gotcha"

Now, don't get too excited about that $56 average COLA increase from last year. Most of us never actually see the full bump in our bank accounts.

Medicare Part B premiums are usually deducted straight from your Social Security. For 2026, those premiums jumped to about $202.90 a month. So, if your check went up by $57 but your Medicare cost went up by $18, you’re really only "up" by $39. It's better than nothing, but it's not exactly a windfall.

Is Waiting Actually Possible?

It's easy for an expert to say "just wait." It's harder when you’re 64, your knees hurt, and your company just "restructured" you out of a job.

There's a nuanced reality here. Most people (nearly 90% by some estimates) don't actually wait until 70. Life happens. Health scares happen. Sometimes you need the cash now to keep the lights on.

But if you can swing it—maybe by working part-time or tapping into a 401(k) first—the average social security check at age 70 becomes a powerful hedge against inflation. Since COLAs are percentages, a 2.8% increase on a $3,500 check is way more helpful than 2.8% on a $1,800 check.

What You Should Do Next

Checking your "My Social Security" account is the only way to move from "averages" to "your reality." The SSA's website has gotten a lot better lately, and their calculators are actually pretty decent now.

- Step 1: Download your latest statement. Look at the "Delayed Retirement Credits" section.

- Step 2: Run a "what-if" scenario. If you stop working at 66 but don't claim until 70, how does that affect the math? (Hint: The 8% credits still apply even if you aren't earning a paycheck).

- Step 3: Factor in your spouse. If you were the higher earner, waiting until 70 also locks in a higher survivor benefit for them. It’s a legacy move as much as a budget move.

Don't just look at the $2,071 average and think you're set. That number is a baseline, not a goal. Your goal is to maximize the one "pension" in America that is still guaranteed and inflation-adjusted for life.