Honestly, if you've been scrolling through job boards lately, you've probably noticed that the numbers are all over the place. One site tells you the average wage in canada is $72,000, while another claims it’s closer to $65,000. It’s enough to make your head spin. But here’s the thing—the "average" is often a trap.

Think about it this way. If you put a billionaire in a room with nine people making minimum wage, the average person in that room is a multi-millionaire. Doesn't feel right, does it? That’s why we need to look at the median and the sector-specific data to see what's actually hitting Canadian bank accounts in 2026.

The Raw Numbers: What the Average Wage in Canada Really Looks Like

Let's talk cold, hard cash. As of early 2026, the average hourly wage for all employees in Canada has climbed to approximately $36.40. If you're working a standard 40-hour week, that lands you at an annual gross salary of roughly $75,700.

But wait.

💡 You might also like: Who Owns Bobbi Brown Cosmetics? Why the Founder Left and What’s Happening Now

Most people don't work exactly 40 hours, and a huge chunk of the workforce is part-time. Statistics Canada recently reported that average weekly earnings (including overtime) are sitting around $1,312. That sounds decent until you realize it’s only a 2.2% increase from last year. With the price of a head of lettuce still feeling like a luxury purchase, that 2.2% is basically just treading water.

Why Your Location Changes Everything

Canada is massive, and your paycheck knows it. You can't compare a salary in downtown Toronto to one in rural New Brunswick without looking at the context.

- Nunavut and Northwest Territories: These spots consistently show the highest weekly earnings—often over $1,750. Why? Because it’s expensive to live there, and the jobs (mostly mining and public admin) require a "hardship" premium.

- Ontario and Alberta: These are the traditional heavyweights. In Ontario, the average weekly pull is about $1,357. Alberta is right on its heels at $1,353, though its growth has slowed down a bit lately due to energy market fluctuations.

- The Maritimes: Places like PEI and Nova Scotia are seeing faster percentage growth (over 4% in some spots), but the actual dollar amounts are lower, usually ranging between $1,140 and $1,180 per week.

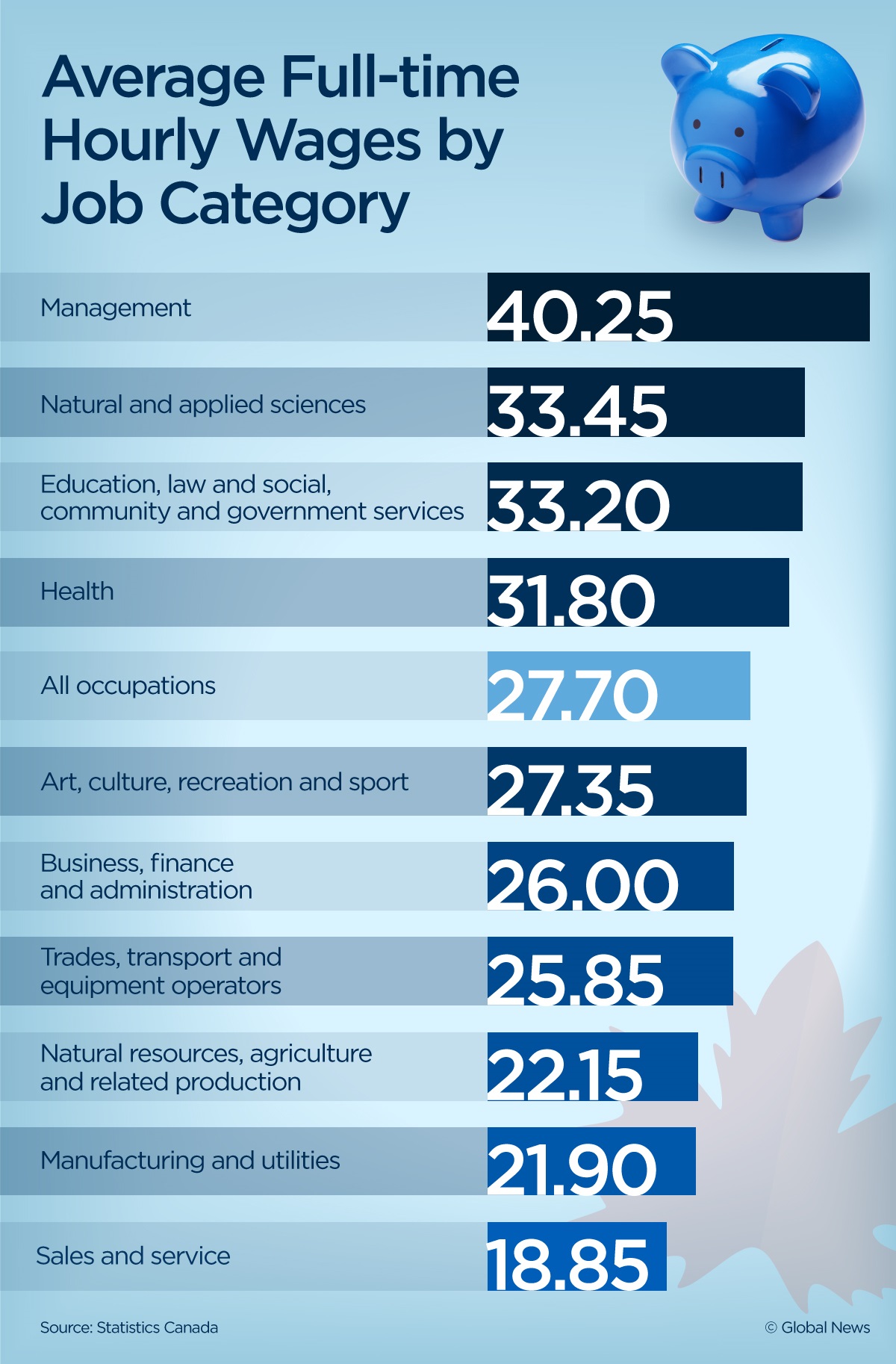

Industry Matters More Than You Think

You've probably heard that "tech is where the money is." While that’s still mostly true, the 2026 landscape has some surprises. Utilities workers are currently the kings of the mountain. We're talking an average of $55.90 per hour. If you can manage a power grid, you're doing alright.

Professional, scientific, and technical services aren't far behind, averaging about $47.14 per hour. On the flip side, if you're in accommodation and food services, the reality is much tougher—averaging just $20.88 per hour. That's a massive gap.

The Skilled Trades Boom

Something interesting is happening in the "blue-collar" world. There is a massive shortage of people who actually know how to fix things. Because of this, wages for industrial electricians and senior millwrights are skyrocketing. A journeyperson in a specialized trade can easily clear $115,000 a year now, which often beats out many "white-collar" office roles.

The Reality Check: After-Tax Income and Cost of Living

We need to be real for a second. Your "gross" salary is a fantasy. After the CRA takes their cut and you pay for your mandatory CPP and EI, that $75,000 feels a lot smaller.

In Ontario, a $75,000 salary nets you roughly $54,000 to $57,000 depending on your deductions. Now, compare that to the average rent for a one-bedroom apartment in a city like Vancouver or Toronto, which is hovering around **$2,400 to $2,600**.

Do the math.

That’s $30,000 a year just for a roof over your head. Toss in $500 a month for groceries, $200 for transport, and another $300 for utilities/internet. You're looking at basic survival costs of roughly **$42,000 to $48,000** a year.

💡 You might also like: Sub Barge Tug Barrel Logistics: What Most People Get Wrong

If you're making the average wage in Canada, you're not "rich." You're comfortable, sure, but you're one major car repair or dental emergency away from a stressful month. This is why many Canadians are feeling "income rich but cash poor."

What Most People Get Wrong About Minimum Wage Increases

There’s this common myth that raising the minimum wage is what drives the average wage in canada up. It helps at the bottom, yeah, but the real needle-mover is the "middle-out" growth.

As of late 2025 and early 2026, most provinces have pushed their minimums to between $15.00 and $17.85. While this is great for entry-level workers, it has created a "compression" effect. Someone who has been an assistant manager for three years might now only be making $2 more an hour than a brand-new hire. This is forcing employers to raise "middle" wages just to keep their experienced staff from walking out the door.

How to Actually Increase Your Personal Average

If you're looking at these numbers and feeling like you're on the wrong side of the curve, don't panic. The 2026 job market is weirdly specific about what it wants.

1. Specialize or Pivot

Generic "admin" or "generalist" roles are seeing the slowest wage growth (about 1.8% to 2%). However, if you add a specific certification—like data analytics, specialized welding, or project management—you can jump your personal "average" by 15% in a single hop.

2. The "Remote" Premium

Interestingly, the "work from home" salary dip hasn't really happened. Companies are finding they have to pay national averages to keep talent, even if that talent lives in a "cheaper" province. If you live in New Brunswick but work for a Toronto-based tech firm, you're winning the wage game.

3. Negotiate on "Total Rewards"

Since many employers are capping base salary increases at 3% this year to "recession-proof" their books, they are getting creative with other things. Ask for more vacation days, a higher RRSP match, or even a four-day workweek. Sometimes those "extras" are worth more than an extra $2,000 on your gross pay.

Practical Steps to Take Now

It's one thing to know the stats; it's another to use them. If you're planning your next career move or just wondering why your bank account looks the way it does, here is what you should actually do:

- Check the Median, Not the Average: Look up the median income for your specific job title in your specific city using the Job Bank Canada tool. It gives a much more "human" view of the market than a national average.

- Audit Your Tax Bracket: Understand that a raise might push you into a higher provincial tax bracket. In some provinces, like Nova Scotia or PEI, the brackets are narrower, meaning you might keep less of your raise than you think.

- Watch the "Utilities" and "Technical Services" Sectors: Even if you aren't an engineer, these high-paying sectors need HR, sales, and admin staff. A receptionist at a utility company often makes 20% more than a receptionist at a retail head office.

- Get a Pay Equity Check: With new pay transparency laws rolling out in provinces like Ontario, companies are being forced to be more open. Ask for the salary range of your current role. If you're at the bottom of the range and your performance is high, you have a data-backed case for a bump.

The average wage in canada is a useful benchmark, but it’s not your destiny. The market in 2026 is rewarding specialization and location-independence more than ever before. Knowing where the money is flowing—like the utilities boom or the skilled trades resurgence—is the first step to making sure your personal average stays well above the national one.