It happens to everyone. You’re sitting on your couch, you’ve got a paper check in your hand, and you just want to get that money into your bank account without driving to a branch. You open your banking app, snap a photo of the front, flip it over, and click. Then, three hours later, you get that annoying notification: "Deposit Declined." Most of the time, the culprit isn't the amount or the person who wrote the check—it’s the back of check image.

It sounds stupidly simple. It’s just a piece of paper, right? But behind that tiny thumbnail on your phone screen is a complex web of Federal Reserve regulations, bank-specific AI scanners, and strict legal requirements. If that image isn't perfect, the bank won't touch it. They can't.

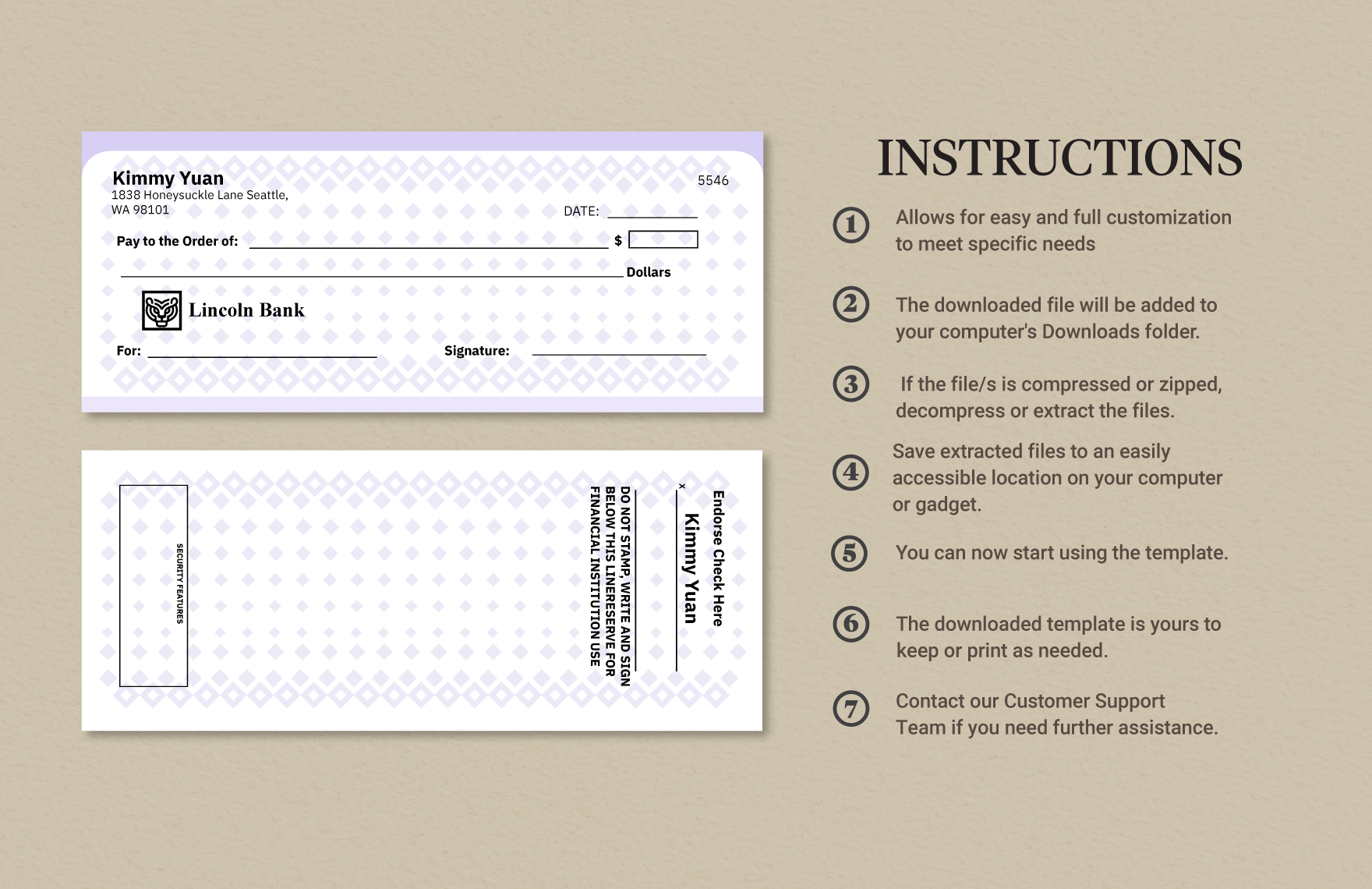

The Anatomy of a Perfect Back of Check Image

Banks aren't just looking at your signature anymore. Since the Check Clearing for the 21st Century Act (Check 21) became the standard, the digital image is the legal check. When you take a photo, you're creating a substitute check. If the back of check image is blurry, or if the "For Mobile Deposit Only" text is missing, the bank loses its legal protection against fraud.

✨ Don't miss: The Home Depot Class Action Lawsuit Canada: What Really Happened

The most important part of the back of the check is the endorsement area. Usually, this is a 1.5-inch space at the top. You’ve probably seen the line that says "Do not write, stamp, or sign below this line." They mean it. If your signature or your mobile deposit restrictive endorsement bleeds into the main body of the check, the bank’s Optical Character Recognition (OCR) software might freak out. It’s trying to read the routing numbers and account numbers from the front through the paper, and your messy ink on the back creates "noise" that leads to a rejection.

The Restrictive Endorsement Problem

This is where most people mess up. Back in the day, you just signed your name. Now, because of Regulation CC (Availability of Funds and Collection of Checks), almost every major bank like Chase, Wells Fargo, or Bank of America requires a specific phrase.

If you don't write "For Mobile Deposit at [Bank Name] Only," you’re asking for trouble. Some apps have a little checkbox that says "Check here if mobile deposit," but honestly? Don't trust it. Write it out by hand. It’s a security feature that prevents a thief from taking your check and trying to cash it at a physical liquor store or a different bank after you’ve already deposited it digitally.

Why Your Camera is Ruining Your Deposit

The quality of your back of check image depends entirely on lighting and contrast. Most people try to take the photo on a white kitchen counter. Big mistake. The white check blends into the white background, and the app's auto-crop tool can't find the edges. Use a dark background. A wooden table or a dark mousepad works wonders.

You also need to watch out for shadows. If your phone is directly above the check, you’re probably casting a shadow right over the endorsement line. Tilt the check slightly or move your light source to the side. The goal is a crisp, high-contrast image where the signature looks black and the paper looks white. If it looks grey or grainy, the bank's automated system will likely spit it out before a human even looks at it.

The Legal Reality of the "Substitute Check"

When you upload that back of check image, you are technically "truncating" the original paper document. This is a big deal in the banking world. According to the Federal Reserve, once a check is scanned, the image becomes the legal equivalent of the paper.

If your image is poor quality, you’re creating a "bad" legal document. This leads to something called "Holder in Due Course" issues. Basically, if the image is unreadable, the bank can't guarantee they can get the money from the other person's bank. They aren't being mean when they reject your photo; they're protecting themselves from a loss they can't recover.

Common Mistakes That Look Like Fraud

- Double Endorsements: If you sign it, then your spouse signs it, but only one of you is on the account, the image will be flagged.

- The "Shadow Signature": When ink bleeds through from the front of the check (common with Sharpies), it can make the back of check image look like it has two signatures. Use a ballpoint pen.

- Frayed Edges: If you tore the check out of a book and the side is all jagged, the image processing software might think the check is "altered." Use scissors if you have to, but keep those edges straight.

What Happens Behind the Scenes at the Bank

Once you hit "submit," your image goes to a server. An AI checks for a few things immediately:

- Is there a signature in the endorsement area?

- Is the phrase "Mobile Deposit" present?

- Does the back image match the dimensions of the front image?

If any of these are "No," the system rejects it automatically. If it passes the AI, it might still go to a human reviewer in a back office. These people spend eight hours a day looking at thousands of back of check images. They have about three seconds to decide if your check looks legit. If your signature looks like a scribble or the image is skewed at a 45-degree angle, they hit "Reject" and move to the next one. They don't have time to squint.

The 2026 Shift in Mobile Imaging

Banks are getting even stricter. With the rise of deepfake technology and sophisticated printer scams, the metadata in your back of check image matters too. They can tell if you’re taking a photo of a computer screen instead of a physical piece of paper. They check the GPS data of the photo and the timestamp. If you’re trying to deposit a "digital" check by taking a photo of your monitor, stop. Print it out, sign the back, and take a real photo.

Actionable Steps for a Guaranteed Deposit

To make sure your check clears on the first try, follow this specific workflow. It feels like overkill until you've had a $500 check stuck in "pending" limbo for a week because of a bad photo.

- Use a dark, flat surface. Avoid towels or wrinkled sheets. You want the check to lie perfectly flat so the four corners are easily visible to the camera's sensor.

- Endorse with a blue or black ballpoint pen. Gel pens and felt tips bleed through the paper, which ruins the image on the other side.

- Write the restrictive endorsement clearly. Don't just sign. Write "For Mobile Deposit Only at [Your Bank]" in clear, legible print above or below your signature.

- Check the lighting. Overhead lights are the enemy. Try to get natural light from a window hitting the check from the side to avoid your phone's shadow.

- Steady your hands. If you have "shaky cam" syndrome, rest your elbows on the table while holding the phone. Most banking apps use auto-capture, so wait for the green box to appear and hold still for two full seconds.

- Keep the physical check for 14 days. This is the industry standard. Write "VOID" or "Mobile Deposited on [Date]" across the front in small letters after you get the confirmation, but don't throw it away until the funds are fully cleared and available in your balance.

By treating the back of check image as a legal document rather than just a quick snapshot, you bypass the automated filters that trip up most users. It’s about making the bank's job as easy as possible so they have no reason to hold onto your money.