You’ve probably heard the legend. Warren Buffett, the Oracle of Omaha, refuses to split Berkshire Hathaway’s original shares because he wants shareholders who think like owners, not like day traders. That’s why a single Class A share (BRK.A) costs more than a decent house in the Midwest. But for the rest of us, there’s berkshire stock class b.

Honestly, most people treat the "B shares" like a consolation prize. They shouldn't. While the price tag is much friendlier—hovering around $498 as of mid-January 2026—the logic behind owning it is identical to the big-boy shares. You're buying into a massive, diversified machine that owns everything from GEICO and Dairy Queen to massive chunks of Apple and American Express.

👉 See also: Why 750 Third Avenue NY NY is Changing the Midtown Office Game

But there are some weird quirks to these shares that even seasoned investors miss. It isn't just a "cheaper version" of the same thing. There’s a specific math to the voting rights, a one-way street for conversions, and a history that involves a fight against high-fee mutual fund managers.

The 1,500-to-1 Reality of Berkshire Stock Class B

Back in 1996, Buffett created the B shares to stop "unit trusts" from carving up Class A shares and charging regular people huge fees to own a tiny slice. He basically said, "If you want a piece of Berkshire, I'll give it to you directly."

Originally, the ratio was different, but after a 50-for-1 split in 2010—the only split in the company's history—the math became fixed. One Class A share is equal to exactly 1,500 shares of berkshire stock class b.

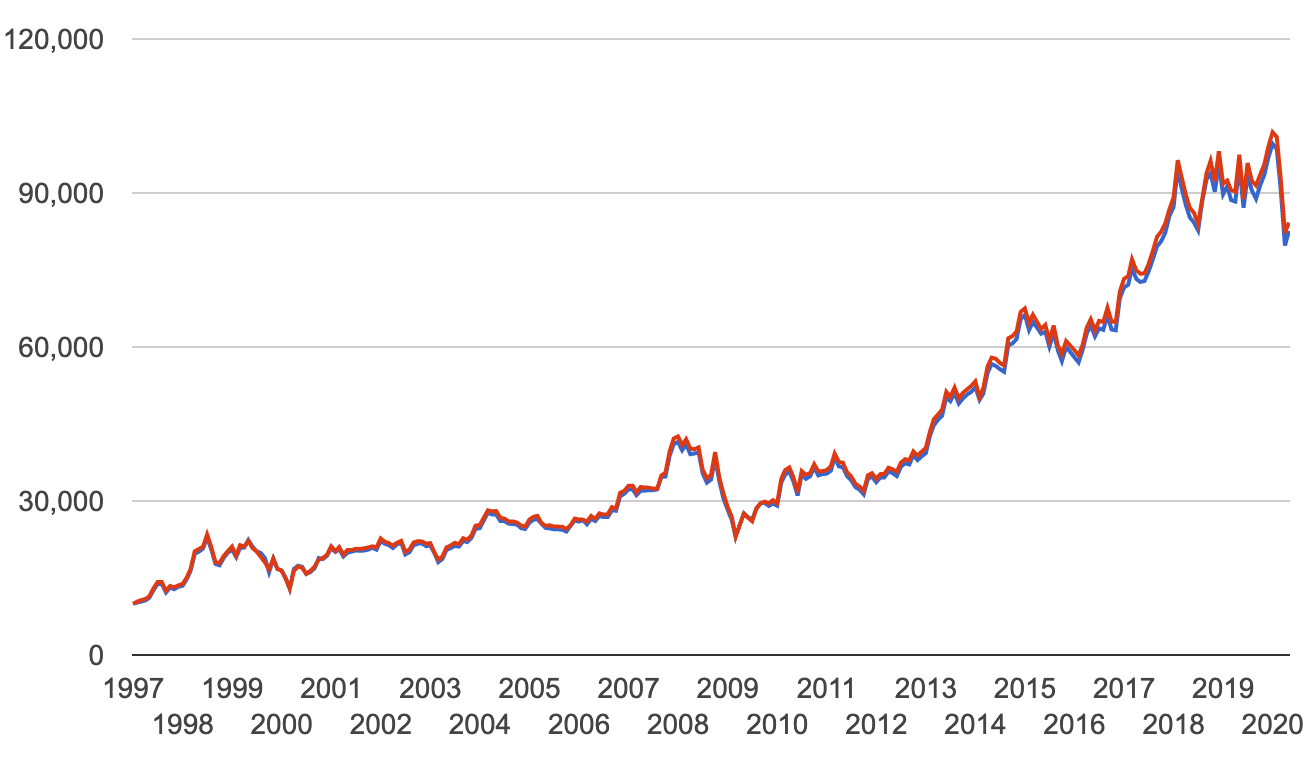

If you look at the ticker today, you'll see they trade in near-perfect lockstep. If the A shares jump 2%, the B shares follow. However, the voting rights are where things get lopsided. A Class B share doesn't give you 1/1,500th of a vote. It gives you 1/10,000th.

Basically, you get the economic meat, but you don't get the seat at the table. For 99% of us, that doesn't matter. You’re likely not planning to lead a shareholder revolt against Greg Abel, who just officially took the CEO reins on January 1, 2026.

Why the "Conversion Trap" Matters

Here is a detail that trips up a lot of people. You can turn Class A shares into Class B shares whenever you want. It’s a simple administrative request. But you cannot go the other way.

Once you buy berkshire stock class b, you are stuck in Class B unless you sell everything and buy Class A on the open market. This is a one-way valve designed to keep the share structure stable.

Why would someone convert? Usually, it's for taxes or gifting. If you want to give $18,000 to a family member without triggering gift taxes in 2026, you can’t exactly hand them 0.02 of a Class A share easily. But you can hand them a specific number of B shares. It’s about flexibility.

The Greg Abel Era and Your Investment

We are officially in the post-Buffett era of leadership. On December 31, 2025, Warren Buffett stepped down as CEO. While he remains the spiritual heart of the company, Greg Abel is now the man making the calls.

🔗 Read more: Stock Market Earnings Reports October 2025: What Most People Get Wrong

Some analysts, like those at Morningstar, have pointed out a "succession discount" in the stock recently. The market is sort of waiting to see if the magic stays in the bottle. But look at the balance sheet. Berkshire is sitting on a "war chest" of roughly $382 billion in cash and Treasuries.

That is an absurd amount of money.

Abel is taking over a company that is less a "stock" and more a private economy. They’ve been trimming Apple—down to about 23% of the portfolio from over 40% a few years ago—and adding things like Alphabet (Google) and Chubb. They are diversifying away from the "Buffett picks" of the last decade and into a broader tech-and-insurance hybrid.

🔗 Read more: Currency Indian Rupee to Australian Dollar: What Most People Get Wrong

Buying Berkshire Stock Class B Without a Headache

If you're looking to jump in, don't overcomplicate it. You don't need a specialized broker. Any standard app like Fidelity, Schwab, or even Robinhood handles the BRK.B ticker.

- Check the Spread: Because B shares are so liquid (millions of shares trade daily), you usually get a very fair price.

- Avoid the "A" Price Anchor: Don't buy just because you see the A shares hitting $800,000 and think the B shares "must" be cheap. Look at the P/E ratio, which is currently sitting around 15.8x.

- Think Decades, Not Days: This stock is notoriously boring. It doesn't pay a dividend. It never has. Buffett (and now Abel) believes they can grow that dollar better than you can if they kept it.

The real value of berkshire stock class b is that it acts as a hedge. When the rest of the tech-heavy S&P 500 is screaming in pain because of a random interest rate hike, Berkshire’s boring railroad (BNSF) and insurance businesses usually just keep grinding out cash.

It’s the "sleep well at night" stock.

Actionable Next Steps

If you want to move forward with berkshire stock class b, start by reviewing your current portfolio's concentration. If you already own an S&P 500 index fund, you already own Berkshire—it’s usually a top 10 holding. Adding more means you are making a specific bet that Greg Abel’s capital allocation will beat the broader market.

Check your brokerage for "fractional shares" if $500 is still too high for a single entry point. Many modern platforms let you buy $10 worth of BRK.B, which is the ultimate way to participate in the "Buffett Way" without needing a fortune. Keep an eye on the May 2026 annual meeting; it will be the first one with Abel fully at the helm, and the "Woodstock for Capitalists" is where the new direction will truly be revealed.