You’ve probably seen the blue checkmark on X (formerly Twitter) promising to pay for someone’s rent or a veteran’s car repairs. Bill Pulte, the face of "Twitter Philanthropy," is a polarizing figure. To some, he’s a modern-day Robin Hood with a smartphone. To others, he’s a master of self-promotion using a family legacy to build a personal brand. But behind the viral giveaways and the loud social media presence, people always ask the same thing: How much money does this guy actually have?

When we talk about Bill Pulte net worth, things get messy fast. You aren't just looking at a single bank account balance. You're looking at a tangled web of private equity, a massive family legacy in homebuilding, and a career that recently jumped into the federal government.

The $100 Million Question

Honestly, if you ask Bill himself, he’s been on the record saying his net worth is around $100 million. He mentioned this specifically back in 2021 during an interview with the Detroit Free Press. While that’s a staggering amount of money for most humans, it’s actually a bit lower than the "multi-billionaire" tag some of his followers—and critics—tend to slap on him.

✨ Don't miss: Rite Aid Haymaker Village: Why This Monroeville Spot is Still Such a Local Hub

Why the confusion? It’s mostly because of his grandfather.

The elder William J. Pulte founded PulteGroup (PHM), which grew into a Fortune 500 giant and one of the biggest homebuilders in the United States. When the patriarch passed away in 2018, he left behind a massive estate. But "Bill Pulte" (the grandson we see on social media) is not "William J. Pulte" (the founder).

Some financial trackers aggregate the total family holdings or the founder's historical stock value—which can soar into the billions—and mistakenly attribute it all to the grandson. In reality, the younger Pulte’s wealth is a mix of inheritance, his own business ventures, and his role as a former director at PulteGroup.

How He Actually Made His Money

He didn't just sit around waiting for a check from grandpa. Well, not entirely.

🔗 Read more: What Does Staffer Mean? Why the Word is Shifting From Politics to Corporate Life

In 2011, he founded Pulte Capital Partners, a private equity firm. This was a smart move. Instead of just building houses, he focused on the "boring" but profitable stuff: building products and housing services. By 2014, the firm was doing well enough to land him on the Forbes 30 Under 30 list.

Breaking Down the Revenue Streams:

- Pulte Capital Partners: His primary vehicle for wealth creation. This firm buys and manages companies in the housing sector.

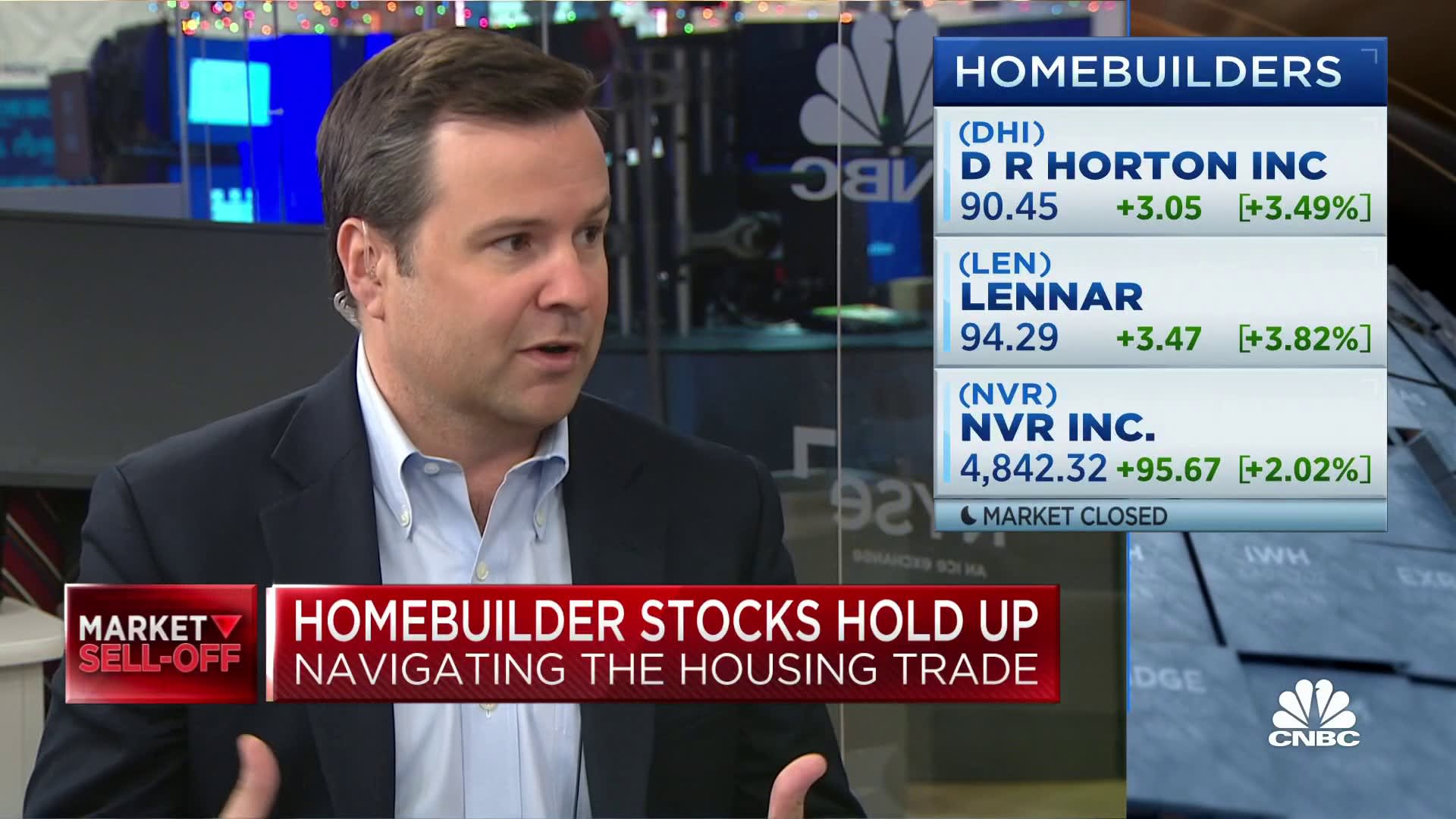

- PulteGroup Stock: As a former director and heir, he holds (or has held) significant shares in the family company. With PulteGroup's market cap sitting in the tens of billions in 2026, even a small percentage is worth a fortune.

- Real Estate Holdings: Like any savvy investor in his position, he has private real estate investments separate from the public company.

- Government Service: In a surprising twist, Pulte was nominated and confirmed in 2025 as the Director of the Federal Housing Finance Agency (FHFA). While a government salary is peanuts compared to private equity, the role puts him in charge of overseeing Fannie Mae and Freddie Mac.

The Cost of Twitter Philanthropy

Is he actually giving away his own money? This is where the internet gets heated.

Pulte claims to have given away millions. Usually, these are $100, $500, or $1,000 increments sent via CashApp. Critics often point out that the engagement he gains from these posts is worth far more than the cash he's sending. It’s a genius marketing loop. He gives away $1,000, gets 50,000 retweets, grows his following, and increases his influence.

Some reports suggest that not all the money comes directly from his pocket anymore. As his "Team Pulte" brand grew, it began to function more like a charitable funnel, where other wealthy donors or partners contribute to the "philanthropy" pot. Regardless of where every cent comes from, the activity is a major part of his public identity.

Bill Pulte Net Worth: The Reality of the "Billionaire" Label

If you look at SEC filings for PulteGroup, you’ll see the Pulte name associated with hundreds of millions of dollars in stock. However, wealth in these circles is often tied up in trusts and diversified among the founder's 14 children and 25 grandchildren.

The younger Bill Pulte has been the most vocal about protecting the "Pulte" legacy, often clashing with the current management of PulteGroup. These public boardroom battles aren't just about pride; they’re about the value of the family’s remaining stake in the company.

🔗 Read more: Federal Reserve Cut Rates: Why Your Bank Account Just Changed and What To Do Now

So, is he a billionaire? Likely not in his own right, unless you count the total family influence and potential future inheritances. But with a self-reported $100 million and a growing private equity portfolio, he’s comfortably in the top 0.1%.

Why the Numbers Matter for 2026

As of early 2026, his role at the FHFA has made his finances even more of a public matter. When you’re overseeing the backbone of the U.S. mortgage market, people want to know if your personal investments—specifically in homebuilding—create a conflict of interest.

His financial disclosure reports (like the OGE Form 278e) provide the most transparent look at his assets. These documents show a wide range of investments in housing-related sectors, which he has had to navigate carefully to maintain his government position.

What You Can Learn From the Pulte Model

Whether you love the guy or think he’s a clout-chaser, his strategy is a masterclass in modern wealth management. He took a legacy name and used it to pivot into private equity. Then, he used social media to create a level of "fame" that usually isn't available to boring real estate investors.

- Leverage your "Unfair Advantage": He didn't ignore his last name; he leaned into it.

- Diversify early: He moved away from the main family business to start his own firm (Pulte Capital) while he was still in his 20s.

- Build a Brand: In 2026, attention is a currency. His X following is an asset just as valuable as his stock portfolio.

If you are tracking Bill Pulte net worth to understand how the ultra-wealthy operate, look at his "Blight Authority" work in Detroit. He used a mix of private funding and city cooperation to clear out abandoned blocks. It was a proof-of-concept for how he handles both charity and business: high visibility, high impact, and always staying at the center of the conversation.

To get a clearer picture of your own investment path compared to these high-net-worth models, you should start by auditing your own "attention assets." Are you building a personal brand that can leverage your professional moves? If not, you're leaving a tool on the table that Bill Pulte has spent the last decade perfecting. Check your recent financial disclosures or portfolio balance and see where you can diversify into sector-specific private equity or REITs to mimic that housing-market exposure.