Ever feel like you’re the last one to get a memo? That’s basically how the crypto market feels right now. While most people are staring at Bitcoin’s struggle to hold the $95,000 line, a much quieter, more calculated shift is happening behind the scenes. We’re talking about the bitcoin whale rotation to ethereum, and honestly, it’s not just a rumor anymore. It’s showing up in the cold, hard data of the blockchain.

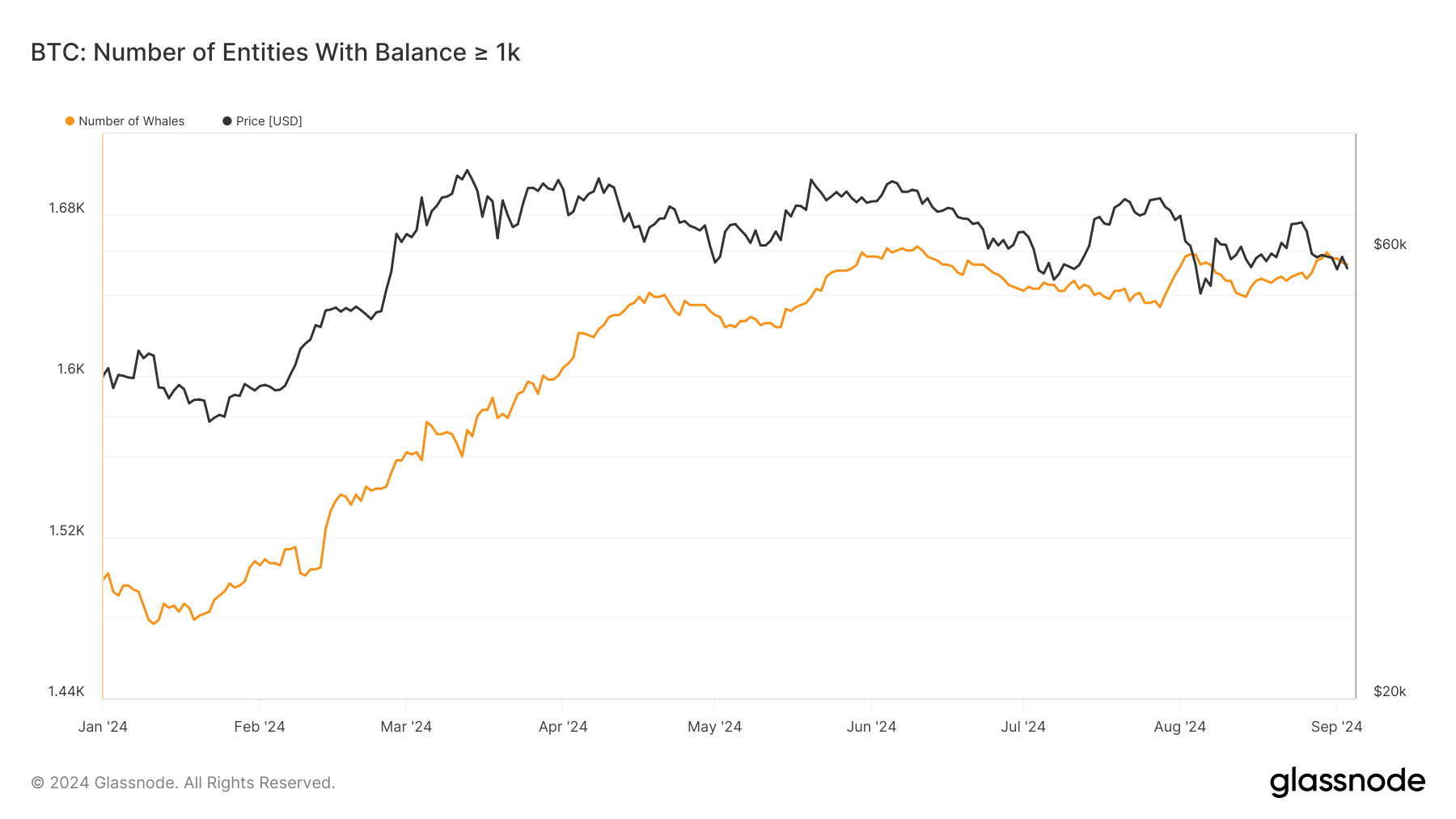

On-chain trackers like Glassnode and Whale Alert have been lighting up. Just this month, we’ve seen massive blocks of BTC—some dormant since the "Satoshi era"—waking up. But they aren't just being sold for cash. A significant chunk of this "ancient" wealth is being funneled directly into Ethereum.

The Great Migration: Why BTC Whales Are Bailing (Sort Of)

Bitcoin is great. It’s the digital gold. Everyone knows that. But once Bitcoin hit its all-time high of $126,080 back in October 2025, the "easy" money was basically made. For a whale holding 5,000 BTC, the path to another 2x return on Bitcoin looks a lot steeper than it does for Ethereum.

Smart money is inherently restless.

Recently, a whale known in the community as "Lightning Counter" was spotted trimming a massive Bitcoin long position to pivot. On January 14, 2026, we saw spot Bitcoin ETFs pull in $843 million, which sounds like a lot until you look at the internal rotation. Institutional players are starting to treat ETH not just as a "tech bet," but as a yield-generating machine.

It’s all about the yield

You can’t "stake" Bitcoin. Well, you can through complex BTCFi protocols, but it’s not native. Ethereum, on the other hand, is currently being transformed into what analysts call a "yield-bearing productive asset."

Think about it. On January 15, 2026, Sharplink Gaming dumped $170 million worth of ETH into a staking and restaking strategy on Linea. That’s not a speculative gamble; that’s a treasury management move. Whales are rotating because they’re tired of their assets sitting idle. They want that 3-5% native yield plus the potential for price appreciation when Ethereum finally breaks its $3,500 resistance level.

✨ Don't miss: UK Pound to Taka: What Most People Get Wrong About Exchange Rates

The "Satoshi Era" Awakening

It’s kinda spooky when a wallet that hasn't moved since 2010 suddenly starts signing transactions.

In early January 2026, a miner from the early days moved over $181 million worth of Bitcoin. Historically, when these "OG" whales move, it signals an inflection point. They usually sell when they think the market is peaked or when they see a better opportunity elsewhere.

- Risk Mitigation: Bitcoin is currently caught in a tug-of-war between $90k and $100k.

- The ETH Catch-up: Historically, Ethereum trails Bitcoin’s rally. Whales are betting that the BTC/ETH ratio, which has been hovering near 0.034, is due for a massive mean reversion.

- Institutional Infrastructure: With EIP-7702 going live, the user experience gap is closing. No more worrying about losing seed phrases when you can use Face ID.

Not Everyone is Buying the Hype

Let’s be real for a second. The rotation isn't a guaranteed win.

While some whales are diving into ETH, others are actually hedging. We’re seeing a nearly even split in whale positions right now—roughly 50% long and 50% short. Some big players are actually opening "short" positions on Ethereum as a hedge while they wait for more clarity on the U.S. crypto bill that’s currently stuck in the Senate.

There’s also the "Solana factor."

Believe it or not, some of that bitcoin whale rotation to ethereum is getting diverted to Solana. Institutional interest in SOL has been surprisingly sticky, with $74,863 SOL in daily net inflows reported just last week. It’s a crowded trade, and Ethereum is feeling the pressure to prove its utility.

The Role of Spot ETFs in 2026

The game changed when BlackRock and Fidelity entered the room.

In the past, a "whale" was just some guy in a hoodie who bought BTC for $10 in 2011. Today, a whale is a pension fund or a corporate treasury. These entities move slow, but they move big.

On January 14, 2026, BlackRock’s ETHA saw $175 million in net inflows. This tells us that the rotation isn't just happening on-chain between private wallets; it’s happening on Wall Street. Investors are moving out of the "pure" store-of-value play (Bitcoin) and into the "smart contract" play (Ethereum) as they look for diversification in a post-ETF world.

What most people get wrong

The biggest misconception is that whales are "dumping" Bitcoin. They aren't. They’re rebalancing.

Most of these addresses holding 1,000 to 10,000 BTC are still net-long on the king of crypto. They are simply taking profits at $95,000 and putting that house money into Ethereum, which they perceive as "undervalued" relative to Bitcoin’s recent run.

Actionable Steps for the Rest of Us

You don't need $100 million to trade like a whale. If you're watching this rotation and wondering how to play it, here’s how the pros are looking at the next few months:

- Watch the BTC/ETH Ratio: This is the most important chart in your arsenal right now. If the ratio starts climbing from 0.034 toward 0.05, the "rotation" is officially in high gear.

- Monitor Staking Inflows: Keep an eye on protocols like EigenLayer or Linea. When whales move ETH, they rarely let it sit in a wallet; they put it to work. High staking deposits usually precede a supply crunch.

- Don’t Ignore the Macro: The U.S. midterm elections and the Senate’s delay on the stablecoin yield ban are creating "noise." Whales use this noise to accumulate while retail is scared.

- Set Levels, Not Hopes: If Bitcoin fails to reclaim $107,000, the rotation might turn into a general market correction. Have an exit plan for your ETH positions if the broader market sentiment shifts bearish.

The bitcoin whale rotation to ethereum is a story of maturity. The market is moving away from pure speculation and toward a world where assets are valued based on the cash flow (yield) they generate. Whether Ethereum hits that predicted $5,000 mark by the end of 2026 depends on whether these whales keep their foot on the gas or if they decide to rotate again—perhaps into the emerging RWA (Real World Asset) sector.

Keep your eyes on the wallets. The blockchain never lies, even when the headlines do.

Next Steps for Your Portfolio

- Audit your BTC/ETH exposure: Check if your current allocation matches the shifting 2026 market dynamics.

- Track On-Chain Inflows: Use tools like Whale Alert or Lookonchain to see if the January 14 ETF trend continues through the rest of the quarter.

- Evaluate Staking Opportunities: Look into native ETH staking or reputable restaking platforms to capture the same yield that institutional whales are currently chasing.