You've probably heard the rumors. People online love to say BlackRock "owns the world," but the reality of the BlackRock Private Investments Fund (BPIF) is actually a lot more technical—and honestly, more interesting—than the conspiracy theories suggest.

It's not about global domination. It’s about access.

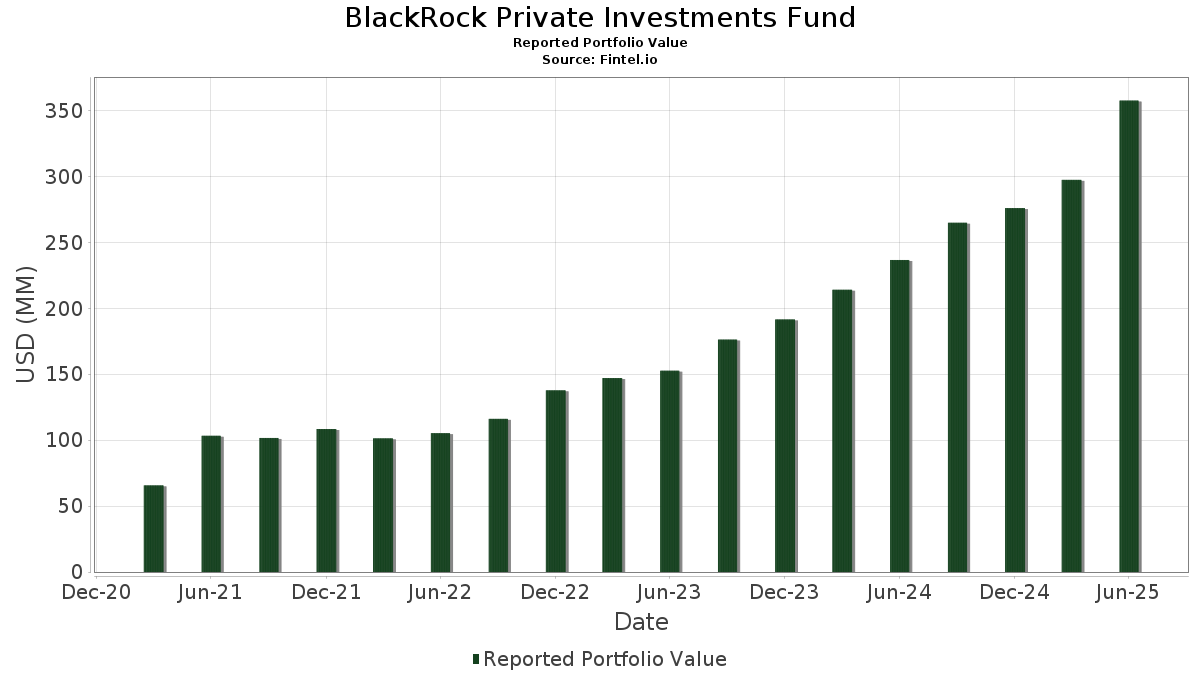

For a long time, if you wanted to get into "private equity," you needed to be a massive pension fund or a billionaire. We're talking $5 million minimums and "capital calls" where the fund manager could basically demand a check from you at any moment. The BlackRock Private Investments Fund (XPIFX) changed that math. It’s a 1940 Act registered "tender offer" fund. Basically, it’s a way for accredited investors to get into the private market without the usual headaches.

The Strategy Behind BlackRock Private Investments Fund

Most people think private equity is just buying up companies and firing everyone. Kinda harsh, right? In this fund, the strategy is actually split between three main buckets: direct investments, secondaries, and a bit of "liquid" stuff to keep things moving.

BlackRock uses its massive scale—we’re talking a $55 billion global private equity platform—to find deals that smaller shops never see. They aren't just buying random businesses. They are looking for "institutional-caliber" companies.

🔗 Read more: How Much is 1000000000000? Visualizing a Trillion Without Losing Your Mind

As of early 2026, the fund is heavily leaning into sectors that feel "future-proof." Think software, financial services, and healthcare.

- Direct Investments: This is the meat of the portfolio. They buy stakes in private companies alongside other big institutional players.

- Secondaries: This is the clever part. They buy "used" private equity stakes from other investors who want out early. It's a great way to avoid the "J-Curve" (that period where you lose money at the start of a fund while waiting for things to grow).

- The Liquid Sleeve: They keep some cash and ETFs on hand. Why? Because unlike traditional private equity, BPIF lets you try to get your money out quarterly.

Why Liquidity Is the Big "Catch"

Here is the thing. Even though it's "semi-liquid," it’s not a stock. You can't just hit "sell" on your phone and get cash tomorrow.

The fund offers "tender offers." Usually, that means they might buy back up to 5% of the fund’s shares every quarter. If everyone wants out at once? You’re stuck. That’s the trade-off for getting those higher potential private market returns.

The Numbers Most People Ignore

Let's talk about the fees because they are... complicated.

There is no "carried interest" or performance fee at the fund level. That’s actually a huge deal. Most private equity funds take 20% of your profits. This one doesn't.

However, you’re still paying a management fee. As of the latest 2026 outlook, the management fee is expected to settle around 1.75% after certain waivers expire. That’s higher than a cheap index fund, but for private equity, it's actually pretty competitive.

| Feature | Detail |

|---|---|

| Ticker | XPIFX (Institutional Class) |

| Net Asset Value (NAV) | Hovering around $13.91 (late 2025/early 2026) |

| 2025 YTD Return | Approx 15.34% |

| Minimum Investment | Usually $1,000,000 for Institutional, but varies by platform |

What's Changing in 2026?

The "New Continuum." That’s the buzzword BlackRock is using this year.

Basically, they are trying to blur the line between public and private. They recently integrated Preqin data into their Aladdin platform. If that sounds like gibberish, it just means they are trying to make private investments look and feel as transparent as regular stocks on an investor's dashboard.

They are also betting big on "Infrastructure."

👉 See also: NY Stock Market Live: Why 2026 Feels So Different for Your Money

We're seeing a massive pivot toward data centers and energy grid modernization. Why? Because AI needs a ridiculous amount of power. The BlackRock Private Investments Fund is part of that shift, looking for assets that have "essential demand."

The Reality of the "BlackRock Owns Everything" Myth

If you go on Reddit or TikTok, you'll see people claiming BlackRock owns all the houses or every company in the S&P 500.

Honestly? It's a misunderstanding of how asset management works.

BlackRock is a fiduciary. They don't "own" the assets in the sense that they can just sell them and buy a private island. The money belongs to the investors—pensioners, 401k holders, and people in funds like BPIF. In BPIF, they usually hold between 5% to 10% of a company. That gives them a seat at the table, sure, but they aren't the "sole owners."

Is It Right for You?

Probably not if you need your money for a house down payment next year.

This is "long-term capital appreciation" territory. You have to be an "accredited investor" to even play (meaning you usually need a $1 million net worth or $200k+ in annual income).

But if you’re tired of the 60/40 portfolio and want to move toward the "50/30/20" model (50% stocks, 30% bonds, 20% alternatives), this is one of the most accessible "entry drugs" into the world of private equity.

🔗 Read more: How Much is Apple Inc Worth: Why Everyone is Looking at the Wrong Numbers

Actionable Next Steps

- Check Your Status: Confirm you meet the SEC "Accredited Investor" criteria before even looking at the prospectus.

- Evaluate Your "Lock-up" Tolerance: Ensure you have at least a 7- to 10-year horizon for this capital.

- Review the Prospectus: Look specifically for the "Repurchase Program" section to understand the risks of quarterly liquidity.

- Talk to a Fiduciary: Ask how a private equity sleeve fits into your existing tax-advantaged accounts versus a taxable brokerage.

The world of private investing is getting smaller, and funds like BPIF are the reason why. It’s not a conspiracy—it’s just a very large, very complex machine for moving capital into businesses that don't trade on the New York Stock Exchange.