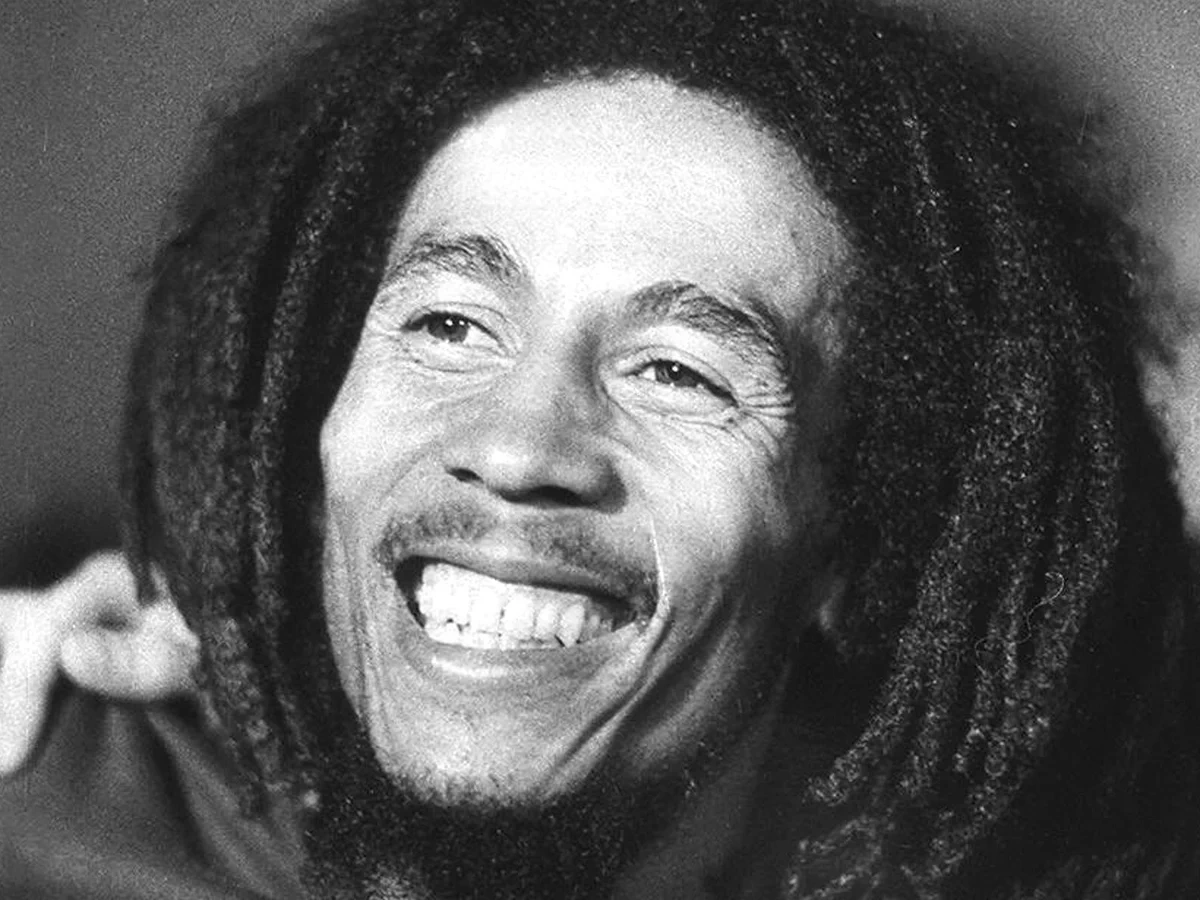

Bob Marley has been gone for over forty years, but his bank account is somehow more active than most living rock stars. It’s wild. When he passed away in 1981, his estate was worth about $11.5 million. That sounds like a lot, but in the world of global icons, it was actually a bit of a mess. Fast forward to 2026, and Bob Marley net worth conversations aren't just about record sales; they’re about a global lifestyle brand that pulls in tens of millions of dollars every single year.

He didn't have a will. Not one. Because of his Rastafarian beliefs, he felt that planning for death was, basically, acknowledging it. To him, life was eternal. That spiritual stance created a legal nightmare that lasted for decades, but it didn't stop the money from piling up.

The Massive Business of Being Bob Marley in 2026

Honestly, the sheer scale of the Marley empire today is staggering. Most people think of the music—Legend still sells like crazy—but the real "bread and butter" has shifted. We're talking about a multi-pronged corporate machine managed by Fifty-Six Hope Road Music Ltd. and Primary Wave.

In 2025 and 2026, his estate has consistently landed on the Forbes list of highest-earning dead celebrities, often pulling in between $15 million and $25 million annually. But that’s just the "reported" income. If you look at the total retail revenue of Marley-branded products—everything from "Marley Natural" cannabis to "House of Marley" headphones—the number is closer to $500 million in global sales.

💡 You might also like: Jordan Love Is Blind Baby Mama: What Most People Get Wrong

Where is the money coming from right now?

- Music Royalties: Streaming is the gift that keeps on giving. Legend is one of the best-selling albums of all time, and it never leaves the charts.

- The Vegas Factor: Primary Wave recently launched "Bob Marley Hope Road" in Las Vegas. This isn't just a tribute; it’s an immersive "experience" with multiple shows a day. Experts estimate this alone could gross over $30 million a year.

- Merchandising: You’ve seen the shirts. But did you know there’s Marley coffee, audio equipment, and even sustainably sourced skateboard decks?

- Licensing: His name and likeness are protected more fiercely than a government secret.

The "No Will" Disaster and the $30 Million Fight

When Bob died at 36, he left behind a widow, Rita Marley, and 11 acknowledged children. Under Jamaican law at the time, without a will, the estate was supposed to be split: 10% to the widow immediately, a "life estate" in another 45%, and the rest shared among the kids.

It got ugly. Fast.

There were forged signatures. There were lawsuits against accountants. There were battles with record labels over who actually owned the songs like "No Woman, No Cry." At one point, the estate was valued at $30 million during these court battles, but millions were being bled out in legal fees. It took nearly 30 years to fully professionalize the management of his legacy.

Sorta ironic, right? The man who sang about freedom and "no more trouble" ended up leaving behind one of the most litigious estates in music history.

The Primary Wave Deal

A major turning point happened a few years back when Primary Wave bought a stake in the Marley estate for roughly $50 million. This wasn't a "sell-out" in the traditional sense. The family kept significant equity, but they brought in the heavy hitters to handle "Name, Image, and Likeness" (NIL) rights. That’s why you’re seeing the Vegas shows and the high-end apparel now. They turned a legend into a blue-chip asset.

What Most People Get Wrong About His Wealth

People assume Bob died a billionaire. He didn't. He lived relatively simply compared to today’s stars. His "net worth" at death was largely tied up in potential—the value of his songs that hadn't even peaked yet.

Another misconception? That the kids are just "trust fund babies." In reality, many of them, like Ziggy, Damian, and Rohan, have built their own massive fortunes. Rohan Marley, for instance, was a driving force behind Marley Coffee, which became a legitimate player in the organic coffee world before the estate took full control back after some legal scuffles.

👉 See also: Is Ellen Leaving The US? What Most People Get Wrong About Her Move

How the Estate Stays at the Top in 2026

The reason Bob Marley net worth stays relevant is "The Disneyfication of Marley." That’s a term some critics use to describe how his revolutionary image has been smoothed out for retail. Whether you like it or not, it works.

- Strict IP Control: They sue anyone using his face without a license. Period.

- Strategic Partnerships: They don't just slap his name on anything; they look for "lifestyle" fits—mostly green, sustainable, or "soulful" products.

- Modern Media: The One Love biopic and new documentaries keep the story fresh for Gen Z, who are discovering him through TikTok and Spotify.

If you’re looking at the numbers, Bob Marley is essentially a "living" brand. The estate is currently valued at well over $150 million if you consider the projected value of the catalogs and the brand equity. That’s a massive jump from the $11 million reported in 1981.

To really understand the business side, you have to look at the "Marley Natural" brand. When the family partnered with Privateer Holdings, it was a landmark deal. It was the first time a global celebrity’s estate went "all in" on the legal cannabis industry. That move alone fundamentally changed the trajectory of the estate’s earnings.

Actionable Insights for Investors and Creators

The Marley story isn't just trivia; it's a blueprint for how intellectual property functions in the 21st century.

- Protect Your NIL: If you're a creator, your name and face are often worth more than your actual "work" over the long term.

- The Power of a Will: Don't be like Bob here. Spiritual beliefs aside, the lack of a will cost his family decades of peace and millions in legal fees.

- Diversification is Key: The Marley estate survived because they didn't just rely on CD sales. They moved into tech, beverages, and live experiences.

The legend of Bob Marley is eternal, but the business of Bob Marley is a masterclass in modern estate management. It’s a mix of rastafarian roots and Wall Street ruthlessness that somehow keeps the "One Love" message playing in every corner of the globe.

🔗 Read more: The Truth About What Did George Harrison Die Of and His Final Days in LA

Next Steps for Deepening Your Knowledge:

Reference the official Bob Marley Foundation filings to see how the estate’s philanthropic arms operate alongside the commercial side. You can also track the Primary Wave portfolio to see how they manage other icons like Whitney Houston or Prince, as the strategies often overlap. Check the U.S. Ninth Circuit archives if you're curious about the specific legal precedents set by the Marley family regarding trademark infringement—these cases are now "the" standard for celebrity image rights.