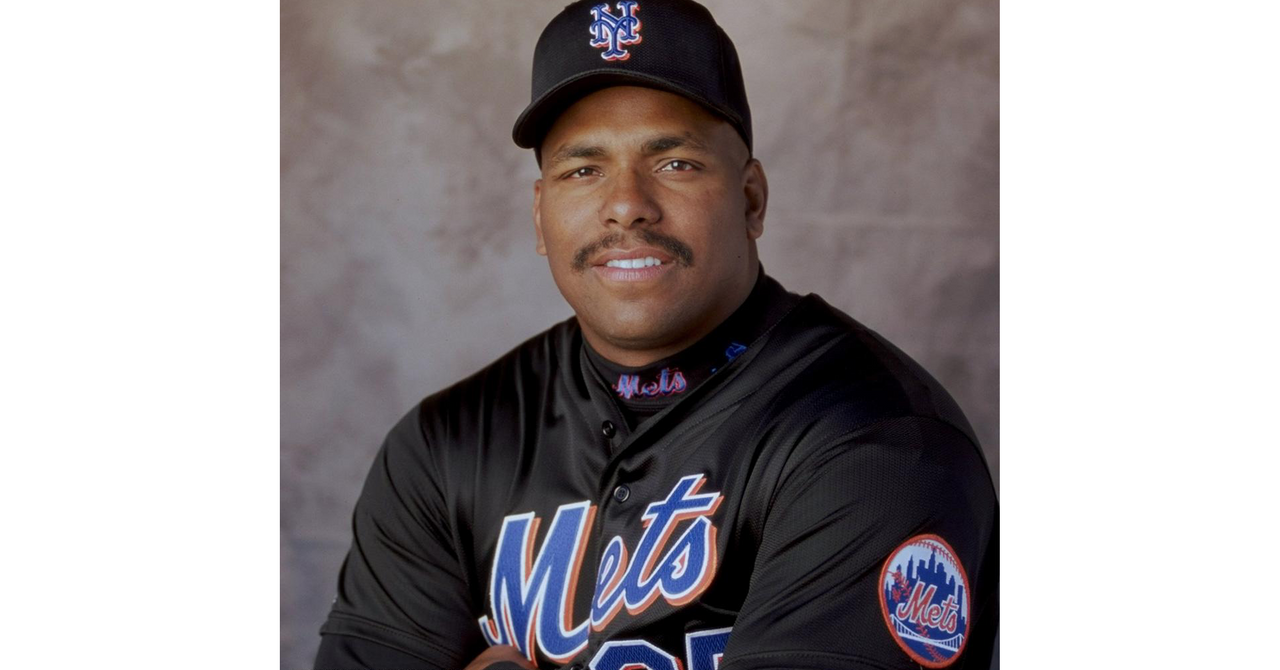

July 1 is a weird day if you're a baseball fan. Most people are thinking about the All-Star break or summer trades, but if you’re a New York Mets fan, you’re thinking about a guy who hasn't stepped onto a professional diamond in over two decades. You’re thinking about Bobby Bonilla. Specifically, you're thinking about that $1,193,248.20 check the team has to cut him every single year. It’s basically a national holiday at this point, often mocked as "Bobby Bonilla Day," but the question on everyone’s mind lately is when the bleeding actually stops.

The bobby bonilla contract end isn't coming anytime soon. Honestly, we’ve still got about a decade of this left.

To understand why this thing is so long-lived, you have to look back at the year 2000. The Mets were in a bit of a spot. They wanted to release Bonilla, who was at the end of his rope as a productive player, but they still owed him $5.9 million for the final year of his deal. Instead of just paying him and moving on, the owners at the time—the Wilpon family—made a bet that would go down as one of the most famous (or infamous) financial blunders in sports history.

The 2035 Deadline: What Really Happened

The bobby bonilla contract end date is officially July 1, 2035. That’s when the final installment of the 25-year payment plan will be delivered. If you're doing the math at home, Bonilla will be 72 years old when he cashes that last check.

Why did the Mets agree to this? It sounds crazy now. But back then, the Wilpons were heavily invested with a guy named Bernie Madoff. You've probably heard the name. Madoff was promising returns of 10% to 15% annually, which made an 8% interest rate on Bonilla’s deferred money look like a bargain. The Mets figured they could take that $5.9 million, invest it with Madoff, pay Bonilla his 8% later, and keep the massive difference for themselves.

📖 Related: U17 World Cup Women: What Most People Get Wrong About the Future of Soccer

It was a brilliant plan. Until it wasn't.

When the Madoff Ponzi scheme collapsed, the Mets were left holding a very expensive bag. That original $5.9 million debt had ballooned. Because they deferred the payment for 10 years (from 2000 to 2011) at an 8% interest rate, the principal grew to nearly $30 million. Divide that by 25 years of payments, and you get the famous $1.19 million annual salary for a guy who is currently enjoying retirement.

The Math That Keeps Giving

Let's look at how the numbers actually break down. It wasn't just a straight line from A to B.

- Original Buyout: $5.9 million in 2000.

- The Wait: 11 years of no payments, but interest was compounding.

- The Total Payout: Roughly $29.8 million by the time we hit 2035.

- The Annual Hit: $1,193,248.20 every July 1st.

It’s easy to laugh at the Mets, but Bonilla’s agent, Dennis Gilbert, was a former insurance agent who knew exactly what he was doing. He wanted a guaranteed annuity for his client. While other players were blowing through their career earnings on cars and bad investments, Bonilla was essentially building the ultimate pension.

He basically turned a mediocre final season into a 35-year financial legacy.

Is He Getting Paid by Others?

Surprisingly, the Mets aren't the only ones sending Bonilla mail. He actually has a second deferred contract with the Baltimore Orioles.

Yeah, really.

Starting in 2004, the Orioles began paying him $500,000 a year. That deal is much shorter than the Mets one, though. The Orioles' version of "Bobby Bonilla Day" is scheduled to end in 2028. So, for a few more years, Bobby is double-dipping on deferred MLB checks. It’s a masterclass in "work smarter, not harder."

Why the Bobby Bonilla Contract End Matters for MLB Today

You might think this was a one-off mistake, but the bobby bonilla contract end in 2035 has actually become a blueprint for how modern contracts are structured. Have you seen Shohei Ohtani’s deal with the Dodgers? It’s basically the Bonilla deal on steroids.

Ohtani is deferring $680 million of his $700 million contract. He’s taking just $2 million a year now so the Dodgers can spend money on other players to win World Series titles. The catch? Between 2034 and 2043, the Dodgers will have to pay him $68 million a year.

The difference is that Ohtani’s deal is at 0% interest, whereas Bonilla’s was at 8%. In the world of finance, that 8% is the "killer" stat. It's why the Mets deal is so much more famous—or painful, depending on which side of the check you're on.

Common Misconceptions

A lot of people think the Mets are still "broke" because of this. They aren't. Steve Cohen, the current owner, is a multi-billionaire who actually leans into the joke. He’s even talked about having a "Bobby Bonilla Day" at the stadium.

Another myth is that this is the worst contract ever. Financially? Maybe for the old owners. But for the team in 2000, it actually helped them. By not paying Bonilla that $5.9 million upfront, they had the cash to trade for Mike Hampton and sign other players who helped them reach the 2000 World Series. In their minds, they traded a future headache for a shot at a ring. They lost the Series to the Yankees, but the logic was there at the time.

What You Can Learn From Bobby

If there’s an "actionable" takeaway here, it’s about the power of time and interest.

✨ Don't miss: Why the Los Angeles Rams 2024 Season Changed How We Value NFL Rosters

- Compound interest is a beast. If you can get someone to agree to an 8% fixed rate over 35 years, take it. You will win every single time.

- Guaranteed income beats a lump sum. Most athletes go broke within five years of retirement. Bonilla is 60+ and still has a million-dollar income for the next decade.

- Check your investment's source. The Wilpons' biggest mistake wasn't the contract; it was trusting a Ponzi scheme to fund it.

The bobby bonilla contract end represents a specific era of baseball finance that we probably won't see again in this exact way, mostly because teams are a lot smarter about interest rates now.

Preparing for 2035

When 2035 finally rolls around, it’ll be the end of an era. We’ve been talking about this check for so long it feels like it’s part of the fabric of the sport. Until then, every July 1st, we'll see the memes, we'll see the tweets, and Bobby Bonilla will go to his mailbox and find a very, very nice piece of paper.

If you want to track this yourself, just mark your calendar for the first of July every year. Check the inflation rates. See how that $1.1 million holds up against the rising cost of living. Even with inflation, it's a hell of a retirement plan.

To stay ahead of how these sports contracts work, you should start looking into the "Present Value" of money. Most teams use a 4% or 5% discount rate today. Understanding that gap—between what a dollar is worth now and what it’s worth in 2035—is the key to understanding why Bobby Bonilla is the smartest man in the history of the New York Mets.

💡 You might also like: New Zealand Breakers vs Illawarra Hawks: What Most People Get Wrong

Check your own retirement accounts or any deferred compensation options you might have at work. Are you getting an 8% match? Probably not. But even a 3% or 4% compound return over twenty years can turn a small sum into a "Bonilla-sized" safety net.