Boeing has had a wild ride lately. If you’re checking the ticker today, January 14, 2026, you'll see the stock price of Boeing (BA) is sitting around $244.50. It actually hit a fresh 52-week high of $247.40 just yesterday. For a company that spent the last few years essentially in the "penalty box" of the stock market, this surge is a massive deal.

Honestly, it’s a bit of a relief for long-term investors. You’ve probably seen the headlines about door plugs, production caps, and endless FAA audits. But the vibe on Wall Street is shifting. People are starting to talk about a "turnaround story" rather than a "survival story."

Breaking Down the Numbers: What Is the Stock Price of Boeing Doing?

Let's look at the raw data. As of mid-January 2026, Boeing is trading near its two-year peak. Just a year ago, it was languishing way down in the $170 range. That is a roughly 40% jump in twelve months.

Why the sudden love?

Basically, Boeing finally started delivering planes again. In 2025, they shipped 600 jets. That sounds like a lot, and it is—it’s their best performance since 2018. The market cares about deliveries because that’s when Boeing actually gets paid. When a 737 MAX rolls off the line and into an airline's hands, the cash registers finally ring.

- Current Price: ~$244.50

- 52-Week High: $247.40

- Market Cap: ~$191.5 Billion

- Recent Momentum: Up about 2% this week alone following a massive order from Delta Air Lines.

The "Ortberg Effect" and New Orders

A lot of the credit for this stability goes to CEO Kelly Ortberg. He took over a mess and has been remarkably quiet, focusing on "boring" things like supply chain health and factory floor quality. It’s working.

Just yesterday, Delta Air Lines signed a massive deal for up to 60 Boeing 787 Dreamliners. That’s huge because Delta had been leaning heavily toward Airbus for years. When a major carrier like Delta says, "Yeah, we trust Boeing again," the stock price of Boeing reacts almost instantly.

We also saw Aviation Capital Group snap up 50 MAX jets. The order book is now worth over $545 billion. Think about that. Boeing has a backlog of over 5,600 aircraft. They have enough work to keep their factories humming for the next decade. The problem isn't finding customers; it's building the planes fast enough without breaking anything.

What Most People Get Wrong About Boeing’s Risk

You might think the biggest risk is another technical failure. While that’s always a nightmare scenario, the real "growth choke point" right now is actually the FAA.

The regulators have been living in Boeing’s pockets. For a long time, there was a strict production cap of 38 planes per month for the 737. Recently, the FAA eased that to 42. Boeing wants to hit 47 planes a month by the end of 2026. If they miss that target because of a quality "escape" or a part shortage from a supplier, the stock will likely take a hit.

The 777X Headache

There’s also the 777X. This plane is the "Beast" of the skies, but it’s been delayed more times than a budget flight in a thunderstorm. Boeing recently took a $4.9 billion charge on the program. They are now looking at 2027 for the first deliveries. Investors have mostly priced this in, but any more bad news here could sour the current rally.

Analyst Sentiment: Is It Still a Buy?

Wall Street is surprisingly bullish. Out of about 28 major analysts, the consensus is a Buy.

💡 You might also like: Mark Levy Cenvill Recreation: What Most People Get Wrong

- Highest Price Target: $285

- Average Target: ~$252

- The "Bears" View: Some folks at places like Bernstein and Morningstar warn that the stock is "overbought" in the short term. The RSI (Relative Strength Index) is high, which basically means the price went up too fast and might need to breathe for a minute.

Honestly, Boeing still isn't profitable on a "GAAP" basis. They lost billions in 2025. But the stock market is a forward-looking machine. It doesn't care about the money lost last year; it cares about the cash flow coming in 2027 and 2028.

The Military Spending Factor

Don't forget the defense side of the house. Boeing isn't just a commercial plane maker. They build the F/A-18 Super Hornet, the Apache helicopter, and the KC-46 Tanker.

With the 2026 U.S. military budget discussions hitting $1.5 trillion, Boeing’s Defense, Space & Security (BDS) segment is looking much healthier. They recently bagged two defense contracts worth $12.8 billion. This provides a "floor" for the stock price of Boeing when the commercial side gets turbulent.

💡 You might also like: Rizzo Agency Clinton NY: What Most Local Business Owners Get Wrong

Actionable Insights for Investors

If you're looking at Boeing right now, don't just stare at the daily chart. Here is how to actually play this:

- Watch the Earnings Call: Boeing reports Q4 results on January 27, 2026. This will be the moment of truth. If they confirm they are on track for positive free cash flow this year, the stock could break $250 easily.

- Monitor Production Rates: Keep an ear out for the "47 per month" number. That is the magic threshold for the 737 MAX in 2026.

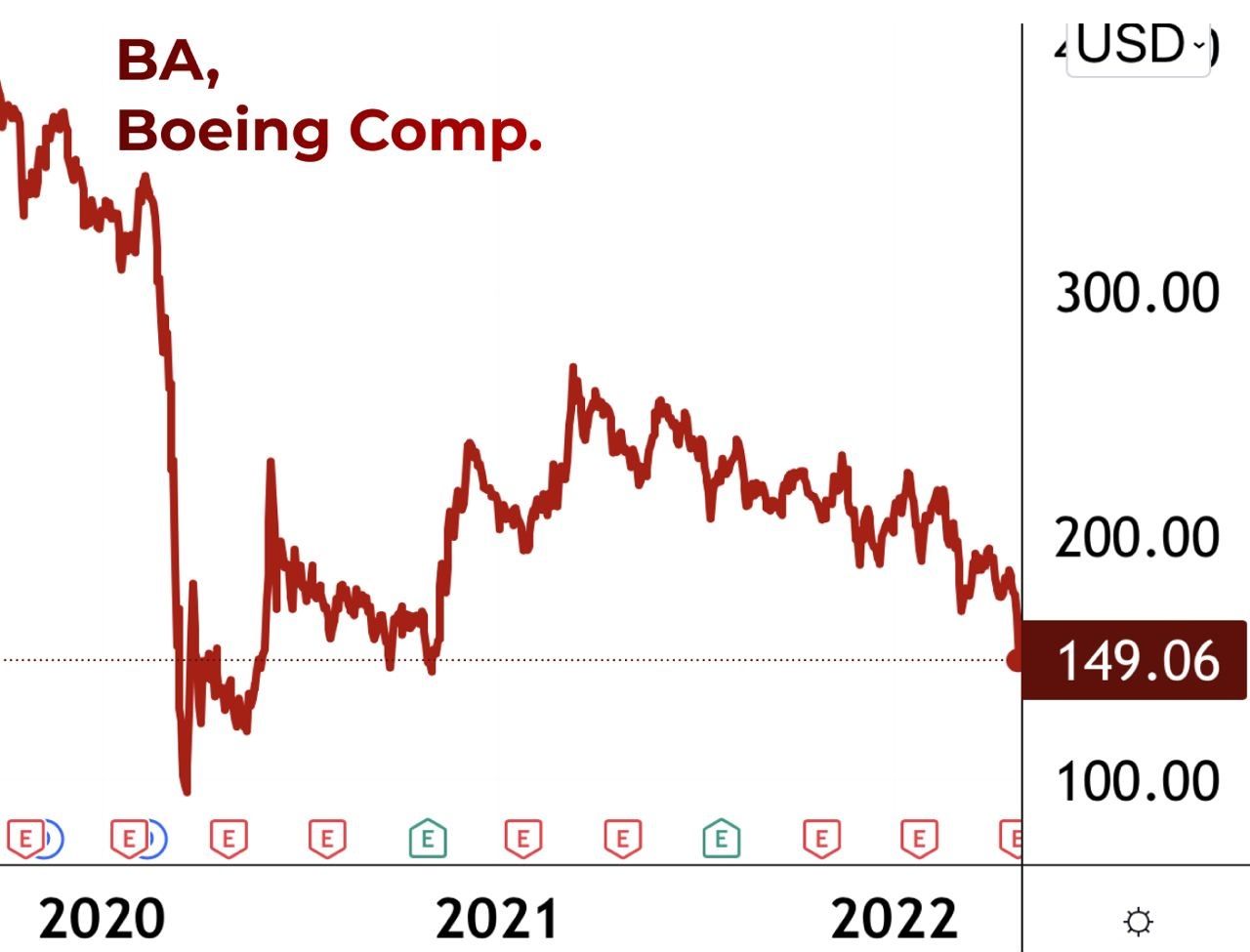

- Mind the Valuation: Trading at 2.2x sales, Boeing is "fairly valued" compared to its peers. It’s not a "steal" anymore like it was at $150, but it’s not exactly a bubble either.

- Diversify Within Aero: If Boeing feels too risky, look at its suppliers like Spirit AeroSystems (which Boeing is in the process of re-acquiring) or GE Aerospace.

Boeing is finally pulling out of its dive. It’s not a smooth flight yet—there will be bumps—but for the first time in a long time, the pilots seem to have control of the plane.

Summary of Key Milestones to Watch

- Jan 27, 2026: Q4 Financial Results (The Big One).

- Mid-2026: Expected FAA certification for the 737 MAX 7.

- Late 2026: Targeted production ramp to 47 aircraft/month.

The stock price of Boeing is no longer just a meme of corporate failure. It’s becoming a legitimate recovery play for people who believe the world needs more planes than Airbus can build alone.