You’ve probably seen the ticker symbol BSX flashing across financial news more often lately. Honestly, if you’re looking at the medical device world, it’s hard to ignore. As of early January 2026, the boston scientific market cap has settled in at roughly $141.9 billion. That is a massive number, especially when you consider where they were just a few years ago.

Market cap—or market capitalization, if we’re being formal—is basically the total price tag the stock market puts on a company. You take the current share price, which has been hovering around $95 to $98, and multiply it by the 1.48 billion shares they have out there. Presto. You have the value of the entire empire.

But here is the thing: a market cap isn't just a static number. It's a living, breathing reflection of what investors think is going to happen next. And for Boston Scientific, the vibe right now is "growth at any cost."

Breaking Down the Boston Scientific Market Cap Growth

A decade ago, this company wasn't even close to the $100 billion club. In fact, back in 2012, the market cap was languishing around $8 billion. Think about that for a second. In about 14 years, they've grown their valuation by more than 1,600%.

Why? It isn’t just luck. It's a very aggressive, very specific playbook of buying up smaller companies before they get too expensive. Just this week—January 12, 2026, to be exact—they announced they’re buying Valencia Technologies. This isn't a random move. Valencia makes a tiny, coin-sized implant called eCoin that treats overactive bladder.

By snagging these niche technologies, Boston Scientific keeps its "moat" wide. They aren't just selling old-school pacemakers anymore. They are moving into every corner of the human body, from the brain to the bladder.

The Numbers That Actually Matter

If you look at the 2025 year-end data, the company pulled in about $19.35 billion in revenue. That’s a 20% jump over the previous year. When a company that is already huge manages to grow its sales by 20% in a single year, the market cap usually follows like a shadow.

Investors currently value BSX at a Price-to-Earnings (P/E) ratio of roughly 30 to 50, depending on which "adjusted" numbers you like to use. Honestly, that’s kind of pricey. For comparison, some of their peers trade at lower multiples. But people are willing to pay a "growth premium" for Boston Scientific because they keep beating expectations.

In the third quarter of 2025, they didn't just meet their goals—they blew them out of the water. They reported 15.3% organic growth, which is a fancy way of saying "sales from stuff we already owned."

What’s Fueling the BSX Valuation?

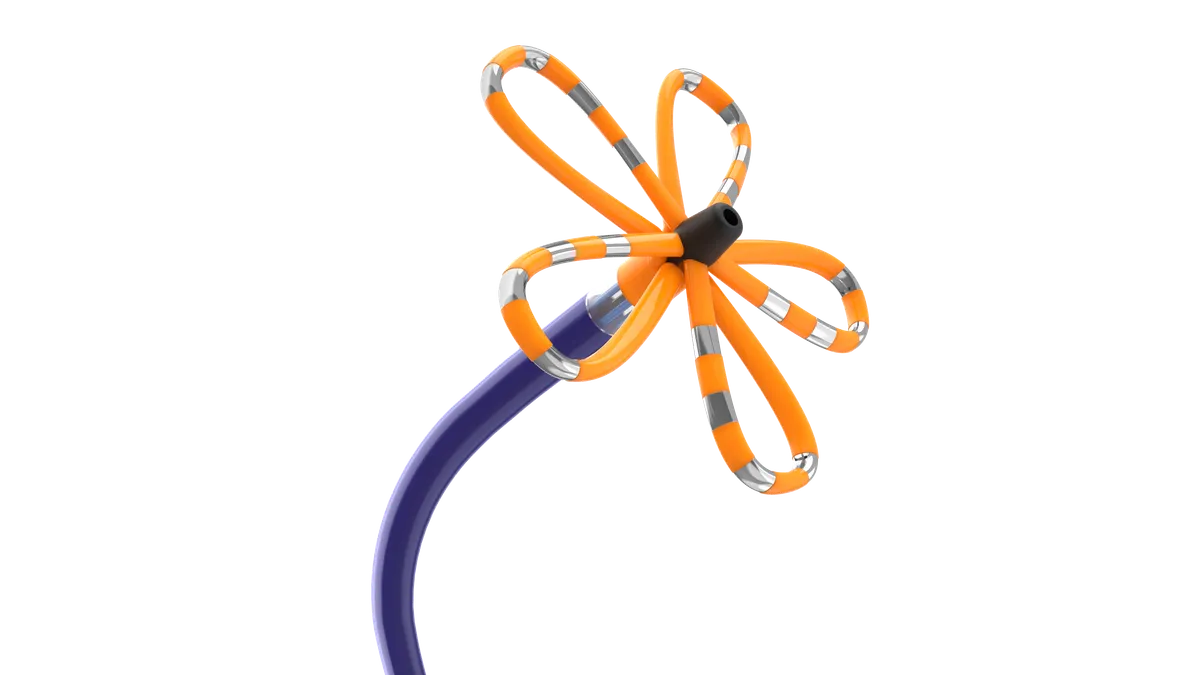

You can’t talk about the boston scientific market cap without talking about the WATCHMAN. It’s arguably their most famous product—a little device that sits in the heart to prevent blood clots. It has become the gold standard for patients with AFib who can't take blood thinners.

But it’s not just the heart stuff. The company is basically split into two big buckets:

- MedSurg: This covers endoscopy, urology, and "neuromodulation" (tech that uses electricity to treat pain).

- Cardiovascular: This is the big engine. It includes everything from stents to high-tech heart mapping systems.

The Cardiovascular side grew by more than 22% recently. That is almost unheard of for a company this size. They did hit a small speed bump in 2025 when they stopped selling certain heart valves (ACURATE) in some markets, but they made up for it by doubling down on Electrophysiology (EP).

📖 Related: Car Wash Signs Ideas That Actually Make People Turn the Wheel

Competition and Market Standing

In the MedTech playground, Boston Scientific is the kid who keeps getting bigger. They are currently duking it out with giants like Abbott Laboratories ($219B market cap), Stryker ($140B), and Medtronic ($125B).

For a while, Medtronic was the undisputed king. But if you look at the trend lines, Boston Scientific has actually overtaken Medtronic in total market capitalization recently. That is a huge symbolic shift in the industry. It shows that investors currently value Boston Scientific's pipeline and agility more than Medtronic's sheer size.

Why the Market Cap Might Shift in 2026

No number stays the same forever. There are a few "catalysts" (investor-speak for "big events") coming up that could send the boston scientific market cap swinging in either direction.

First, there's the CHAMPION AF clinical trial data expected in the first half of 2026. If those results are good, it could open up a massive new group of patients for the WATCHMAN device. We're talking billions in potential new revenue.

Second, the integration of their recent acquisitions—like Nalu Medical and Silk Road Medical—needs to go smoothly. If they overpaid for these companies and can't turn a profit on them, the market cap will take a hit. Analysts at places like UBS and JPMorgan are mostly bullish, though. Some have set price targets as high as $140 per share. If the stock hits that, the market cap would soar toward $200 billion.

A Reality Check on Valuation

Is the company overvalued? Kinda. Maybe.

If you're a "value investor" who likes cheap stocks, Boston Scientific probably makes you nervous. It's trading at a premium. The Enterprise Value is currently sitting around $142 billion, which accounts for their $11 billion in debt. They don't have a ton of cash on hand—only about $414 million at the end of 2024—because they spend almost every cent they make on R&D or buying other companies.

It’s a "run fast and break things" strategy, but applied to the very slow and careful world of medical devices.

Actionable Insights for Tracking BSX

If you are trying to keep an eye on where this company is headed, don't just look at the stock price. The stock price is just the surface. You need to look at the "under the hood" metrics that drive the market cap.

💡 You might also like: How to Launch Businesses to Start With No Money Without Losing Your Mind

- Watch the "Organic Growth" rate: If this stays above 10%, the market cap will likely stay high. If it dips into the single digits, expect a sell-off.

- Keep an eye on Feb 4, 2026: That’s the next big earnings call. Analysts are expecting $0.78 earnings per share. Anything less could cause a temporary dip.

- Monitor the M&A pipeline: Boston Scientific is a serial acquirer. Each time they announce a deal like the Valencia Technologies one, they are adding a new "brick" to their valuation.

- Regulatory wins: Watch the FDA. New approvals for things like the Empower leadless pacemaker are the literal lifeblood of this company's future value.

The boston scientific market cap represents more than just a balance sheet; it represents the market's belief that surgery is becoming more "plug-and-play" and less "open-them-up." As long as they stay at the cutting edge of that transition, that $141 billion figure might actually look small in five years.

Next Steps for Research:

Check the SEC Form 10-K filings for the most recent debt-to-equity ratios, and keep a calendar reminder for the Q4 2025 earnings release on February 4, 2026, to see if they hit their $3.04 full-year EPS target.