If you've spent more than five minutes looking at the exchange rate for British pounds to Nigerian naira lately, you know the feeling. It's a mix of vertigo and confusion. One day you're looking at a specific number on Google, and the next, your local "mallam" or a digital fintech app is quoting you something entirely different.

The reality of the british pounds to nigerian naira exchange is a lot messier than a single ticker on a screen.

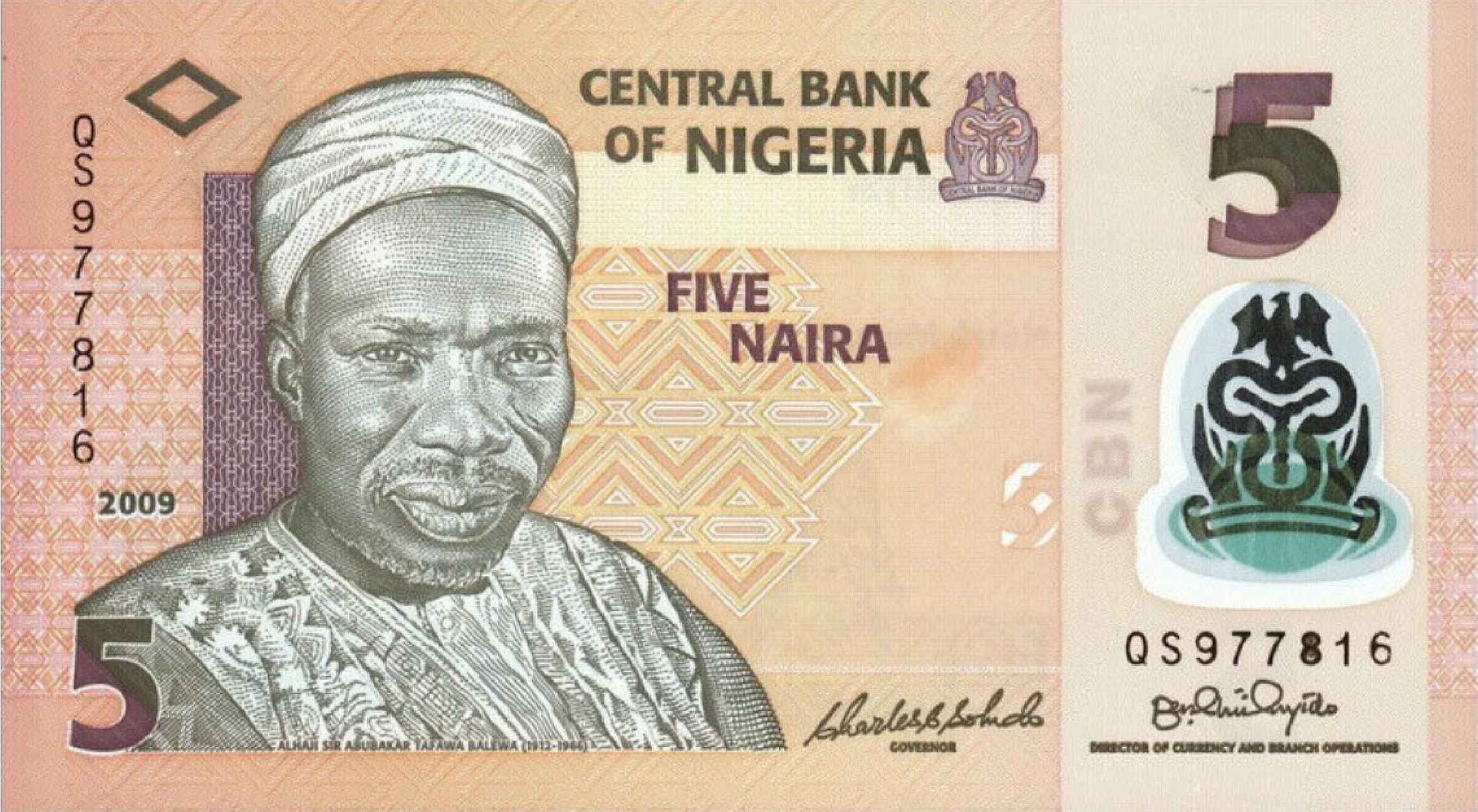

Honestly, it’s not just about numbers. It’s about two economies moving in completely opposite directions, separated by thousands of miles and a massive gap in monetary policy. While the UK’s Bank of England has been flirting with interest rate cuts to keep the British economy from stalling, the Central Bank of Nigeria (CBN) has spent the last year in a literal street fight against inflation.

Why the Official Rate is Only Half the Story

Most people make the mistake of checking a standard currency converter and assuming that's the price they'll get.

Wrong.

In Nigeria, we have what's basically a "multi-layered" reality. There’s the official rate—often referred to as the NAFEM (Nigerian Autonomous Foreign Exchange Market) rate—and then there’s the "street" or parallel market. As of early 2026, the CBN has made massive strides in "unifying" these rates. They want one single price for the naira. But let’s be real: liquidity is king. If the banks don’t have the pounds, people go where the money is.

The 2026 Context

The current landscape is shaped by the CBN's aggressive reforms that kicked off in earnest around 2024 and 2025. Governor Olayemi Cardoso has been pulling every lever available. We’ve seen the Monetary Policy Rate (MPR) sit at staggering highs—upwards of 27% at various peaks—just to mop up excess cash and lure in foreign investors.

Why does this matter for your british pounds to nigerian naira conversion?

Because when interest rates are that high in Nigeria, it’s supposed to make holding naira more attractive. But for the average person sending money home from London or Manchester, all you see is that your £100 doesn't buy as many bags of rice as it did two years ago.

The "Black Market" vs. The Real Market

We need to stop calling it the "black market" like it’s some shady underworld deal in a back alley. For millions of Nigerians, it’s simply the accessible market.

Historically, the gap (or "spread") between the official and parallel rates was wide enough to drive a truck through. In 2026, that gap has narrowed significantly due to the CBN's Electronic Foreign Exchange Matching System (EFEMS). This tech-heavy approach basically forces transparency.

However, "narrowed" doesn't mean "gone."

- Bank Rates: Usually the "cleanest" but often come with the most paperwork.

- Fintech Apps: Think of the ones everyone uses—Wise, LemFi, Remitly, or WorldRemit. They usually hover somewhere in the middle.

- Peer-to-Peer (P2P): This is where things get interesting. On platforms like Binance or local Nigerian exchanges, the rate is determined by pure, unadulterated supply and demand.

If you are looking for the best british pounds to nigerian naira rate, you have to look at the "hidden" fees. A "great" rate with a £15 transfer fee is often worse than a "bad" rate with zero fees.

What’s Actually Driving the Naira’s Value?

It’s easy to blame "speculators," but that’s a lazy answer. The value of the naira against the pound is currently tethered to three main anchors.

- Oil Production Levels: Nigeria’s foreign exchange reserves are basically a piggy bank filled by oil sales. When production hits 1.7 million barrels per day (mbpd), the naira breathes. When it drops due to "technical issues" or theft, the naira gasps for air.

- The Dangote Factor: By 2026, the Dangote Refinery is supposed to be fully operational. This is huge. Nigeria spends a massive chunk of its foreign currency just importing refined petrol. If we stop doing that, the demand for dollars and pounds drops, which should theoretically stabilize the naira.

- UK Inflation: It takes two to tango. If the British pound is strong because the UK economy is outperforming Europe, the naira will naturally look weaker against it, regardless of what happens in Abuja.

The Numbers Game

In early 2026, we've seen the naira trade in a volatile band. It's not uncommon to see swings of 50 to 100 naira in a single week. For a student in the UK paying tuition, that volatility is the difference between eating well and eating indomie for a month.

🔗 Read more: Social Security Administration Customer Service: What Most People Get Wrong

How to Get the Most Naira for Your Pound

If you're sending money, you've gotta be smart about it. Don't just stick to the bank you've used since 2010.

First, check the timing. Nigerian markets often react to the CBN’s Monetary Policy Committee (MPC) meetings. If they announce a rate hike, the naira might see a temporary boost. If you can wait a few days after a major announcement, do it.

Second, diversify your apps. * Wise is great for mid-market rates but sometimes struggles with direct naira deposits depending on current Nigerian regulations.

- LemFi and Sendwave have become the darlings of the diaspora because they often offer "zero-fee" transfers, though they bake their profit into the exchange rate itself.

- Western Union is the old reliable, especially if your recipient needs physical cash in a rural area.

The "Hidden" Costs Nobody Mentions

Everyone looks at the exchange rate, but nobody looks at the "settlement time."

If you lock in a rate for british pounds to nigerian naira today, but the money doesn't land for three days, you might have lost out. In the Nigerian economy, prices change by the hour. If you’re sending money for a business transaction or to buy land, that three-day lag can be a killer.

Also, watch out for the "receiver's fee." Some Nigerian banks charge a small fee to process incoming international transfers. It’s usually negligible, but if you’re sending small amounts, it adds up.

✨ Don't miss: Why the Kearny NJ Distribution Center US Network is Actually the Backbone of the East Coast

Looking Ahead: Will it Get Better?

Experts like Dr. Ayo Teriba have argued that Nigeria needs to focus on "liquidity, not just exchange rates." The sentiment in 2026 is one of "cautious optimism." The IMF and World Bank have praised the reforms, but the average Nigerian on the street is still waiting for that "macroeconomic stability" to turn into cheaper bread.

If the 2027 election cycle starts to see massive government spending (as it usually does), we might see the naira come under pressure again. Politics and currency are inseparable in West Africa.

Practical Steps for Your Next Transfer

Don't just wing it. If you have a significant amount of British pounds to convert:

- Comparison shop across at least three platforms. Look at the final "amount received" figure, not the headline rate.

- Avoid weekends. Liquidity is lower on Saturdays and Sundays, which often leads to wider spreads and worse rates.

- Use P2P for small amounts. If you're comfortable with crypto-linked platforms, the P2P market often reflects the most "honest" rate in real-time.

- Monitor the CBN's official website. They’ve become much better at publishing daily rates, which gives you a baseline for what a "fair" price looks like.

The journey of the british pounds to nigerian naira remains a rollercoaster. While the extreme freefall of previous years seems to have been arrested by tight policy, the path to a truly "strong" naira is long. Stay informed, stay cynical of "too good to be true" rates, and always prioritize speed and liquidity over a few extra kobo.