The British stock market index is often treated like a dusty museum piece by global investors. You've heard the talk. It's too "old economy." It’s just banks, oil, and miners. While the S&P 500 was busy minting trillionaires in Silicon Valley, the London scene felt stuck in 1994.

But things changed.

💡 You might also like: AAPL Premarket Stock Quote: What Most People Get Wrong

If you haven’t looked at the numbers lately, specifically in early 2026, you might be surprised to see the FTSE 100 comfortably sitting above the 10,000 mark. It’s not a fluke. It's a massive shift in how the world views "boring" companies that actually make stuff and pay dividends. Honestly, the narrative that the UK market is dead is just plain wrong. It’s actually in a bit of a sweet spot because of the exact things people used to complain about.

Why the FTSE 100 Finally Broke 10,000

For years, the FTSE 100 was the "unloved" child of the investing world. But in 2025, it pulled off a 21.5% return. That was its best year since 2009. Why? Because the world got rocky. When geopolitics gets messy and tech valuations look like they might pop, investors run toward "tangible assets."

London is the king of tangible assets.

Take today, January 14, 2026. Gold prices just hit a fresh record of $4,639.68 an ounce. Because the FTSE 100 is packed with miners like Endeavour Mining, Glencore, and Rio Tinto, the index is getting a massive lift. These aren't speculative software startups; they are companies pulling essential materials out of the ground.

- Miners and Defense: Companies like BAE Systems are dominating the leaderboard. With global tensions where they are, a $27bn order book makes BAE look a lot more attractive than a high-growth app that doesn't turn a profit.

- The Yield Factor: While US tech stocks often offer zero dividends, the British stock market index is a cash machine. The FTSE 250 currently boasts a dividend yield of around 4.3%, while the FTSE 100 sits at roughly 3.5%.

In an era where interest rates are finally starting to settle—some experts expect the Bank of England to hit a terminal rate of 3.25% by April 2026—those dividends are looking like pure gold to income-hungry retirees.

The Real Difference: FTSE 100 vs. FTSE 250

If you want to understand the British stock market index, you have to stop thinking of it as one big blob. It’s really two very different animals.

The FTSE 100 is a global behemoth. Roughly 70% of its revenue comes from outside the UK. When the pound is weak, these companies actually look better because their dollar earnings convert into more sterling. It’s basically a proxy for global trade, dominated by healthcare giants like AstraZeneca and energy titans like Shell.

Then there’s the FTSE 250. This is the "real" UK.

👉 See also: US Currency to Samoa Tala: What Most People Get Wrong

These are mid-cap companies—the 101st to 350th largest. They are much more tied to how people in Birmingham or Manchester are actually spending their money. UBS recently pointed out that the FTSE 250 is in a "sweet spot." It’s trading at a significant discount compared to its global peers, yet it’s poised to benefit most from a domestic economic uptick.

What’s Happening in the Mid-Cap Space?

Mid-caps have had a rougher ride than the big boys lately, but the tide is turning. Analysts are becoming the most bullish they've been in 12 years. About 63% of recommendations for FTSE 350 stocks are now "buys."

It’s about valuation. The FTSE 250 is currently valued at about 12.4 times forward earnings. Compare that to the S&P 500, which is hovering over 22 times. You’re basically getting British companies at a nearly 50% discount compared to American ones.

The "Old Economy" Is New Again

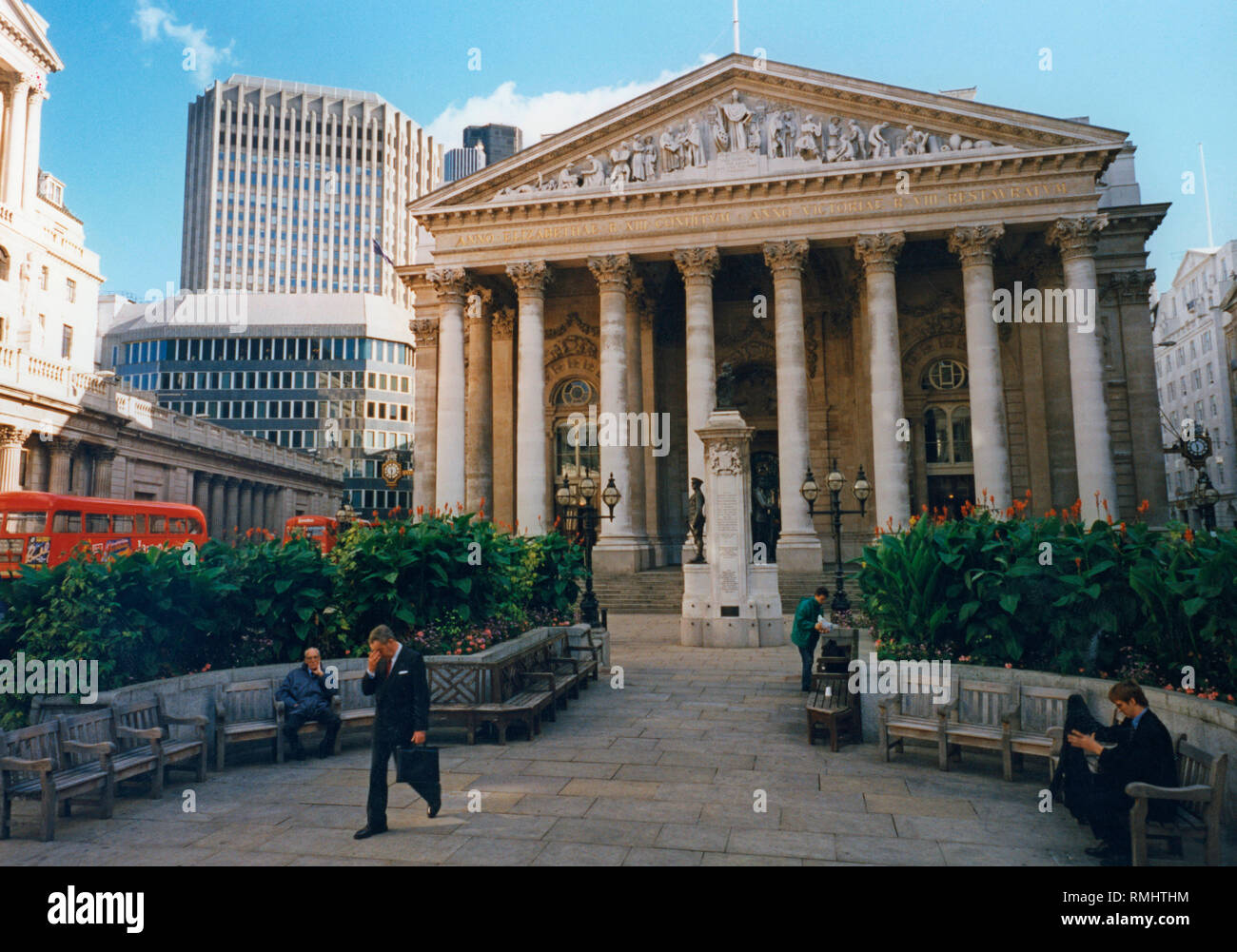

People used to mock the London Stock Exchange (LSE) for its lack of tech. But in 2026, being "old" is a feature, not a bug. The index is heavily weighted toward Financials (about 25%), Consumer Staples, and Energy.

When inflation is sticky—it's been hovering around 2.7% to 3%—you want to own companies that can raise prices without losing customers. Think Unilever or Diageo. People still need soap and they still want a drink, regardless of what the stock market is doing today.

"The composition of the year's best performers looks familiar... miners and defense companies are dominating, reflecting ongoing geopolitical concerns and a flight to tangible assets." — Recent Market Analysis, January 2026.

There’s also a quiet revolution happening in the IPO market. For a long time, companies were fleeing London for New York. But recent regulatory reforms and a three-year stamp duty exemption for newly listed companies are starting to work. In the final quarter of 2025, we saw 11 IPOs raising nearly £2 billion. It’s not a flood yet, but the "London is closed" narrative is starting to crumble.

📖 Related: Duke Stock Prices Today: Why Dividend Hunters Are Looking Closer at DUK

The Risks: What Could Trip Things Up?

It isn't all sunshine and dividends. There are real risks.

- The US Tariff Shadow: Trade tensions are the biggest elephant in the room. The IMF estimates that trade frictions could shave 0.3% off UK GDP growth this year. Since the FTSE 100 is so global, any trade war between the US and China hits London hard.

- Concentration Risk: The FTSE 100 is top-heavy. The top 10 dividend payers account for more than half of the total payout. If one of the big banks or oil companies has a bad year, the whole index feels it.

- The "Boring" Penalty: Even if these companies are profitable, they struggle to attract the massive "FOMO" capital that drives US markets.

How to Actually Use This Information

If you're looking at the British stock market index right now, don't just buy a tracker and forget it. You have to be selective.

Experts are currently pointing toward Industrials as a breakout sector for 2026. Names like AB Dynamics and discoverIE are being highlighted as "recovery opportunities" because they have solid balance sheets but got unfairly punished during the 2025 volatility.

Also, watch the housebuilders. Companies like Vistry have seen their completions drop recently, but as the Bank of England cuts rates in February and April, the mortgage market should thaw. That’s a classic cyclical play.

Actionable Insights for Your Portfolio

- Rebalance for Income: If your portfolio is too heavy on non-dividend-paying tech, the FTSE 100's 3.5% yield is a great way to stabilize your returns.

- Look at Mid-Caps for Growth: The FTSE 250 is where the real "bargains" are. Look for companies with high "customer stickiness" and low debt.

- Currency Hedge: Remember that a stronger Pound (currently around $1.34) can actually be a headwind for the FTSE 100. If you think the Pound will continue to rise, look more toward the domestic FTSE 250.

- Check the Winners: Keep an eye on the mining sector. If gold and copper stay at these record levels, the FTSE 100 has a natural floor that other markets lack.

The British market isn't a museum. It's a defensive powerhouse that finally found its footing in a volatile world.

Next Steps:

To get started, research the specific sector weights of the FTSE 350 to see which industries align with your risk tolerance. You should also check your current exposure to UK Gilts, as the relationship between bond yields and dividend stocks will be the primary driver of market movement throughout the first half of 2026.