Money is messy. Politics is messier. When you combine them into the red-ink-stained ledger of the U.S. federal government, you get a story that’s less about simple math and more about timing, luck, and massive, unexpected crises. Most folks think a president just opens a checkbook and starts spending. Honestly, it's way more complicated than that.

The budget deficits by president aren't just a scoreboard of who "spent more." They are a reflection of everything from the 2008 housing collapse to the once-in-a-century chaos of 2020.

The Big Red Numbers: Who Ran the Largest Deficits?

If we're just looking at raw dollars, the numbers have exploded lately. You’ve probably seen the headlines. For example, in the 2025 fiscal year, the federal government ran a deficit of roughly $1.8 trillion. That’s a massive gap between what the Treasury took in and what went out the door.

But looking at the budget deficits by president through the lens of percentage increases tells a different story. Ronald Reagan inherited a deficit of around $79 billion from Jimmy Carter. By the time Reagan signed his final budget in 1989, that number had climbed to $153 billion. That’s a 94% increase.

Compare that to George W. Bush. He walked into a rare situation: a budget surplus left by Bill Clinton. By the time Bush left in the middle of the Great Recession, the deficit had swung by a staggering 1,204%.

The 21st Century Explosion

- Barack Obama: Inherited the 2009 peak deficit of $1.4 trillion (largely set in motion by the previous administration's bank bailouts and a tanking economy). By the end of his term, he’d actually cut the annual deficit by about 53%, though the total debt continued to climb.

- Donald Trump: His 2017 tax cuts and the massive COVID-19 stimulus packages in 2020 saw the deficit balloon to $3.13 trillion in FY 2020. That was roughly 15% of the entire U.S. economy.

- Joe Biden: Oversaw a period where deficits remained high—around $1.7 trillion to $1.8 trillion—as the government dealt with post-pandemic recovery and rising interest rates.

Why Presidents Don't Have Total Control

Basically, the President proposes, but Congress disposes. The Constitution gives the "power of the purse" to the legislative branch. A president sends a budget to Capitol Hill, but it's often "dead on arrival."

Plus, there are "automatic stabilizers." These are things like unemployment benefits and food stamps. When the economy tanks, more people need these services. At the same time, people earn less, so tax revenue drops. The deficit grows automatically without anyone in the White House even lifting a pen.

Then there's the "timing shift" problem. Fiscal years run from October to September. This means a president’s first year in office is actually running on their predecessor's budget. It takes about 18 months for a new administration’s policies to actually show up in the deficit data.

The Interest Rate Trap

Current data from the Bipartisan Policy Center shows a scary trend. We're spending more on interest. In fiscal year 2026, interest payments are eating up a huge chunk of the budget. It's like having a credit card where the minimum payment is so high you can't afford to buy groceries.

📖 Related: Bank of America Stock Today: Why Investors Are Selling a Blowout Earnings Report

Under the second Trump term in 2025, we saw a significant rise in customs duties from new tariffs. These brought in billions—customs revenue jumped by over 300% in some months. But even with that extra cash, the structural deficit remains. Why? Because Social Security and Medicare costs are rising as the population ages. No president has successfully "fixed" that math yet.

What This Means for Your Wallet

High budget deficits by president aren't just abstract numbers. They eventually lead to higher interest rates for your mortgage or car loan. When the government borrows trillions, it competes with you for capital.

The Congressional Budget Office (CBO) projected a $1.7 trillion deficit for FY 2026. If these numbers keep climbing, the government might have to hike taxes or cut services just to keep the lights on.

Actionable Insights: What You Can Actually Do

- Hedge Against Inflation: Persistent deficits often put upward pressure on prices. Consider assets that historically hold value during inflationary periods, like certain commodities or inflation-protected securities (TIPS).

- Monitor Interest Rate Trends: If the deficit stays high, the Federal Reserve may keep rates "higher for longer." This is a bad time to take on variable-rate debt.

- Watch the "X-Date": That’s the day the Treasury runs out of cash. In 2025, we saw a debt limit increase of $5 trillion to avoid a default. These political standoffs cause market volatility. If you see one coming, make sure your portfolio is diversified enough to handle the swing.

- Vote on Policy, Not Just Rhetoric: Look at the actual budget proposals. Does the plan address "mandatory spending" (Social Security/Medicare) or just "discretionary spending" (the small stuff)? Most of the deficit is driven by the big programs that politicians are afraid to touch.

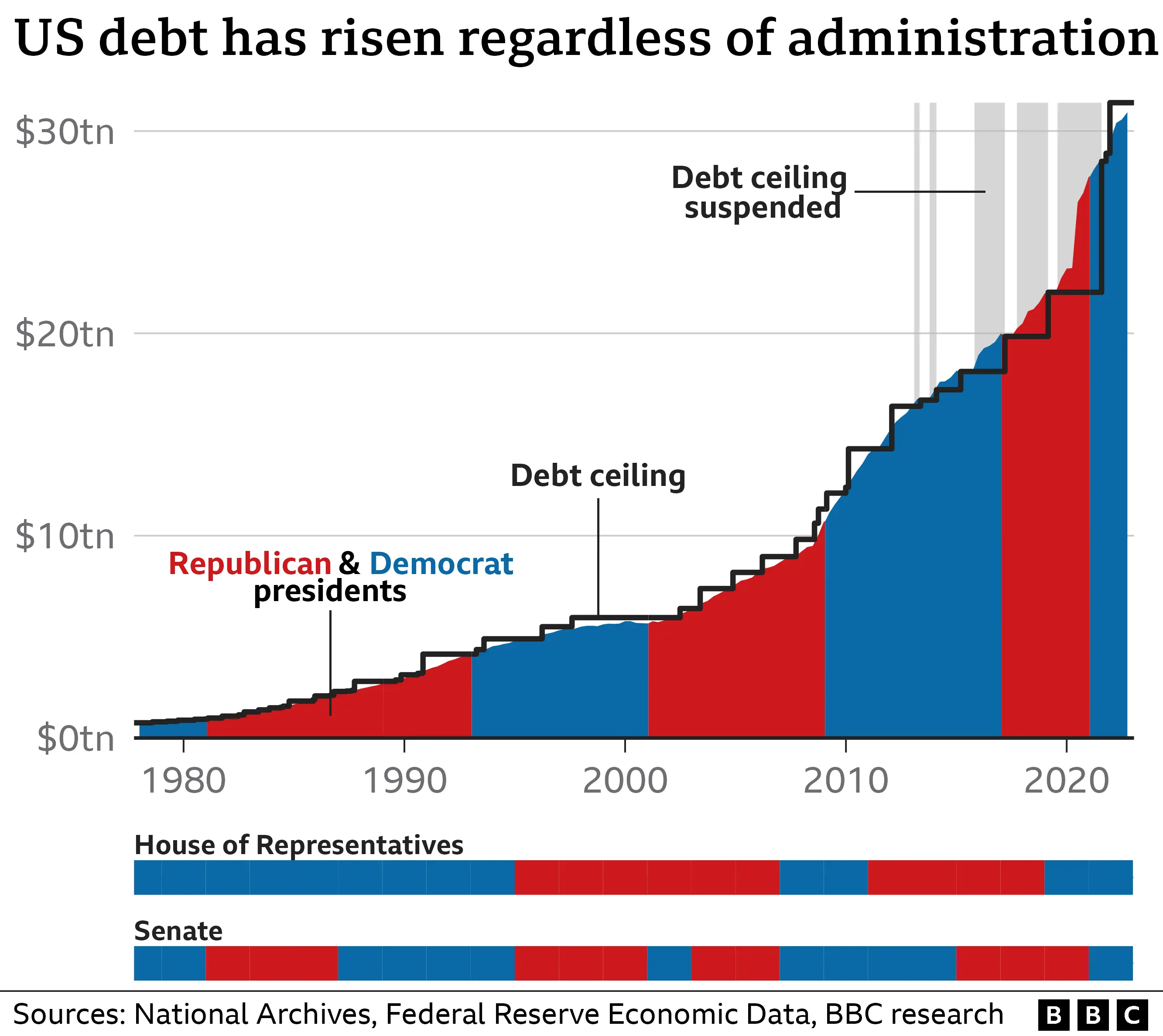

The reality of budget deficits by president is that they are a shared legacy. Every administration since 2001 has added to the pile. Understanding that it's a mix of policy, demographics, and unexpected disasters is the first step to making sense of the noise.