You’ve probably seen the headlines about TikTok being banned or sold every other week, but there is a much bigger story happening in the bank accounts of its parent company. While politicians argue, the money just keeps rolling in.

Honestly, the sheer scale of the ByteDance revenue 2022 2023 2024 trajectory is a bit hard to wrap your head around unless you look at the raw numbers. We are talking about a company that grew its top line from around $80 billion in 2022 to a staggering $155 billion by the end of 2024. That is not just "growth"—that is a complete takeover of the digital attention economy.

🔗 Read more: Small Business AI Tools: What Most People Get Wrong

It’s easy to think of this as just a "TikTok success story," but that is actually the first thing most people get wrong. TikTok is the famous child, but Douyin—the Chinese version—is the one actually paying the bills and funding the global expansion.

Breaking Down the ByteDance revenue 2022 2023 2024 Numbers

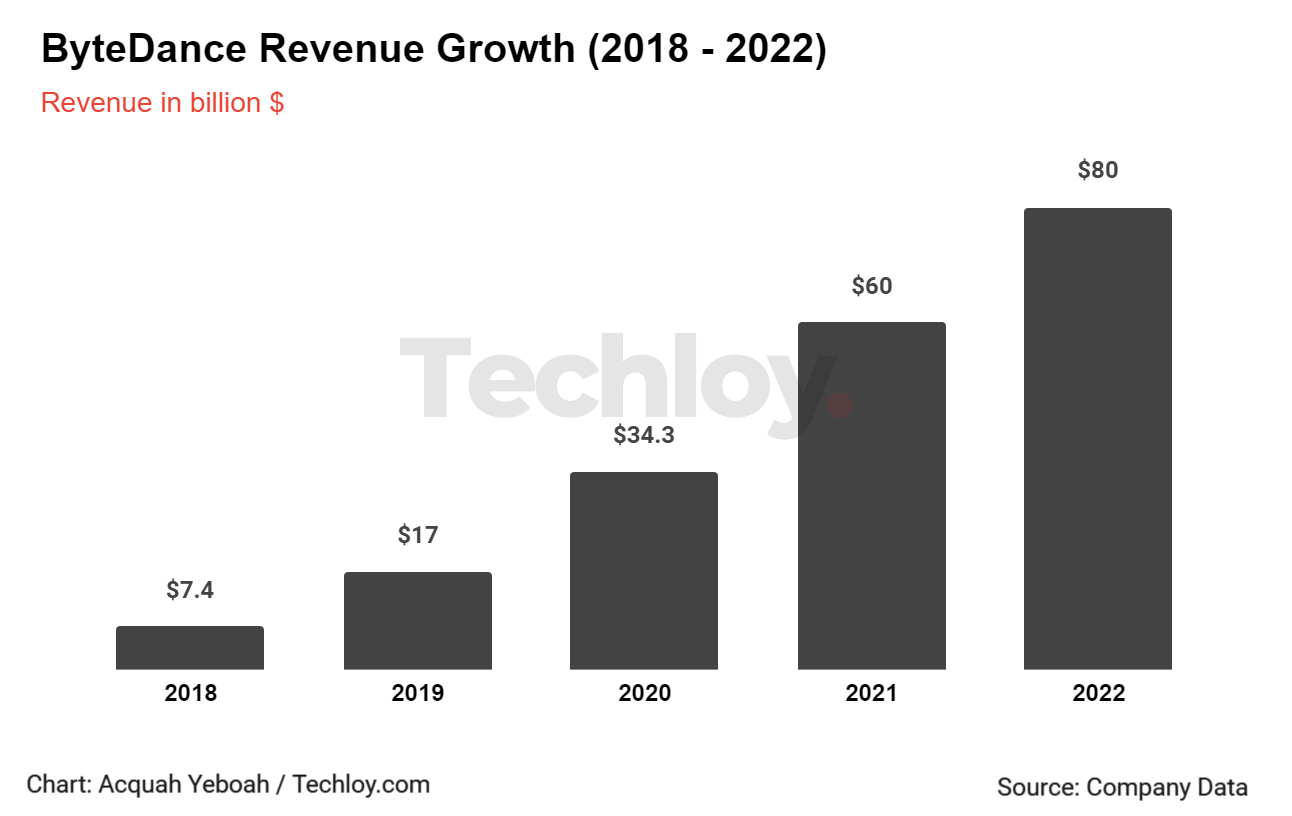

To understand where ByteDance is going, you have to see where they started this three-year sprint. In 2022, the company was already a giant, bringing in roughly $80 billion. At that time, people were wondering if they could sustain that pace while China's domestic economy started to feel some friction.

Fast forward to 2023. Revenue jumped about 50% to nearly $120 billion. This was a massive year because it marked the first time ByteDance actually overtook Tencent in both revenue and profit. For anyone following Chinese tech, that is basically like a newcomer suddenly out-earning Apple or Google in their own backyard.

Then we hit 2024. Despite all the legal drama in the U.S. and Europe, ByteDance revenue hit an estimated $155 billion. That is a 29% increase from the previous year. While that sounds like a "slowdown" compared to the 50% jump in 2023, it's actually incredibly impressive when you realize they added $35 billion in new revenue in just twelve months.

Why the 2023 surge was a turning point

The 2023 fiscal year was weirdly pivotal. While the world focused on TikTok’s Congressional hearings, ByteDance was busy perfecting its e-commerce engine. Profits soared 60% that year, hitting roughly $40 billion.

Most of this didn't come from ads alone. It came from people buying everything from hoodies to high-end skincare directly inside the apps.

The TikTok vs. Douyin Revenue Gap

If you live in the U.S. or Europe, you probably think TikTok is the main event. In reality, TikTok only accounted for about 15% to 20% of the total ByteDance revenue between 2022 and 2024.

The heavy lifter is Douyin.

In 2024, Douyin's e-commerce platform—Douyin Ecommerce—hit a gross merchandise volume (GMV) of about $490 billion. That isn't what ByteDance "kept," but they take a slice of every single transaction. In China, Douyin has moved beyond just videos; it’s now a place where people order food, book hotels, and buy groceries.

TikTok is trying to copy this exact blueprint with TikTok Shop, which is why you’ve seen those "Shop" tabs appearing at the bottom of your screen. In 2024, TikTok's international revenue (mostly from the U.S. and Europe) jumped 63% to $39 billion. They are basically trying to turn the rest of the world into the same "everything app" ecosystem they've already mastered in China.

The Real Cost of Being the World's Biggest Startup

Success isn't free. While the ByteDance revenue 2022 2023 2024 figures look like a straight line up, their profit margins tell a slightly more complex story.

By 2024, ByteDance's net profit was around $33 billion.

Wait—didn't they make $40 billion in profit in 2023? Yes.

🔗 Read more: Kevin O'Leary Net Worth 2025: What Most People Get Wrong

The reason for the dip in profit despite higher revenue is a massive pivot toward AI. ByteDance is currently pouring billions into AI infrastructure. We are talking about an estimated $23 billion investment into servers, data centers, and those specialized Nvidia chips everyone is fighting over. They aren't just a social media company anymore; they are trying to out-AI Google and Meta.

The Regulatory Tax

You also have to account for the "legal and compliance" black hole.

- Legal Fees: Fighting bans in multiple countries isn't cheap.

- Data Sovereignty: Building "Project Texas" in the U.S. and similar localized data hubs in Europe costs billions in overhead that their competitors didn't have to deal with ten years ago.

- The Trump Deal: As of late 2025 and early 2026, the company has been forced into complex divestment agreements that effectively cap how much of the U.S. profit they can actually keep.

What This Means for the Future of Social Media

ByteDance has essentially proven that the "interest graph" (what you like) is much more valuable than the "social graph" (who you know).

Facebook was built on who your friends are. ByteDance was built on an algorithm that knows you better than your friends do. Between 2022 and 2024, we saw every other platform—Instagram, YouTube, even LinkedIn—try to mimic this "vertical video" feed.

The actionable insight here for businesses and creators? The "Social" part of social media is dying. The "Entertainment and Commerce" part is what is driving the $155 billion machine. If you aren't thinking about how to sell products directly through short-form video, you're essentially playing a game from 2018.

Next Steps for Tracking ByteDance's Performance:

- Monitor TikTok Shop GMV: This is the most important metric for 2026. If TikTok can replicate Douyin's $490 billion shopping success in the West, their revenue will double again.

- Watch the AI Spend: Keep an eye on their "Doubao" AI chatbot. If that gains traction, it moves ByteDance into the productivity and search space, competing directly with ChatGPT and Google.

- Check the Internal Share Buybacks: Since ByteDance isn't public, their employee buyback prices are the only way to see their "real" valuation. As of late 2025, they were valuing themselves at over $330 billion.