You’re sitting there, staring at a screen, wondering if that CA state tax refund calculator you just used is actually telling the truth. Most people just want to know if they can afford that weekend trip to Tahoe or if they're going to be eating ramen for a month because they owe the Franchise Tax Board (FTB). Taxes in California are a beast. Honestly, the math is enough to make anyone's head spin.

The reality is that California's tax system is one of the most progressive—and aggressive—in the country. We have high brackets. We have weird credits. We have the Mental Health Services Act tax for high earners. It's a lot. If you're using a basic calculator, you're likely missing the nuance that defines the "California experience."

The Math Behind the CA State Tax Refund Calculator

Most online tools are basically just glorified spreadsheets. They take your gross income, subtract a standard deduction, and apply a tax bracket. Easy, right? Not exactly. California doesn't just copy-paste federal rules. For example, while the federal government gave us a massive standard deduction hike a few years back, California kept its own, much lower standard deduction.

For the 2025 tax year (filing in 2026), the California standard deduction is significantly different from the federal $15,000+ range. If your CA state tax refund calculator doesn't ask you specifically about your California-specific adjustments, it's already giving you a bad number. You’ve got to account for things like the California Earned Income Tax Credit (CalEITC) and the Young Child Tax Credit. These aren't just small bonuses; they can swing a refund by thousands of dollars.

🔗 Read more: Purdue Pharma CEO: What Most People Get Wrong About the Leadership Today

Think about the brackets. California starts at 1% but zooms up to 13.3% for the highest earners. That 13.3% includes a 1% surcharge on taxable income over $1 million. If you’re a freelancer or a tech worker with a big RSU vest, a simple calculator will probably whiff on the withholding requirements versus the actual tax liability.

Why Your Refund Might Disappear

Refunds aren't "free money." It’s just the government giving back the interest-free loan you gave them all year. Sometimes, though, that loan gets intercepted. The FTB is notorious for its Interagency Intercept Program. If you owe money to a California county for unpaid parking tickets, child support, or even certain court debts, your refund gets snatched before it even hits your bank account.

I've seen people get hyped over a $2,000 estimate from a CA state tax refund calculator, only to receive a letter saying their refund was $0 because of a five-year-old toll bridge violation they forgot about. It's brutal.

Another big one? Residency. California is "sticky." If you worked remotely from a beach in Mexico but kept your California driver’s license and registered your car in San Diego, the FTB might still consider you a resident. They track "source income" with the intensity of a bloodhound. If your calculator doesn't ask where the work was physically performed, the estimate is basically a guess.

Credits That Actually Move the Needle

Forget the standard deduction for a second. The real magic in California taxes happens in the credits. Credits are better than deductions because they reduce your tax bill dollar-for-dollar.

- The CalEITC: This is huge for lower-income households. Even if you don't owe any tax, you can get this as a refund.

- The Young Child Tax Credit (YCTC): If you qualify for CalEITC and have a kid under six, you could get an extra $1,100ish.

- Foster Youth Tax Credit: A newer addition that provides up to $1,100 for qualifying former foster youth.

- Renter’s Credit: It’s small—usually around $60 to $120—but hey, in this economy, every bit helps. Most people forget to check this box.

If you’re using a CA state tax refund calculator and it doesn't have a section for "Rent Paid," find a new calculator. It’s a classic California omission.

The "Middle Class Tax Refund" Ghost

We have to talk about the confusion surrounding past stimulus payments. A few years ago, California sent out the Middle Class Tax Refund (MCTR). People are still confused about whether that was taxable. For California state purposes, it wasn't. For federal purposes, the IRS eventually said it mostly wasn't. But if you're looking at older guides or using a tool that hasn't been updated since 2023, you're going to get bad advice.

California's tax code evolves faster than most software. The 2025-2026 cycle has specific nuances regarding climate credits and health insurance mandates. Speaking of which, California has its own individual mandate for health insurance. If you didn't have qualifying coverage last year, the FTB will slap you with a penalty that eats your refund alive. A basic CA state tax refund calculator often ignores the penalty math, leading to a nasty surprise when you actually file.

Real-World Example: The "Two-State" Trap

Let's look at a scenario. "Sarah" works for a tech company in Mountain View but moved to Austin, Texas, in June. She uses a CA state tax refund calculator and enters her total yearly salary of $150,000. The calculator tells her she’s getting a massive refund because it thinks she overpaid California taxes.

The problem? California requires "Part-Year Resident" filing (Form 540NR). Sarah only owes California tax on the money she earned while physically present in the state, plus any California-sourced income. However, the tax rate applied to her California income is determined by her total global income. It's a "look-through" rule that catches people off guard. She might actually owe money if her Texas-based withholding didn't account for the higher California bracket logic.

Common Mistakes When Estimating

People are generally optimistic. We want the big check. But the FTB is precise.

- Ignoring the "Mental Health Services Act" Tax: If your taxable income is over $1 million, add 1%.

- Underestimating the Penalty for No Insurance: It can be hundreds or even thousands of dollars depending on family size.

- Miscalculating W-2 vs. 1099: If you have a side gig, you aren't just paying income tax; you're often forgetting that California has its own rules for self-employment expenses that don't always mirror federal Section 179 rules.

What to Do Before You File

Check your "California Adjusted Gross Income" (CA AGI). This is the number that actually matters. You start with your federal AGI and then add or subtract things California doesn't like. For example, California doesn't tax Social Security benefits. If you included that in your CA state tax refund calculator without a specific CA-adjustment, your estimate is way too high.

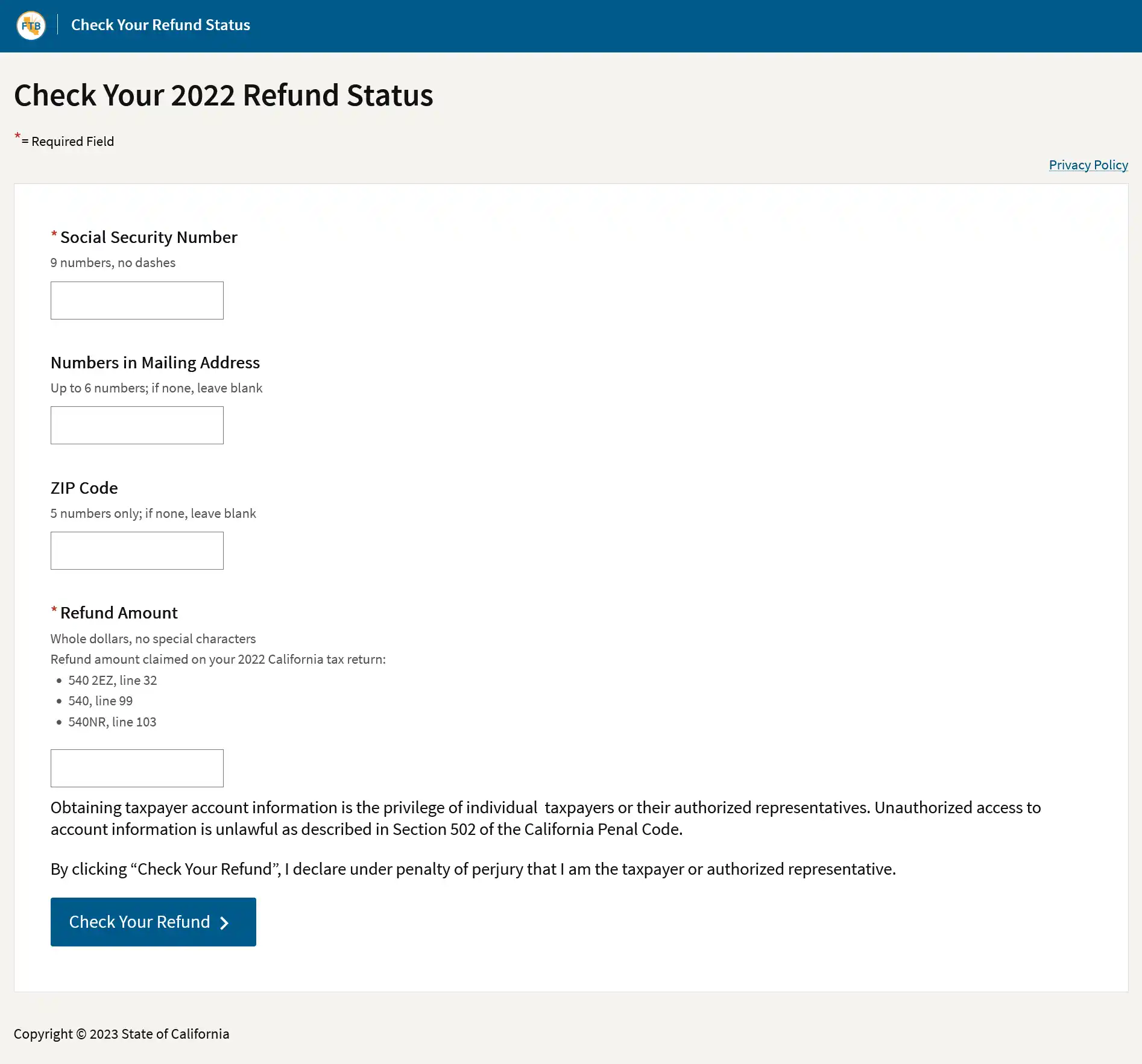

Also, look at your "Check Your Refund" status on the FTB website only after you've received an acknowledgment that the return was processed. Using an estimator in January is fun for dreaming, but it's not a financial plan.

Actionable Next Steps

If you want an estimate that actually holds water, don't just use one tool.

- Gather your final paystubs: Look at the "CA PIT" (Personal Income Tax) withheld line. This is the actual amount you've paid in.

- Identify your specific credits: Do you have a child under 6? Did you pay rent for more than half the year? These are the primary refund drivers.

- Run a "Mock" Return: Use a reputable tax software's "preview" mode rather than a simple web calculator. The software actually runs the 540 or 540NR forms.

- Check for FTB Liens: Log into your FTB "MyFTB" account. If you have an outstanding balance from a previous year or a "Notice of Proposed Assessment," that refund you're calculating is already gone.

- Adjust your W-4/DE-4: If your refund is massive—like over $3,000—you’re overpaying. Use the DE-4 form to adjust your California withholding so you get that money in your paycheck every month instead of waiting for the FTB to send it back a year later.

The best way to handle a CA state tax refund calculator is to treat it as a "best-case scenario" and then start looking for the reasons why the FTB might disagree. Accuracy in California taxes requires looking at the specific adjustments on Schedule CA (540). Without that, you're just guessing in the dark.