Math is weird. We use it every single day to track our bank accounts, monitor our gym progress, or look at how much a stock price jumped, yet most people hit a mental wall the second they need to calculate increase in percentage between two numbers. It sounds simple. You have an old number and a new number. You want to know the gap. But honestly, even seasoned business analysts sometimes mix up the "from" and the "to," which ends up totally wrecking their data.

Let’s be real: if your rent goes from $1,000 to $1,200, that’s a $200 jump. Everyone gets that. But saying it’s a 20% increase? That’s where the brain starts to itch. Why 20% and not 16.6%? It all comes down to the "base" value. Most of us were taught this in middle school and promptly forgot it because we had calculators in our pockets. But when you’re sitting in a board meeting or trying to figure out if a 5% raise actually covers inflation, you need to know the mechanics.

The Raw Mechanics of the Calculation

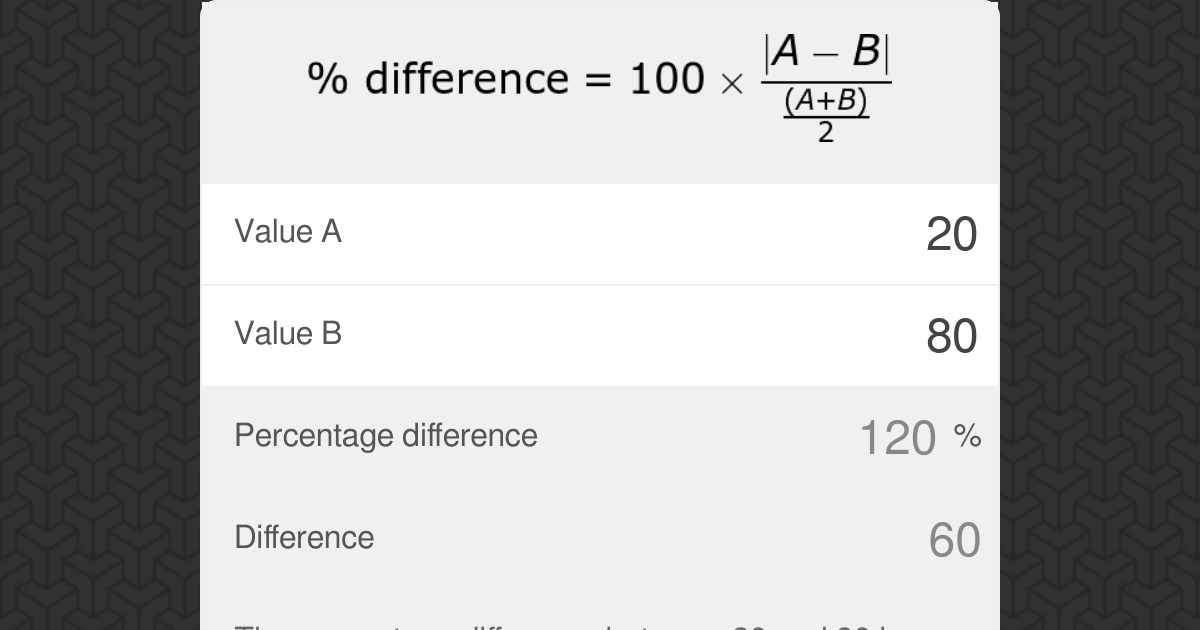

You don’t need a PhD. You just need a three-step process that you can memorize in about thirty seconds. To calculate increase in percentage between two numbers, you basically take the new value, subtract the old value, and then divide that result by the old value.

The formula looks like this:

$$\text{Percentage Increase} = \frac{\text{New Value} - \text{Original Value}}{\text{Original Value}} \times 100$$

Let's break that down into human speak.

First, find the "absolute difference." That’s just the raw change. If you sold 50 cupcakes yesterday and 75 today, your difference is 25. Simple. Second, you take that 25 and divide it by where you started—the 50 cupcakes. 25 divided by 50 is 0.5. Finally, you multiply by 100 to make it a percentage. Boom. 50% increase.

📖 Related: Richard Anderson Delta CEO: Why the Refinery King Still Matters

If you had divided by the 75 instead, you’d get 33%. That’s a massive difference in a business report. This is the "Base Year Fallacy," a term often used by economists like Thomas Sowell to describe how statistics can be manipulated or misunderstood depending on which starting point you choose.

Why the Starting Number is Everything

Context matters. Imagine a small town that gains 100 new residents. If the town only had 100 people to begin with, that’s a staggering 100% growth rate. The local news would be screaming about a population explosion. But if that same 100 people moved to New York City? The percentage increase would be so microscopic it wouldn't even register as a rounding error.

This is why looking at raw numbers alone is dangerous. Percentages provide the "scale" of the change. They tell us if a change is significant or just noise. In the world of investing, a $5 jump in a stock price is incredible if the stock was $10 (50% gain), but it’s pretty boring if the stock was $500 (1% gain).

Real-World Scenarios Where People Mess This Up

Kinda funny how we struggle with this when it involves our own money. Take "Sales Tax" or "Discounts."

Retailers love to play with your head. If a store marks an item 50% off and then later increases that new price by 50%, you aren't back at the original price. You're actually lower. Why? Because the 50% increase is calculated off the discounted price, not the original high price.

👉 See also: Why Using a Currency Converter Euro to Naira Is More Complicated Than It Looks

Illustrative Example:

- Start: $100

- 50% Decrease: $50

- 50% Increase on $50: $75

You just lost $25 because of the "Percentage Change Asymmetry." This isn't just a math quirk; it’s a psychological trick used in retail and finance constantly. You've gotta be sharp.

The Inflation Confusion

Inflation is probably the most common place where people try to calculate increase in percentage between two numbers and get frustrated. When you hear the Consumer Price Index (CPI) rose by 3%, that’s a percentage increase compared to the previous year. If it rises another 3% the following year, it’s "compounding."

The math doesn't stay linear. It’s like a snowball rolling down a hill. Each increase is building on the previous increase, which is why a "small" 3% annual increase can lead to prices doubling in about 24 years (shoutout to the Rule of 72, a handy mental shortcut used by finance pros).

Common Pitfalls and "Gotchas"

Most errors happen because of "Order of Operations." If you're typing this into a cheap calculator and you hit 100 - 80 / 80, the calculator might do the division first because of PEMDAS (Parentheses, Exponents, Multiplication, Division, Addition, Subtraction). It’ll give you 99. That’s wrong.

You have to force the subtraction to happen first.

- (100 - 80) = 20

- 20 / 80 = 0.25

- 0.25 * 100 = 25%

Also, watch out for "Percentage Points" vs. "Percent." If an interest rate goes from 4% to 5%, that is a 1 percentage point increase. But if you calculate increase in percentage between two numbers (4 and 5), it’s actually a 25% increase in the rate itself. Politicians and marketers swap these terms constantly to make things sound bigger or smaller than they really are. It’s sneaky.

Negative Results (The Decrease)

What if the number goes down? The formula still works. If you end up with a negative number, like -15%, you’ve found a percentage decrease. The logic remains identical. The "New" is just smaller than the "Old." Don't let the minus sign freak you out. It’s just math’s way of saying things are trending south.

Practical Steps to Master Percentage Increases

You don't need to be a math whiz, but you should have a workflow so you don't look silly in front of your boss or your accountant.

- Double-check your "Base." Always ask: "What was the number before the change happened?" That is always your divisor.

- Use the "Step Method." Subtract first. Get that number. Then divide. Don't try to do it all in one string on a calculator unless you're using parentheses.

- Sanity Check. Does the answer make sense? If your price doubled, the increase should be 100%. If your answer is 10% or 200%, you did something wrong.

- Decimal Movement. Remember that 0.05 is 5%, 0.5 is 50%, and 5.0 is 500%. Misplacing a decimal point is the fastest way to lose a job or a lot of money.

To really get good at this, start doing it in your head when you're out shopping. If a bag of coffee went from $12 to $15, think: "Okay, $3 difference. $3 is a quarter of $12. So that’s a 25% hike." It gets easier.

Actionable Next Steps

- Audit Your Subscriptions: Go back and look at what you paid for Netflix or Spotify three years ago versus today. Calculate increase in percentage between two numbers to see exactly how much your "small" price hikes have stacked up.

- Excel Shortcuts: If you're doing this for work, stop doing it manually. Use the formula

=(New-Old)/Oldin your cells. Set the cell format to "Percentage" and let the software handle the decimals. - Benchmark Your Salary: Next time you get a raise, don't just look at the extra money per paycheck. Calculate the percentage. If your raise is 3% but inflation is 4%, you actually took a 1% pay cut in terms of purchasing power.

Math isn't just for school; it's a defense mechanism against being misled. Once you can comfortably find the percentage gap between any two figures, you’ll start seeing the world—and your finances—a lot more clearly.