Math anxiety is real. You've probably felt that slight stomach drop when a client asks for the "exact growth metric" on a call, and your brain suddenly forgets how numbers work. It happens to everyone. Whether you're tracking a stock portfolio, looking at a grocery bill, or trying to figure out if your website traffic actually improved, calculating change in percentage is one of those fundamental life skills that we all pretend to master in middle school but secretly Google as adults.

The logic is actually pretty straightforward once you strip away the academic jargon. Basically, you’re just trying to figure out how much a number grew or shrank relative to where it started. It’s a comparison of the "gap" to the "start."

Why Your Starting Point Changes Everything

If you have ten dollars and I give you five, you’re 50% richer. But if you have a hundred dollars and I give you five, you’ve only gained 5%. The "five" didn't change, but the context did. That’s the heart of the matter.

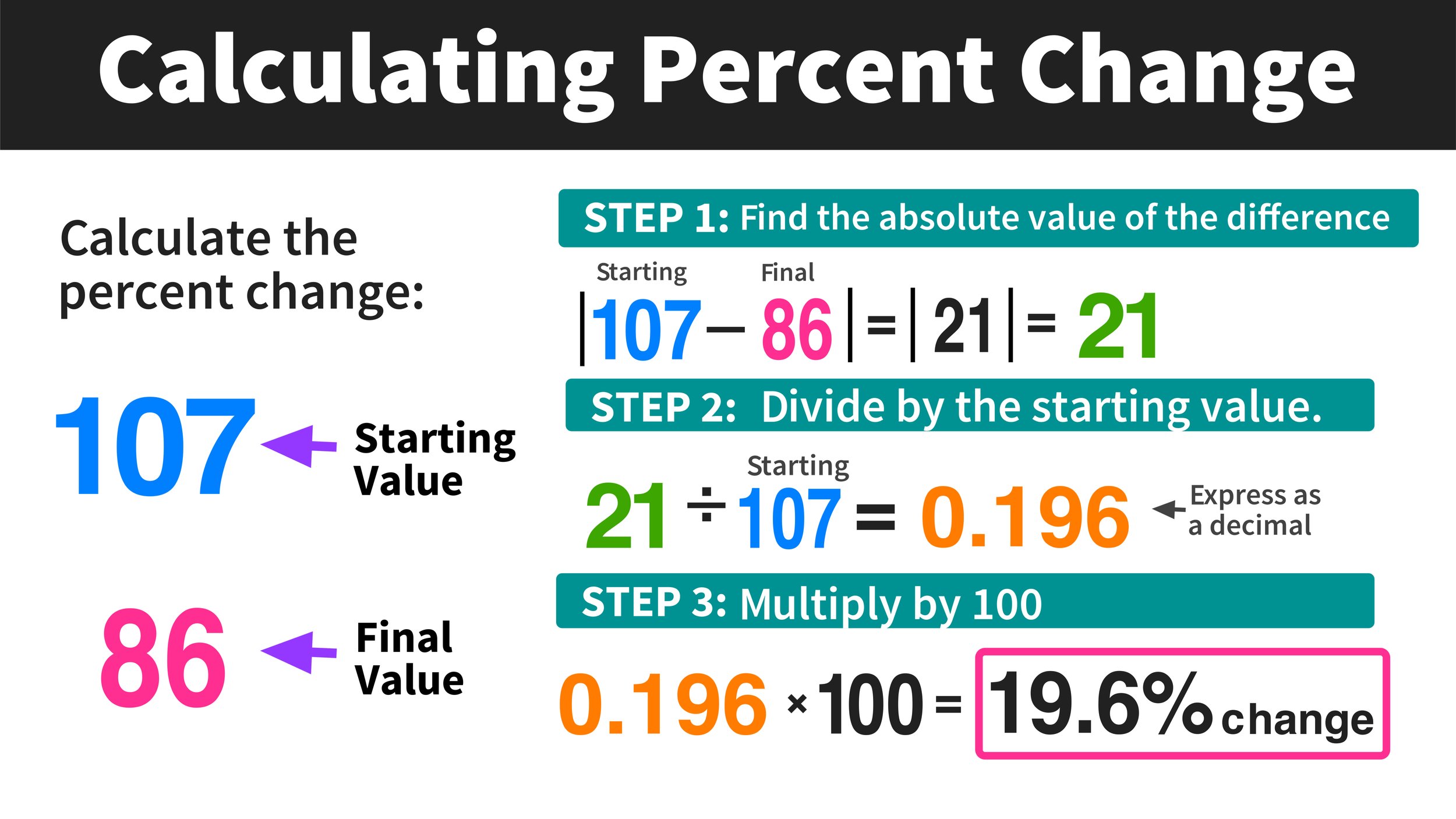

To get the right answer, you take the New Value and subtract the Old Value. That gives you the "raw change." Then, you divide that raw change by the Old Value. Multiply by 100, and there you go. You have your percentage.

The formula looks like this:

$$\text{Percentage Change} = \left( \frac{\text{New Value} - \text{Old Value}}{\text{Old Value}} \right) \times 100$$

Don’t let the symbols freak you out. It’s just subtraction then division. Honestly, the biggest mistake people make—and I see this in professional business reports all the time—is dividing by the new number instead of the old one. If you do that, your data is junk. Always go back to the beginning. The "Old Value" is your anchor.

The 100% Increase vs. the 50% Decrease

Numbers are slippery. They don't play fair.

Imagine a Bitcoin enthusiast who bought at $10,000. The price jumps to $20,000. That’s a 100% increase. Awesome, right? But then the market crashes, and it drops back down to $10,000. You might think, "Well, it went up 100%, so if it goes down 100%, it's zero." Nope. A drop from $20,000 to $10,000 is only a 50% decrease.

👉 See also: What Stocks to Buy: The Strategy Professionals Use While Everyone Else Chases Hype

This asymmetry is why bear markets feel so much more painful than bull markets feel good. You need a 100% gain to recover from a 50% loss. Math is cruel like that. When you're calculating change in percentage in a volatile market, you have to keep your head on straight about which direction you're moving.

Real-World Messiness: Retail and Discounts

Retailers love to mess with your head using these stats. Have you ever seen a "Double Discount" sale? Say a jacket costs $100. It’s 20% off. Now it's $80. Then they offer an additional 10% off the sale price. Most people instinctively think, "Cool, 30% off!"

It’s not.

10% of $80 is $8. So the final price is $72. A true 30% discount would have made it $70. Those two dollars represent the difference between additive logic and the actual percentage of change. It’s a small gap on a jacket, but on a $500,000 corporate procurement contract, that kind of sloppy math gets people fired.

🔗 Read more: Michael David Weiss: Why This Houston Lawyer Still Matters

Calculating Change in Percentage in Modern Business

In 2026, we have tools for everything, but the "Human-in-the-loop" factor is still where things break. I recently looked at a SaaS (Software as a Service) dashboard that claimed a "200% increase in user engagement." It sounded incredible.

But when we dug into the raw numbers? The "Old Value" was 1 user. The "New Value" was 3 users.

Technically, the math was right.

$$(3 - 1) / 1 \times 100 = 200%$$

But contextually? It was meaningless. This is why experts look at "absolute change" alongside percentage change. If the base size is tiny, the percentage change will look like a vertical line on a graph even if nothing significant actually happened.

Common Pitfalls to Dodge

- The Negative Number Trap: If you're dealing with a business that's losing money (negative net income) and it moves to a profit, the standard formula breaks. You can't really have a "percentage increase" from a negative number in a way that makes logical sense to a human brain.

- Percentage Points vs. Percent: This is the big one. If interest rates go from 3% to 4%, that is a 1 percentage point increase. However, it is a 33.3% increase in the cost of the interest. If you mix these up in a meeting with a CFO, they will look at you like you have three heads.

- Rounding Errors: If you're working in Excel, the software might show you "12%" but the underlying cell is 11.5492%. If you use the rounded number for further calculations, your final result will be off. Always calculate using the raw data, then round at the very last step.

How to Do This Fast (The Napkin Method)

Sometimes you don't have a calculator. You're at dinner, or you're walking into a store. Here is the "cheat code" for calculating change in percentage in your head.

Find 10% first. It’s easy; just move the decimal one spot to the left. If something was $80 and now it's $88, you know the change is $8. Since 10% of 80 is 8, you immediately know it's a 10% increase.

📖 Related: lebron james blaze pizza: Why The King Walked Away From $15 Million

What if the change is $12? Well, 10% is 8, and half of that (5%) is 4. Since 8 + 4 = 12, the change is exactly 15%.

This mental gymnastics keeps your "BS detector" sharp. When a news report says "Property taxes are up 25%," and you know your bill went from $4,000 to $4,200, you can quickly realize that $200 is only 5% of $4,000. You'll know immediately that the report is either wrong or doesn't apply to your specific neighborhood.

Practical Steps for Accurate Reporting

If you're responsible for presenting this data, follow a strict workflow to avoid embarrassment.

- Verify the Base: Ensure your "Old Value" is actually the correct starting point for the period you're measuring. Don't compare a 30-day month to a 31-day month without adjusting.

- Run the Subtraction: Determine the delta. Is it positive or negative?

- Divide by the Start: This is the "Anchor Rule." Always divide by the chronological beginning.

- Sense Check: Does the result look right? If a price doubled, it's a 100% increase. If it tripled, it's 200%. If you're seeing 500% but the numbers only look slightly different, go back and check your decimal points.

- Declare the Context: Always mention the raw numbers alongside the percentage. "We saw a 50% increase (from 10 to 15 units)" is much more honest than just saying "50% growth."

Understanding these shifts is basically a superpower in a world driven by data. It stops people from being able to trick you with "big" percentages that represent small gains, and it helps you spot real trends before they become obvious to everyone else. Stick to the anchor value, watch your decimal places, and always ask what the raw numbers were before you celebrate a percentage.