It is a weird time to be a driver in the Golden State. Honestly, if you just looked at the headlines about global oil supply, you'd think we'd all be cruising for cheap. But pull up to any Shell or Chevron in Los Angeles or the Bay Area today, and you’ll see a different reality.

As of January 13, 2026, the average price for a gallon of regular unleaded in California is sitting at approximately $4.22.

That might sound high—and it is, compared to the national average of about $2.79—but it’s actually a bit of a "relief" compared to where we were this time last year. Back in early 2025, we were staring down averages closer to $4.40 or $4.50. You've probably noticed that the sting at the pump isn't quite as sharp as it was during the post-pandemic spikes, yet we are still paying a massive premium compared to the rest of the country.

Why the gap? It’s not just "corporate greed," though that's the favorite talking point in Sacramento. It’s a messy mix of taxes, boutique fuel blends, and a refining infrastructure that is basically shrinking by the day.

The Reality of What Are Gas Prices in California Right Now

If you're driving through the Central Valley, you might get lucky. In places like Stockton, prices have dipped as low as $3.91 recently. But head toward the coast, and it’s a total flip. San Diego is averaging around $4.42, and San Francisco is hovering near $4.27.

Here is the kicker: Hawaii actually took the "most expensive" crown from us for a brief moment this month. They’re at $4.40. We’re right behind them. For most of 2025, California held that #1 spot with a grip like iron.

- Los Angeles-Long Beach: ~$4.38

- San Jose: ~$4.10

- Sacramento: ~$4.08

- Fresno: ~$4.13

It is a patchwork of prices. You can drive ten miles and see a 40-cent difference. That’s usually down to local zone pricing—a practice where oil companies charge more based on the perceived "wealth" or competition in a specific neighborhood.

Why the Price Tag Stays So High

The question of what are gas prices in California influenced by isn't just about the price of crude oil. Crude has actually been relatively stable. The real "California Premium" comes from the fact that we are an island. Not literally, of course, but our power grid and our fuel supply are largely cut off from the rest of the U.S.

We don't have pipelines bringing in gas from Texas or the Gulf Coast. We have to make it here or ship it in via tankers.

Then there’s the "Boutique Blend." California requires a specific formula of gasoline designed to reduce smog. It’s cleaner, sure, but it’s more expensive to produce. No other state uses it. So, if a refinery in Richmond or El Segundo has a mechanical hiccup, we can’t just "borrow" gas from Arizona. Their gas is illegal to sell here. This creates a massive supply crunch whenever a plant goes down for "planned maintenance."

👉 See also: Why Every Million and Billion Calculator Is Harder to Use Than You Think

The Tax Man and the Refinery Crisis

We have the highest gas tax in the nation. Period. As of July 1, 2025, the state excise tax jumped again to 61.2 cents per gallon.

That’s just the base.

When you add in the federal tax, the underground storage tank fee, and the state’s "Cap-and-Trade" and "Low Carbon Fuel Standard" costs, you are looking at roughly $1.20 to $1.30 per gallon in taxes and regulatory fees before a single drop of gas even hits your tank.

The Shrinking Supply

Here is what nobody talks about: the refineries are leaving. Phillips 66 shut down its massive Los Angeles refinery complex late last year. Valero’s Benicia facility is eyeing the exit soon. Experts like Patrick De Haan from GasBuddy have been shouting from the rooftops that we are losing 20% of our refining capacity.

When supply goes down and demand stays flat—or even drops slightly as people switch to EVs—the price doesn't necessarily fall. The overhead for these remaining plants gets spread across fewer gallons. It’s a slow-motion supply chain squeeze.

What to Expect for the Rest of 2026

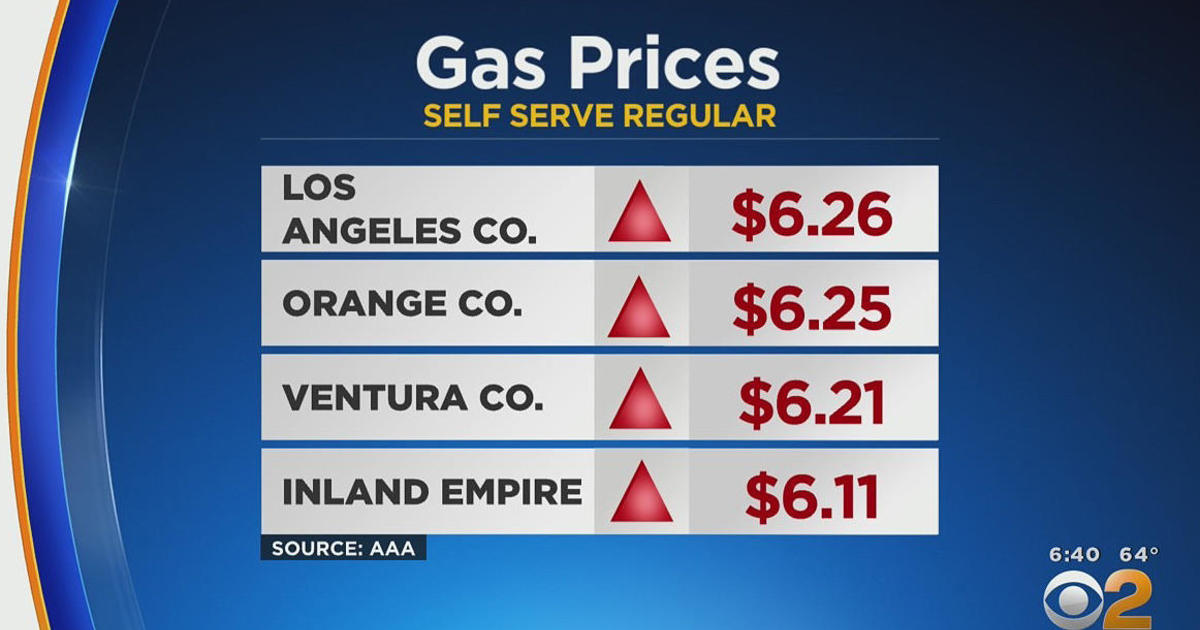

Kinda feels like we’re in a holding pattern. The EIA (Energy Information Administration) shows that gasoline demand is actually down a bit—roughly 8.17 million barrels per day nationally. That’s helping keep prices from exploding to the $6.00 levels we saw a few years ago.

However, don't get too comfortable.

👉 See also: 60 British Pounds to US Dollars: Why the Math Isn't as Simple as Google Says

Spring is coming. In California, that means the "Spring Transition" where refineries switch from the cheaper winter blend to the more expensive summer blend. This usually happens in February or March and almost always triggers a 20-to-50-cent jump.

If you want to keep your costs down, honestly, the old advice is still the best. Use apps like GasBuddy or Waze to find the "cheapest" station in a 5-mile radius. Avoid the stations right off the freeway—they’re usually 30 cents higher just for the convenience. And if you can, join a warehouse club like Costco or Sam’s Club. Their "loss leader" strategy on gas usually saves you enough in a month to pay for the membership itself.

Actionable Next Steps:

- Check your tires: Seriously. Under-inflated tires can drop your fuel economy by 3%. In California, that’s like throwing $5 away every time you fill up.

- Monitor the "Spring Switch": Plan for a price hike in late February. If you’re planning a road trip, try to do it before the summer blend requirements kick in.

- Use Cash: Many independent stations in the Valley and Inland Empire offer a 10-cent discount for cash. It’s a hassle, but it offsets a chunk of that 61-cent state tax.