Tax season in the Golden State is basically a rite of passage. You get that first big paycheck after a raise or a new job, look at the net amount, and immediately wonder where the rest of the money went. It’s no secret that California has some of the highest taxes in the country, but the way the california tax rate income actually works is way more nuanced than the scary headlines suggest.

Most people think they just lose 13% of their money. That's not true.

California uses a progressive tax system. This means you only pay the higher rates on the dollars that fall into specific "buckets" or brackets. If you’re a single filer making $60,000, you aren't paying the same percentage on your first $10,000 as you are on your last $1,000. It’s a ladder. You climb it one rung at a time.

The Reality of California Tax Rate Income Brackets

Let’s talk numbers, but keep it real. For the 2025-2026 tax years, the rates start as low as 1% and go all the way up to 13.3%. That 13.3% is the "millionaire’s tax," which actually includes a 1% mental health services tax on income over $1 million. If you aren't clearing seven figures, you aren't hitting that peak.

Here is how the state usually carves things up for a single filer. The first $10,000 or so is taxed at 1%. Then it jumps to 2% for the next chunk, 4% for the next, and so on. By the time you hit roughly $68,000 in taxable income, you’re looking at a 9.3% marginal rate.

Wait. Marginal.

That’s the word that trips everyone up. Your marginal tax rate is what you pay on the very last dollar you earned. Your effective tax rate is the actual percentage of your total income that goes to Sacramento. Because of the lower brackets and the standard deduction, your effective rate is almost always significantly lower than your marginal bracket.

It's Not Just the Brackets

You have to account for the standard deduction. For the current tax year, California’s standard deduction for single filers is around $5,500 (it adjusts for inflation). If you don't itemize, that money is basically "free" from state tax. Then there are the credits. The California Earned Income Tax Credit (CalEITC) and the Young Child Tax Credit can put thousands back in the pockets of lower-income families.

Honestly, the state is weirdly generous to lower earners while being incredibly aggressive toward high earners.

If you’re a high-net-worth individual, California is expensive. Period. There is no way to sugarcoat it. But if you’re making $50,000 a year, your state tax bill might actually be lower than it would be in some "low tax" states that rely heavily on high sales tax or property taxes.

The 1% Mental Health Services Act

Back in 2004, voters passed Proposition 63. It’s still a huge factor in the california tax rate income conversation today. This adds a 1% surcharge on any taxable income exceeding $1 million. This isn't a "bracket" in the traditional sense; it’s a flat add-on. So, if you earn $1.1 million, that extra 1% applies to the $100,000 over the limit.

✨ Don't miss: Why What to Buy Before Tariffs Matters More Than the Headlines Say

This is why you see celebrities and tech founders complaining. When you combine the top 12.3% bracket with the 1% surcharge, you hit 13.3%. It’s the highest state income tax rate in the United States.

Why People Move (And Why They Stay)

You’ve heard the stories. Joe Rogan moved to Texas. Elon Musk headed to Florida. People claim there's a mass exodus because of the california tax rate income levels.

Does it happen? Yeah.

But it’s usually the ultra-wealthy. For a middle-class family, moving to a state with no income tax sounds great until you see the property tax bill in Austin or the insurance premiums in Miami. California’s Proposition 13 keeps property taxes relatively stable for long-term homeowners, which acts as a weird sort of balance to the high income tax.

Also, the Franchise Tax Board (FTB) is legendary for its tenacity. If you try to "move" to Nevada but keep your house in Malibu and spend 200 days a year there, the FTB will find you. They track cell phone records, credit card swipes, and even where you walk your dog. Residency audits are a real thing and they are brutal.

Common Misconceptions About the FTB

The FTB is not the IRS. They are often considered more aggressive.

One thing people get wrong: thinking that a "tax-free" state means more money. If your company is based in California and you work remotely from another state, you might still owe California taxes depending on the "source" of that income. It gets complicated. Fast.

The Middle-Class Squeeze

For those in the $100,000 to $250,000 range, California feels heavy. You’re likely in the 9.3% bracket. You’re making "good money," but the cost of living combined with the state’s take makes it feel like you’re treadmilling.

In 2024 and 2025, inflation adjustments helped a little. The state adjusts the bracket thresholds every year so that "bracket creep" doesn't destroy your soul. Bracket creep is when you get a cost-of-living raise that pushes you into a higher tax percentage, effectively making you poorer despite the raise. California’s indexing prevents the worst of this.

How to Lower Your Bill

You aren't totally helpless. You can lower your california tax rate income exposure by playing the game smartly.

- Max out your 401(k): Since California tracks federal Adjusted Gross Income (AGI) for the most part, traditional 401(k) contributions lower your state taxable income too.

- Health Savings Accounts (HSA): Warning! California is one of the only states that does not recognize HSAs as tax-advantaged at the state level. You’ll pay state tax on those contributions even if you don't pay federal tax. It’s annoying.

- Charitable Giving: If you itemize, your donations to 501(c)(3) organizations can help.

- Business Expenses: If you're a freelancer (1099), the California tax code allows for many of the same deductions as the federal code, but watch out for the $800 minimum franchise tax if you formed an LLC.

The Big Picture

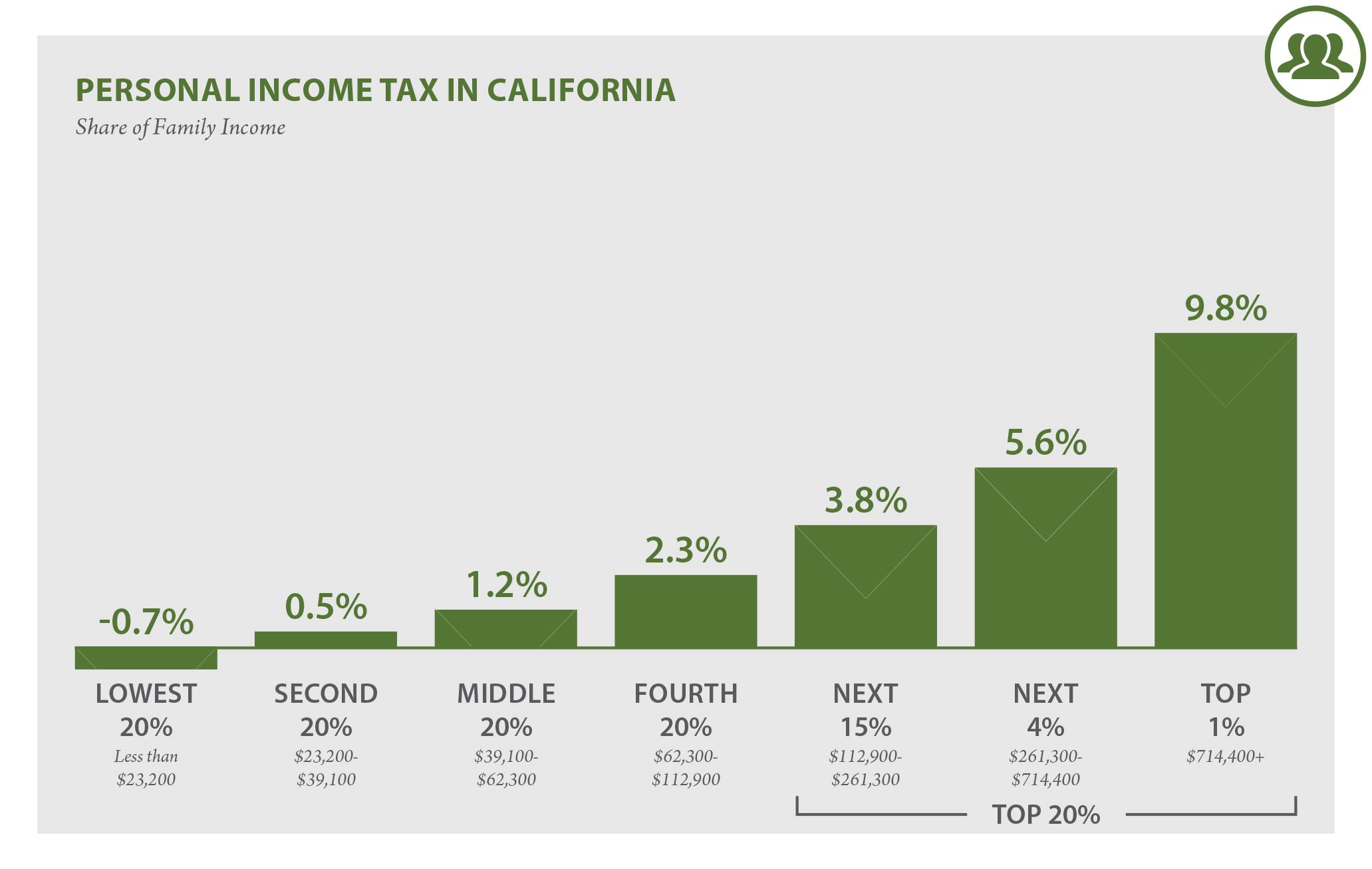

California's tax system is designed to be "volatile." Because it relies so heavily on the top 1% of earners—people whose income often comes from capital gains and stock options—the state’s budget swings wildly. When the stock market is up, California has a massive surplus. When tech tanks, the state faces a deficit.

This volatility is why there are constant debates in Sacramento about reforming the system. Some want to flatten the tax to make revenue more predictable. Others want to raise the top rates even higher to fund social programs.

Actionable Steps for Tax Planning

Stop guessing.

First, go pull your last pay stub. Look at the "CA PIT" (Personal Income Tax) line. That’s what’s being withheld. If you’re consistently getting a massive refund, you’re giving the state an interest-free loan. You can update your DE 4 form with your employer to keep more of your money each month.

Second, understand your residency status if you travel. If you spend more than nine months in California, the state presumes you are a resident. If you’re moving, keep every receipt, change your voter registration, and get a new driver's license immediately. The FTB looks for "intent."

Third, consult a professional if you earn over $200,000. At that level, the difference between a 9.3% and 10.3% bracket is thousands of dollars. Tax-loss harvesting in your brokerage account can help offset gains and lower your overall taxable income.

Fourth, keep an eye on the "California Standard Deduction" every January. It changes. Knowing that number helps you decide if it's worth it to keep those shoeboxes full of receipts for itemization or if you should just take the easy route.

California is a high-cost, high-service state. Whether the trade-off is worth it depends on your career, your family, and how much you value the weather. Just don't let the "sticker price" of the tax brackets scare you without doing the math on your actual effective rate. It’s usually not as bad as the "tax-free" state advocates make it out to be, but it’s definitely not cheap.

The best way to handle it? Stay informed, use the deductions you're entitled to, and maybe don't check your YTD tax totals right before a weekend. It'll just ruin the mood.