Living in the "OC" isn't just about surf sessions at Newport or the manicured lawns of Irvine. It’s about the math. Honestly, if you’re looking at your paycheck or a store receipt and wondering why the numbers don't add up, you're not alone. The California tax rate Orange County residents face is a moving target.

It’s a mix of state-level mandates and hyper-local ballot measures that can change just by crossing the street from Santa Ana into Tustin.

Most people think California has one "high" tax rate. That’s a total myth. In reality, your tax burden in Orange County is a layered cake. You’ve got the base state rate, then the county adds its slice, and finally, your specific city might decide it needs a new library or better roads and adds another layer on top.

📖 Related: Tata Steel Share Price: Why Most Investors Are Looking at the Wrong Numbers

The Sales Tax Scramble: Why Your Receipt Varies

The floor for sales tax in Orange County is currently 7.75%.

But wait. You’ll rarely actually pay 7.75%.

Why? Because local "district taxes" are the real heavy hitters. If you’re shopping in Santa Ana, you’re looking at a much steeper 9.25% thanks to Measure X. Meanwhile, other spots like Fountain Valley or La Habra have their own specific add-ons that push them toward the 9% mark.

If you buy a $50,000 Tesla in one city, you might pay hundreds more in tax than if you’d driven ten miles north to a different dealership. It’s wild.

👉 See also: Current price of silver per troy ounce: What most people get wrong

Here is the basic breakdown of how that 7.75% minimum is even calculated:

- 6.00% goes straight to the State of California.

- 0.25% is the Orange County local tax.

- 0.50% is for "District" taxes (like Measure M for transportation).

- 1.00% is the "local" city/county portion.

Income Taxes: The 2026 Progressive Ladder

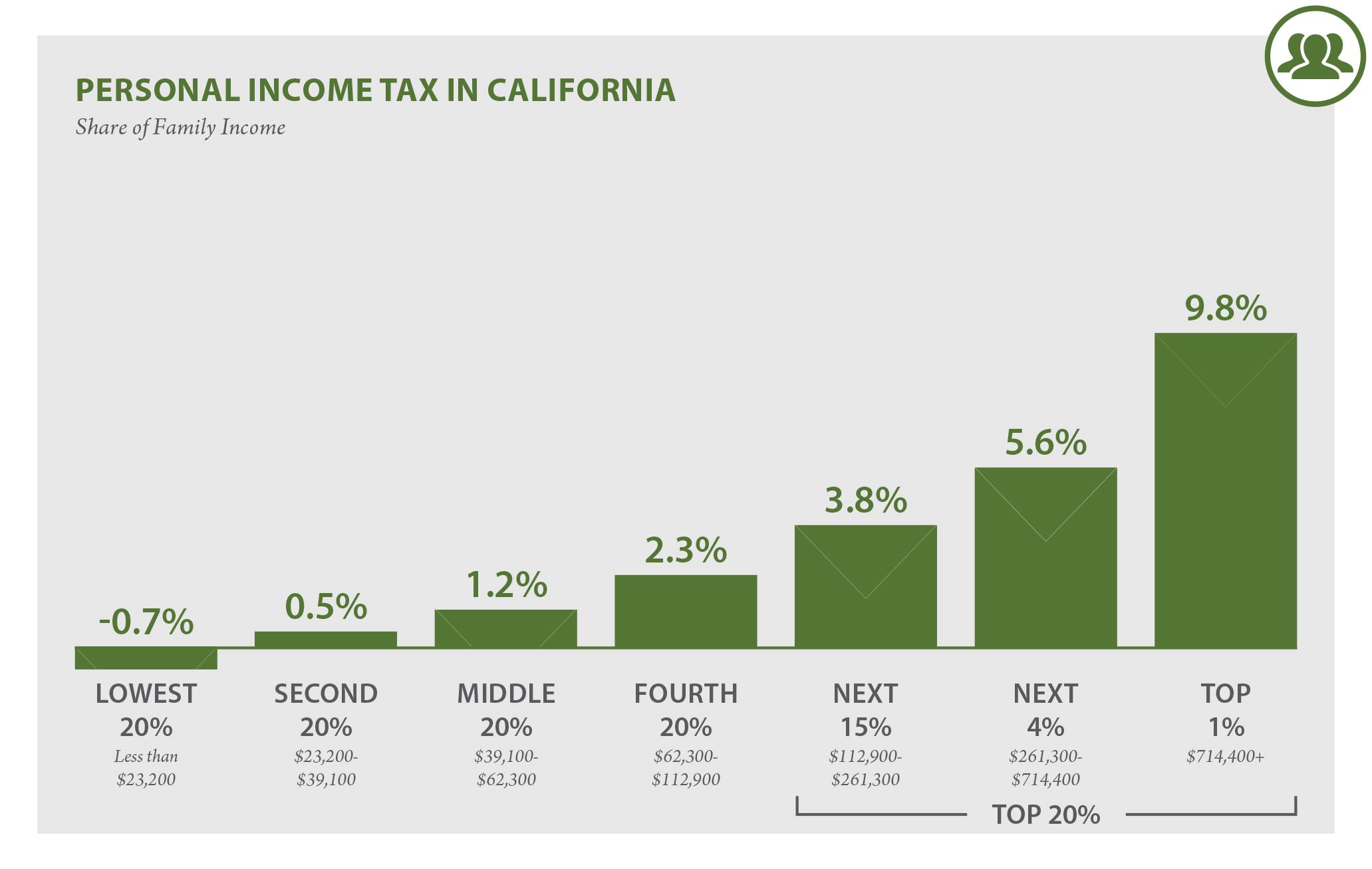

California is famous—or maybe infamous—for its progressive income tax. For 2026, the brackets have shifted slightly to account for inflation, but the "millionaire tax" (that extra 1% for Mental Health Services on income over $1 million) is still very much alive.

If you’re a single filer in Orange County making $70,000, you aren't paying the top rate. You’re likely landing in the 9.3% marginal bracket. But remember, that’s marginal. You only pay that rate on the dollars inside that specific bucket.

Recent 2026 Changes You Should Know

There’s some actually good news for once. The SALT (State and Local Tax) deduction cap was recently adjusted. For years, you could only deduct $10,000 of your state taxes on your federal return. As of this year, under the "One Big Beautiful Bill" (OBBBA) changes, that cap has been bumped to **$40,000**.

For a homeowner in Newport Beach or Yorba Linda, this is massive. It basically means you can actually deduct a significant portion of what you pay to Sacramento and the OC Treasurer from your federal bill.

Property Taxes and the "1% Myth"

Every Realtor in Orange County loves to say, "Property tax is 1%."

They’re lying. Sorta.

Prop 13 does limit the base tax to 1% of the assessed value. But in the OC, you have to deal with Mello-Roos and special assessments. If you’re buying a new build in Irvine’s Great Park or Rancho Mission Viejo, your "effective" tax rate could be 1.5% to 1.8%.

On a $1.2 million home (which is basically a starter home in some parts of the county now), that 0.5% difference is an extra $6,000 a year. That’s a $500 monthly payment just for "extra" taxes.

- Fixed Base: 1.0% (The Prop 13 limit).

- Bonds: Usually 0.10% to 0.25% for local schools or water districts.

- Mello-Roos: A flat fee often found in newer neighborhoods for "community facilities."

What’s On the Horizon?

The 2026 November election is looking spicy. There are already rumblings about new 0.5% sales tax increases in cities like Fullerton to fix crumbling infrastructure. There's also the "2026 Billionaire Tax Act" floating around at the state level. While it only targets those with a net worth over $1 billion, the "trickle-down" concern is that it might cause some of the county’s biggest employers to look at Nevada or Texas.

How to Not Overpay

Look, nobody likes giving money away. To keep your "California tax rate Orange County" burden as low as possible:

- File the Homeowners’ Exemption: It’s a tiny $7,000 reduction in your assessed value, but it saves you about $70 a year. It’s free. Do it.

- Audit Your Use Tax: If you buy things online for your business and weren't charged sales tax, the state expects you to report "Use Tax." Don't get caught in an audit over a laptop purchase.

- Check the SALT Cap: Talk to your CPA about the new $40,000 limit. If you haven't adjusted your withholdings, you might be giving the government an interest-free loan.

Basically, taxes here are a headache, but they aren't a mystery if you know where the trapdoors are.

Next Steps for You:

Check your most recent property tax bill (available on the OC Treasurer-Tax Collector website) and look specifically at the "Special Assessments" line. If you are in a Mello-Roos district, find out when those bonds expire—it might be sooner than you think, which could lead to a significant "raise" for your household budget.