You’re standing at the kitchen counter, pen in hand, staring at a blank check. Maybe your lawn guy only takes paper, or perhaps you need a quick twenty for a birthday card and the ATM is three blocks too far. You wonder: Can I write a check for cash?

Yes. You can. But honestly, it's not always the smartest move in 2026.

Writing a check to "Cash" is basically creating a golden ticket for anyone who finds it. If you lose that piece of paper before you hit the teller window, anyone who picks it up can technically walk into a bank and try to claim those funds. It’s a bearer instrument. That means the "bearer" of the document owns the value. It’s risky, it’s a bit old-school, and there are specific rules your bank expects you to follow if you don't want your transaction flagged or denied.

💡 You might also like: 100 Dollars to Naira: What Most People Get Wrong

How to Actually Write a Check to Cash Without Messing Up

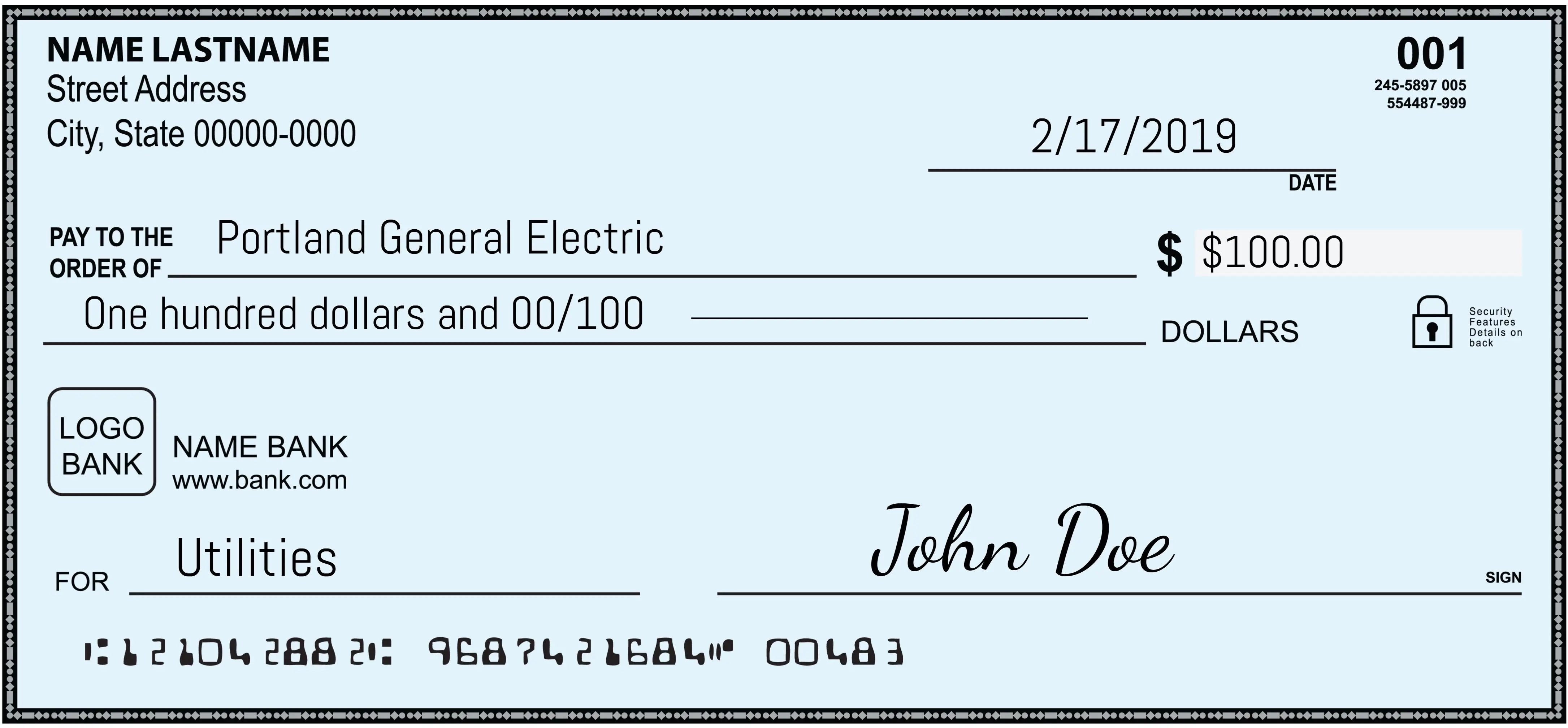

The process is deceptively simple. Where you would normally write a person’s name or a business like "Target" or "Landlord LLC," you just write the word Cash.

Don’t overthink the capital letters. Just make it legible. Fill out the date. Write the numerical amount in the small box. Write the word-version of the amount on the long line. Sign it. That’s it. You’ve just turned a piece of paper into a liquid asset.

But here is where people trip up.

When you get to the bank, the teller is going to ask you to endorse the back. You’re essentially acting as both the payer and the payee. It feels redundant. It feels like you’re doing double the work for the same ten dollars. However, the bank needs that second signature to prove who actually walked away with the physical bills. Most banks, including giants like Chase or Wells Fargo, will also demand a government-issued ID. Even if you’ve had an account there since the nineties, they need a paper trail for the "cash" side of the ledger.

The Massive Security Risk Nobody Mentions

If you write a check to a specific person, say, "John Smith," and you drop it on the sidewalk, John Smith is the only one who can (legally) do anything with it. If a stranger finds it, they’d have to forge a signature and likely fake an ID to get the money.

If you write a check to "Cash" and drop it?

📖 Related: Comfort Systems USA Stock Price: What Most People Get Wrong About This HVAC Giant

You’ve essentially dropped a $100 bill. Or a $500 bill. Or whatever amount you wrote down. Because the check is made out to "Cash," it is no longer restricted to a specific recipient. It belongs to whoever is holding it. It’s a "bearer instrument" under the Uniform Commercial Code. This is why financial advisors usually tell you to wait until you are literally standing inside the bank branch before you even think about writing "Cash" on that Pay To The Order Of line.

Where Can You Actually Cash It?

Don't expect to walk into a random grocery store and hand them a check made out to cash in exchange for a stack of twenties. Most retailers stopped doing that years ago because the fraud risk is just too high.

- Your own bank: This is the path of least resistance. Since they hold your money, they can verify the funds instantly.

- The issuing bank: If you have a check from a friend made out to cash, you have to go to the bank named on the check. They might charge you a "non-customer cashing fee," which usually ranges from $5 to $10.

- Check-cashing stores: Places like MoneyMart or various "Payday" outlets will do it, but they’ll take a massive bite out of your money in fees. It’s rarely worth it.

The ATM Alternative You Probably Forgot

Most modern ATMs allow you to withdraw money without a check. But if you're trying to get a very specific amount that the ATM won't dispense—like $43.12—writing a check to yourself is one way to do it.

Actually, wait.

There’s a better way. Instead of writing "Cash," write your own name on the recipient line. This provides the same result (you get the money) but adds a layer of security. If you lose a check made out to "Your Name," a thief can't easily cash it. You get the cash, the bank gets their record, and you get peace of mind. It’s a cleaner trail for your monthly statement too. Seeing "Check #104 - Cash" in your banking app doesn't tell you much three months later. Seeing "Check #104 - [Your Name]" at least tells you the money stayed in your pocket.

Fees, Limits, and the "Fine Print"

Banks aren't always thrilled about manual transactions. In an era of Zelle, Venmo, and instant transfers, a physical check requires human labor.

Some smaller credit unions might have daily limits on how much cash they’ll give you for a check on the spot, especially if it’s a large amount like $5,000. If you’re planning to withdraw a significant sum, call ahead. They need to make sure they have the physical currency in the vault to cover you without running dry for other customers.

Also, watch out for the "held funds" trap. If you deposit a check made out to cash from a different bank into your account, they might not give you the cash immediately. They might put a three-to-five-day hold on it. If you need the money now, you have to go to the bank the money is coming from.

When Writing a Check to Cash Makes Sense

Believe it or not, there are a few niche scenarios where this isn't just an old-fashioned habit.

If you are closing out an account and want the exact balance down to the penny, writing a final check to cash is a common tactic. Or, if you’re a small business owner who needs to replenish a "petty cash" drawer for minor office supplies or coffee runs, a check to cash creates a clear entry in your accounting software. It says: "This money left the bank and went into the office till."

👉 See also: Why the Social Market Economy Model is Basically the Only Way Forward

But even then, most accountants will tell you to just write the check to "Petty Cash" or "Office Manager" to keep the audit trail slightly tighter.

Common Misconceptions About Checks for Cash

Many people think you can’t bounce a check to cash. That’s dangerously wrong.

If you write a check for $200 to cash, but you only have $150 in your account, you are going to get hit with an NSF (Non-Sufficient Funds) fee. Your bank doesn't care that the check was for you. They care that you tried to spend money you didn't have. These fees are usually around $35, which makes that "quick cash" very expensive.

Another myth: "I don't need my ID if I have my debit card."

Wrong. Most tellers are trained to follow a strict protocol for "Cash" checks. They want to see your face and your ID. They might even thumbprint the check in some states. It’s all about risk mitigation.

Step-by-Step: The Safest Way to Get Your Money

If you’ve decided that writing a check to cash is your best option, follow this sequence to keep your money safe:

- Leave the checkbook at home until you are ready to go to the bank.

- Wait until you are in the parking lot or at the teller's desk to fill out the "Pay to" line.

- Use a blue or black gel pen. These are harder to "wash" (a type of fraud where criminals erase your ink) than standard ballpoint pens.

- Double-check your balance on your mobile app before you sign.

- Endorse the back only when the teller is looking at you. ## Better Alternatives for 2026

If the goal is just getting money from Point A to Point B, the check is the slowest vehicle on the road.

Consider using Cash Back at a grocery store. Buy a pack of gum, pay with your debit card, and ask for $50 back. No fees, no teller lines, and no paper trail for a thief to find.

Or use P2P apps. If you’re trying to give cash to someone else, Venmo or Zelle is instantaneous and carries much lower fraud risk than a physical piece of paper that says "Cash" on it.

Actionable Next Steps

If you absolutely must write a check for cash today, take these three steps:

- Write your name instead of Cash. It’s just as easy to cash at your bank but significantly safer if you lose it between your front door and the bank branch.

- Verify your bank's cashing policy. If it’s a large amount (over $1,000), call the branch to ensure they have the liquidity on hand and ask if they require any secondary form of ID.

- Record the transaction immediately. Don't wait for your statement. Write it in your check register or log it in your budgeting app so you don't forget that $100 is "missing" from your balance tomorrow morning.

Writing a check for cash is a surviving relic of a different financial era. It works, it's legal, and it's occasionally necessary, but it requires a level of physical caution that digital banking has made us forget. Treat that check like a stack of bills, because the moment you write those four letters—C-A-S-H—that is exactly what it becomes.