It’s a weird time to walk into a Canadian grocery store. You see the headlines saying things are "stabilizing," yet you’re still paying seven bucks for a head of lettuce that looks like it’s seen better days. Honestly, trying to track the current inflation rate Canada feels like trying to hit a moving target while wearing a blindfold.

As of mid-January 2026, the official numbers tell one story, but your bank account probably tells another.

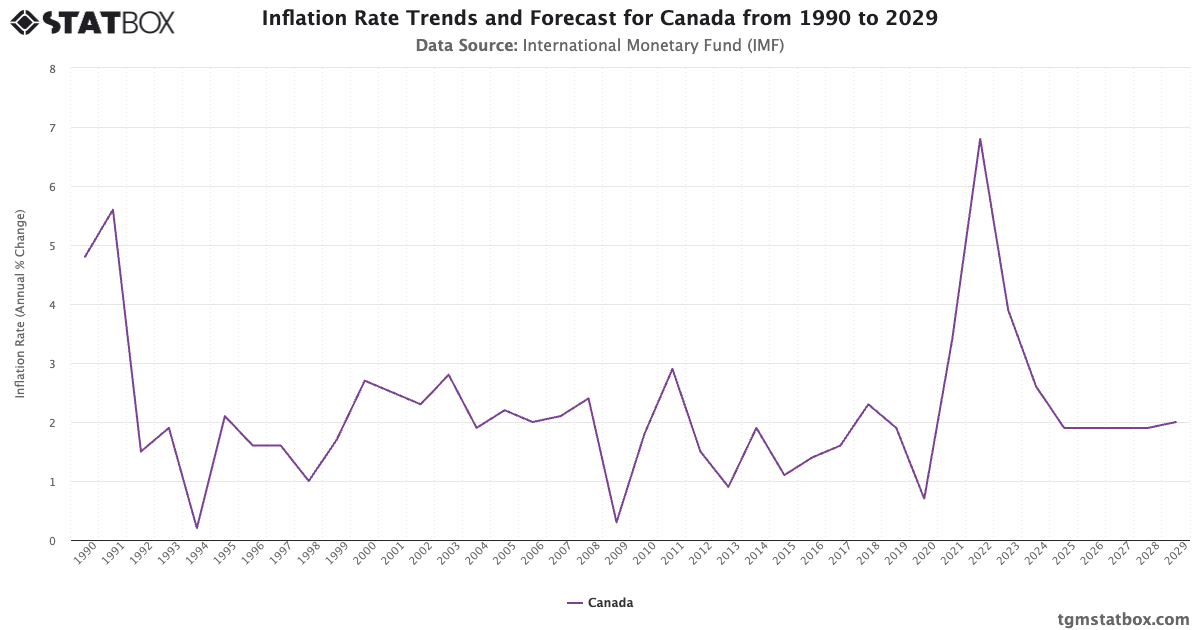

The latest data from Statistics Canada shows headline inflation hovering right around 2.2%. On paper, that’s a massive win. We are a long way from those 8% peaks that kept everyone awake at night in 2022. But if you look under the hood, the "vibe shift" isn't quite as rosy as the Bank of Canada might want you to believe.

Why the Current Inflation Rate Canada Feels Like a Lie

The 2% target is the "north star" for Tiff Macklem and the folks at the Bank of Canada. They want to keep it there. They need to keep it there. But for the average person in Toronto, Calgary, or Halifax, that 2.2% figure feels suspiciously low.

Here’s the thing: inflation is a "rate of change," not a price level.

When the current inflation rate Canada hits 2.2%, it doesn't mean prices are going back to 2019 levels. It just means they are growing more slowly. If a bag of milk went from $4 to $6 during the crisis, a 2% inflation rate means it’s now $6.12. It’s still expensive; it’s just not getting more expensive as fast.

The Core vs. Headline Divide

Economists love to talk about "Core Inflation." This is the number that strips out the volatile stuff—the things that jump around like gasoline and groceries.

In early 2026, core inflation is actually stickier than the headline number. While gasoline prices have taken a bit of a dive—falling about 7.8% year-over-year—the cost of "living" (rent, insurance, and services) is still stubbornly high.

- Rent: Still climbing at nearly 4.7% in many regions.

- Phone Plans: Surprisingly up by double digits (roughly 11.7%) as promotions vanished.

- Food: Grocery stores are still seeing hikes around 4.7%, far outstripping the "official" 2.2% average.

What's Actually Driving the Numbers Right Now?

We’ve moved past the "supply chain" excuses of the pandemic era. Today, the current inflation rate Canada is being tugged in two different directions.

On one hand, the economy is sluggish. GDP growth is dragging at a measly 1.3%. People aren't spending like they used to because their mortgages are eating their disposable income. This "demand destruction" is what finally cooled off the massive price spikes of previous years.

On the other hand, we have "protectionist" pressures. Trade tensions and new tariffs have made imported goods more expensive. You can’t just buy cheap stuff from abroad and expect the price to stay low when there’s a trade war brewing or new carbon adjustments hitting the border.

The Shelter Problem

Shelter remains the biggest weight in the Consumer Price Index (CPI) basket, making up about 30% of the total.

Even though the Bank of Canada has paused rate hikes—keeping the policy rate at 2.25%—the lag effect is brutal. People are still renewing mortgages they signed in 2020 and 2021. When they move from a 2% interest rate to a 4% or 5% rate, that’s a massive hit to their monthly cash flow. That shows up in the data as "mortgage interest cost" inflation, and it's one of the main reasons the current inflation rate Canada hasn't crashed to zero.

📖 Related: EUR to TND Rate: Why Your Money Goes Further (or Not) in Tunisia Right Now

The 2026 Outlook: Will It Get Better?

Most analysts, including those at RBC and TD Economics, think we’re in a "fragile equilibrium."

We are basically walking a tightrope. If the Bank of Canada cuts rates too fast to save the struggling economy, they risk reigniting the housing market and sending inflation back up. If they hold too long, they might trigger a deeper recession than anyone wants.

The consensus for the rest of 2026 is "steady as she goes." Expect the current inflation rate Canada to stay in that 2% to 2.5% range. It’s not exactly a celebration, but it’s better than the alternative.

Survival Steps for Your Wallet

Since "low" inflation doesn't mean "low" prices, you’ve gotta be proactive. Waiting for the government to fix your grocery bill is a losing game.

- Audit Your Subscriptions: Seriously. Cellular services and streaming apps have been sneakily raising rates. If you haven't switched providers or threatened to cancel in 12 months, you're overpaying.

- Lock in What You Can: If you’re on a variable-rate anything, talk to a broker. The era of "emergency low" rates is over. We are in a "higher for longer" world now.

- Watch the Loonie: The Canadian dollar is hovering around 72-74 cents USD. If it drops further, your winter produce (which we import from the States) is going to get even pricier. Buy local or frozen when the exchange rate gets ugly.

Inflation isn't a monster anymore, but it's a persistent headache. Staying informed about the current inflation rate Canada is less about tracking a number and more about understanding why your paycheck doesn't go as far as it used to.

✨ Don't miss: Current Euro to USD Conversion Rate: Why the 1.16 Level is Tricky Right Now

What You Should Do Today

Start by looking at your fixed costs. Since shelter and insurance are the primary drivers of current inflation, these are the areas where a 10% saving can change your life. Shop your home insurance and check your mortgage renewal date. Don't wait until 30 days before renewal to start negotiating with your bank; start six months out.

Monitor the next CPI release scheduled for late February. If the "trim" and "median" core measures start to tick upward again, it’s a signal that the Bank of Canada might actually have to raise rates later this year, contrary to what the "pivot" crowd is hoping for.