Waking up to a zero-dollar balance when you know it's payday is a special kind of stress. It’s that sinking feeling in your stomach while you’re staring at the Capital One app, hitting refresh like it’s a slot machine that just won't pay out. If you're dealing with capital one direct deposit issues today, you aren't alone. Honestly, thousands of people are currently refreshing their screens, wondering if they should start calling HR or if the bank is just having another "moment."

Banks usually feel like these giant, unshakeable fortresses, but the reality is way more glitchy. Between third-party processing hiccups and the way "Early Pay" features actually work behind the scenes, there’s a lot that can go wrong.

Why Your Capital One Deposit Is Missing Right Now

So, what’s the deal? If your money isn't there, it usually boils down to one of three things. First, Capital One might be having a legitimate system-wide outage. This happened famously back in January 2025 when a third-party vendor called FIS Global had a massive power failure. It locked people out of their accounts for days. Deposits didn't show up, bills bounced, and it was a total mess.

👉 See also: How Much Is 1 Ounce of Gold Worth Today: Why Prices Are Suddenly Weird

The second culprit is often the "Early Pay" feature. Capital One 360 accounts advertise that you can get paid up to two days early. It's a great perk, until it doesn't happen. People get used to seeing that money on Wednesday, and when it doesn't arrive until Friday, it feels "late" even if, technically, Friday was the actual payday.

- The ACH Network: This is the "plumbing" of the banking world. If there's a clog here, no bank gets the money on time.

- Payroll Submission: If your boss was late clicking "submit" on the payroll software, Capital One can't show you money they haven't seen yet.

- Federal Holidays: If today is a Monday holiday, everything shifts.

The "Early Pay" Trap

Most people don't realize that for "Early Pay" to work, your employer has to send the payroll file to the Federal Reserve early. If they wait until the last minute, Capital One has nothing to "advance" to you. Kinda annoying, right? You’ve planned your groceries around a Wednesday deposit, but the system relies on a chain of events where every link has to be perfect.

Is Capital One Down Today?

Before you lose your mind, check the status page. Capital One maintains an official outage tracker that shows if the app, website, or transaction processing is borked. But here’s the thing: that page isn't always updated in real-time. Sometimes, DownDetector or even Reddit threads are faster at spotting a trend than the bank’s own PR department.

If the status page says "All Systems Operational" but you still don't have your cash, it’s probably a localized issue or a specific delay with the ACH batch your employer uses.

What to Do If Your Money is MIA

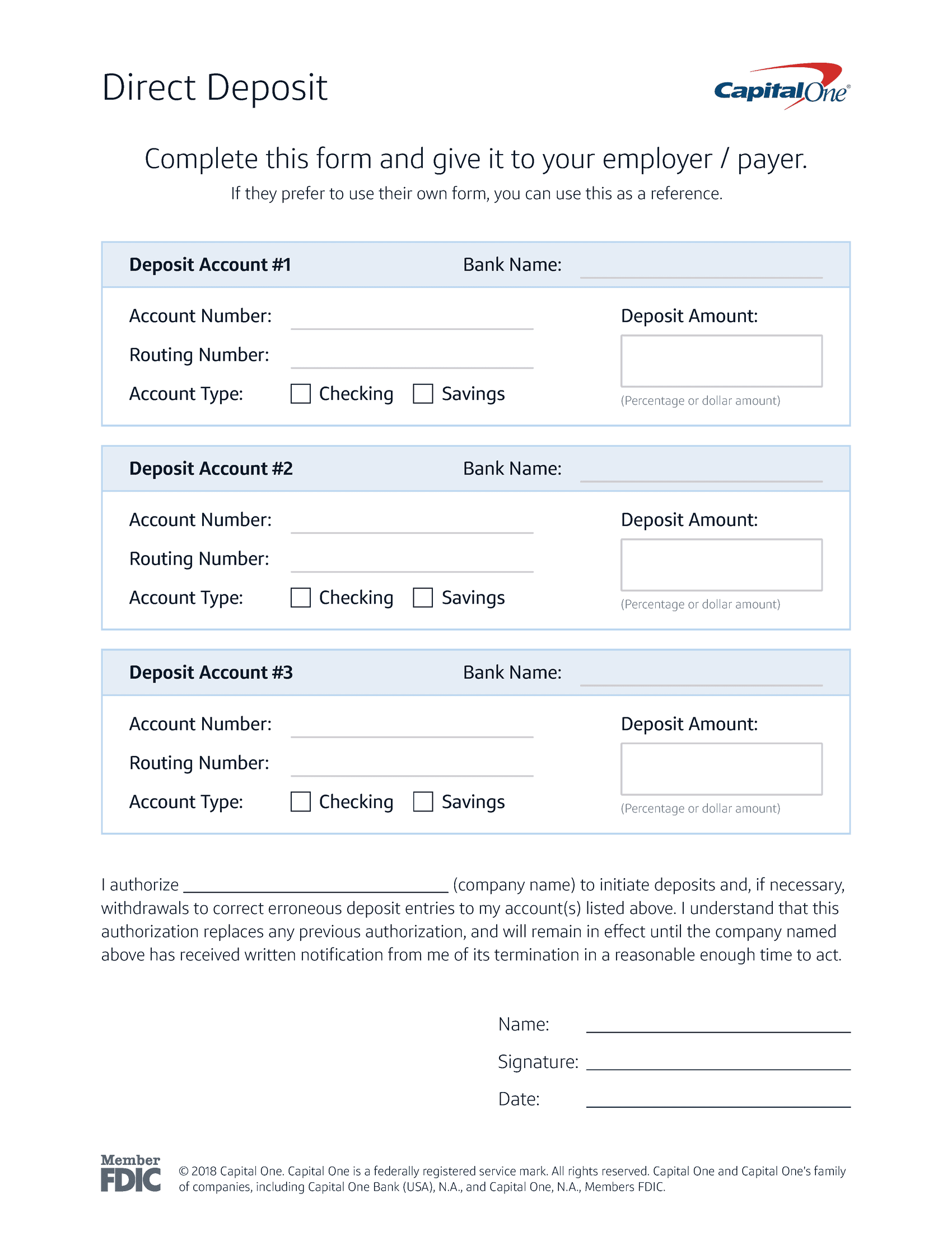

- Check your paystub. Seriously. Make sure the routing and account numbers didn't get messed up.

- Talk to HR. Ask them specifically when they sent the ACH file. If they say "Tuesday," and it's now Thursday, the ball is in Capital One's court.

- Wait until 9:00 AM ET. Most banks finish their final processing "sweep" by then. If it’s not there by mid-morning, it’s time to escalate.

- Call the bank. Use the number on the back of your card. Don't just rely on the chatbot; Eno is cool, but sometimes you need a human to look at the "pending" queue.

Dealing with the Fallout of Delayed Pay

When capital one direct deposit issues today happen, the consequences aren't just digital numbers on a screen. They’re real-life problems. Rent is due. The car payment is automatic. If a delay causes you to rack up late fees, Capital One has been known to "care for" or reimburse those fees if the fault was theirs (like during the 2025 FIS outage).

Keep records. Take screenshots of the app showing no deposit. Save the emails from your landlord about the late rent. You’ll need this evidence if you ever want to get those fees waived.

💡 You might also like: Park Meadow MHC LLC: The Truth About Mobile Home Park Investing and Residents

Practical Next Steps

If you’re still staring at an empty account, don't just sit there and fume. Start by calling Capital One at 1-877-383-4802. Ask specifically if there are any "ACH processing delays" currently affecting 360 Checking accounts.

If they tell you it's an employer issue, get a "trace number" from your payroll department. This is a unique ID for your specific transfer. Once you give that number to a bank rep, they can't just give you the runaround—they actually have to track where that specific pile of money is sitting.

Lastly, consider keeping a small "buffer" in a different bank. Relying 100% on one institution for your immediate survival is risky, especially when third-party tech glitches can happen at any moment. It's not a fun solution, but it beats eating ramen because a server in Virginia decided to take a nap.