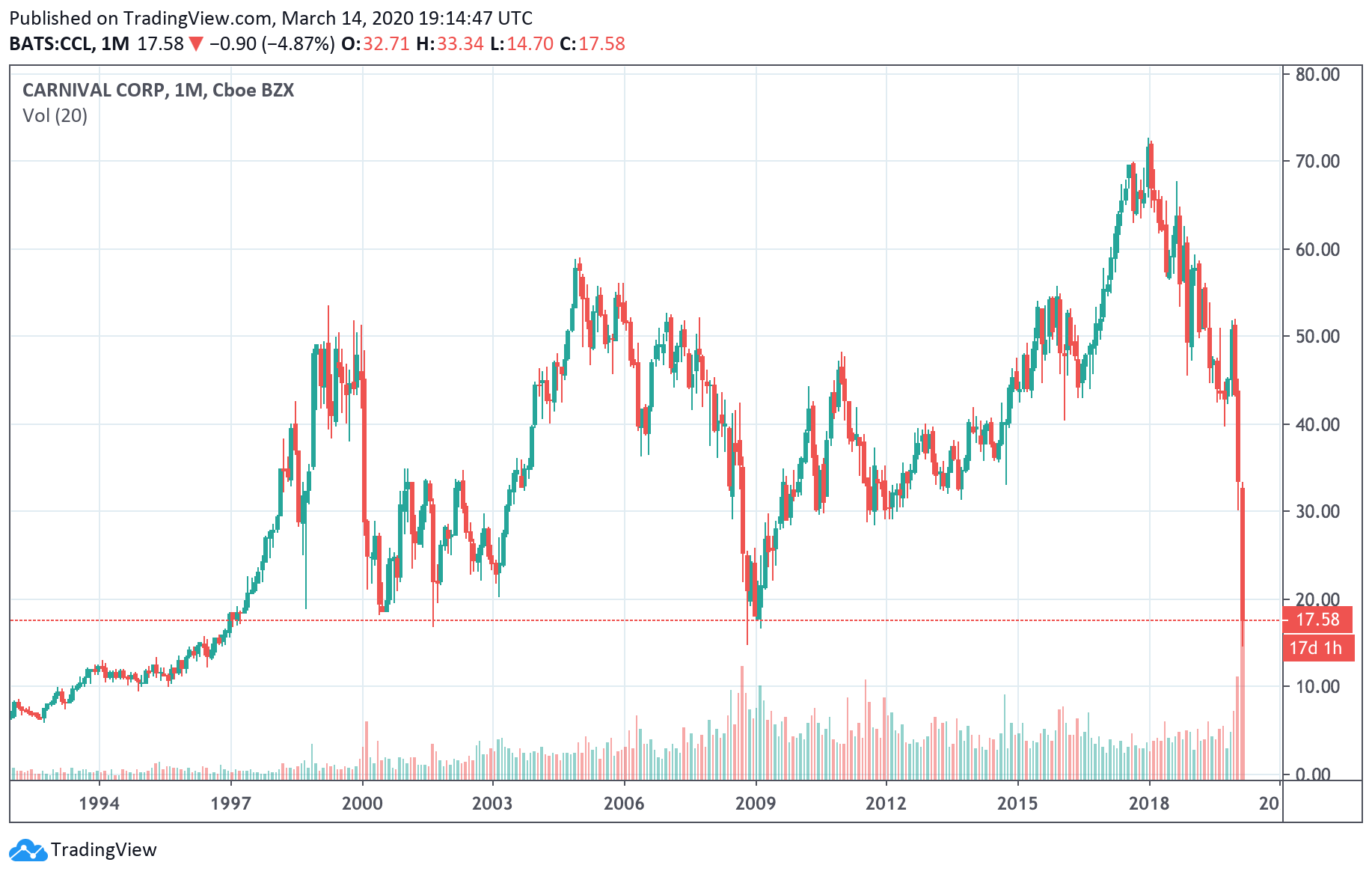

Honestly, if you looked at a chart of the carnival cruise stock market performance back in 2020, you probably would have bet against the house. Most people did. The industry was basically a ghost town, and Carnival Corporation (CCL) was bleeding cash like a severed artery. But fast forward to January 2026, and the narrative has shifted so hard it's giving some investors whiplash.

It’s not just about ships floating again. It’s about the math.

💡 You might also like: Currency rate dollar to pakistani rupee: Why It Is Staying Surprisingly Quiet This Month

As of mid-January 2026, Carnival is trading around $29.45 to $30.18. If you’re tracking the 52-week range, we’ve seen a low of $15.07 and a high of $32.89. The stock is currently breathing down the neck of its yearly highs, yet there’s this weird tension in the air. Why? Because the company just reinstated its quarterly dividend—a modest **$0.15 per share**—for the first time since the world fell apart. That’s a massive signal.

The Debt Monster Is Finally Under Control

You can’t talk about Carnival without talking about that mountain of debt. It was the elephant in the room for five years. But here is the thing: they’ve been aggressive. Management has managed to hack away over $10 billion from their peak debt levels.

By May 2025, they were sitting on about $27.3 billion in total debt. Sounds like a lot, right? It is. But their net debt to adjusted EBITDA ratio dropped to 3.4x by the end of 2025. Fitch even recognized them as investment grade again. That’s the financial equivalent of moving from the ICU to a regular hospital ward.

Analysts like James Hardiman at Citigroup and Steven Wieczynski at Stifel are leaning into this. They’ve been boosting price targets, with some reaching as high as $45.00. They aren't just looking at the number of people on ships; they’re looking at how much those people are spending once they get there.

The Real Driver: Onboard Spending

People are spending money like crazy once they step on deck. It’s sort of wild. We aren't just talking about the buffet. It's the specialty dining, the casinos, and the "RelaxAway" experiences at places like Half Moon Cay.

- Record Revenues: The company pulled in roughly $26.6 billion in fiscal 2025.

- Booking Volume: For 2026 and even 2027, bookings are hitting all-time highs.

- Pricing Power: Prices are higher than they’ve ever been, and people are still clicking "book."

AAA recently projected that over 21.7 million Americans will cruise in 2026. That is a 4.5% jump year-over-year. Even with inflation being a constant headache, the "experience economy" is winning. Young travelers are choosing a week at sea over a new iPhone or a down payment they can't afford anyway.

Why 2026 Is the "Make or Break" Year

While the vibes are good, the carnival cruise stock market isn't without its trap doors. Some technical analysts are pointing out a "bearish divergence." Basically, while the stock price is hitting higher highs, the Relative Strength Index (RSI) is hitting lower highs.

It suggests the momentum might be getting tired.

Also, capacity growth for 2026 is expected to be less than 1%. Carnival isn't just throwing more ships at the problem; they are trying to squeeze more profit out of the ones they already have. They’re launching a new loyalty program in June 2026—Carnival Rewards—which ties status to actual spending rather than just days at sea. It’s a smart move, but it’s a shift that might ruffle the feathers of old-school cruisers.

What Most People Get Wrong

The biggest misconception is that Carnival is still a "recovery play." It’s not. The recovery is over. We are now in the "efficiency phase."

The company is projecting an adjusted net income of $3.5 billion for the full year of 2026. If they hit that, they’ll surpass the records they just set in 2025. But they missed their Q4 2025 earnings estimate slightly—reporting $0.23 EPS against an expected $0.25. The market didn't love that, and the stock took a 2% dip recently.

It shows how sensitive the stock has become. Investors are no longer grading on a curve; they want perfection.

Actionable Insights for Your Portfolio

If you’re looking at the carnival cruise stock market right now, you need to be surgical. The "buy and forget" days of 2022 are gone.

- Watch the Credit Ratings: Keep an eye on Moody’s and S&P. Another upgrade to investment grade across all agencies would lower their interest expense significantly, which drops straight to the bottom line.

- Monitor the $32 Resistance: The stock has struggled to stay above $32-33. If it breaks that with high volume, $40 becomes a very real conversation.

- The Dividend Reinvestment: With the record date of February 13, 2026, for the new dividend, look for "dividend capture" traders to jump in, which might create a temporary price floor.

- Fuel and Labor Costs: These are the silent killers. Management expects cruise costs (excluding fuel) to rise by about 2.5% in 2026. Any spike in oil prices will eat those margins for breakfast.

The reality is that Carnival is a much leaner, meaner machine than it was five years ago. It’s no longer just a cruise line; it’s a massive data-driven hospitality company that happens to own ships. Whether that’s enough to carry the stock to $45 remains to be seen, but for now, the wind is mostly at their back.

Next Steps for Investors: Check the official SEC filings for the Q1 2026 guidance updates and verify if the $0.15 dividend payout aligns with your personal yield requirements. You should also compare CCL's debt-to-equity ratio against Royal Caribbean (RCL) to see which balance sheet is actually healthier in the current high-rate environment.