You land in Grand Cayman, the sun is shining, and you head to a local shack for some conch fritters. You see the price: CI$15. You hand over a twenty-dollar bill from your wallet—a US twenty—and wait. The cashier hands you back some colorful change, but it’s not the amount you expected. This is where most people get tripped up by the cayman dollar to usd exchange.

Honestly, the math isn't hard, but it is constant. The Cayman Islands Dollar (KYD) is actually worth more than the US Dollar. That surprises a lot of folks who are used to their USD going further in the Caribbean. Since 1974, the Cayman Islands has kept its currency locked in a fixed dance with the Greenback. Specifically, the official peg is set at 1 KYD to 1.20 USD.

But here’s the kicker. Just because the official rate is 1.20 doesn't mean that's what you'll actually pay at the register or get at the bank.

📖 Related: When Was Sam’s Club Founded? The Real Story Behind Walmart’s Bulk-Buying Giant

The 1.20 Peg vs. The "Island Rate"

If you're looking at a formal financial statement, the cayman dollar to usd rate is a rock-solid $1.20. It's been that way for over 50 years. This stability is a huge reason why the islands became a global financial powerhouse. Investors love predictability.

However, in the real world of tourism and retail, things get a bit "sorta" official. Most shops and restaurants on the islands operate on a simplified "retail rate." Usually, they treat 1 USD as 80 cents KYD.

Do the math: if you buy something for CI$80 and pay in USD, they’ll ask for US$100. That effectively makes the exchange rate $1.25. Why the extra five cents? Convenience. The shops are doing the conversion for you, taking the risk of handling foreign cash, and essentially charging a small "convenience fee" built right into the exchange.

- Official Peg: $1.20 (Used by banks for wire transfers).

- Retail/Cash Rate: $1.25 (Commonly found in shops).

- Bank Buy Rate: $0.82 KYD for $1 USD (What you get when you trade your US cash for local cash).

It's a weird ecosystem where two currencies live side-by-side. You can pay for a taxi in US Dollars, get change back in Cayman Dollars, and use that change to buy a coffee ten minutes later.

Why the Cayman Dollar to USD Rate Never Moves

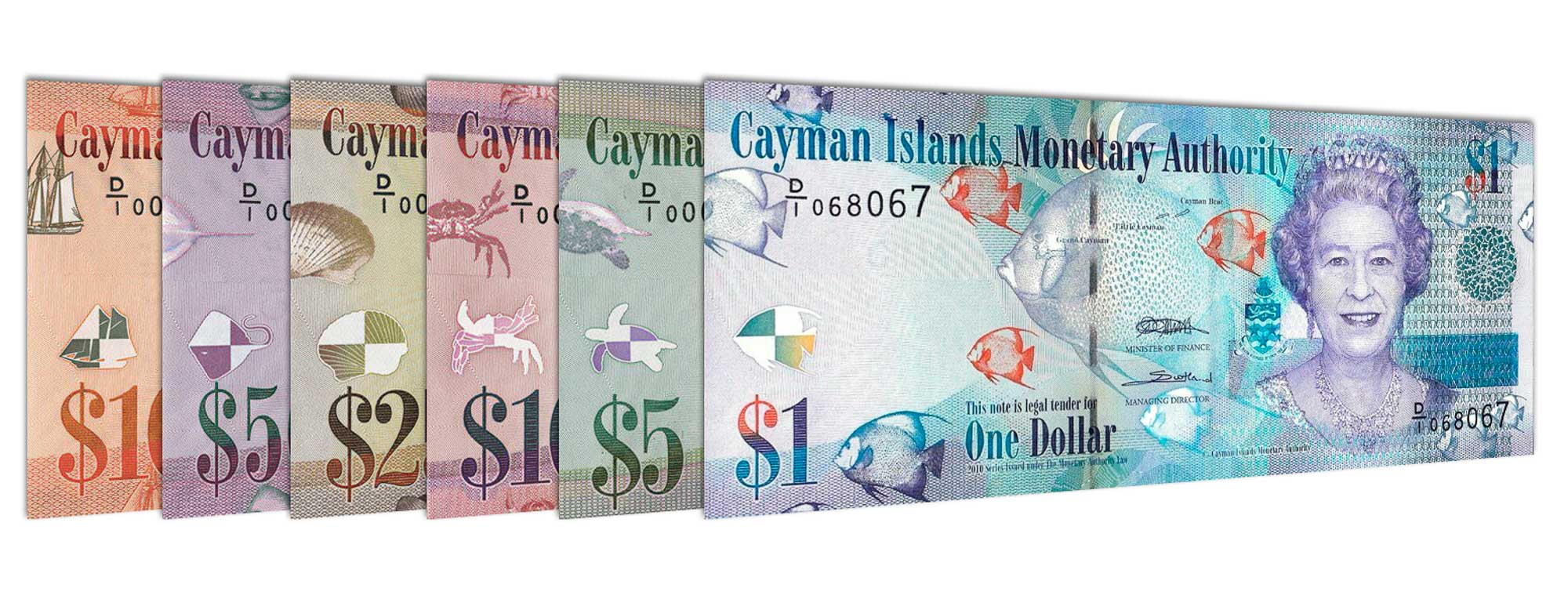

You might be wondering why the rate doesn't fluctuate like the Euro or the Yen. The Cayman Islands Monetary Authority (CIMA) manages this through a currency board system. Basically, for every Cayman Dollar in circulation, CIMA holds at least an equivalent amount in US Dollar-denominated reserve assets.

This means they aren't just printing money and hoping for the best.

The peg is a psychological and economic anchor. Because the Cayman Islands imports almost everything—from fuel to milk—having a stable link to the currency of their primary trading partner (the US) keeps inflation from spiraling out of control. It makes life easier for the thousands of hedge funds and banks registered in George Town.

👉 See also: John Staluppi Net Worth: Why the Car King and Yacht Legend Still Rules

Tips for Exchanging Money Without Getting Ripped Off

If you want to get the best bang for your buck, don't just wing it at the airport. You’ve probably heard that advice before, but in Cayman, it’s particularly true.

Local banks like Cayman National or Butterfield will generally give you a better rate than a hotel front desk. As of mid-January 2026, the rates have remained steady. Most banks will "buy" your USD cash at a rate of 0.82. So, for every US$100 you hand them, you get CI$82 back.

If you use a credit card, you’re usually better off. Most modern cards will process the transaction at the official 1.20 rate (or very close to it), though you should definitely check if your card has "foreign transaction fees." If it does, those 3% fees will eat up any gains you made on the exchange rate.

- Avoid the Airport: The booths at Owen Roberts International are convenient, but they often have the widest spreads.

- Pay in KYD: If a shop gives you the choice, pay in the local currency.

- Check the ATM: Local ATMs dispense KYD. Your home bank will do the conversion behind the scenes. Usually, this is the most efficient way to get cash, provided your bank doesn't hit you with massive out-of-network fees.

The "Hidden" 1.227 Rate

There is a bit of a "pro tip" detail that most tourists never see. CIMA actually uses a retail exchange rate of CI$1.00 = US$1.227 for certain over-the-counter sales of numismatic coins and specific government transactions. It’s a tiny nuance, but it shows that the "1.20" number isn't the only one in play.

Banks also have a "Sell" rate. If you have leftover Cayman Dollars at the end of your trip and want your US Dollars back, the bank will "sell" you those USD at a rate that usually works out to about 1.20. You'll always lose a couple of cents on both ends of the transaction. That’s just how the banks keep the lights on.

Practical Steps for Your Trip

To handle the cayman dollar to usd conversion like a local, follow this simple strategy. Carry a small amount of US cash for emergencies, but rely on a no-foreign-transaction-fee credit card for everything else. When you see a price in CI$, just multiply it by 1.2 in your head.

CI$10? That’s 12 bucks.

CI$50? That’s 60 bucks.

It’s a quick mental shortcut that keeps you from overspending. If you find yourself with a pocket full of Cayman coins on your last day, spend them. They are beautiful—look for the ones with the shrimp or the thrush bird—but they are nearly impossible to exchange once you leave the islands.

Before you head to the airport, check your bank's app to see if they have a partnership with any local Caymanian banks. Sometimes this can waive the ATM fees, which are often $5 or more per withdrawal on the island. Being prepared saves you enough for an extra round of drinks at Seven Mile Beach.