Managing your money shouldn't feel like a part-time job. Honestly, most of us just want to check if that direct deposit hit or move some cash into savings without jumping through a dozen digital hoops. If you’ve got the Chase app for iPhone, you're holding a pretty powerful piece of software, but I’ve noticed a lot of people barely scratch the surface of what it actually does. They log in, look at the balance, and log out. That's a waste.

It’s not just a window into your bank account; it’s basically a financial Swiss Army knife that Apple’s hardware makes even better.

The app currently sits with a massive rating on the App Store—over four million reviews and counting—which is wild when you think about how much people usually hate their banks. But there’s a reason for it. JPMorgan Chase has poured billions into their digital infrastructure. They aren't just trying to keep up with fintech startups like Chime or Monzo anymore; they’re trying to outpace them by blending old-school security with new-school features like FaceID integration and real-time fraud monitoring that feels almost psychic.

Why the Chase App for iPhone Beats the Browser Experience

Desktop banking is dying. It’s clunky. You have to deal with 2FA codes sent to your phone anyway, so why not just start on the phone? The Chase app for iPhone is built specifically for the iOS ecosystem, which means it uses the Secure Enclave for your biometric data. When you use FaceID to log in, that’s not Chase storing your face; it’s the app asking your iPhone if you’re actually you. It’s faster and, frankly, way more secure than typing a password on a laptop in a coffee shop.

I’ve talked to people who are scared to bank on their phones. They think if the phone gets stolen, the money is gone. That’s just not how it works. Chase uses 128-bit encryption, and because the app is siloed on iOS, it’s arguably the safest way to handle your business.

The Siri Shortcut You’re Not Using

Did you know you can actually use Siri to check your balances? Most people skip this because they think it's a gimmick. If you go into your iPhone settings and look at the Chase app permissions, you can set up shortcuts. You can literally ask your phone "Hey Siri, what's my balance?" while you're driving to the grocery store. It saves those ten seconds of fumbling with the app at the checkout counter when you're stressed about whether a check cleared.

👉 See also: How Long Does It Take To Get An EIN Number: What Most People Get Wrong

Zelle and the Death of the ATM

Cash is becoming a relic. If you’re still driving to an ATM to pay back a friend for dinner, you’re doing it wrong. The Zelle integration inside the Chase app is seamless. Because it’s baked directly into the "Pay & Transfer" tab, you don't need a separate app like Venmo.

Money moves fast. Often instantly.

One thing to watch out for, though—and this is a big one—is that Zelle transactions are usually final. Scammers love this. Chase has added more warnings lately, but you’ve got to be careful. Only send money to people you actually know. Don't use it to buy a "too good to be true" used car off a random internet stranger.

Deposit Checks Without Leaving Your Couch

The "QuickDeposit" feature is probably the best thing to happen to banking in twenty years. You just sign the back of the check, snap a photo of the front and back, and you're done.

Pro tip: Use a dark background. If you try to take a photo of a white check on a white kitchen counter, the app’s auto-capture will lose its mind. Put it on a dark wood table or a black mousepad. The contrast helps the iPhone's camera sensors find the corners of the check instantly. It saves you from that annoying "Unable to read image" error that makes you want to throw your phone across the room.

The "Wealth Plan" Tool Is Actually Useful

Most banking apps have these lame "budgeting" charts that don't really tell you anything. Chase’s "Wealth Plan" is different because it uses your actual spending history to project where you’ll be in ten years. It’s a bit sobering, to be honest.

You can input goals, like buying a house in 2028 or retiring by 60. The app looks at your current savings, your 401k (if you link it), and your spending habits. It’ll tell you if you’re on track. If the line graph turns red, you’re spending too much on DoorDash. It’s a reality check that fits in your pocket.

💡 You might also like: PNB Housing Share Price: Why Everyone Is Watching the Rs 1,000 Mark

Credit Journey: More Than a Score

You probably check your credit score once a month. Cool. But the Chase app for iPhone has this "Credit Journey" section that does a lot more than give you a number. It has a simulator. You can see what happens to your score if you pay off a specific credit card or if you take out a new loan.

It’s an educational tool masquerading as a bank feature. It also gives you alerts if your email address shows up on the dark web. That’s the kind of stuff people used to pay $15 a month for through services like LifeLock, but Chase just throws it in for free.

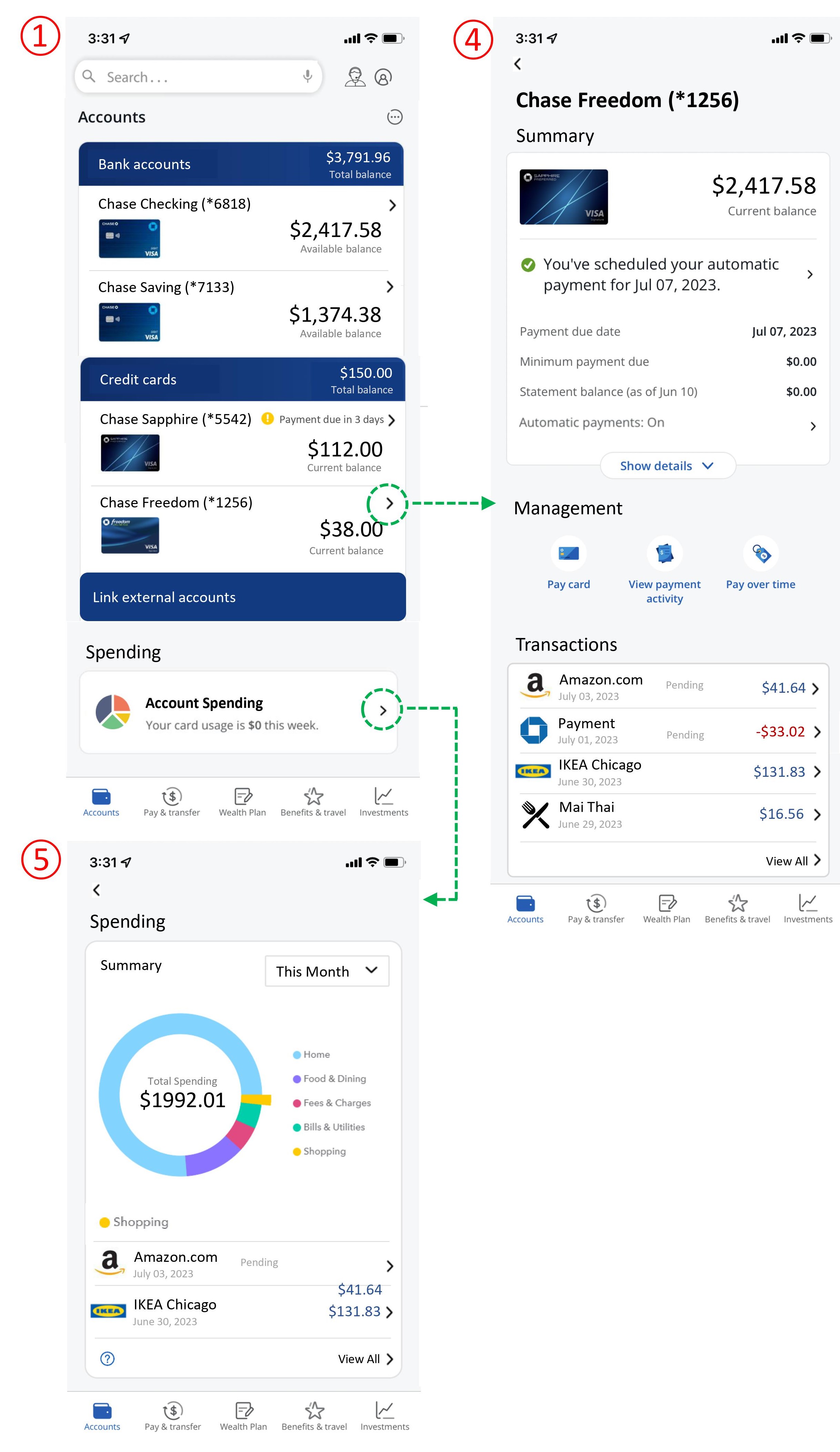

Managing Your Cards on the Go

We've all had that moment of panic. You're at a restaurant, you reach for your wallet, and your Sapphire Preferred isn't there.

Instead of calling customer service and waiting on hold for twenty minutes to cancel the card, you just open the app. Tap the card. Tap "Lock." Boom.

If you find it in the cushions of your sofa ten minutes later, you just unlock it. No harm done. You don't have to wait for a new card to arrive in the mail. This level of control is why the iPhone app feels like a remote control for your entire financial life.

Adding to Apple Wallet

This is a small detail, but the integration is slick. You can add a new Chase card to your Apple Wallet directly from the Chase app before the physical card even arrives in the mail. If you lose your wallet and order a replacement card on a Tuesday, you can be using that card via Apple Pay on your iPhone by Tuesday afternoon.

Digital Security in 2026

Cybersecurity isn't getting any easier. Chase has implemented something called "Privacy & Security" settings where you can see every third-party app that has access to your data. Think about all those random apps you linked to your bank account three years ago—budgeting apps, tax software, crypto exchanges.

You can go in there and revoke access with one tap. It’s a digital spring cleaning that most people completely ignore.

Real-World Actionable Steps

Stop using the app just to check your balance. To really get the most out of your iPhone's banking experience, do these three things right now:

- Set up Push Notifications for every transaction. Go to your profile, tap "Alerts," and turn on "Transactional Alerts." You'll get a ping the second your card is swiped. If someone steals your card number, you'll know before they even leave the store.

- Turn on "Travel Notifications" automatically. The app can use your iPhone's location to realize you’re in a different city, which prevents your card from getting declined when you're trying to buy dinner in London or Tokyo.

- Use the "Search" function for taxes. Stop scrolling through months of statements. You can search for "Internal Revenue Service" or "Target" or "Rent" and get a total for the year in seconds.

The Chase app for iPhone is basically a personal accountant that lives in your pocket. It’s fast, the UI is clean, and as long as you’re using the security features correctly, it’s the most efficient way to handle your money without ever having to step foot inside a physical bank branch again. Check your "Credit Journey" tonight—you might be surprised at what’s dragging your score down.