Walk into the control room of a modern Chinese "ultra-supercritical" plant and it doesn't look like a scene from the industrial revolution. It's quiet. Screens glow with real-time data. But outside, the scale of the operation is staggering. China operates more than 1,000 gigawatts of coal-fired capacity. That’s roughly half the world’s total. If you’ve been following the headlines, you've probably heard two conflicting stories. One says China is the global leader in green energy. The other says China coal power stations are being built at a record-breaking pace.

Both are true. It’s a paradox that drives climate scientists crazy.

Basically, China is building wind and solar faster than anyone else on Earth, but they aren’t ready to pull the plug on coal just yet. Why? Because the Chinese economy is built on a "stability first" mantra. When the lights went out in Sichuan back in 2022 due to a massive heatwave and drought, the government’s reaction was swift: more coal. They view it as the "ballast" of the energy system. It’s the insurance policy for when the sun doesn’t shine and the wind doesn’t blow.

🔗 Read more: Selling City Cast: What Most Media Buyers Get Wrong About Local Podcasting

The Massive Scale of China Coal Power Stations Today

We aren't talking about old, soot-belching chimneys from the 1970s. Well, some of those still exist, but the new wave is different. China is obsessed with efficiency. They’ve pioneered something called High-Efficiency Low-Emission (HELE) technology.

Most of the new China coal power stations use ultra-supercritical technology. This basically means they operate at such high temperatures and pressures that they get more electricity out of every lump of coal than a standard US or European plant. According to data from the Global Energy Monitor, China permitted the equivalent of two new coal plants per week in 2022 and 2023. That’s a lot of steel and concrete.

But here is the kicker: many of these plants aren't running at full capacity.

They are sitting idle or running at 40% or 50% "plant load factor." In the West, a coal plant that runs half the time is a financial disaster. In China, the state sees it differently. These plants are increasingly being used as "peaking" units. They sit there, ready to ramp up the second the grid feels the strain of an electric vehicle charging surge or a summer air conditioning spike. It’s an incredibly expensive way to run a grid, but for the Communist Party, a blackout is a political failure they cannot afford.

Why Does China Keep Building Them?

You’d think with the plummeting cost of solar, coal would be dead. Honestly, it's not that simple. The geography of China is a bit of a nightmare for engineers. Most of the wind and solar power is generated in the far west—think Xinjiang and Inner Mongolia. But the people and the factories? They’re in the east, in places like Shanghai, Shenzhen, and Guangzhou.

Moving that power across thousands of miles requires Ultra-High Voltage (UHV) lines. While China is a leader in UHV technology, the "grid friction" is real.

Local provinces also have a huge say. If you’re a provincial governor, a big coal plant is a guaranteed way to boost your GDP numbers. It creates jobs in construction, mining, and logistics. A wind farm? It’s great for the environment, but once it's built, it doesn't employ that many people. This local political pressure is a massive "hidden" driver behind why China coal power stations keep getting the green light even when the national government talks about "carbon peaking" by 2030.

The Technology: Ultra-Supercritical and Beyond

Let’s get nerdy for a second. The efficiency of a coal plant is measured by how much coal it takes to produce a kilowatt-hour of electricity. Old subcritical plants might use 360 grams. Modern Chinese ultra-supercritical plants are pushing that down toward 270 grams.

$Efficiency = \frac{W_{net}}{Q_{in}}$

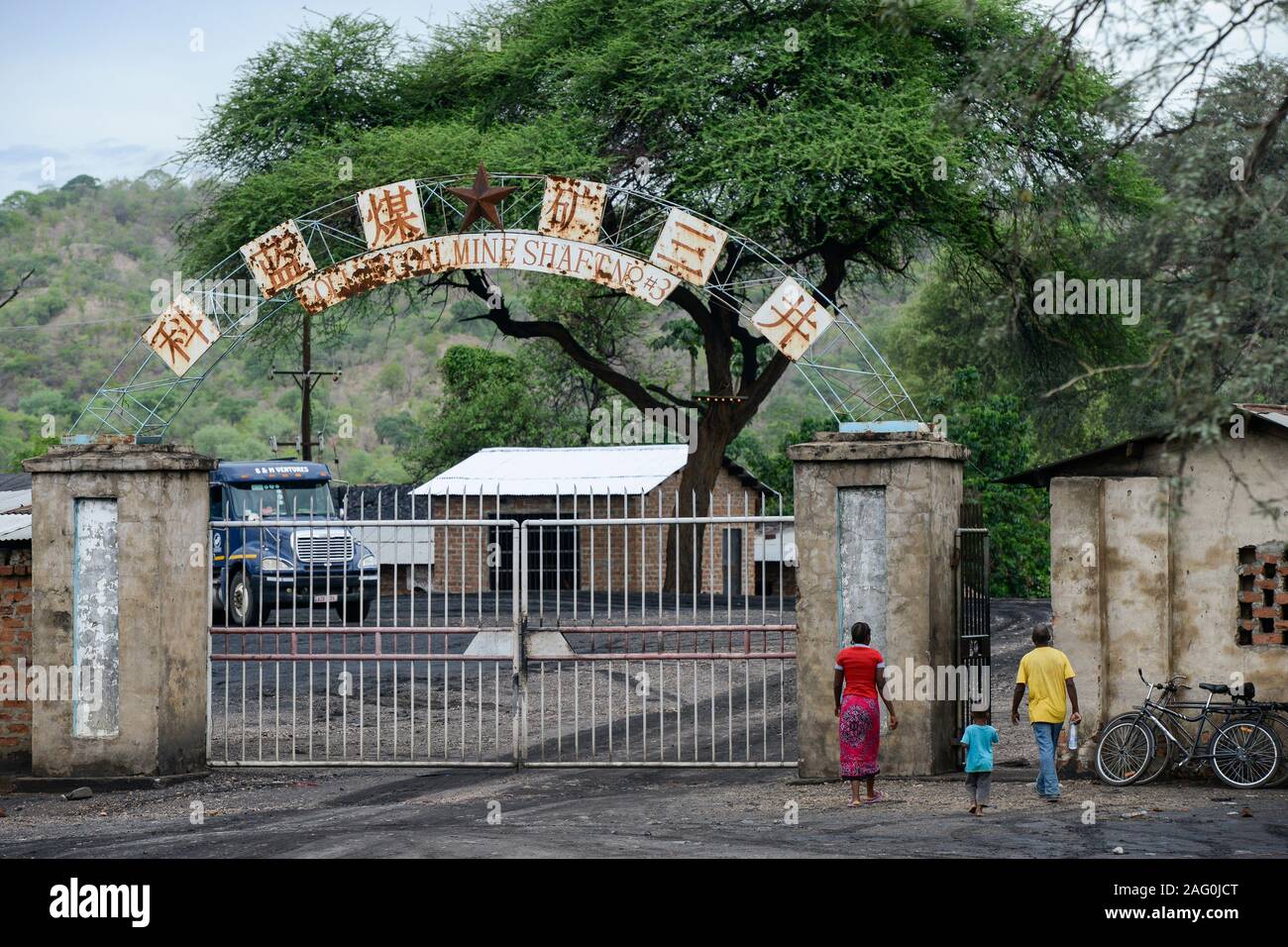

By raising the steam temperature to over 600°C, these plants achieve thermal efficiencies that were previously thought to be impossible. Companies like Shanghai Electric and Dongfang Electric are the titans here. They aren't just building these for China; they're exporting this tech to places like Pakistan and Indonesia through the Belt and Road Initiative.

However, "cleaner" coal is still coal. Even the most efficient plant in the world emits massive amounts of $CO_2$. While China is experimenting with Carbon Capture, Utilization, and Storage (CCUS) at projects like the Shengli Oilfield, the scale is tiny compared to the total emissions. The cost of capturing that carbon is still prohibitively high. Most experts, like those at the International Energy Agency (IEA), argue that CCS is a niche solution, not a get-out-of-jail-free card for the coal industry.

The Economic Impact on Global Markets

China’s hunger for coal dictates global prices. When China decided to ban Australian coal a few years back over a political spat, the ripple effects were felt everywhere from Newcastle to Rotterdam.

🔗 Read more: Henry Walser Funeral Home Kitchener: What Most People Get Wrong

Now, China is trying to boost domestic production to avoid being dependent on imports. They’re mining more coal than ever—over 4 billion tons a year. This massive internal supply chain keeps their electricity prices relatively stable, which is a huge competitive advantage for Chinese manufacturing. If you're wondering why your smartphone or your EV battery is made in China, cheap (albeit dirty) energy is a big part of the answer.

Common Misconceptions About China’s Energy Strategy

"China is ignoring its climate goals."

This isn't quite right. China is actually on track to hit its 2030 peak carbon goal early. The strategy is "build everything." They are building coal and renewables simultaneously. The hope is that once the renewable fleet is big enough, they can start mothballing the coal plants."Coal is cheap for China."

Not anymore. The cost of wind and solar in many Chinese provinces is now lower than the cost of coal power. The reason they keep coal is for "firmness" and grid reliability, not because it's the cheapest way to get a megawatt."All Chinese coal plants are the same."

Actually, the gap between a 30-year-old plant in a northern mining town and a new plant in a coastal tech hub is lightyears. China has been aggressively shutting down its smallest, most polluting "zombie" plants over the last decade.

The Future: The Long Goodbye to Coal?

Xi Jinping has pledged that China will start phasing down coal consumption starting in 2026. That’s a huge "if." To make it happen, the country needs to solve its energy storage problem. Battery technology is improving, but storing enough energy to power a city like Beijing through a week of cloudy, still weather is a gargantuan task.

We are seeing a massive shift toward "Long-Duration Energy Storage" and pumped hydro. But until those technologies can match the sheer "on-demand" power of a turbine spinning in a China coal power station, the chimneys will keep smoking.

🔗 Read more: QAR Riyal to USD: What Most People Get Wrong About the Peg

Actionable Insights for Observers and Investors

If you're looking at the energy landscape, don't just count the number of plants. That’s a rookie mistake. Look at the utilization hours. If the number of plants goes up but the hours they run goes down, that's actually a sign of an energy transition in progress.

- Watch the UHV lines: The faster China builds its "electricity highways" from West to East, the sooner coal becomes obsolete.

- Monitor Coal Prices in Qinhuangdao: This is the benchmark for Chinese coal. If prices stay high, the economic pressure to switch to renewables intensifies.

- Track Provincial Approval Data: If provinces like Guangdong and Shandong continue to approve new builds despite national rhetoric, it indicates internal friction in China's climate policy.

- Follow CCUS Pilot Projects: Keep an eye on the Guohua Jinjie carbon capture project. If they can make the economics work, coal might have a longer lease on life than people think.

The story of China’s coal is really the story of a nation trying to have its cake and eat it too. They want a green future, but they refuse to risk a dark present. Understanding this tension is key to understanding the global energy market for the next twenty years. It's a messy, complicated, and incredibly high-stakes transition that affects everything from the price of the goods in your shopping cart to the temperature of the planet.

For those tracking the sector, the real "pivot" point won't be a grand announcement at a climate summit. It will be the day a major Chinese province proves it can handle a peak-load winter without firing up its reserve coal units. Until then, coal remains the uncomfortable bedrock of the Chinese miracle.