You just started a new job. The HR person hands you a stack of digital paperwork, and there it is: the Form W-4. Most of us just want to breeze through it so we can get back to actually working, but if you mess up the section on how to claim dependents on W-4, your paycheck is going to look a little weird. Either you’ll get way too much taken out and "lend" the government interest-free money until April, or you’ll underpay and owe the IRS a massive, painful lump sum later.

Tax laws changed a few years ago. If you’re still looking for "allowances," you’re living in the past. The IRS got rid of those back in 2020. Now, it’s all about raw dollar amounts. It’s more accurate, sure, but it’s also kind of a headache if you haven't looked at the form in a while.

The Reality of Step 3

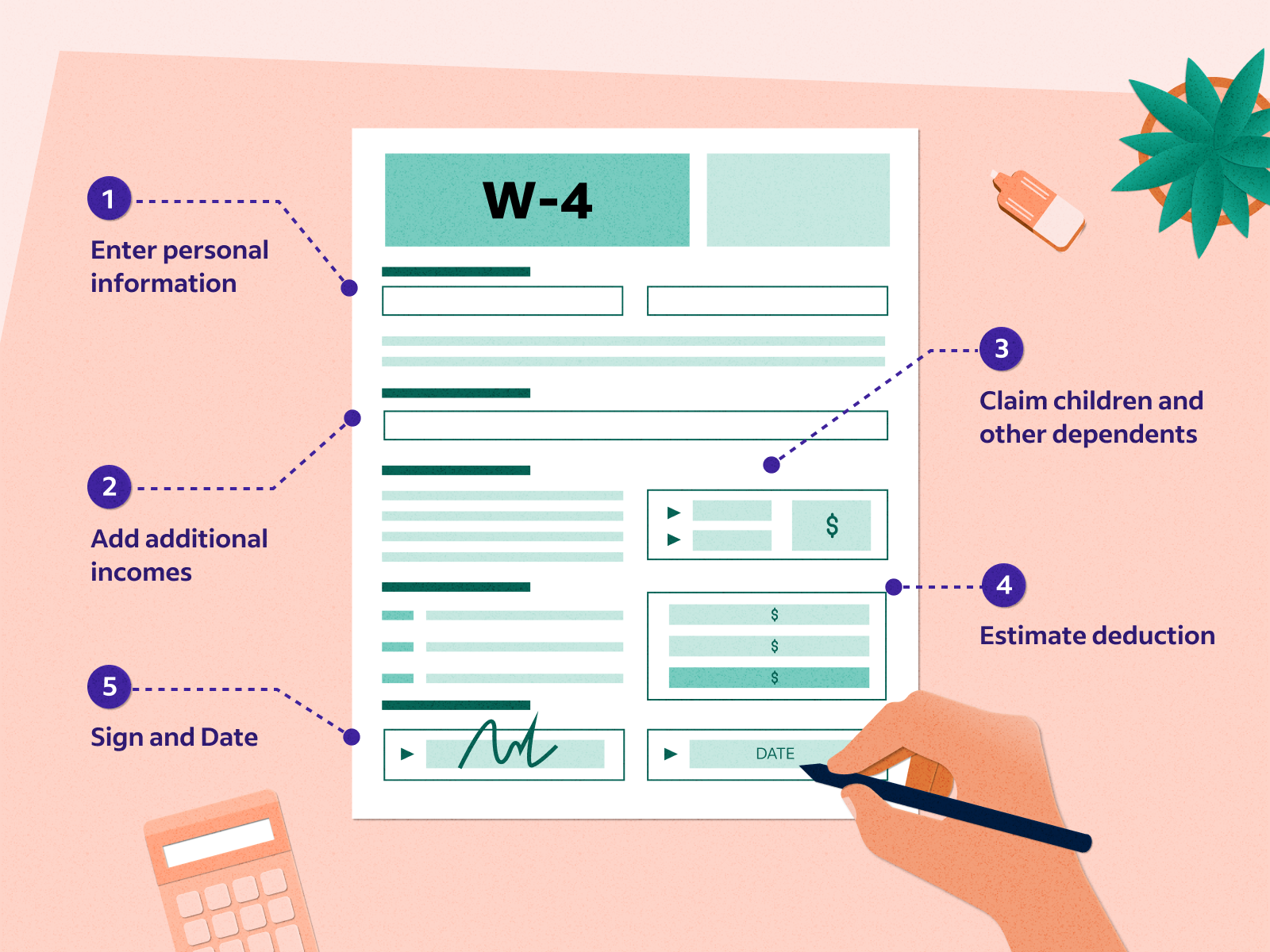

When you look at Step 3 on the W-4, it asks you to "Claim Dependents." This is where the magic happens. Or the tragedy, depending on your math skills. Basically, you’re telling your employer exactly how much your tax bill should be reduced based on the people you support.

For kids under 17, the math is simple on paper. You multiply the number of qualifying children by $2,000. If you have two kids, that’s $4,000. Easy. But wait. There’s a catch. You can only do this if your income is under $200,000 (or $400,000 if you’re filing jointly). If you make more than that, the credit starts to phase out.

Don't forget the "other" dependents. Think about your aging parents you support or that 19-year-old college student who still lives in your basement and eats all your cereal. Those folks are worth $500 each. It’s not as much as a toddler, but it adds up.

Why the $2,000 Figure Matters

The reason we use $2,000 is that it mirrors the Child Tax Credit. By putting this number on your W-4, you are essentially telling your employer, "Hey, don't take this much out of my check over the course of the year because the government already promised me this credit."

If you don't fill this out, your employer will withhold tax as if you have zero kids. You'll get a bigger refund in the spring, but your monthly take-home pay will be smaller. Some people like that. They treat the IRS like a forced savings account. Honestly? It's usually a bad move. With inflation being what it is, you're better off having that money in your own high-yield savings account or using it to pay down credit card debt month-to-month.

Who Actually Counts as a Dependent?

This is where people trip up. The IRS is very picky about who counts. You can't just claim your roommate because they're unemployed and you pay for the Netflix subscription.

To count a child, they have to be under 17 at the end of the calendar year. If your kid turns 17 on December 31st, guess what? They aren't a "qualifying child" for that $2,000 credit anymore. They drop down to the $500 "other dependent" category. It feels harsh, but that's the rule.

They also have to live with you for more than half the year. There are exceptions for kids away at college or situations involving divorced parents, but generally, the "half-year" rule is the gold standard.

The Support Test

Then there's the support test. The dependent cannot provide more than half of their own financial support. If your 16-year-old is a TikTok star making six figures, you probably can't claim them. They’re supporting themselves.

For "other" dependents, like an elderly parent, the rules are slightly different. They don't necessarily have to live with you, but you must provide more than half of their financial support, and their gross income has to be below a certain threshold (usually around $4,700-$5,000 depending on the specific tax year adjustments).

Common Mistakes with Multiple Jobs

If you have two jobs, or if you and your spouse both work, things get messy. How to claim dependents on W-4 becomes a game of coordination.

Never claim the same dependents on both W-4s. If you have two kids ($4,000 total credit) and you put $4,000 on your W-4 and your spouse puts $4,000 on theirs, you are essentially telling the IRS you have $8,000 in credits. You don't. You will severely under-withhold. When tax season rolls around, you’ll be staring at a massive bill and potentially underpayment penalties.

The IRS recommendation? Put the dependent credits on the W-4 for the highest-paying job. Leave Step 3 blank on the other one. This keeps the math clean and ensures the withholding is high enough to cover your actual liability.

✨ Don't miss: Joe Biden Worth in 2025: Why He's Not as Rich as You Might Think

What About Privacy?

Sometimes, people don't want their boss knowing they have six kids or a side hustle. It’s understandable. The W-4 is a public-facing document within your company’s payroll department.

If you want to keep your personal life private, you can technically leave Step 3 blank. This will result in more tax being taken out. You won't lose the money—you'll just get it back as a refund when you file your Form 1040 the following year. It’s a trade-off between privacy and cash flow.

Adjusting Throughout the Year

You aren't locked into your W-4. If you have a baby in June, you don't have to wait until next year to change your withholding. You can submit a new W-4 to your employer immediately.

In fact, you should probably check your withholding every time your life changes.

- Got married? Update it.

- Got divorced? Update it.

- Kid graduated and got a full-time job? Definitely update it.

The IRS has a "Tax Withholding Estimator" on their website. It’s actually pretty good. You plug in your recent pay stubs, and it tells you exactly what to put on each line of the W-4. It takes about 10 minutes, but it can save you thousands in "surprises" later.

Specific Examples for Real Life

Let's look at a couple of scenarios.

Example A: The Single Parent

Sarah has one child, age 5. She makes $60,000 a year. On her W-4, she should enter $2,000 in Step 3. Her employer will then reduce her annual withholding by $2,000, spreading that "savings" across all her paychecks.

Example B: The Dual-Income Family

Mark makes $80,000 and Elena makes $50,000. They have three kids under 17. Total credit: $6,000. Mark should put $6,000 on his W-4. Elena should put $0 on hers. They should also make sure to check the box in Step 2(c) if their salaries are somewhat similar, or use the Multiple Jobs Worksheet to be more precise.

Example C: Supporting an Adult Relative

James supports his mother, who lives in an assisted living facility. He pays for 70% of her expenses. She earns $3,000 a year from a small pension. James can claim her as an "other dependent." He should enter $500 in Step 3.

The Pitfalls of "Head of Household"

Claiming dependents often goes hand-in-hand with the "Head of Household" filing status. To claim this on your W-4 (Step 1, box c), you must be unmarried and pay more than half the cost of keeping up a home for yourself and a qualifying person.

This status gives you a higher standard deduction and more favorable tax brackets. But be careful. If you’re living with a partner and you both contribute to the rent, only one of you (at most) can be the Head of Household. You can't both claim it for the same home.

Final Steps for Getting It Right

If you’re still staring at the form and feeling a bit paralyzed, don't overthink it. The goal is to get as close to your actual tax liability as possible.

- Count your "Child Tax Credit" eligibles. These are kids under 17. Multiply by $2,000.

- Count your "Other" dependents. These are older kids, relatives, or qualifying friends. Multiply by $500.

- Sum them up. Put that total in Step 3.

- Coordinate with your spouse. If you both work, only one of you should claim the total amount to avoid underpaying.

- Use the IRS Estimator. If your tax situation involves stocks, rental property, or self-employment income, the basic W-4 math isn't enough. Use the online tool.

The most important thing to remember is that the W-4 is a tool for you to control your money. Don't let the technical jargon intimidate you. If you realize you made a mistake, just hand your HR person a new form next week. There’s no limit on how many times you can update it.

Check your pay stub after you make a change. Look at the "Federal Income Tax" line. If it didn't move, or if it moved in a way that doesn't make sense, talk to a tax pro or your payroll department. It's better to fix a small error in February than a $5,000 disaster in April.

Take your time. Read the instructions on the form carefully. Keep a copy for your records so you remember what you did when you finally sit down to do your taxes next year.