Honestly, if you look at your bathroom shelf right now, there is a better-than-even chance a red tube is sitting there. That ubiquitous presence is exactly why people treat Colgate Palmolive India stock price like a boring utility bill—something that just exists, unchanging and safe. But if you’ve been watching the charts lately, you’ll know it’s been anything but boring.

The stock has been doing a weird dance. One day it's a defensive hero, the next it’s sweating over rural demand or a GST shake-up. As of mid-January 2026, the price is hovering around ₹2,104, which is a far cry from its 52-week high of ₹2,975.

If you're wondering why a company that literally owns the mouth of the Indian consumer is seeing its stock take a 20% haircut over the last year, you aren't alone. It’s a mix of math, toothpaste, and some very stubborn economic trends.

The GST Shock Nobody Saw Coming

Everyone talks about "market sentiment," but let’s talk about the actual plumbing of the business. Recently, the Indian government dropped the GST on oral care products from 18% to 5%. On paper? Amazing. Lower taxes should mean cheaper toothpaste and more sales.

In reality, it created a massive mess for the short term.

Distributors and retailers aren't exactly fans of holding stock they bought at high tax rates when the new stuff is suddenly cheaper. It led to a temporary "destocking" where everyone just stopped buying from the company for a minute to clear out old inventory. This hit the Q2 FY26 numbers hard. Net sales dropped about 6.3% year-on-year, landing at ₹1,507 crore.

✨ Don't miss: KO Stock Price Dividend: Why Most People Get It Wrong

Profit also took a tumble, sliding over 17% to ₹327 crore. When the market sees double-digit profit dips in a "safe" FMCG stock, people panic-sell. They forget that this is a transition pain, not a fundamental "people stopped brushing their teeth" problem.

Urban Slowdown vs. The Rural Rebound

There is a weird narrative going around that urban India is the only place that matters for premium brands. But right now, urban demand is actually looking a bit sluggish.

The middle class in the big metros is feeling the pinch of inflation. Suddenly, that fancy ₹300 whitening toothpaste feels like an easy place to save a few bucks. On the flip side, the company is betting big on the "bottom of the pyramid."

They are pushing hard into Tier 2 and Tier 3 cities where people are still switching from tooth powder or "unbranded" options to proper toothpaste.

- The ₹10-20 price point: This is where the war is won.

- The E-commerce Surge: Even if the local kirana store is seeing fewer feet, the digital carts on Blinkit and Zepto are filling up. Colgate actually gained 500 basis points in e-commerce market share recently.

- Herbal Wars: You can't talk about Colgate without mentioning Patanjali or Dabur. The "natural" segment isn't a fad anymore; it's a permanent front in the war for the Indian sink.

The Dividend Safety Net

If you’re a "buy and hold" type, the stock price movement is only half the story. Colgate is a cash machine. They don't have massive factories to build every year, so they give a lot of that money back.

The dividend yield is currently sitting around 2.4%. That doesn't sound like much until you realize they’ve been paying uninterrupted dividends since before most of us were born (well, since 1895 globally, and for decades in India). In late 2025, they declared an interim dividend of ₹24 per share.

💡 You might also like: Sarah Wright State Farm: Why Most People Get Their Coverage Wrong

For a lot of institutional investors, this makes the stock a "bond proxy." When the market gets volatile, they park money here because they know the dividend check is coming, regardless of what the Nifty 50 is doing.

Is the Valuation Actually Fair?

Let’s be real: Colgate is never "cheap."

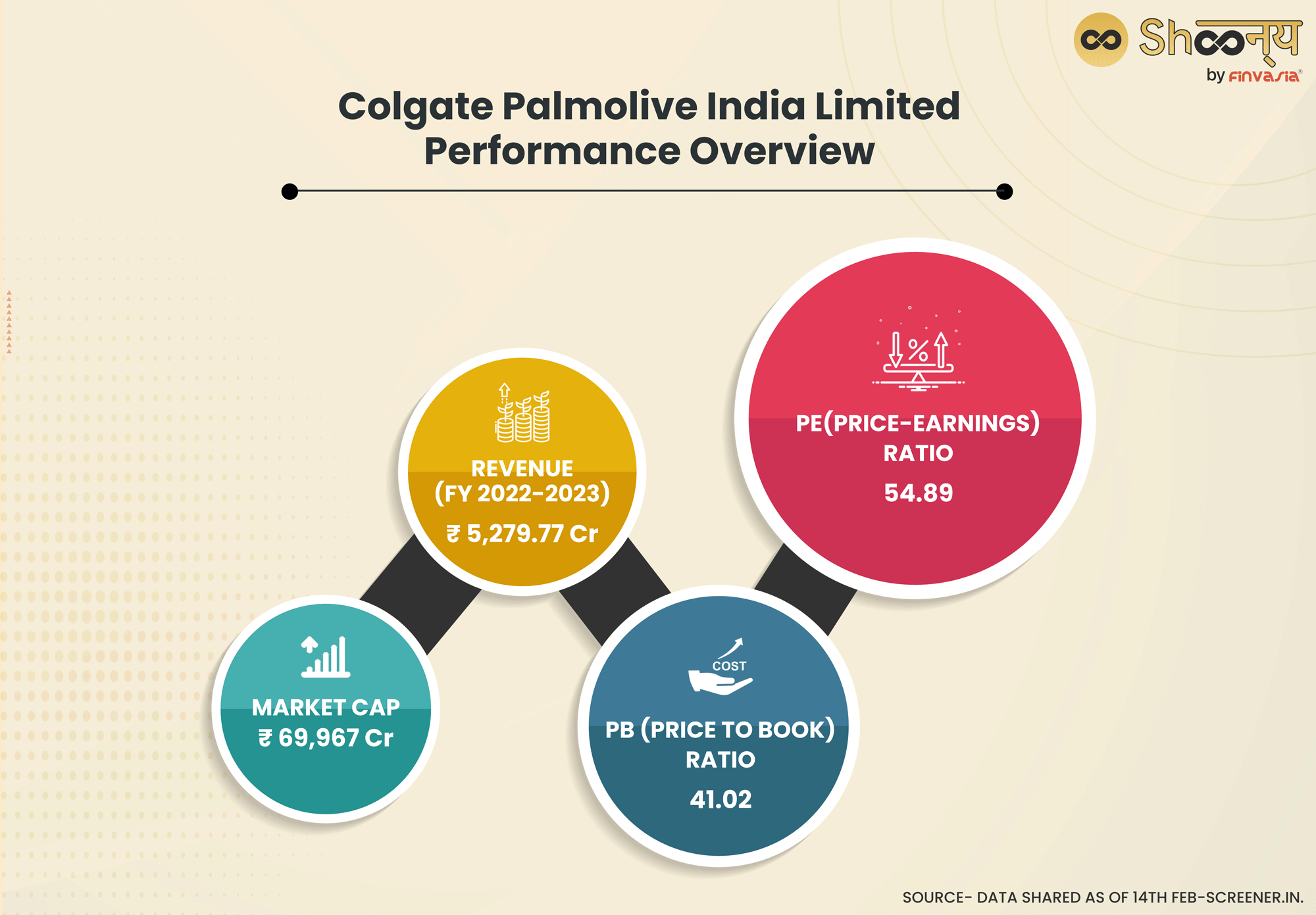

The Price-to-Earnings (P/E) ratio is currently around 43. For a company growing its top line in the single digits, that looks expensive. If you compare it to a tech company, it's insane. But you aren't paying for explosive growth; you're paying for a 50%+ market share.

Some analysts, like those at JP Morgan, have actually been raising price targets for the parent company, which usually trickles down into positive sentiment for the Indian arm. Locally, views are split. You have some brokerages giving it a "Strong Buy" with targets near ₹3,100, while others are shouting "Sell" because they think the urban slowdown will last longer than expected.

👉 See also: Ipca lab stock price: What most people get wrong about this pharma giant

The truth probably lies in the middle. The stock is currently trading near its 52-week low of ₹2,033. Historically, when Colgate hits these levels, it finds a "floor" because the valuation starts looking attractive to long-term value funds.

What Really Matters for the Next Six Months

If you're holding the stock or thinking about it, keep your eyes on the Q3 and Q4 results of FY26.

The management is basically promising a "gradual recovery" now that the GST disruption is in the rearview mirror. They are leaning heavily into premiumization—stuff like the Colgate Visible White Purple toothpaste. Why? Because the margins on whitening products are significantly higher than the basic calcium carbonate tubes.

Also, watch the monsoon. I know it sounds cliché, but rural India's ability to buy toothpaste depends on crop yields. If the rural recovery picks up, the volume growth will follow.

Actionable Insights for Investors

If you're looking at the Colgate Palmolive India stock price today, don't just stare at the red and green candles. Start by checking the sequential (quarter-on-quarter) volume growth in the next earnings report; if volumes are rising even if revenue is flat, the "real" demand is back.

You should also monitor the delivery percentage on the NSE. High delivery usually means big players are accumulating the stock at these lower levels rather than just day-trading it. Lastly, use the current dip to evaluate your portfolio's defensive balance—Colgate rarely makes you a millionaire overnight, but it rarely lets your portfolio go to zero either.

Check the next dividend record date, likely in mid-2026, to ensure you're eligible for the next payout if you decide to jump in.