You’ve probably never stepped foot inside a physical branch of Community Federal Savings Bank (CFSB). Honestly, most people haven't. Based out of Woodhaven, New York, it looks like your typical, unassuming community bank on the surface. But if you’ve ever used a fintech app, transferred money internationally via a popular digital platform, or used a prepaid card, there is a massive chance you’ve already done business with them.

They are the "bank behind the curtain."

While big-box banks like Chase or Bank of America spend billions on Super Bowl ads and naming rights for stadiums, CFSB has taken a radically different path. They found a niche. A big one. They’ve basically become the plumbing for the digital economy.

The CFSB Identity Crisis (That Isn't Really a Crisis)

If you Google Community Federal Savings Bank, you’ll see it’s a federal savings bank chartered by the Office of the Comptroller of the Currency (OCC). It’s legit. It’s FDIC-insured. But the confusion starts when people look at their bank statements and see "CFSB" next to a transaction they don't recognize.

"I don't have an account there," is the common refrain on Reddit threads and consumer forums.

Here is the deal: CFSB specializes in Banking as a Service (BaaS). They partner with fintech companies that have great apps but don't have their own banking licenses. When you use a service like Wise (formerly TransferWise), Revolut, or even certain payroll platforms, CFSB is often the one actually holding the funds or processing the ACH transfer. They provide the regulatory umbrella and the connection to the Federal Reserve that a startup in Silicon Valley simply doesn't have.

It’s a smart business model. While other local banks were struggling to compete with national chains for mortgage loans, CFSB leaned into the tech boom. They aren't just a "small town bank" anymore; they are a critical node in the global financial network.

Why Fintechs Flock to This Woodhaven Bank

Fintech is hard. Regulators are, understandably, very picky about who gets to move money around. For a new app to launch a spending account, they have two choices. One, they can spend five years and millions of dollars trying to get their own bank charter. Two, they can partner with an existing institution.

CFSB became the go-to partner because they were early to the game.

They understood the tech. They didn't freak out when a developer talked about APIs or real-time ledger updates. Most traditional bankers hear the word "crypto" or "neobank" and run for the hills. CFSB saw an opportunity to grow their deposits without needing to build a thousand physical branches. It’s lean. It’s efficient. It’s also why you see their name on everything from government payment disbursements to international wire transfers.

The ACH Powerhouse

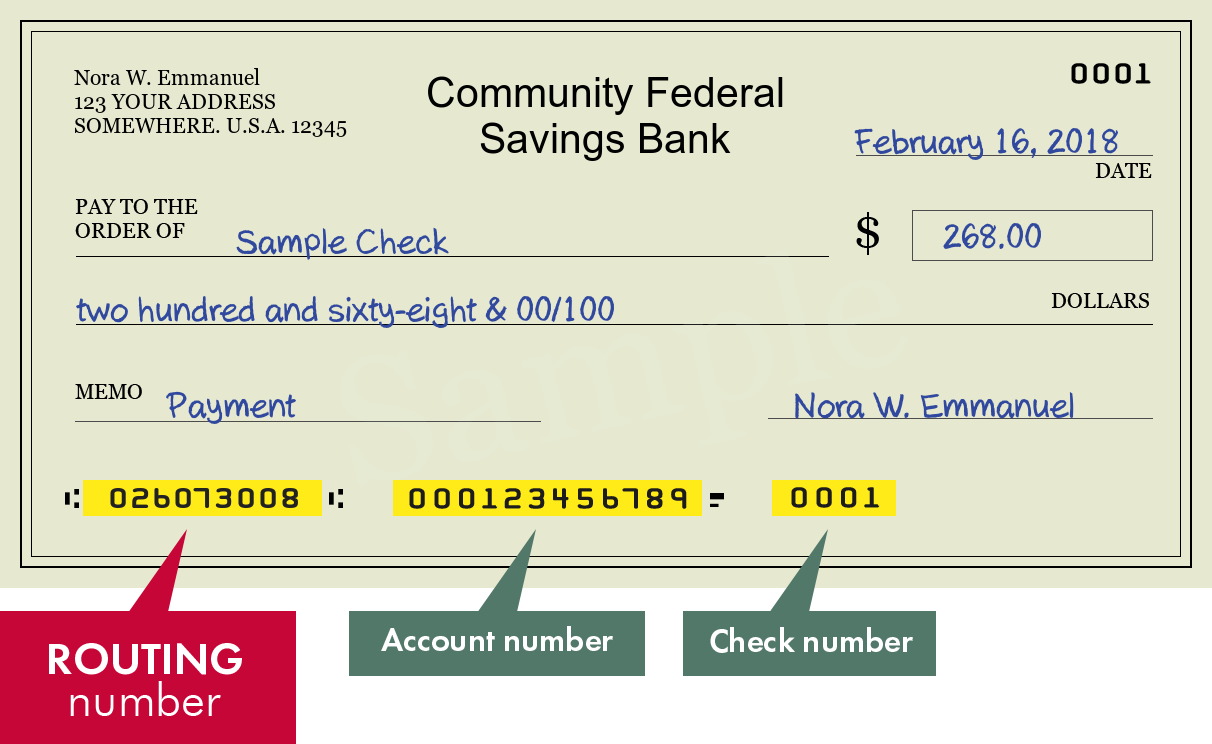

A huge chunk of what CFSB does involves the Automated Clearing House (ACH) network. When you get paid via direct deposit, that's an ACH transfer. When you pay your electric bill online, that's an ACH transfer. CFSB acts as an Originating Depository Financial Institution (ODFI).

Because they work with so many third-party payment processors, they handle a volume of transactions that would make other banks of their size dizzy. It’s not just about holding money; it’s about moving it. Fast. And according to the rules.

Is Your Money Safe with CFSB?

Short answer: Yes.

Because they are a federally chartered savings bank, your deposits are insured by the FDIC up to $250,000. That’s the gold standard. Even if the fintech app you use—the "pretty" interface on your phone—goes belly up, the money held in the underlying CFSB account is protected by the federal government.

However, there is a nuance here that people often miss.

The relationship is between you and the fintech, and then the fintech and the bank. If you have an issue with a transaction, calling CFSB’s Woodhaven branch probably won't help you much. They don't have access to your individual app settings or your "User123" profile. You still have to deal with the customer support of the app you're using. CFSB provides the vault and the rails; the fintech provides the customer service.

Common Red Flags and "CFSB" Scams

Because CFSB is so prolific in the digital space, their name often shows up in places people don't expect. This has led to some anxiety.

Sometimes, people see a "CFSB" credit on their statement and think it’s a mistake or a scam. Often, this is just a tax refund, a government stimulus check, or a rebate that was processed through one of their partners. If you used a tax prep software like TurboTax or H&R Block, they frequently use intermediary banks like CFSB to handle the refund disbursement.

But—and this is a big "but"—scammers also know that CFSB is a common name in the financial world.

- Ghost Transfers: If you see a withdrawal you didn't authorize, report it to your primary bank immediately.

- Verification Codes: Never give a "CFSB verification code" to someone over the phone. No bank will ever ask for that.

- Employment Scams: Some fake "work from home" jobs will send you a check from a CFSB account and ask you to buy equipment. These are almost always fraudulent.

The bank itself is solid. The players using the bank's "rails" can vary in quality. Always vet the app or service you are actually interface with.

📖 Related: Check New Jersey Refund Status: Why Yours Might Be Taking So Long

The Future of Community Banking

What CFSB is doing is essentially a blueprint for how small banks survive in 2026 and beyond. The days of relying solely on local car loans and checking accounts are dying. By becoming a "utility" for the broader tech industry, they've ensured their relevance.

They aren't trying to be the coolest brand on the block. They don't care if you know their name. They care that the transaction clears. In a world of flashy startups and volatile "fin-fluencers," there is something deeply comforting about a boring, regulated bank in Queens doing the heavy lifting.

It’s the ultimate pivot. A neighborhood bank turned global engine.

How to Handle a CFSB Transaction on Your Statement

If you’ve found yourself here because of a mysterious line item on your bank statement, don't panic. Follow these steps to figure out what happened:

- Check your digital wallets. Did you recently add money to Venmo, CashApp, or Wise? Did you receive a payout from a selling platform like eBay or Etsy?

- Look at your tax returns. If it's tax season, look for "CFSB" or "Tax Refund" identifiers. They are a major player in refund processing.

- Identify the amount. Often the exact dollar amount is the best clue. Match it against your recent receipts.

- Contact the merchant first. If the charge is linked to a specific service, call that service’s support line before calling the bank. They will have the transaction logs.

- File a formal dispute. If you genuinely don't recognize it and can't find a link to any of your apps, treat it as fraud and contact your own bank's fraud department to initiate a chargeback.

Understanding the role of Community Federal Savings Bank helps demystify the modern financial landscape. They aren't trying to hide; they're just working in the background so your apps work the way they’re supposed to. It’s complex, it’s a bit messy, but it’s how the money moves now.

Actionable Insights for Consumers

If you are a business owner looking for a partner for a new tech venture, CFSB is a name you should have on your shortlist for BaaS providers, alongside others like Coastal Community Bank or Cross River. For the average consumer, the best move is to maintain a list of which "underlying banks" your favorite apps use. This makes it much easier to audit your finances at the end of the month and prevents "statement shock" when an unfamiliar acronym pops up. Keep your fintech apps updated and always enable two-factor authentication, because while CFSB secures the vault, you are the one who holds the key to the front door of your app.