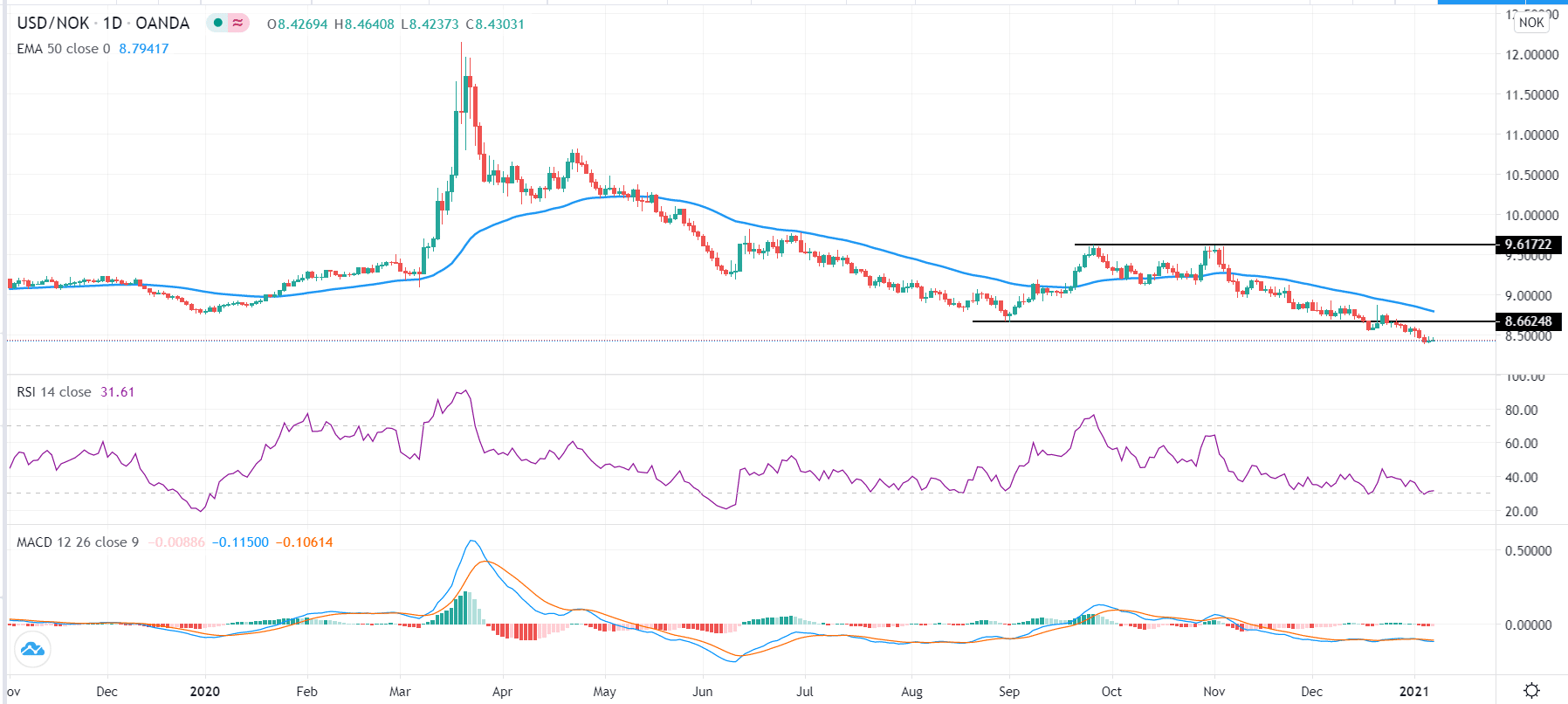

You’re looking at the screen, watching those tiny green and red numbers flicker, and wondering if today is the day to pull the trigger on that transfer. Honestly, the conversion rate NOK to USD is one of those things that looks simple on a Google search but is actually a chaotic mess of oil prices, central bank stubbornness, and global jitters.

If you're sitting on a pile of Norwegian kroner or planning a trip stateside, you've probably noticed the krone hasn't exactly been a powerhouse lately. It’s been a rough ride for the "Petro-currency."

The Oil Ghost in the Machine

Norway basically floats on oil. It’s the country's biggest export, making up over half of its total sales to the world. Because of this, the conversion rate NOK to USD usually moves in lockstep with Brent crude prices. When oil prices dip, the krone tends to face-plant.

Interestingly, experts like those at SEB Research have pointed out an annoying asymmetry: the NOK reacts much more violently to oil prices dropping than it does to them rising. It’s like the currency is looking for any excuse to weaken. Right now, in early 2026, Brent crude is hovering around $60 a barrel. That’s not "panic" territory, but it’s certainly not high enough to send the NOK skyrocketing against a dollar that still feels like the safest house in a bad neighborhood.

Why Norges Bank is Playing Hardball

You’d think with the krone being so weak, the folks at Norges Bank would be panicking. Not quite. Governor Ida Wolden Bache has been pretty clear: they aren't in a hurry.

As of January 2026, the Norwegian policy rate is sitting at 4.00%. Compare that to the U.S. Federal Reserve, which just shaved its rate down to a range of 3.50% to 3.75% in December 2025. Usually, higher interest rates in Norway should attract investors and boost the krone. But because inflation in Norway is still "sticky"—running around 3%—the central bank is keeping rates high to cool things down.

Here’s the kicker: markets are betting that Norges Bank won't even think about a rate cut until summer 2026. Meanwhile, the Fed is expected to cut at least once more by the end of March. This "rate spread" should favor the NOK, but global investors are still obsessed with the U.S. dollar's liquidity.

The Real Numbers Right Now

If you checked the rate this morning, you probably saw something around 0.099 USD for 1 NOK.

To put that in perspective:

- 100 NOK gets you about $9.91.

- 1,000 NOK is roughly $99.06.

- 10,000 NOK lands you just under $991.

Just a year ago, in early 2025, the rate was closer to 0.087. So, the krone has actually clawed back some ground, but it’s still a far cry from the "golden era" when your 100-kroner bill felt like it was worth a lot more in a New York deli.

The "Safe Haven" Trap

Why is the USD so stubborn? Well, the U.S. economy is currently projected to grow at 2.3% in 2026, which is actually faster than most of Europe. When the world feels "weird"—whether it's because of trade tariffs or geopolitical drama—everyone buys dollars.

Bank of America analysts are actually somewhat bullish on the NOK for the rest of 2026, predicting it could strengthen toward 9.26 NOK per 1 USD (which would be about 0.108 USD per 1 NOK). They’re banking on a rebound in global growth and a potential cooling of the dollar’s "war-chest" status. But that’s a big "if."

🔗 Read more: NUE Stock Price Today: Why Nucor Just Hit a Fresh High

Common Pitfalls When Converting

Most people make the mistake of looking at the "Mid-Market Rate" on Google and thinking that’s what they’ll get at the bank. Spoiler: it isn't.

Banks and airports take a massive "spread." If the official conversion rate NOK to USD is 0.099, a retail bank might only give you 0.094. You’re essentially paying a 5% "lazy tax" for the convenience.

Actionable Steps for Your Money

If you’re managing a significant amount of money between Norway and the U.S., stop using traditional banks.

🔗 Read more: Images of Human Resource Management: Why Stock Photos Are Killing Your Culture

- Use a Specialist: Services like Wise or Revolut use the real mid-market rate and charge a transparent fee. It can save you hundreds on a single house payment or large purchase.

- Watch the 22nd: Norges Bank has their next big interest rate announcement on January 22. If they sound even slightly "dovish" (meaning they might cut rates sooner), expect the NOK to dip. If they stay "hawkish" (keeping rates high), the NOK might see a small rally.

- Don't "Time" the Bottom: Unless you’re a professional forex trader, trying to catch the absolute peak of the krone is a fool's errand. If the rate is near 0.10, that’s historically a decent exit point compared to the lows of 2024.

- Consider the Oil Tax Effect: Norges Bank buys and sells kroner to manage the government's oil tax revenues. These "daily NOK purchases" are expected to increase slightly in 2026, which provides a bit of an artificial floor for the currency’s value.

The bottom line? The conversion rate NOK to USD is currently caught in a tug-of-war. You have high Norwegian interest rates pulling it up, but shaky oil prices and a dominant U.S. economy pulling it down. If you need to move money, doing it in smaller batches over the next few months might be smarter than betting the farm on a single day's rate.