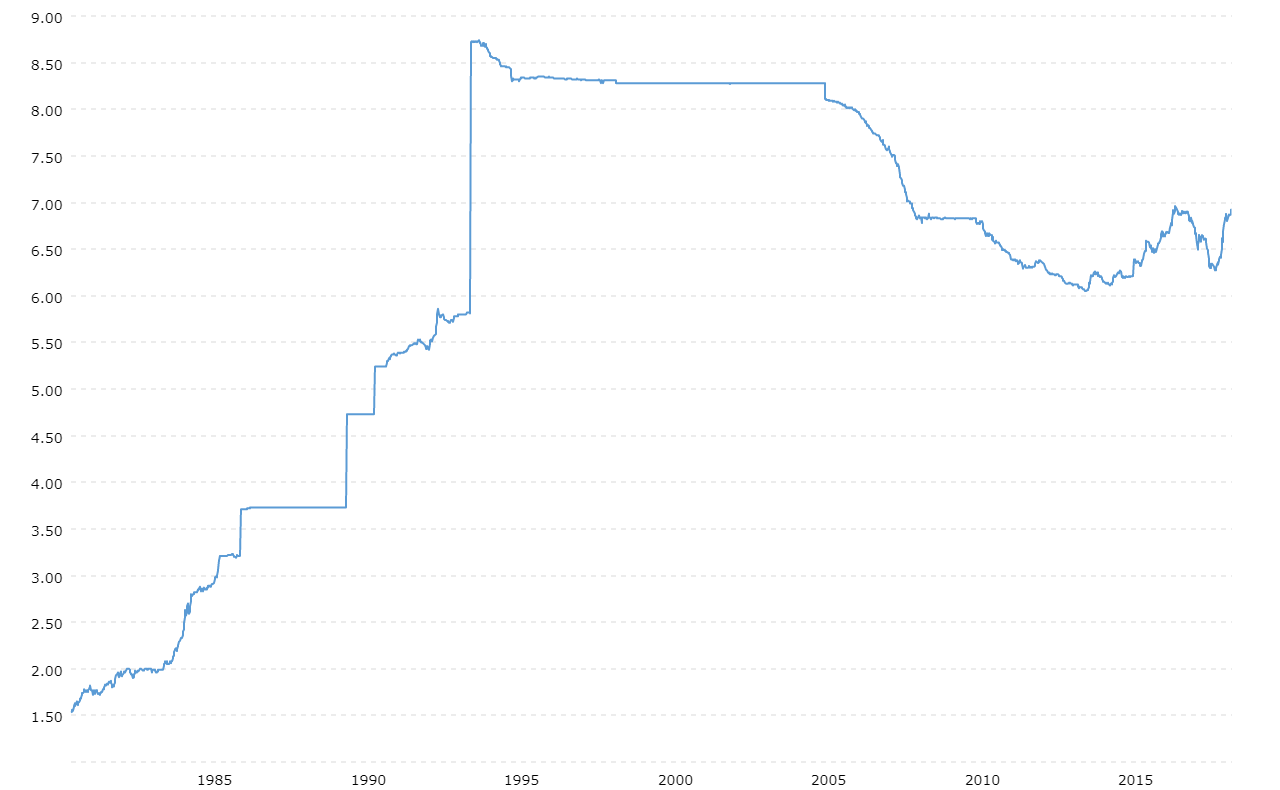

Money is moving. If you’ve been watching the conversion rate yuan to dollar lately, you’ve probably noticed the vibe shifted. Big time. After years of the Chinese Yuan (CNY) feeling like it was stuck behind a wall, it finally punched through the psychological floor of 7.00 against the US Dollar.

It happened right at the tail end of 2025. Now, in mid-January 2026, we’re looking at a rate hovering around 6.97.

Why does this matter? Honestly, because for the last few years, everyone was betting on the Yuan getting weaker. Now, the smart money is betting on it getting stronger. It’s a 180-degree flip that affects everything from your Temu bill to the global price of a barrel of oil.

The Reality of the Yuan Breaking 7.00

For a long time, the "7 mark" was the line in the sand. If the dollar was worth more than 7 Yuan, China’s exports were cheap and the world was happy to buy. But as of January 17, 2026, the spot rate has dipped to roughly 6.9688.

Basically, your dollar doesn't go quite as far in Shenzhen as it did last summer.

This isn't just some random market wiggle. It’s the result of a massive trade surplus—about $1.2 trillion in 2025—that has left China swimming in foreign cash. When you have that much "extra" money coming in, your currency naturally wants to go up. The People's Bank of China (PBOC) has been trying to play it cool, but you can only hold back a tidal wave with a bucket for so long.

What’s driving the rate right now?

- The Yield Gap is Shrinking: The US Federal Reserve is finally cutting rates faster than the PBOC. When US interest rates drop, the "carry trade" (where people borrow cheap and invest where it's expensive) starts to favor the Yuan.

- The "Busan De-escalation": Remember that meeting between Xi and Trump in Busan back in October? It actually worked. The trade war cooled down, and markets breathed a sigh of relief, which usually helps the Yuan.

- De-dollarization is Real: It’s not just a conspiracy theory anymore. Over 30% of China’s $6 trillion trade is now settled in Yuan. When countries don't need dollars to buy Chinese goods, demand for the dollar slips.

Conversion Rate Yuan to Dollar: What You’ll Actually Pay

Look, the "mid-point" rate you see on Google or XE isn't what you get at the airport or when you wire money. That’s the interbank rate.

✨ Don't miss: Convert Chinese Yuan to AUD: What Most People Get Wrong

If you're converting $1,000 into Yuan today, you aren't getting 6,968 CNY. You’re probably getting closer to 6,700 after the bank takes its "convenience" cut.

The PBOC sets a daily "fixing" rate. They allow the Yuan to trade within a 2% band of that number. Lately, they’ve been setting the fix higher than the market expects. That’s their way of saying, "Whoa, slow down, we don't want the Yuan getting too strong too fast." They want stability. They hate surprises.

The Two Different Yuans (CNY vs. CNH)

You might see two different tickers and get confused.

- CNY: This is the onshore Yuan. It’s what’s used inside mainland China. It’s heavily controlled.

- CNH: This is the offshore Yuan, traded in places like Hong Kong and London.

Usually, they’re pretty close. But when things get spicy—like right now—the CNH tends to move first. If the CNH is much stronger than the CNY, it’s a signal that the global market thinks the conversion rate yuan to dollar is headed even lower (meaning a stronger Yuan).

Why This Isn't Just "Good News" for Everyone

A stronger Yuan is a double-edged sword.

👉 See also: Tesla Share Prices Today: Why the Market is Ignoring the Noise

If you’re a US importer, your costs just went up. Those lithium batteries or plastic parts are now 3-5% more expensive than they were six months ago.

Inside China, a strong currency makes imports cheaper, which sounds great, but it also fuels deflation. If prices keep falling in China, people stop spending because they’re waiting for things to get even cheaper. That’s a nightmare for an economy trying to grow at 4.5% or 5% this year.

Goldman Sachs actually raised their growth forecast for China to 4.8% for 2026 because of strong exports, but a runaway Yuan could trip that up.

How to Get the Best Rate Today

If you actually need to move money, don't just click "send" on your banking app.

Standard banks usually charge a spread of 3% or more. On a $10,000 transfer, you're literally handing them $300 for nothing. Specialized fintech platforms or "neobanks" usually give you a rate much closer to the mid-market.

Also, watch the clock. The PBOC releases its daily fix at 9:15 AM Beijing time. Markets usually go nuts for thirty minutes right after that. If you can wait for the afternoon lull in the Shanghai market, you’ll often find a slightly more stable spread.

Looking Ahead: Where is the Yuan Going?

Most analysts, including those at ING and JPMorgan, are eyeing a fluctuation band between 6.85 and 7.25 for the rest of 2026.

We’re likely in a period of "two-way fluctuation." The days of the Yuan only going down are over. But the PBOC won't let it turn into a rocket ship either. They need to protect their exporters while also making the Yuan look like a credible global currency.

If you're planning a trip or a business deal, the "new normal" is a Yuan that sits comfortably under that old 7.00 ceiling.

Actionable Next Steps

- Check the "Fixing": Before any major transaction, check the PBOC daily reference rate. If the market rate is way off the fix, expect a correction soon.

- Compare Spreads: Use a comparison tool to see the "all-in" cost of your conversion, including hidden fees in the exchange rate itself.

- Hedge if Necessary: If you’re a business owner, consider a forward contract. Locking in a rate of 6.95 might feel annoying if it goes to 7.05, but it’s better than getting caught at 6.80.

- Watch the Fed: The biggest mover of the conversion rate yuan to dollar isn't always in Beijing. It’s in Washington. If the US Fed pauses its rate cuts, the Dollar will claw back some ground immediately.

The bottom line? The Yuan is playing a different game now. The psychological barrier is broken, and the floor has become the new ceiling. Keep your eyes on the data, not the headlines.