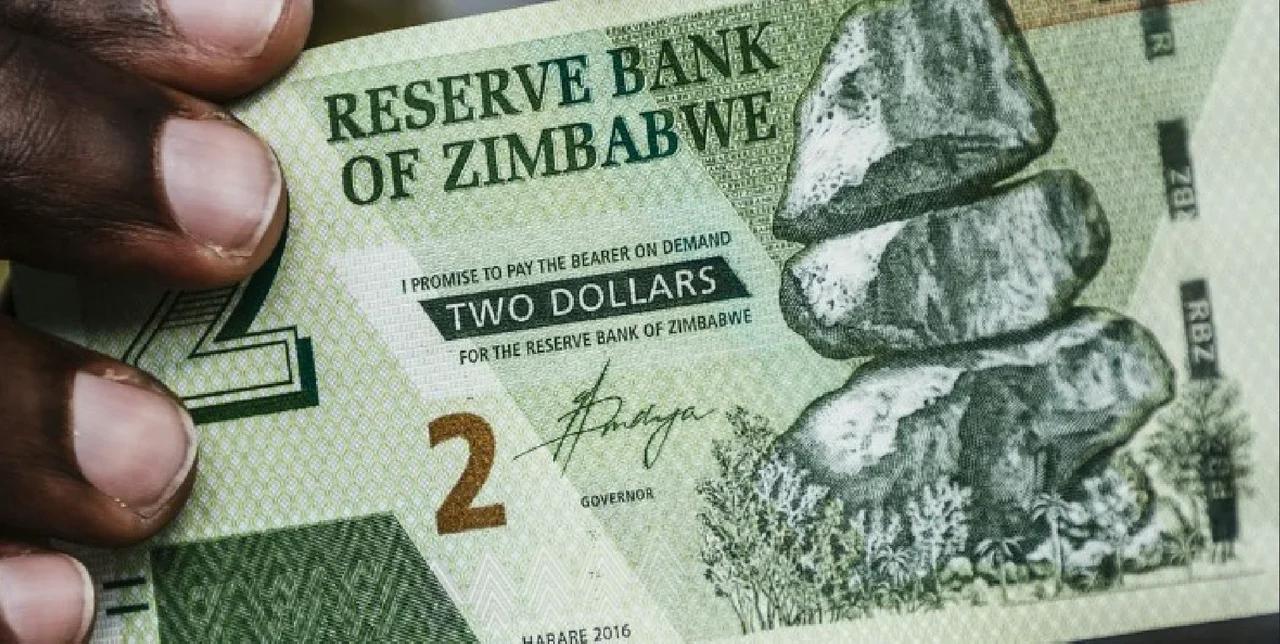

You’re probably looking at a pile of notes or a digital balance and wondering how to convert Zim dollar to USD without getting ripped off. Honestly, it’s a mess. If you are holding the old "ZWL" bank notes from last year, I have some bad news: they are basically wallpaper now. Zimbabwe recently underwent its sixth currency reset since 2008. The "Zim dollar" isn't even called that anymore by the people on the ground. It’s the ZiG, short for Zimbabwe Gold.

It’s confusing.

In April 2024, the Reserve Bank of Zimbabwe (RBZ) scrapped the old inflation-ravaged dollar and introduced this gold-backed newcomer. To convert Zim dollar to USD today, you have to understand that there are two worlds: the official bank rate and the street rate. If you go to a bank in Harare, they’ll give you one number. If you talk to a guy leaning against a Toyota Vitz on Fourth Street, you’ll get a very different one. This isn't just about math; it's about survival in one of the most volatile monetary environments on the planet.

Why the ZiG Changed Everything

When the RBZ Governor, John Mushayavanhu, announced the ZiG, he promised it would be different because it’s backed by 2.5 tons of gold and about $100 million in foreign currency reserves. This was supposed to stop the bleeding. For a few months, it actually did. But recently, the gap between the official rate and the black market has started to yawn wide again.

Converting your money isn't as simple as checking a converter on Google. In fact, most of those online converters are lagging behind by days or even weeks.

If you’re trying to convert Zim dollar to USD via official channels, you’re looking at a rate that the government tries to keep stable. But businesses—the shops, the landlords, the fuel stations—often look at the "parallel market." In late 2024, the RBZ actually had to devalue the ZiG by over 40% in a single day just to try and catch up to the reality of the streets. That's a massive hit if you're holding local cash. It's why nobody wants to keep ZiG for more than twenty-four hours if they can help it.

The Math Behind the Conversion

To convert Zim dollar to USD (specifically the ZiG), you divide your local balance by the current exchange rate. For example, if the rate is 25:1, and you have 250 ZiG, you have 10 bucks. Simple, right? Not really.

Prices in Zimbabwe are often "multi-tier."

A bottle of water might cost $1 USD. If you pay in ZiG, the shop might use a rate of 30:1, even if the official bank rate is 26:1. They do this to protect themselves against the inevitable slide of the currency. You're basically paying a "panic premium."

The Old Trillion-Dollar Notes

Let's clear something up. If you found a 100 trillion dollar note in your grandfather's drawer and want to convert Zim dollar to USD, you aren't a billionaire. Those notes are from the 2008 hyperinflation era. They have zero value as legal tender. However, they have huge value as collectibles. On eBay, a crisp 100 trillion dollar note can sell for $100 to $200 USD. That is the ultimate irony: the money is worth more as a souvenir than it ever was as currency.

How to Actually Get USD in Zimbabwe

Cash is king.

If you are a local worker getting paid in ZiG, your first instinct is usually to head to the "money changers." These are the informal traders who facilitate the bulk of the country's liquidity. While the government has tried to crack down on them—even arresting hundreds of traders in 2024—the market remains.

- Bureau de Change: These are the legal spots. They are safer but often have limited USD reserves. You might walk in and be told they simply don't have any "greenbacks" today.

- The Parallel Market: This is where the real convert Zim dollar to USD action happens. It’s risky. You could get counterfeit notes, or you could get robbed. But it’s where you get the "real" rate that reflects the cost of bread and fuel.

- Internal Transfers: Many people use Zipit or Ecocash (mobile money) to send ZiG to a trader, who then hands over physical USD bills.

Why the Rate Fluctuates So Fast

Money is a belief system. In Zimbabwe, people have been burned so many times that the belief is thin. When the government spends a lot of ZiG on infrastructure projects, that money eventually hits the streets. The contractors want USD to buy imported materials. They dump their ZiG, the supply goes up, the value goes down, and suddenly your convert Zim dollar to USD calculation from yesterday is useless.

The Role of Gold and "Real" Value

The ZiG is "structured." This means it’s tied to the price of gold. In theory, if gold prices go up globally, the ZiG should get stronger. But currency value isn't just about what's in a vault; it's about trust in the central bank.

Economists like Gift Mugano have often pointed out that without production—actually making things in factories—no amount of gold backing will save a currency. Zimbabwe imports almost everything from South Africa and China. To buy those imports, the country needs USD. This constant thirst for US dollars is what keeps the Zim dollar (in all its incarnations) under constant pressure.

Practical Steps for Handling Your Money

If you have ZiG and want to convert Zim dollar to USD, don't wait for a "better" rate. History shows the local currency rarely gains value over the long term.

- Spend it immediately: Buy non-perishable groceries or fuel. These are "hard assets" that hold value better than the paper.

- Use the Interbank Rate for Bills: Some government services and utilities allow you to pay in ZiG at the official rate. This is the only time the ZiG is actually "stronger" than the USD.

- Watch the RBZ Website: They post the official mid-rate daily. Use this as your baseline, but add at least 20% to 30% to get a realistic idea of what you’ll actually pay in a store.

- Check Peer-to-Peer Groups: Many Zimbabweans use WhatsApp groups to trade currency amongst themselves, cutting out the middleman and getting a rate somewhere in between the bank and the street.

The reality of trying to convert Zim dollar to USD is that it's a moving target. You have to be fast, you have to be informed, and you have to be skeptical of any rate that looks too good to be true. Whether it’s the old ZWL or the new ZiG, the US dollar remains the true anchor of the Zimbabwean economy. If you can hold USD, hold it. If you have ZiG, move it.

💡 You might also like: 4950 Goodman Way Eastvale CA 91752: Why This Massive Hub Actually Matters to Your Next Delivery

Actionable Advice for Your Next Transaction

Stop relying on global currency apps like XE or Oanda for Zimbabwe. They don't reflect the "street" reality that dictates your actual purchasing power. Instead, follow local financial news outlets like Techzim or NewZwire which track the daily shifts in the parallel market. When you are ready to convert, always ask for the "rate for today" before showing your money. In this economy, the person with the USD has all the leverage. Use it.

Calculate your needs for the week, convert only what you must spend on ZiG-denominated bills, and keep the rest in a stable currency. This is the only way to avoid the "inflation tax" that has eroded Zimbabwean wealth for decades.